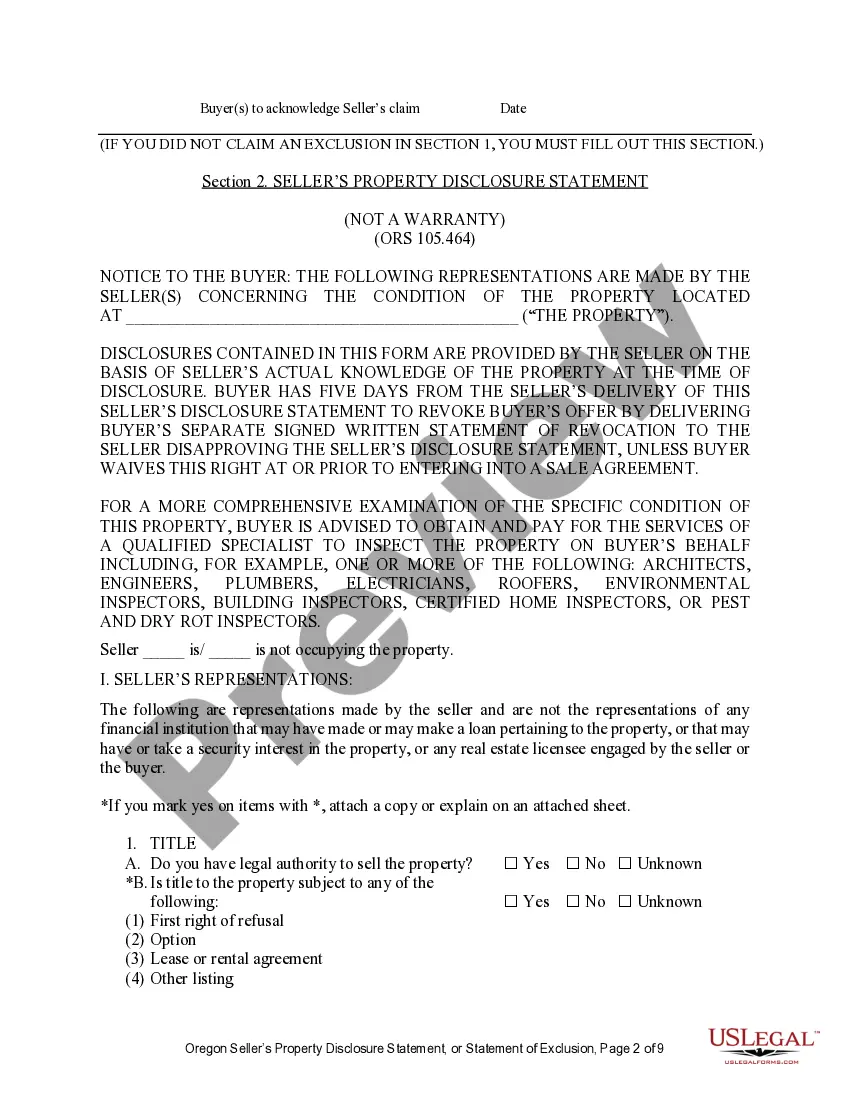

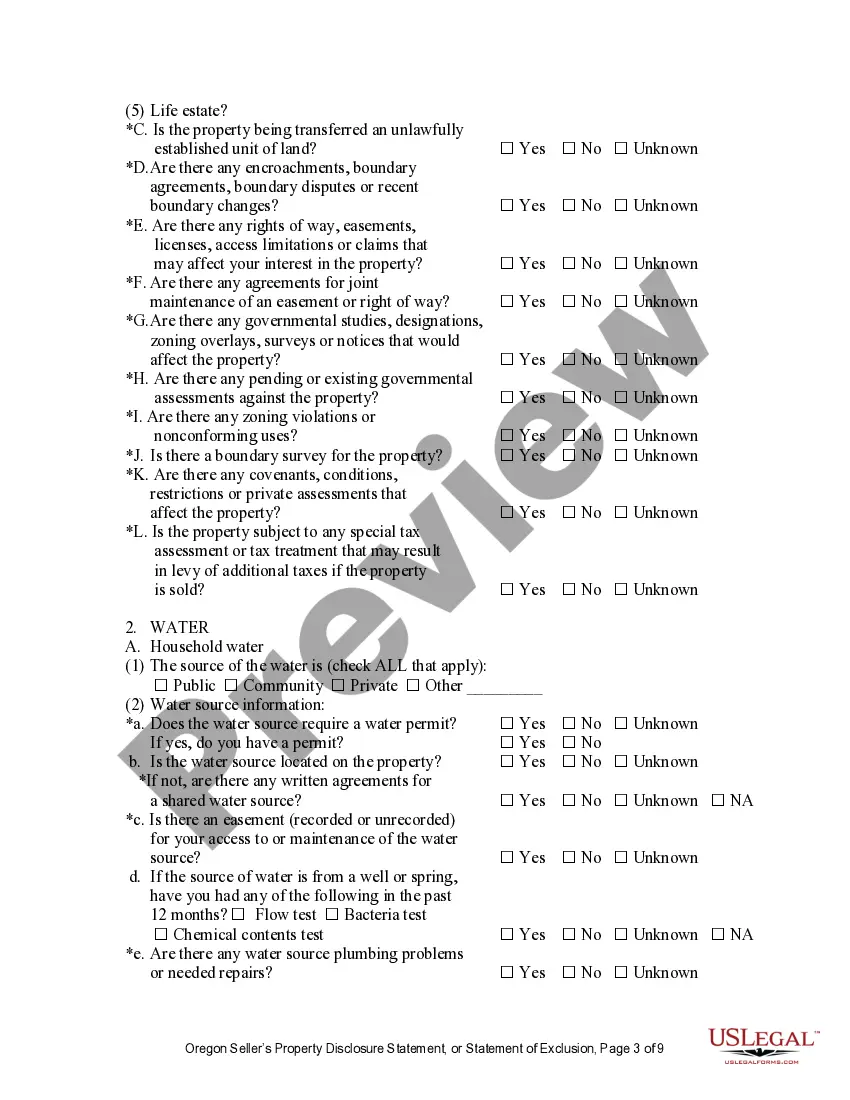

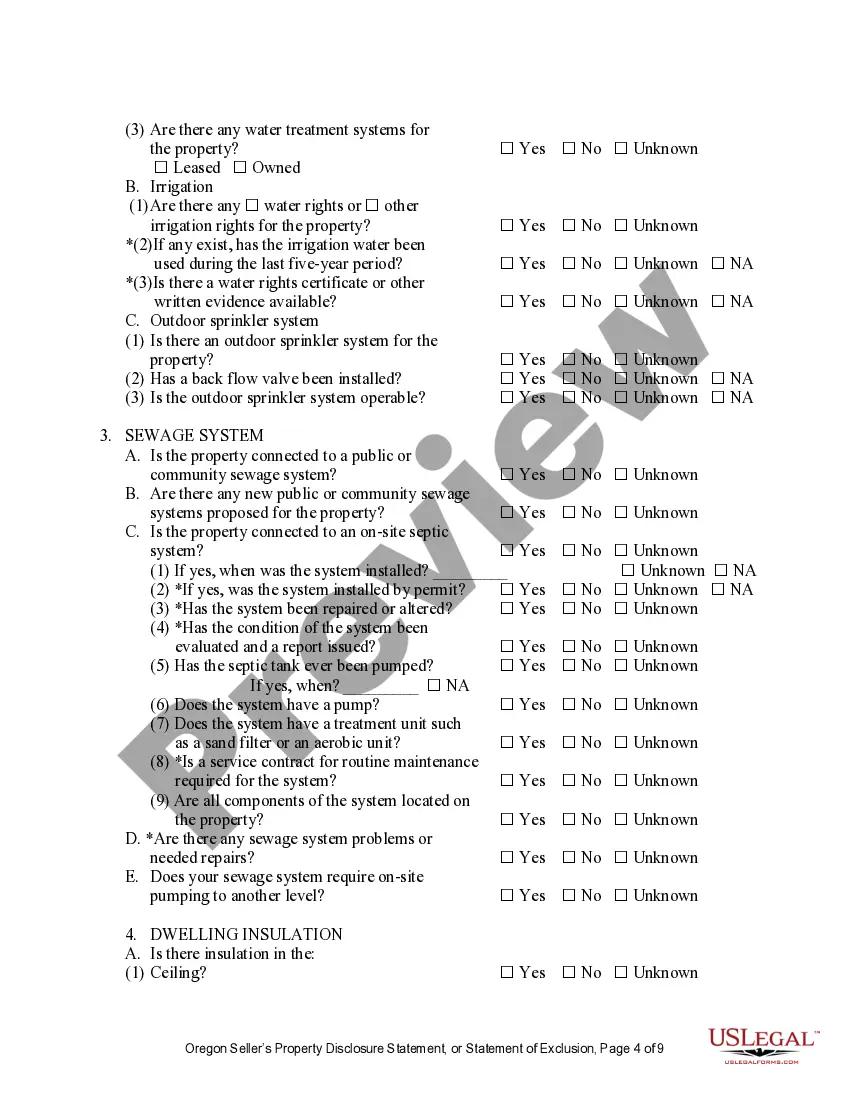

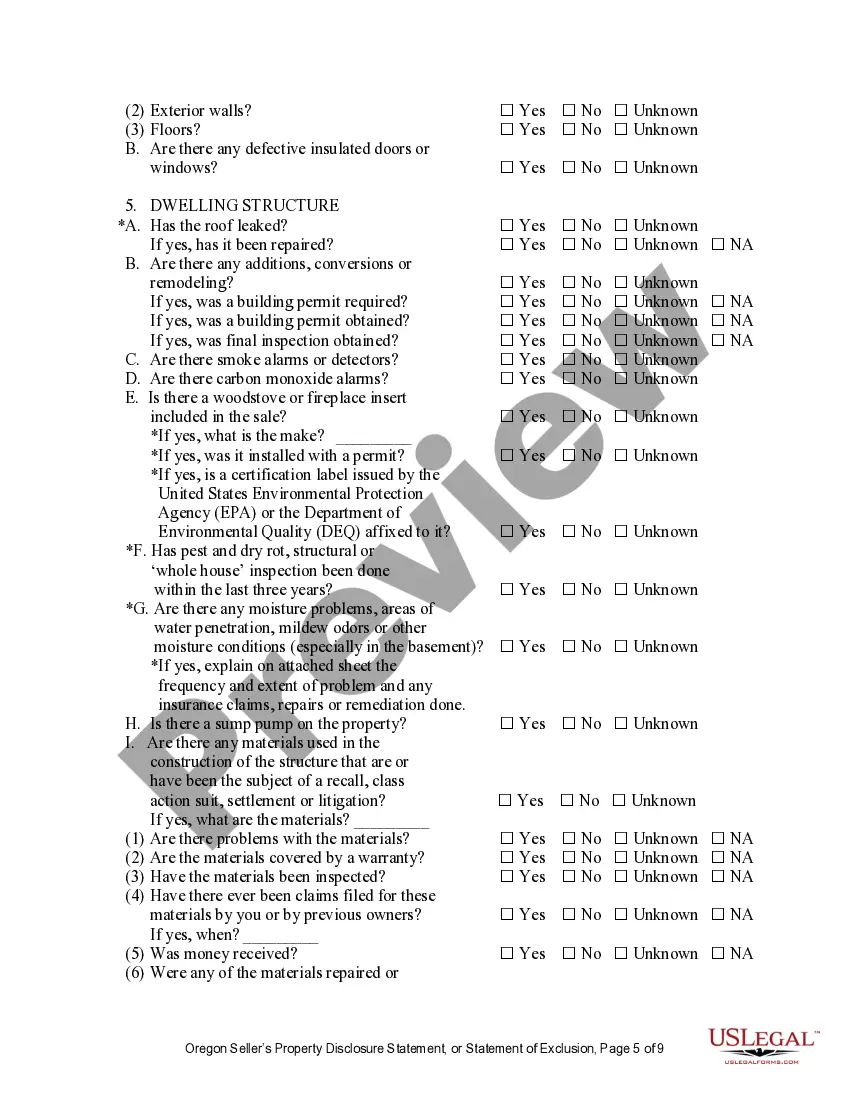

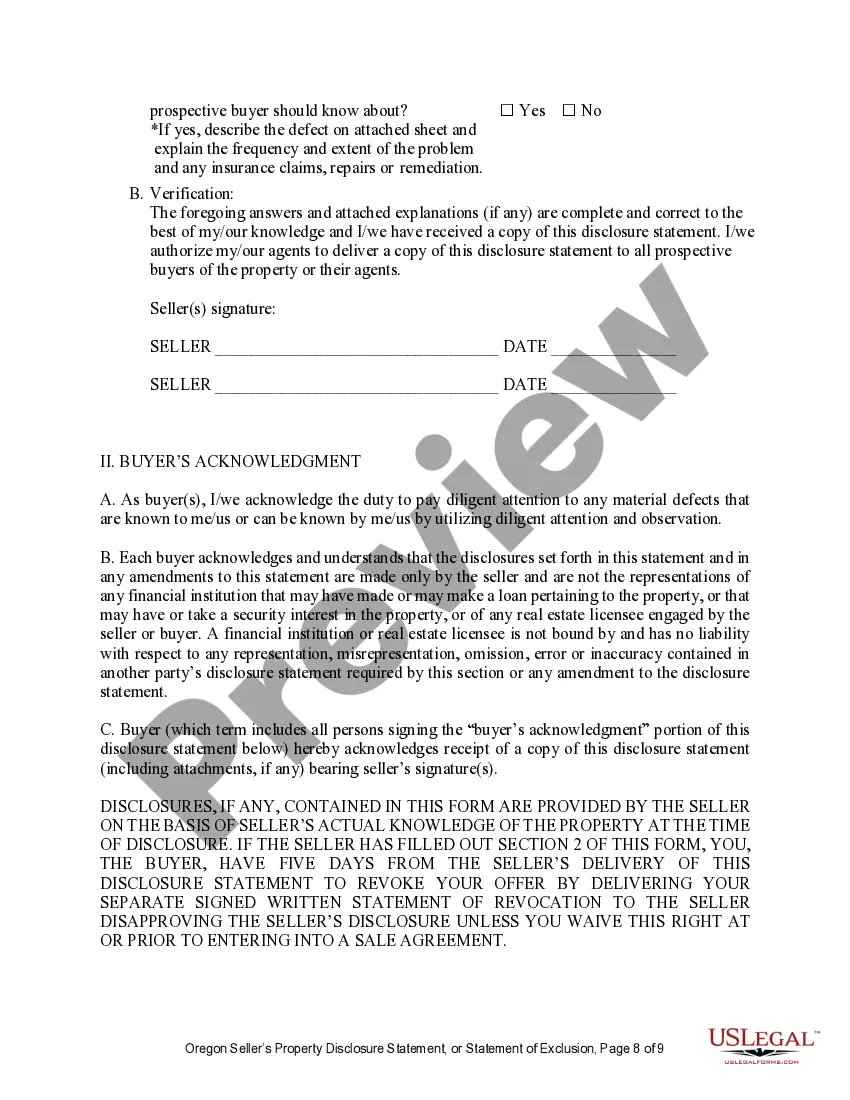

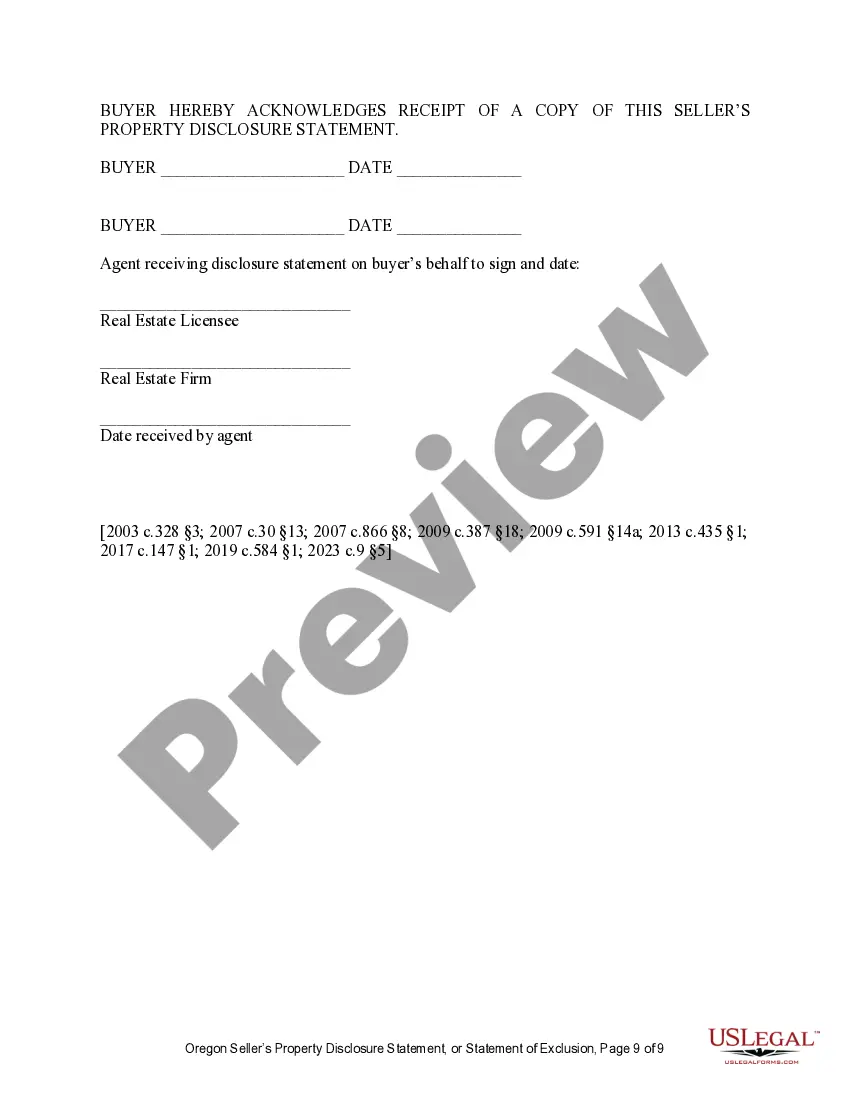

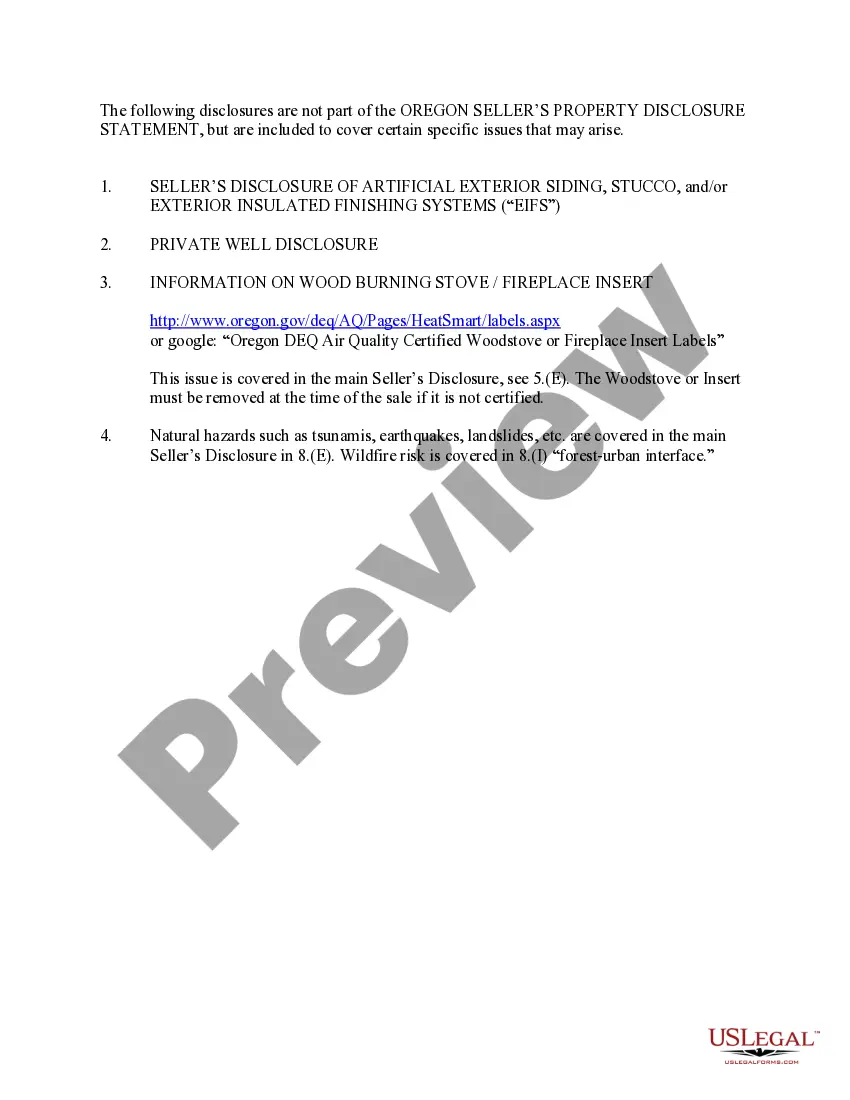

This form is a Seller's Disclosure Statement for use in a residential sales transaction in Oregon. This disclosure statement concerns the condition of property and is completed by the Seller.

Oregon Residential Real Estate Sales Disclosure Statement

Description Oregon Estate Disclosure Online

How to fill out Oregon Estate?

In terms of submitting Oregon Residential Real Estate Sales Disclosure Statement, you probably visualize a long process that involves choosing a suitable sample among a huge selection of very similar ones after which having to pay out an attorney to fill it out for you. Generally, that’s a slow and expensive option. Use US Legal Forms and choose the state-specific template in a matter of clicks.

For those who have a subscription, just log in and click Download to find the Oregon Residential Real Estate Sales Disclosure Statement form.

If you don’t have an account yet but need one, follow the point-by-point guide below:

- Make sure the file you’re saving applies in your state (or the state it’s needed in).

- Do this by reading through the form’s description and through clicking the Preview option (if available) to see the form’s content.

- Click Buy Now.

- Select the proper plan for your financial budget.

- Sign up to an account and choose how you want to pay: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Get the file on the device or in your My Forms folder.

Professional legal professionals work on drawing up our samples to ensure after downloading, you don't need to bother about modifying content outside of your individual details or your business’s details. Join US Legal Forms and get your Oregon Residential Real Estate Sales Disclosure Statement sample now.

Oregon Real Disclosure Statement Form popularity

Real Estate Disclosure Document Other Form Names

Real Disclosure Form FAQ

Do not exclude any information. Be honest. Write clearly. Use simple words in writing your income statement for disclosure. Attach necessary documents to your disclosure statement. Review and revise.

Who Must Make These Seller Disclosures in California. As a broad rule, all sellers of residential real estate property containing one to four units in California must complete and provide written disclosures to the buyer.

It includes the name of the organization, the party of the loans, approval, date, and place at which the document was signed, key terms such as tenure of the loan, interest charged, annual percentage rate, total processing fees, loan statement, prepayment terms, and various other information including the terms

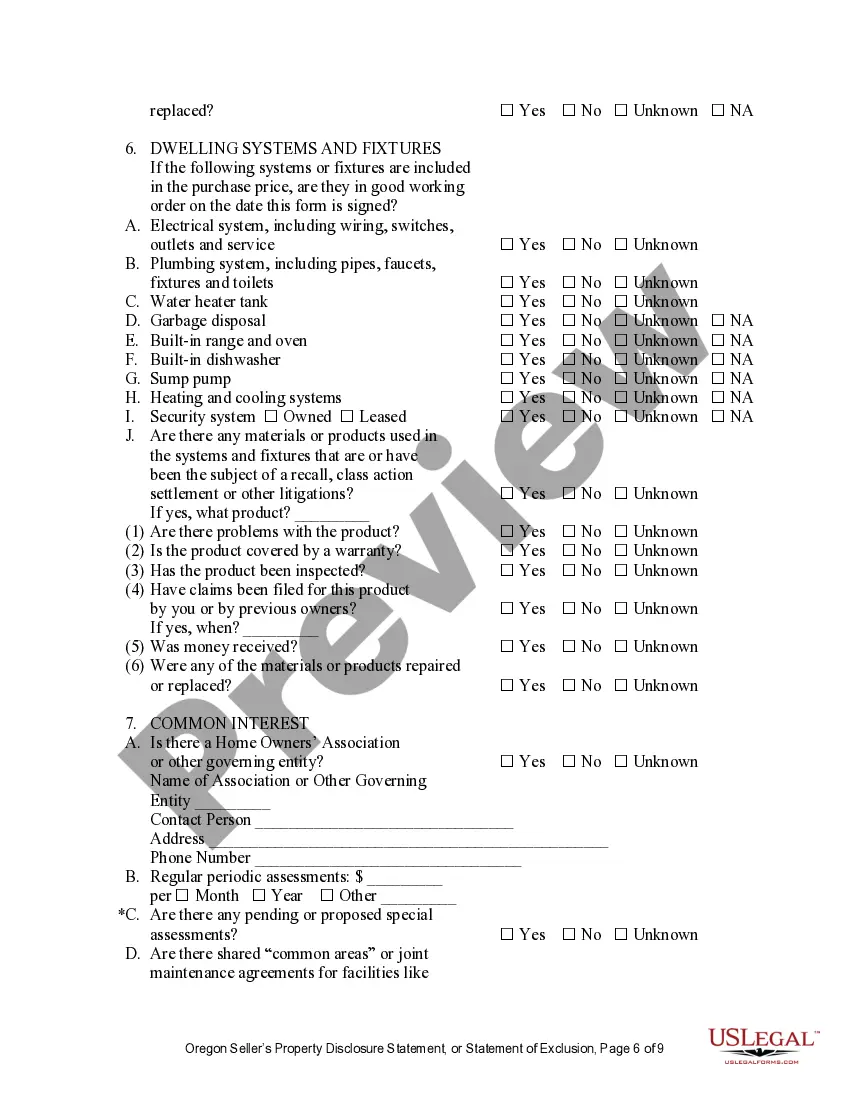

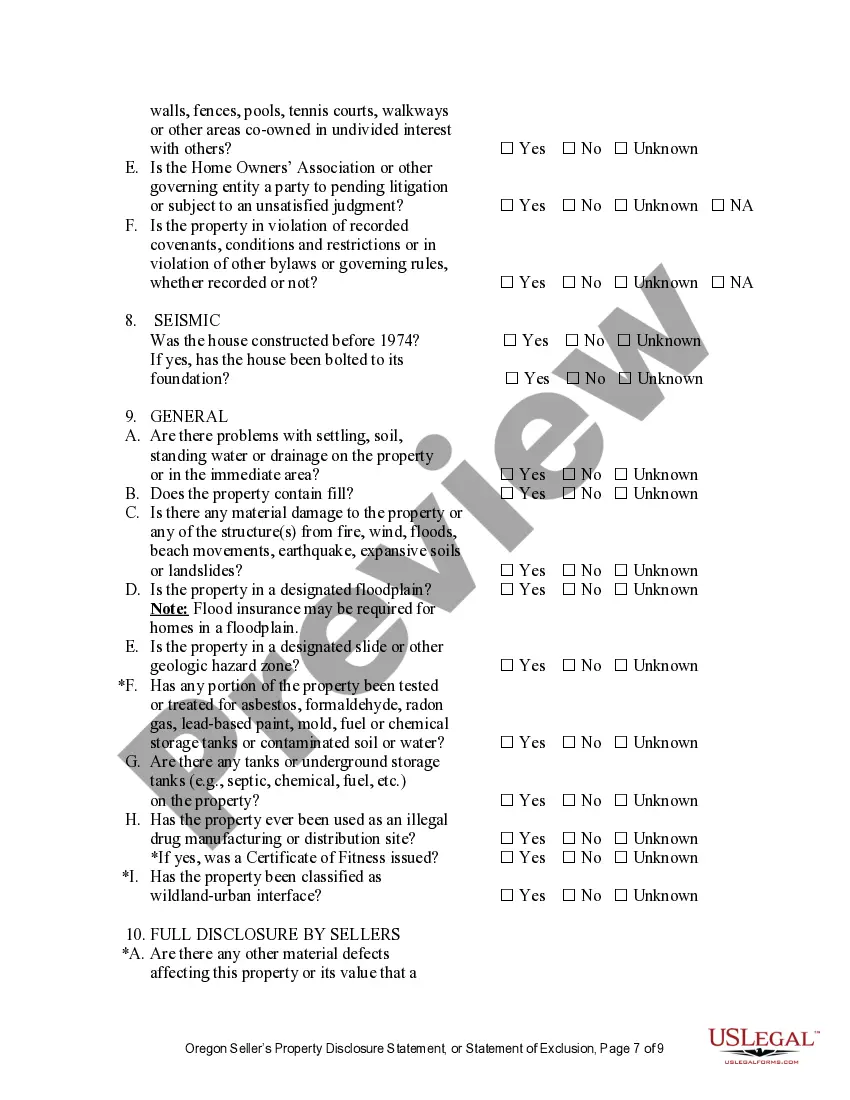

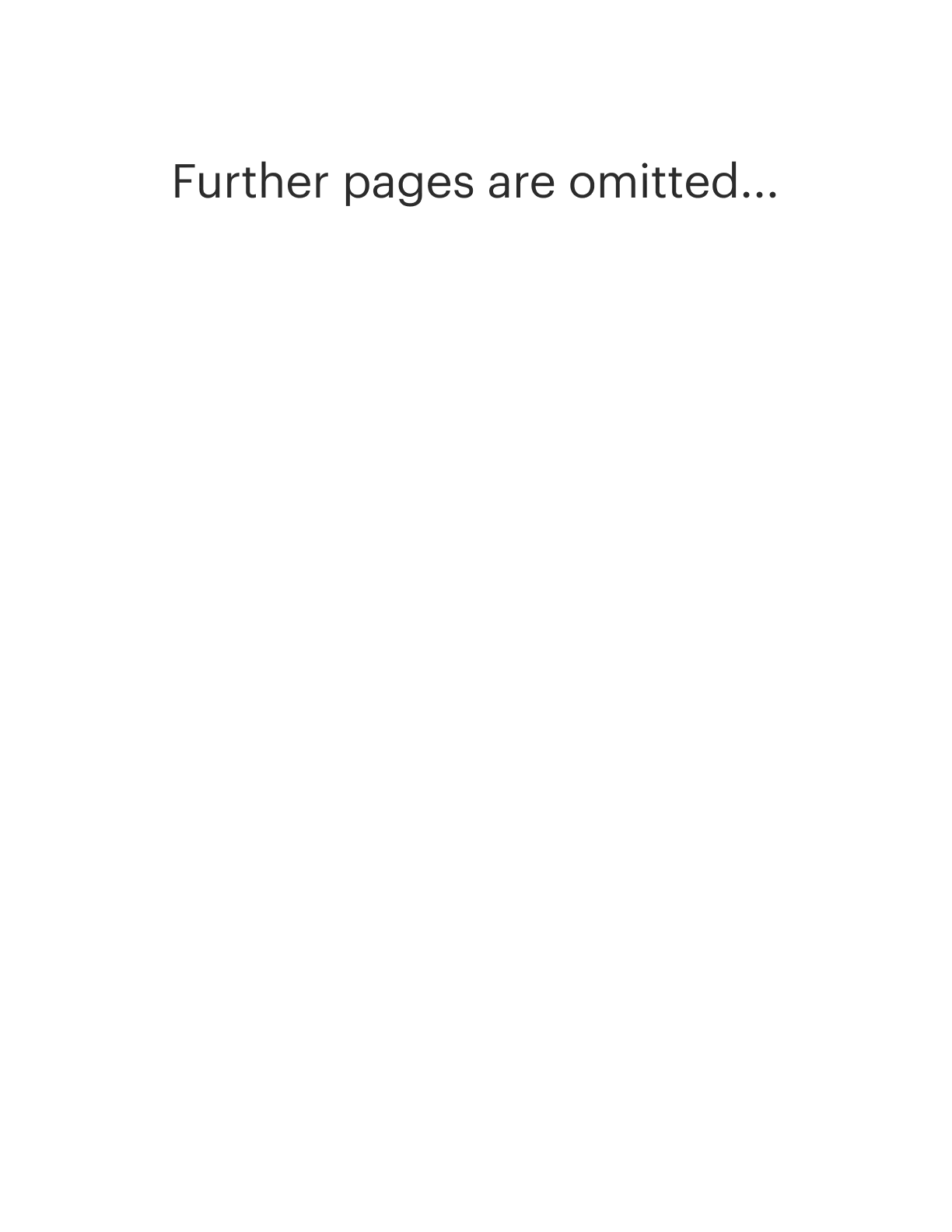

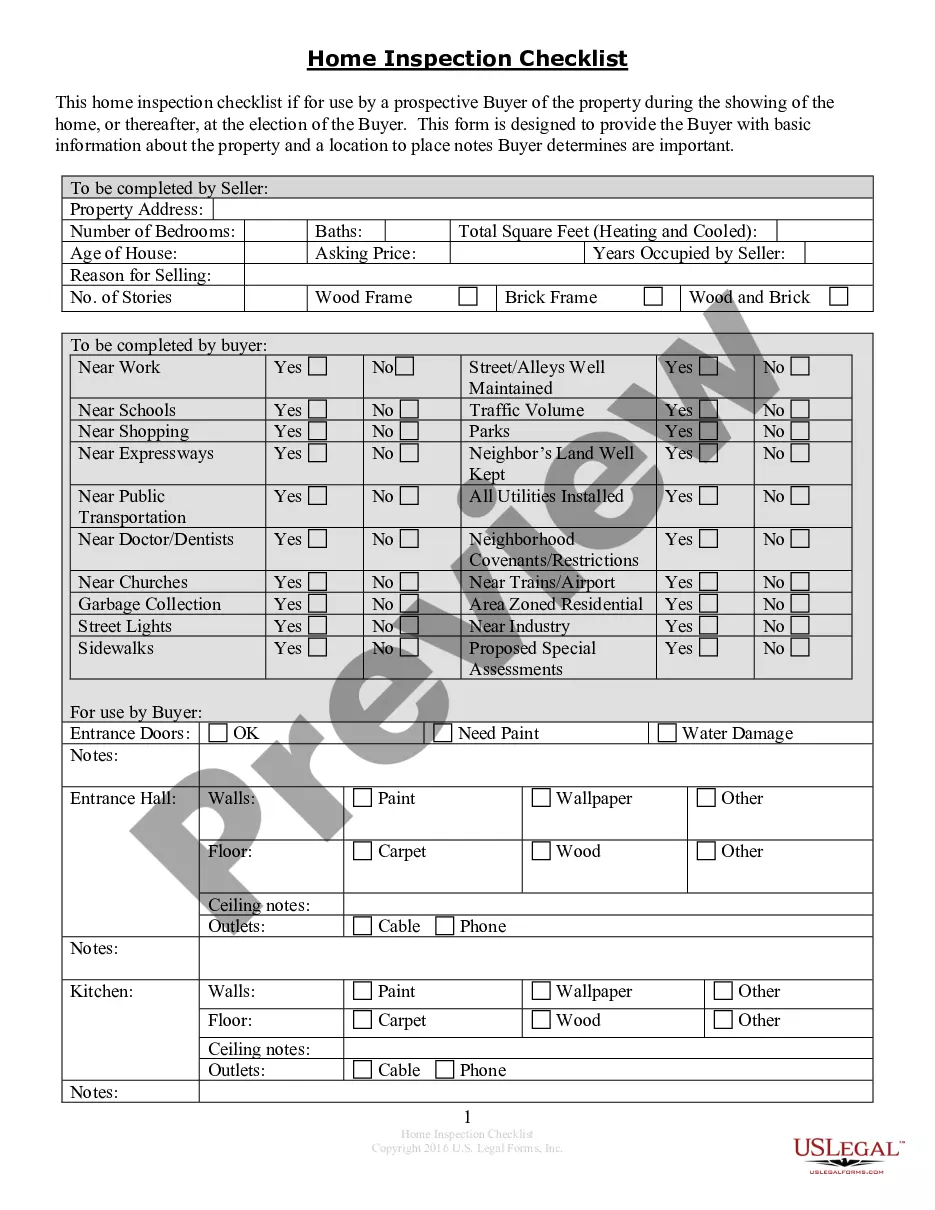

The typical seller disclosure form is several pages long, and it asks the seller to report known defects in the home. This will include the appliances, as well as information about electrical, heating, sewer, water or other mechanical systems.

One question all sellers are required by law to answer on the Real Estate Transfer Disclosure Statement is whether there are any neighborhood noise problems or other nuisances. If the answer is yes, the seller must explain that answer in detail.

Oregon has no inheritance tax. When state residents and individuals who own property in the state begin their estate planning process, they may need to take Oregon's estate tax into consideration.

If you're a resident of Oregon and leave an estate of more than $1 million, your estate may have to pay Oregon estate tax. The $1 million exemption is the current figure; the law in effect at your death will apply to your estate.

Under Oregon law, a small estate affidavit can be filed if the estate has no more than $75,000 in personal property and no more that $200,000 in real property. These limits may be subject to change. A larger estate may require probate.

In Oregon, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).