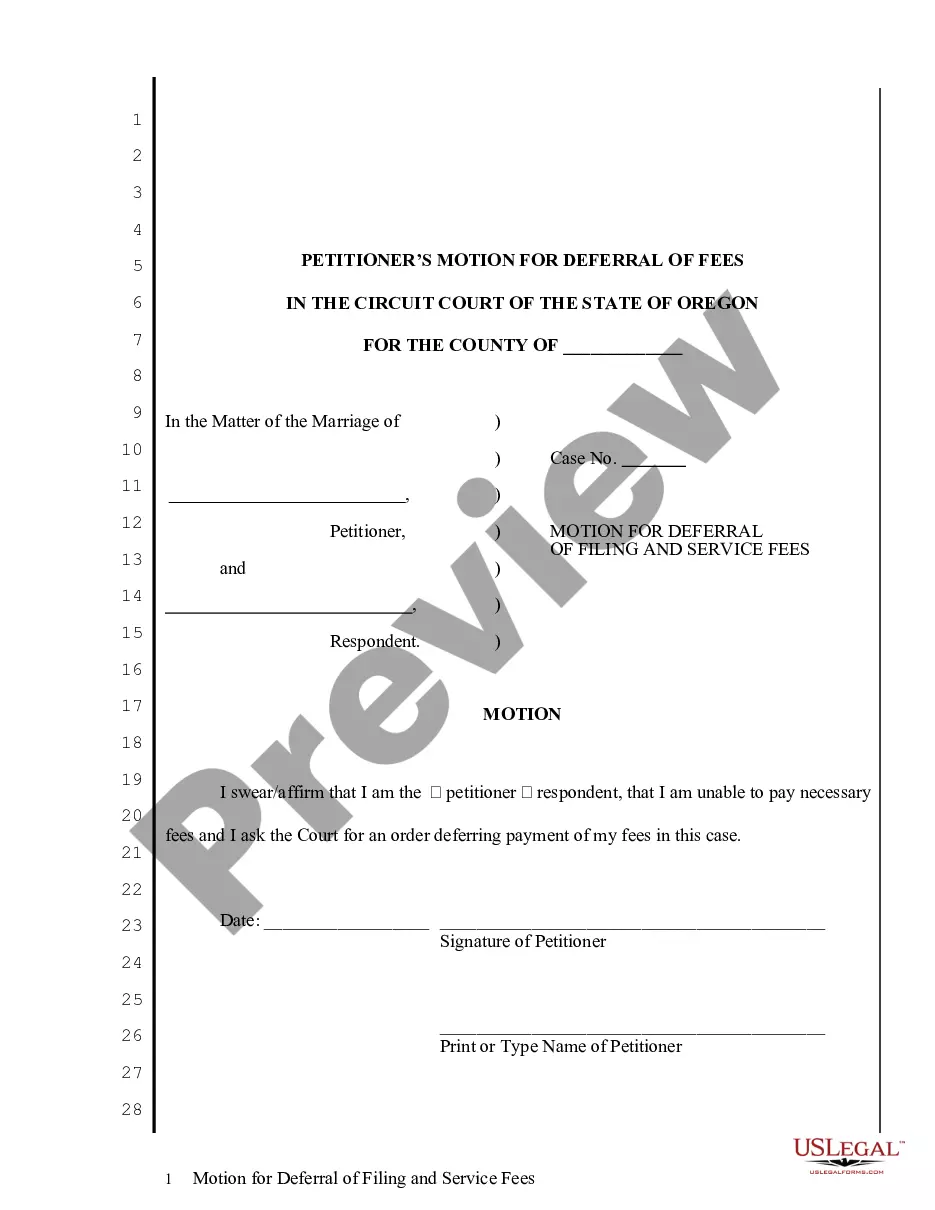

Oregon Motion for Deferral of Filing and Service Fees

Description

How to fill out Oregon Motion For Deferral Of Filing And Service Fees?

In terms of completing Oregon Motion for Deferral of Filing and Service Fees, you almost certainly imagine a long procedure that involves getting a suitable form among a huge selection of similar ones after which having to pay a lawyer to fill it out for you. Generally speaking, that’s a slow and expensive option. Use US Legal Forms and pick out the state-specific template within clicks.

If you have a subscription, just log in and then click Download to get the Oregon Motion for Deferral of Filing and Service Fees sample.

If you don’t have an account yet but need one, follow the point-by-point manual listed below:

- Make sure the document you’re downloading applies in your state (or the state it’s required in).

- Do it by reading through the form’s description and by clicking on the Preview function (if readily available) to view the form’s information.

- Simply click Buy Now.

- Pick the proper plan for your budget.

- Join an account and select how you want to pay: by PayPal or by card.

- Save the file in .pdf or .docx format.

- Get the document on the device or in your My Forms folder.

Professional lawyers work on creating our samples so that after saving, you don't have to bother about editing and enhancing content material outside of your personal information or your business’s info. Sign up for US Legal Forms and receive your Oregon Motion for Deferral of Filing and Service Fees example now.

Form popularity

FAQ

The $400/$200 non-electronic filing fee (fee codes 1090/2090/3090 or 1690/2690/3690) must be paid in addition to the filing, search and examination fees, in each original nonprovisional utility application filed in paper with the USPTO.

The law in California generally provides that unless attorneys' fees are provided for by statute or by contract they are not recoverable. In other words, unless a law or contract says otherwise the winning and losing party to lawsuit must pay their own attorneys fees.

The typical attorney-fee clause states that if one party breaches the contract, the other party can sue and recover its attorney fees for bringing the suit. If you have a contract dispute or you if you are negotiating a contract, you should pay careful attention to any language on attorneys' fees.

Filing fee is fee charged by a government organization to accept a document for processing. For instance, the fee required for filing of pleading in a civil proceeding. A filing fee is also charged by the United States Patent and Trademark Office for processing a patent application.

A notice of motion to claim attorney's fees for services up to and including the rendition of judgment in the trial court-including attorney's fees on an appeal before the rendition of judgment in the trial court-must be served and filed within the time for filing a notice of appeal under rules 8.104 and 8.108 in an

In general, USCIS does not refund a fee or application regardless of the decision on the application.USCIS will review the request for a refund and either approve or deny the request based on the information at hand.

The cost to file a motion will increase from $30 to $50. Finally, it will now cost $25 to file a non-dissolution (FD) application/motion.

If you're filing the Form I-765 separately, the filing fee is $410. You must also pay an additional $85 biometric services fee, for a total of $495.

(k) For a commission on all money coming into the clerks' hands by law, rule, order or writ of court and caring for the same, one and one-half (1.5 %) per centum on all sums not exceeding forty thousand (P40,000.00) pesos, and one (1%) per centum on all sums in excess of forty thousand (P40,000) pesos.