Oregon Living Trust for Individual Who is Single, Divorced or Widow (or Wwidower) with Children

Description

How to fill out Oregon Living Trust For Individual Who Is Single, Divorced Or Widow (or Wwidower) With Children?

In terms of completing Oregon Living Trust for Individual Who is Single, Divorced or Widow (or Wwidower) with Children, you almost certainly think about a long procedure that requires choosing a perfect sample among numerous similar ones then having to pay an attorney to fill it out to suit your needs. Generally, that’s a sluggish and expensive choice. Use US Legal Forms and pick out the state-specific document within just clicks.

For those who have a subscription, just log in and then click Download to have the Oregon Living Trust for Individual Who is Single, Divorced or Widow (or Wwidower) with Children form.

In the event you don’t have an account yet but need one, keep to the point-by-point manual below:

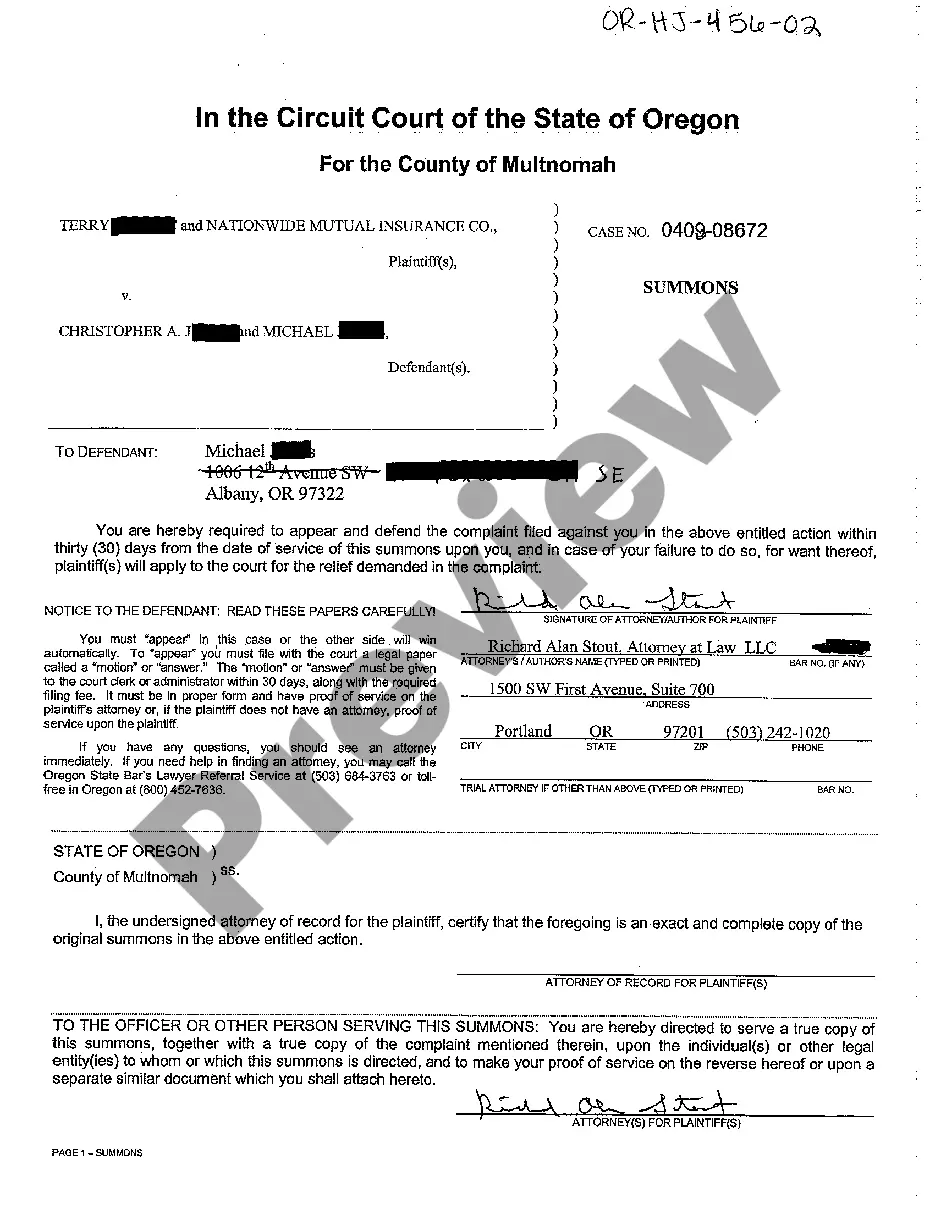

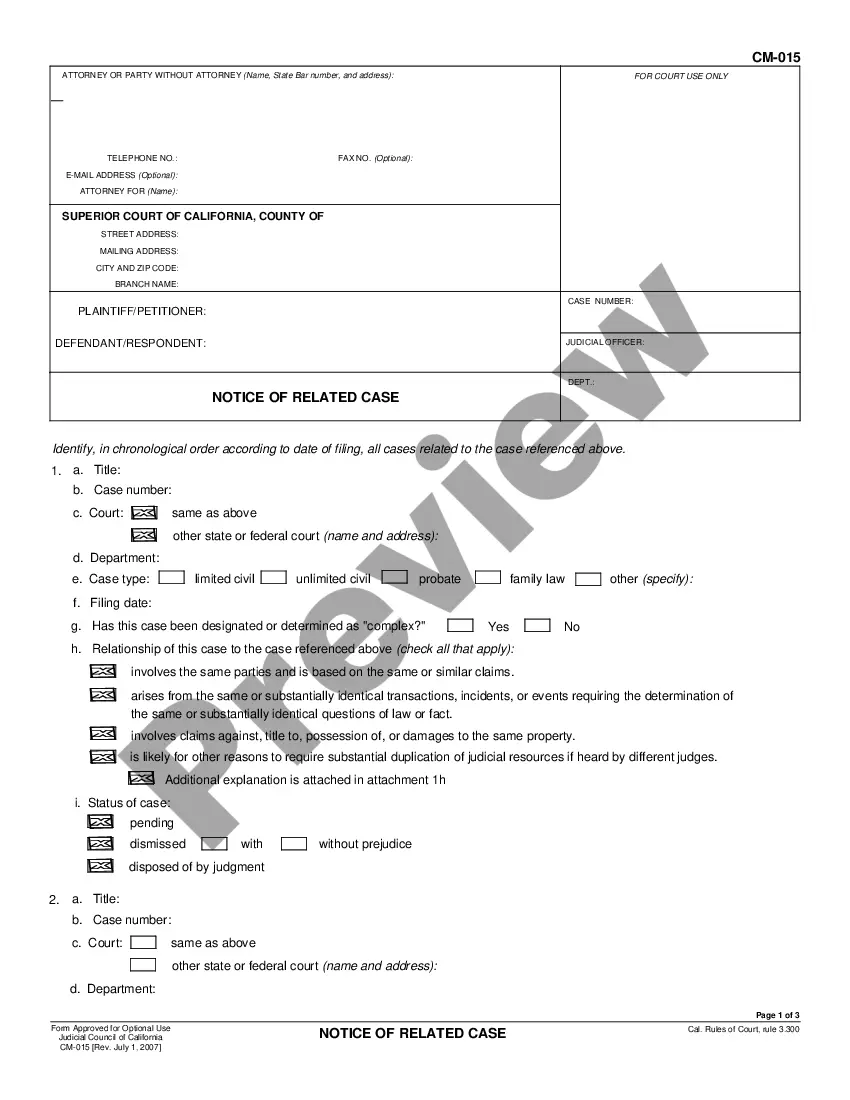

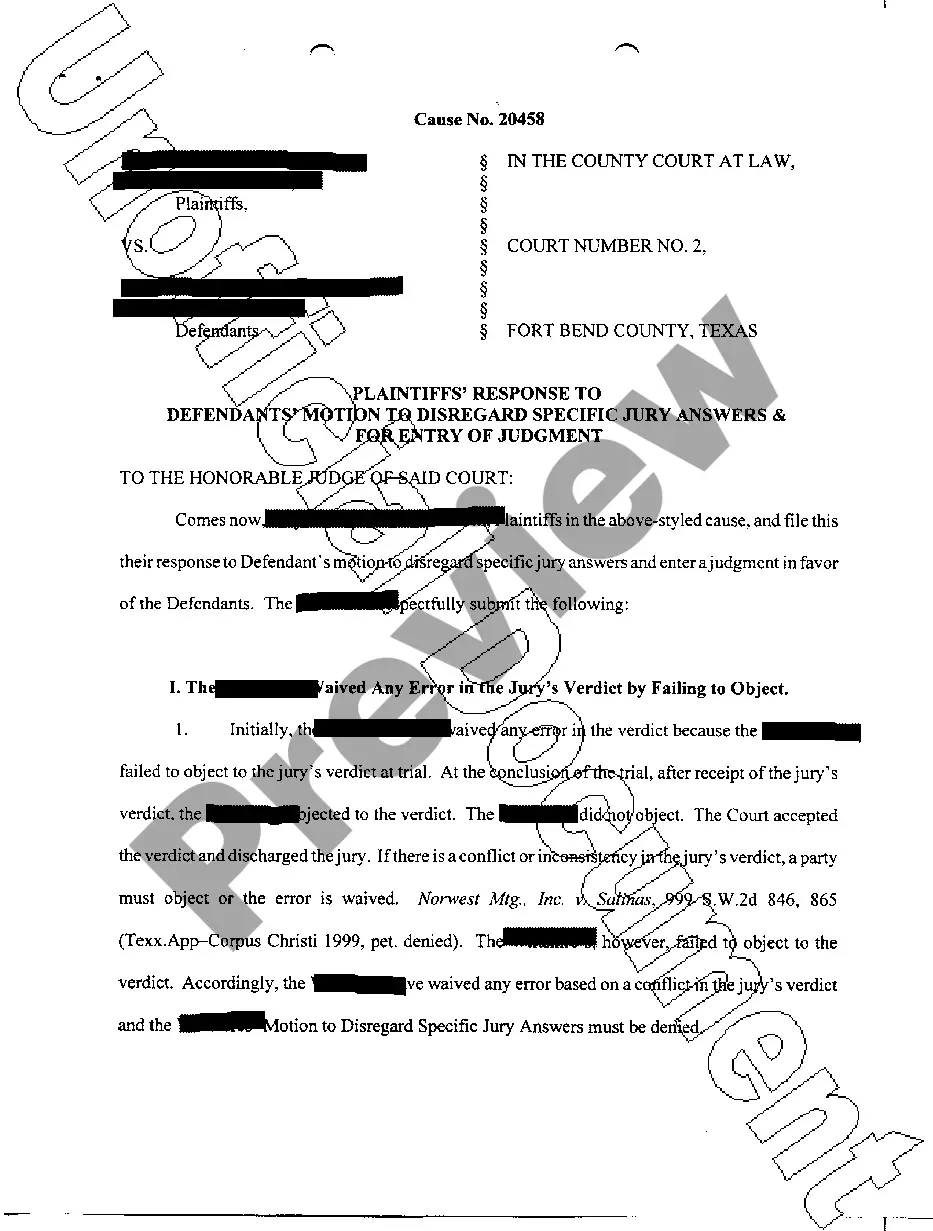

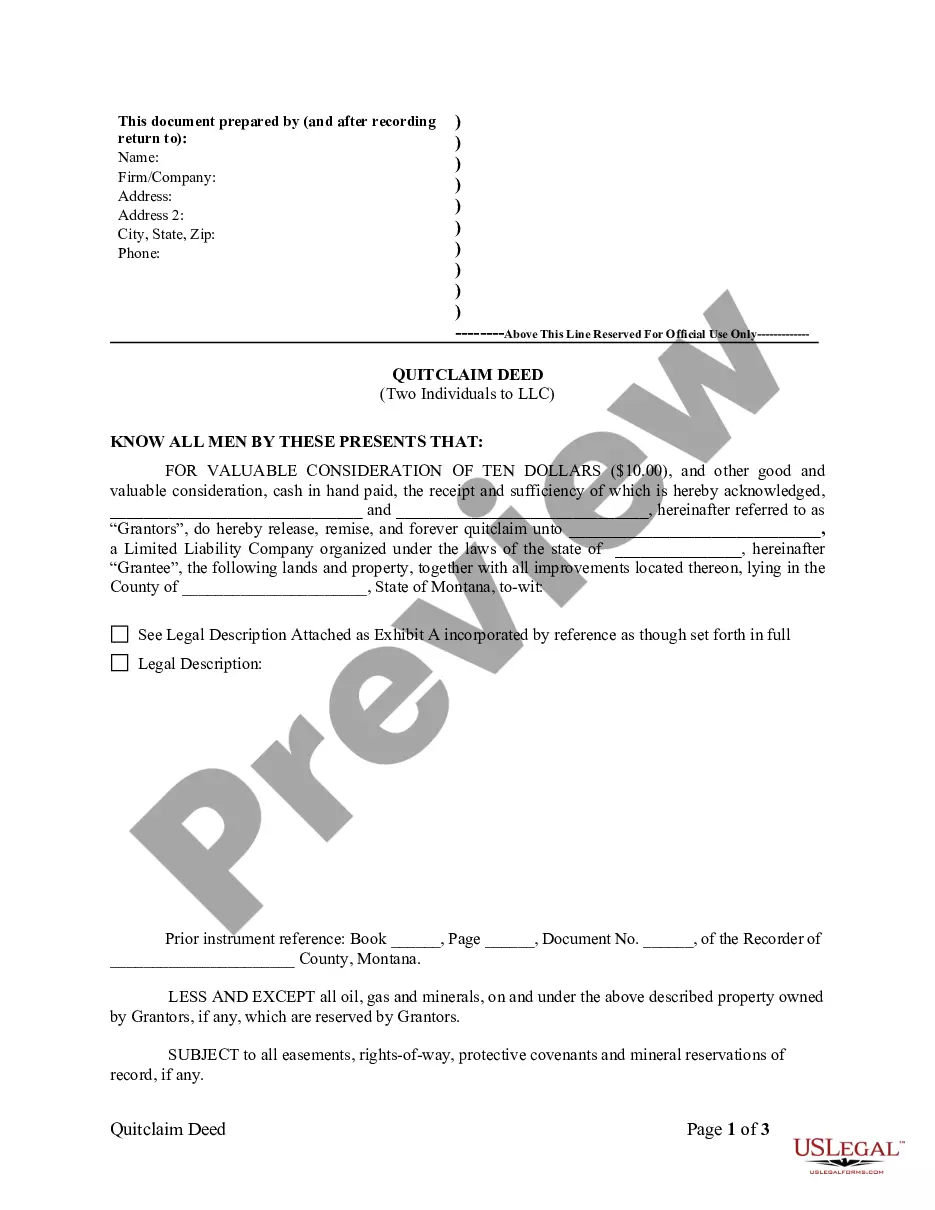

- Be sure the file you’re saving applies in your state (or the state it’s required in).

- Do so by looking at the form’s description and through clicking the Preview option (if accessible) to see the form’s content.

- Click Buy Now.

- Select the proper plan for your budget.

- Sign up to an account and choose how you would like to pay: by PayPal or by card.

- Download the file in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

Skilled lawyers work on creating our samples to ensure that after saving, you don't have to bother about enhancing content outside of your individual details or your business’s details. Join US Legal Forms and get your Oregon Living Trust for Individual Who is Single, Divorced or Widow (or Wwidower) with Children document now.

Form popularity

FAQ

A joint revocable living trust is a trust that is set up by two people (joint grantors) and funded with joint or separate property.

A basic trust plan may run anywhere from $2,000 to $3,000 or more, depending on complexity. There are additional costs for making changes and administration costs after your death. Different types of trusts and trustees can require different fees for administration and wealth management.

The main purpose of a living trust is to oversee the transfer of your assets after your death. Under the terms of the living trust, you are the grantor of the trust, and the person you designate to distribute the trust's assets after your death is known as the successor trustee.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Wills and Trusts FAQs Deciding between a will or a trust is a personal choice, and some experts recommend having both. A will is typically less expensive and easier to set up than a trust, an expensive and often complex legal document.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

A living trust in Oregon allows you to have use and control of your assets while they remain in trust for your beneficiaries. A revocable living trust (sometimes known as an inter vivos trust) is a popular estate planning option with a variety of benefits.