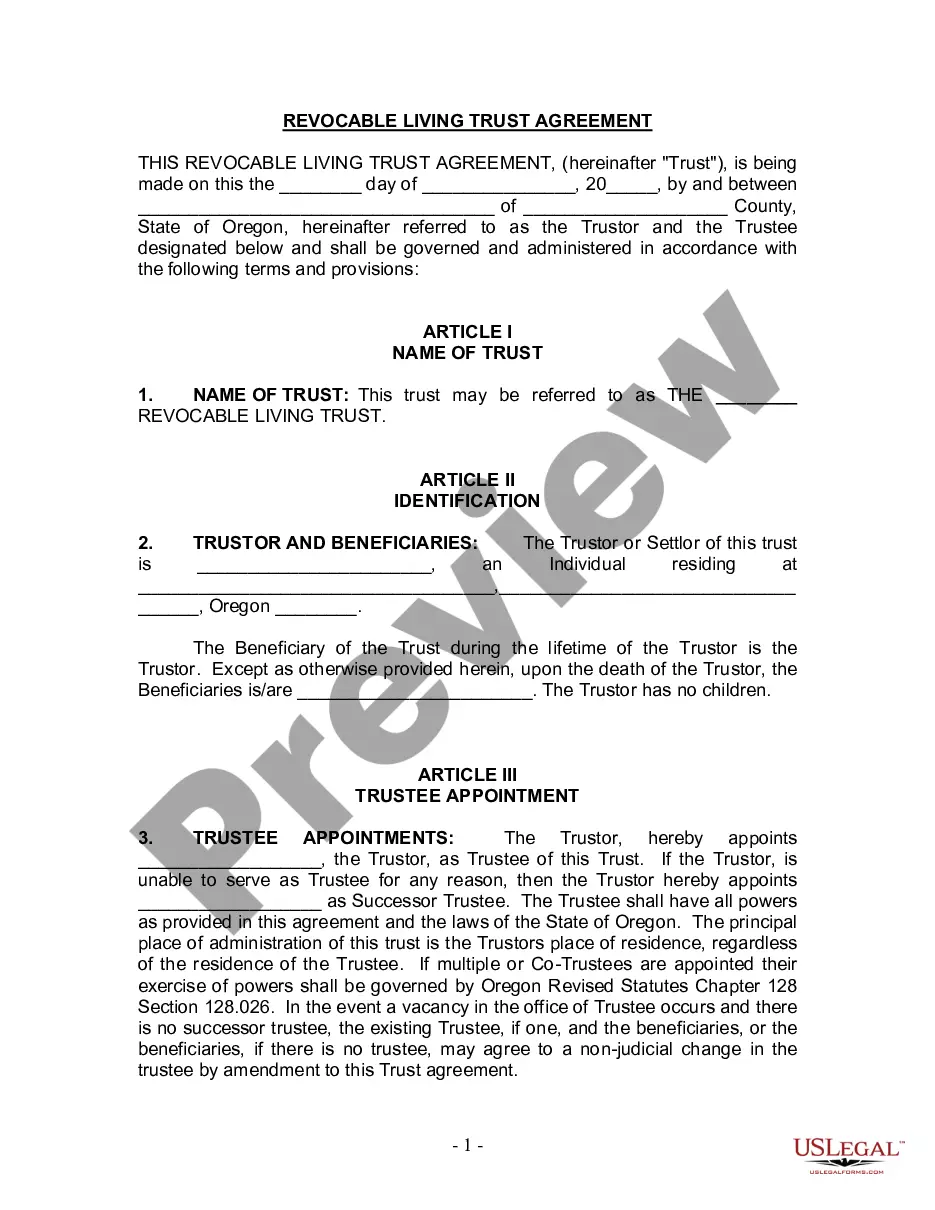

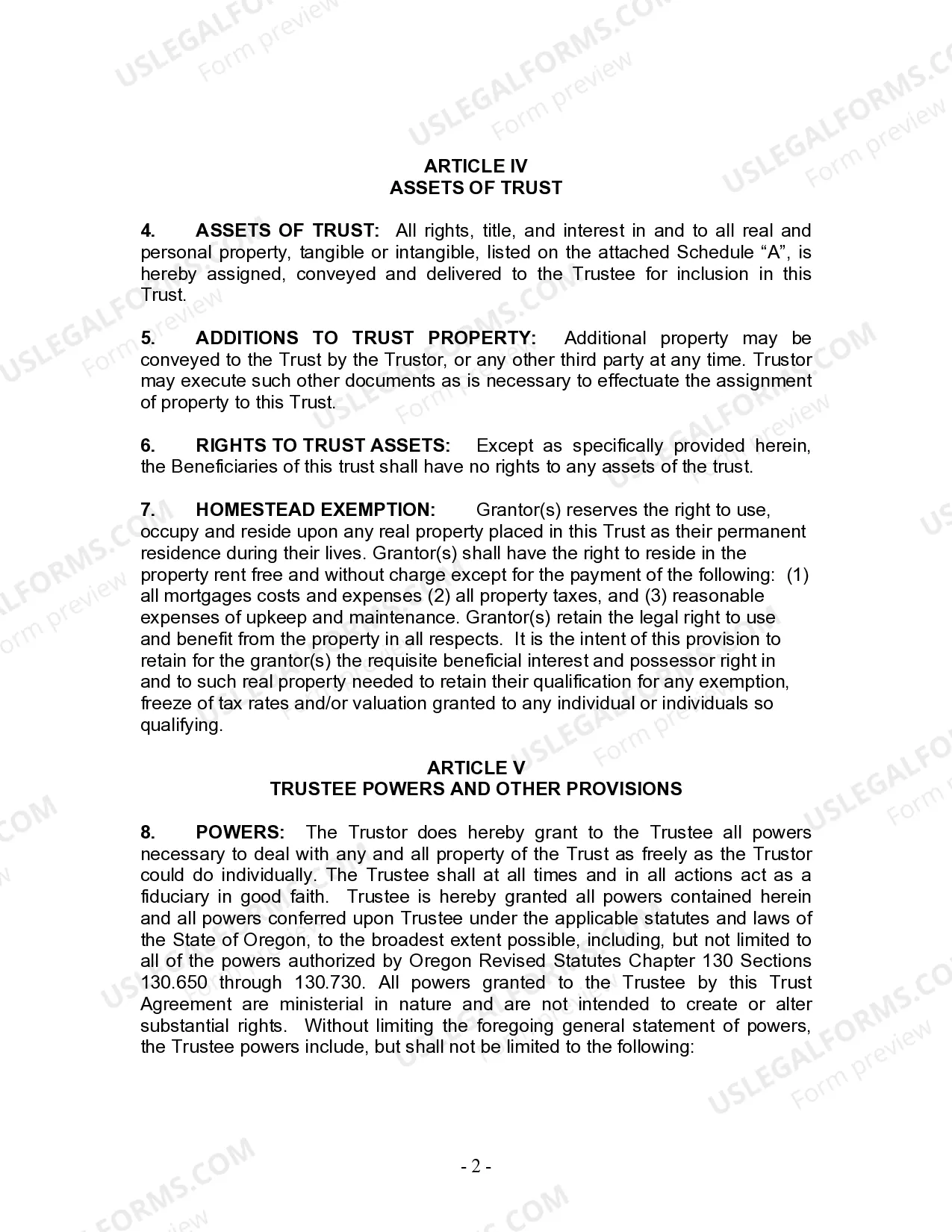

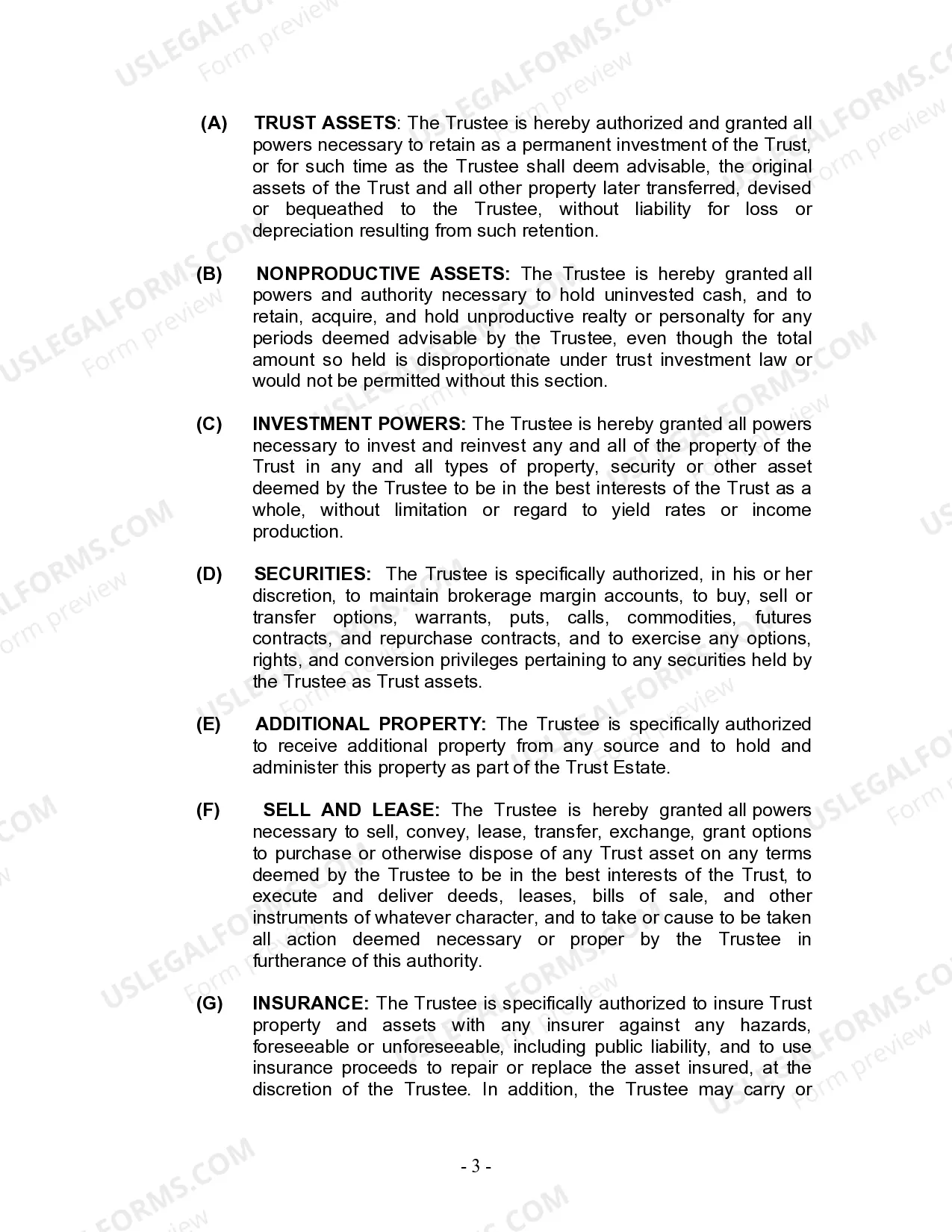

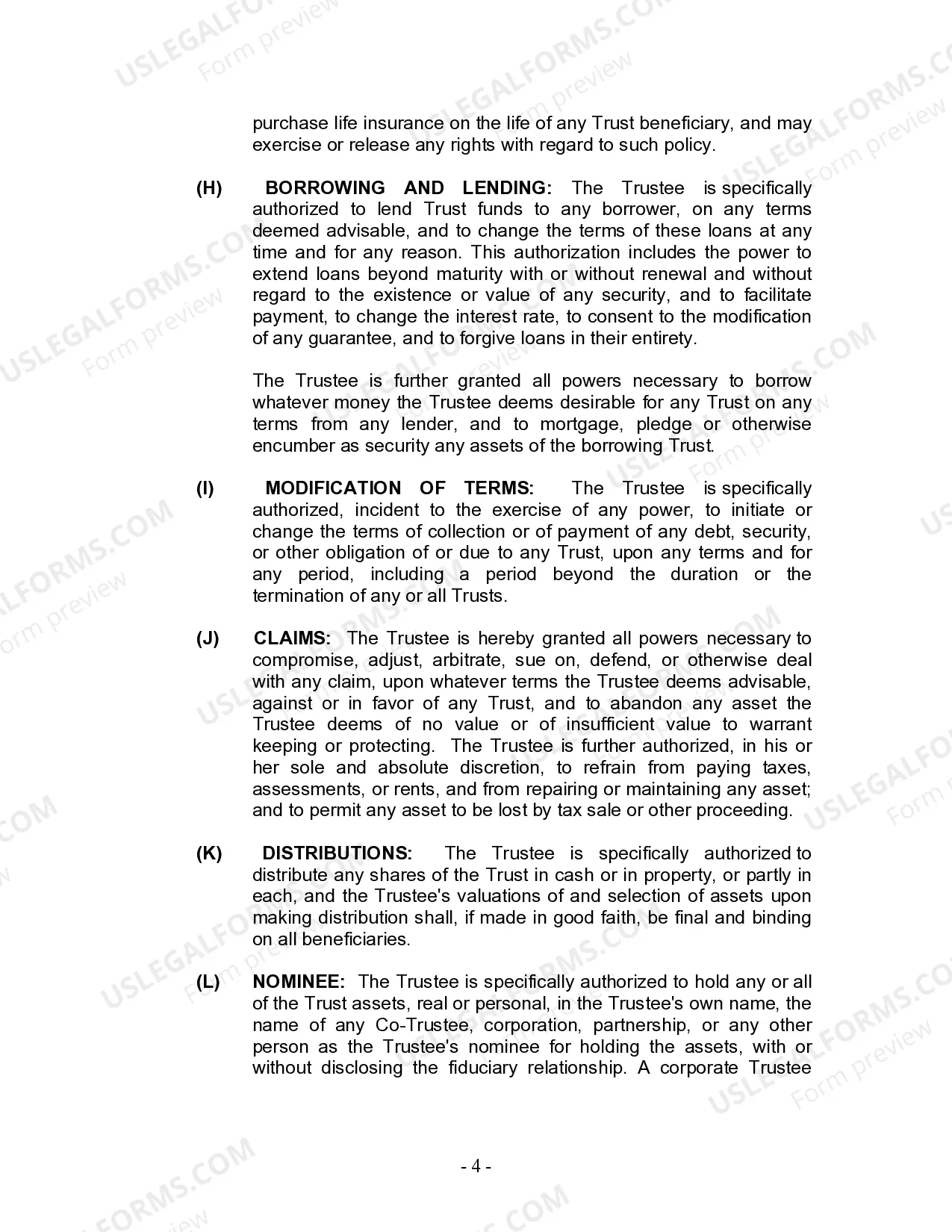

Oregon Living Trust for Individual Who is Single, Divorced or Widow (or Wwidower) with No Children

Description

How to fill out Oregon Living Trust For Individual Who Is Single, Divorced Or Widow (or Wwidower) With No Children?

In terms of submitting Oregon Living Trust for Individual Who is Single, Divorced or Widow (or Wwidower) with No Children, you most likely visualize an extensive procedure that consists of finding a ideal sample among numerous very similar ones and after that having to pay an attorney to fill it out to suit your needs. Generally, that’s a slow-moving and expensive option. Use US Legal Forms and pick out the state-specific document within clicks.

If you have a subscription, just log in and then click Download to find the Oregon Living Trust for Individual Who is Single, Divorced or Widow (or Wwidower) with No Children template.

If you don’t have an account yet but need one, follow the step-by-step manual below:

- Be sure the document you’re saving is valid in your state (or the state it’s needed in).

- Do this by reading through the form’s description and by clicking on the Preview option (if available) to see the form’s content.

- Click on Buy Now button.

- Pick the appropriate plan for your budget.

- Join an account and choose how you want to pay out: by PayPal or by credit card.

- Save the document in .pdf or .docx file format.

- Find the document on your device or in your My Forms folder.

Skilled lawyers draw up our templates so that after saving, you don't have to bother about editing and enhancing content outside of your personal details or your business’s details. Join US Legal Forms and receive your Oregon Living Trust for Individual Who is Single, Divorced or Widow (or Wwidower) with No Children document now.

Form popularity

FAQ

If you die without a will and do not have any family, your property will go to (escheat) the state. This rarely happens because Oregon's inheritance laws are designed to get your property to your family, however remote.

When one spouse dies, the joint trust will continue to operate for the benefit of the surviving spouse as a Survivor's Trust. Any specific gifts of tangible property from the first spouse to beneficiaries (other than the surviving spouse) will be given to those people.

Get a legal pronouncement of death. Arrange for transportation of the body. Notify the person's doctor or the county coroner. Notify close family and friends. Handle care of dependents and pets. Call the person's employer, if he or she was working.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

If you die without a will in Oregon, your children will receive an intestate share of your property. The size of each child's share depends on how many children you have, whether or not you are married, whether your spouse is also their parent, and whether you have any children from a previous relationship.

No probate is necessary. Joint tenancy often works well when couples (married or not) acquire real estate, vehicles, bank accounts or other valuable property together. In Oregon, each co-owner must own an equal share.

A basic trust plan may run anywhere from $2,000 to $3,000 or more, depending on complexity. There are additional costs for making changes and administration costs after your death. Different types of trusts and trustees can require different fees for administration and wealth management.

A joint revocable living trust is a trust that is set up by two people (joint grantors) and funded with joint or separate property.

Like a will, a living trust can be altered whenever you wish.After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.