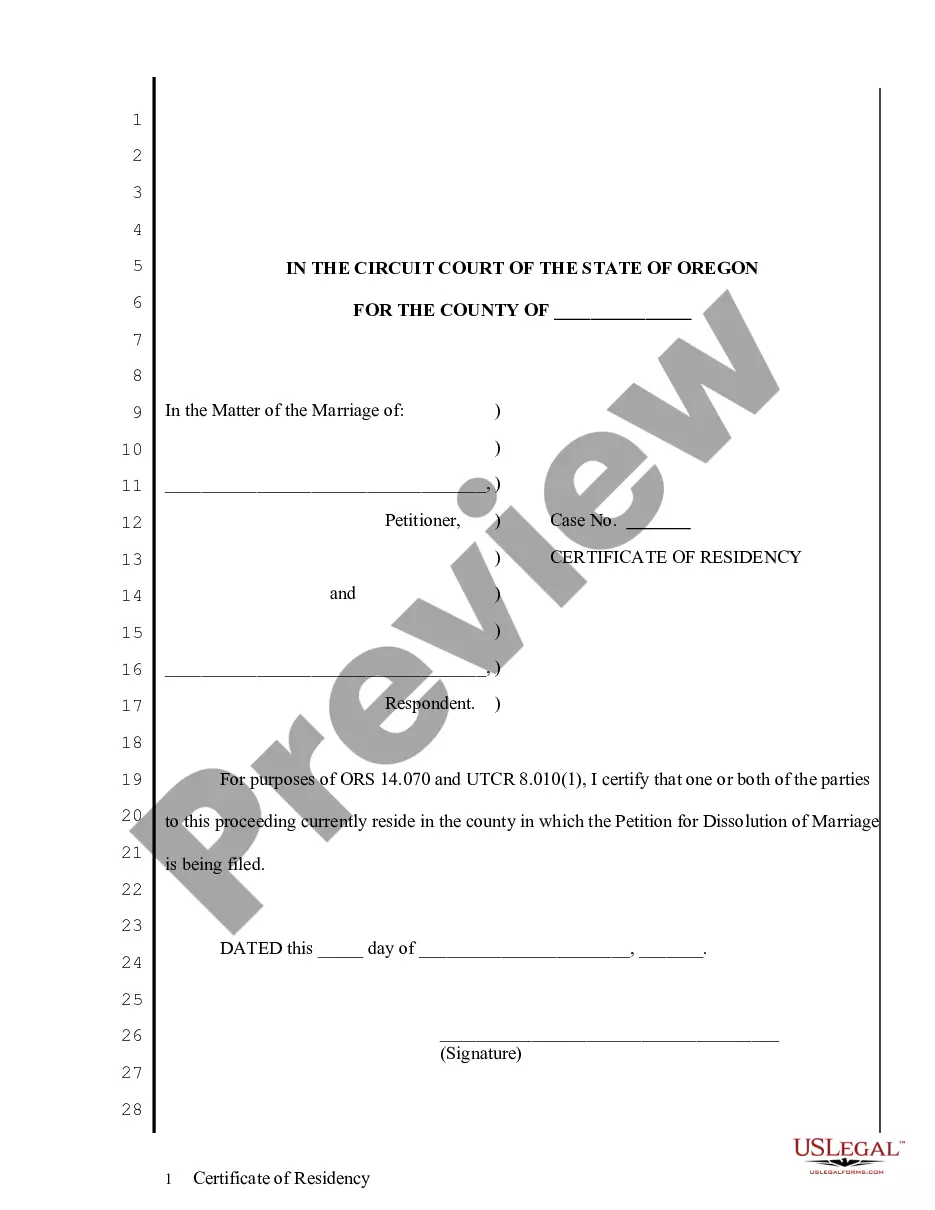

Oregon Certificate of Residency

Description Letter Of Residency Template

How to fill out Temporary Domicile Certificate?

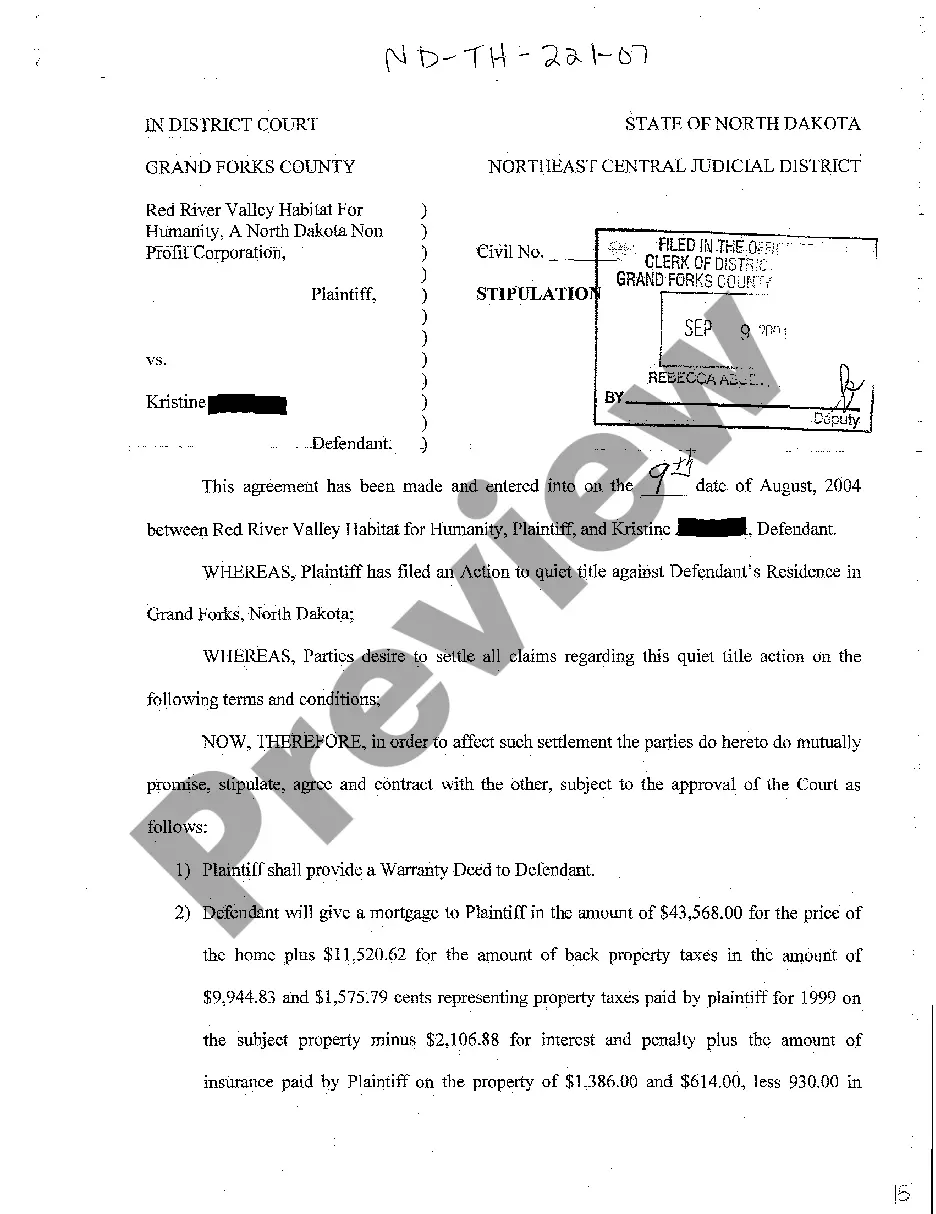

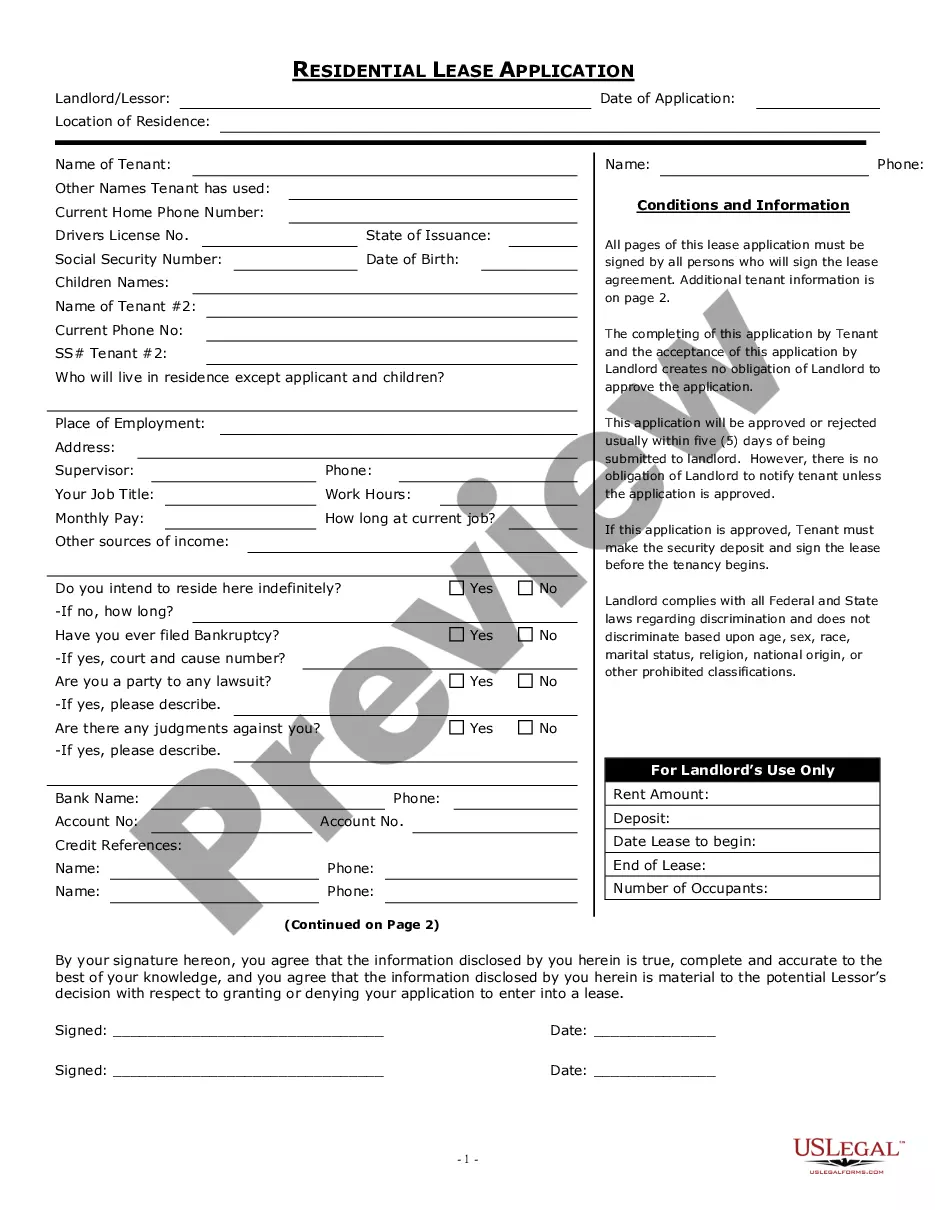

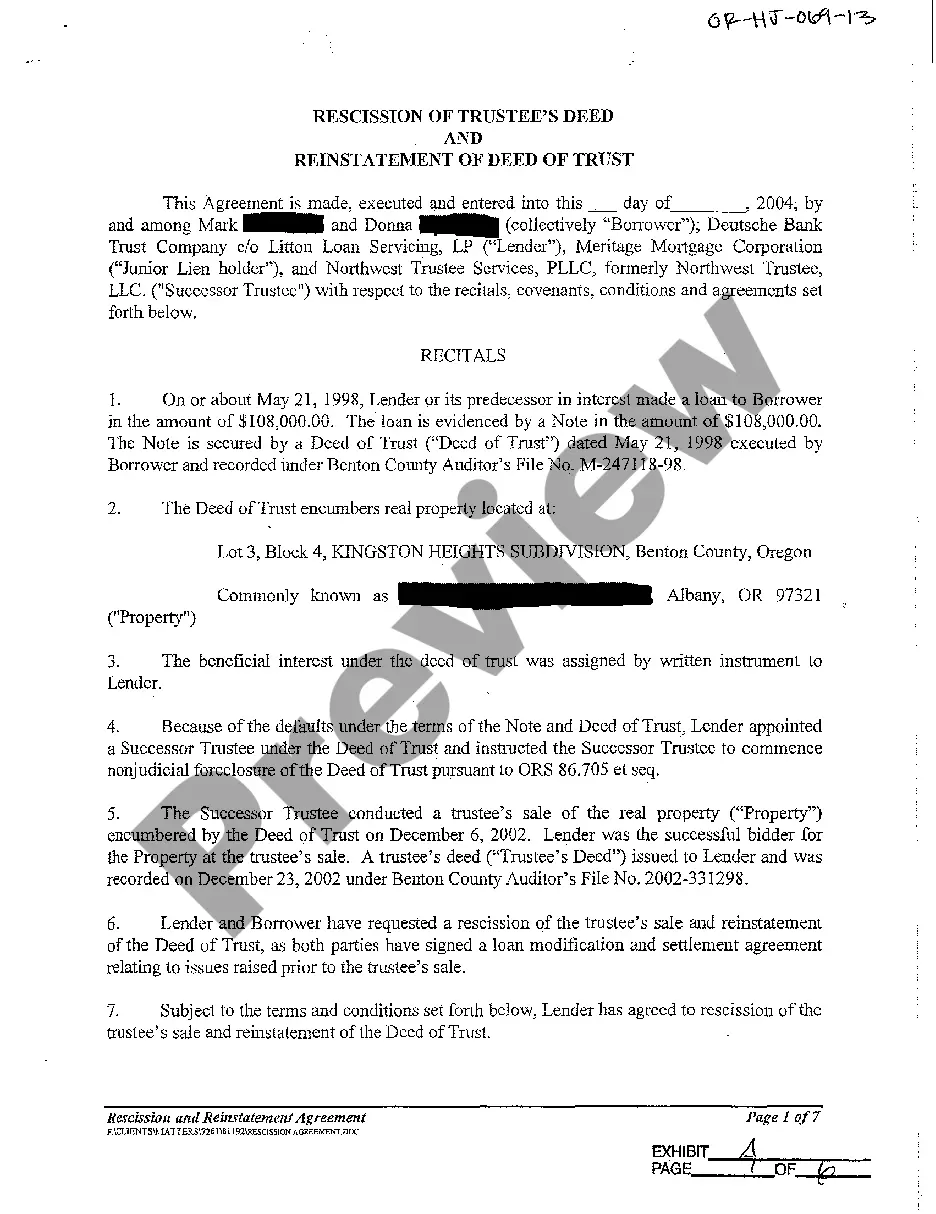

In terms of filling out Oregon Certificate of Residency, you almost certainly visualize a long process that requires finding a suitable form among numerous very similar ones and then needing to pay a lawyer to fill it out for you. Generally, that’s a slow and expensive option. Use US Legal Forms and pick out the state-specific form within just clicks.

For those who have a subscription, just log in and click Download to get the Oregon Certificate of Residency sample.

If you don’t have an account yet but want one, stick to the step-by-step manual listed below:

- Be sure the document you’re getting applies in your state (or the state it’s required in).

- Do it by reading the form’s description and also by visiting the Preview option (if offered) to see the form’s content.

- Simply click Buy Now.

- Find the proper plan for your budget.

- Sign up for an account and choose how you want to pay out: by PayPal or by card.

- Save the file in .pdf or .docx file format.

- Get the record on the device or in your My Forms folder.

Skilled lawyers work on drawing up our templates to ensure after saving, you don't need to bother about modifying content outside of your individual details or your business’s details. Join US Legal Forms and get your Oregon Certificate of Residency example now.

Certification Of Oregon Residency Form popularity

Letter Of Residency Other Form Names

Certificate Of Residency Sample FAQ

Generally, you need to establish a physical presence in the state, an intent to stay there and financial independence. Then you need to prove those things to your college or university. Physical presence: Most states require you to live in the state for at least a full year before establishing residency.

Find a new place to live in the new state. Establish domicile. Change your mailing address and forward your mail. Change your address with utility providers. Change IRS address. Register to vote. Get a new driver's license. File taxes in your new state.

Government-issued photo ID.Residential lease/property deed.Utility bill.Letter from the government/court (marriage license, divorce, government aid)Bank statement.Driver's license/learner's permit.Car registration.Notarized affidavit of residency.

Typical factors states use to determine residency. Often, a major determinant of an individual's status as a resident for income tax purposes is whether he or she is domiciled or maintains an abode in the state and are present" in the state for 183 days or more (one-half of the tax year).

By statute, an individual is a resident of Oregon under two scenarios. A. An individual who is domiciled in Oregon, unless he a) does not have a permanent place of abode in Oregon; b) maintains a permanent place of abode in a place other than Oregon, and c) spends less than 31 days of a taxable year in Oregon.

To qualify as an Oregon resident (for tuition purposes), one must live in Oregon for 12 consecutive months while taking eight credits or fewer per term while demonstrating that they are in the state for a primary purpose other than education (such as working, volunteering, or other purposes).

If you reside in Oregon, and need to provide proof that you are a resident of or domiciled in Oregon, a true copy of your Oregon permanent or part-year income tax return filed with the Oregon Department of Revenue for the previous tax year is acceptable proof with this form.

An individual can at any one time have but one domicile. If an individual has acquired a domicile at one place (i.e. California), he retains that domicile until he acquires another elsewhere.