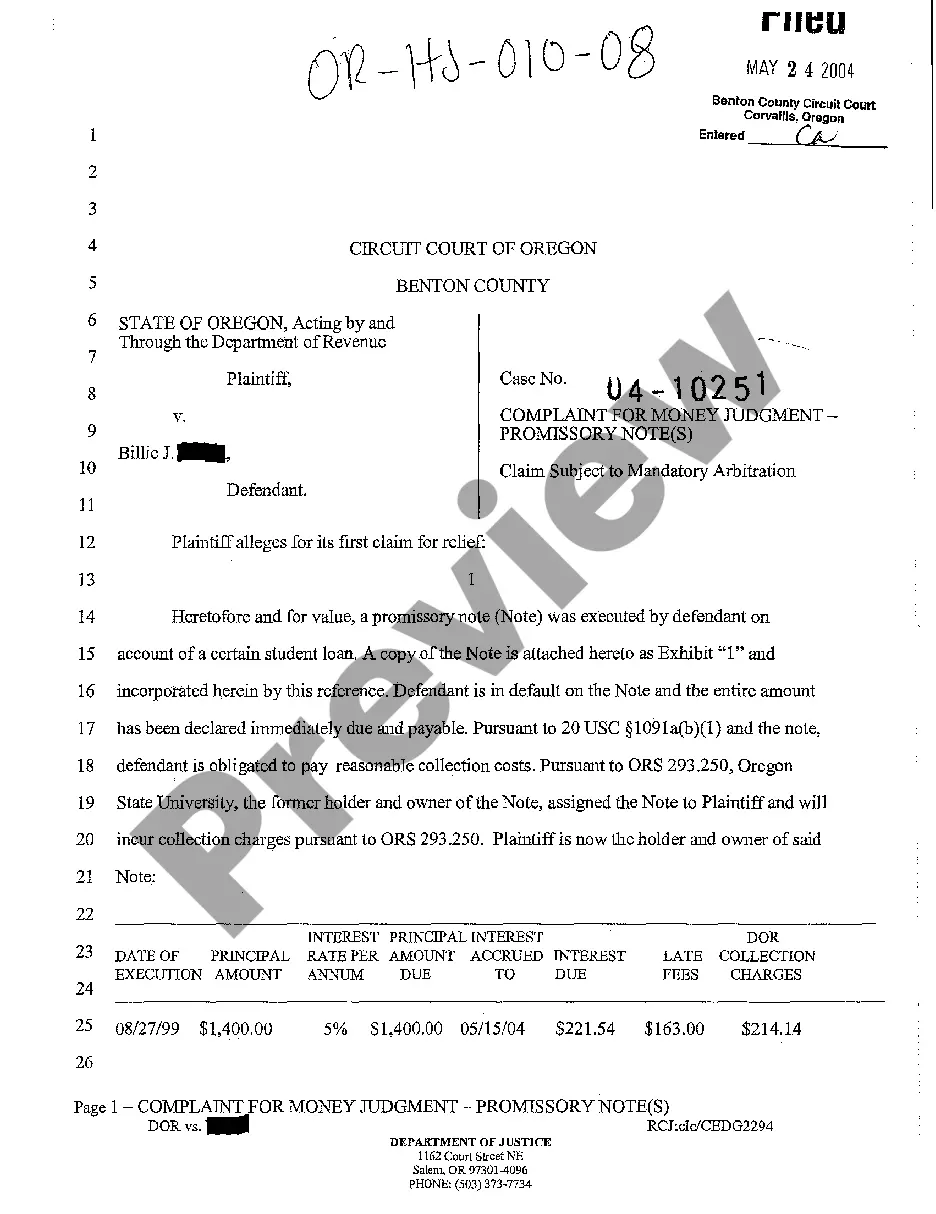

Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan

Description

How to fill out Oregon Complaint For Money Judgment On Promissory Note For Failure To Pay On Student Loan?

Among lots of paid and free templates that you’re able to find on the web, you can't be certain about their accuracy and reliability. For example, who created them or if they are competent enough to take care of what you need these people to. Always keep calm and make use of US Legal Forms! Find Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan samples made by professional attorneys and get away from the expensive and time-consuming procedure of looking for an lawyer or attorney and after that paying them to draft a document for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button next to the file you’re seeking. You'll also be able to access all of your earlier acquired files in the My Forms menu.

If you’re utilizing our platform the first time, follow the tips listed below to get your Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan with ease:

- Make sure that the document you find applies where you live.

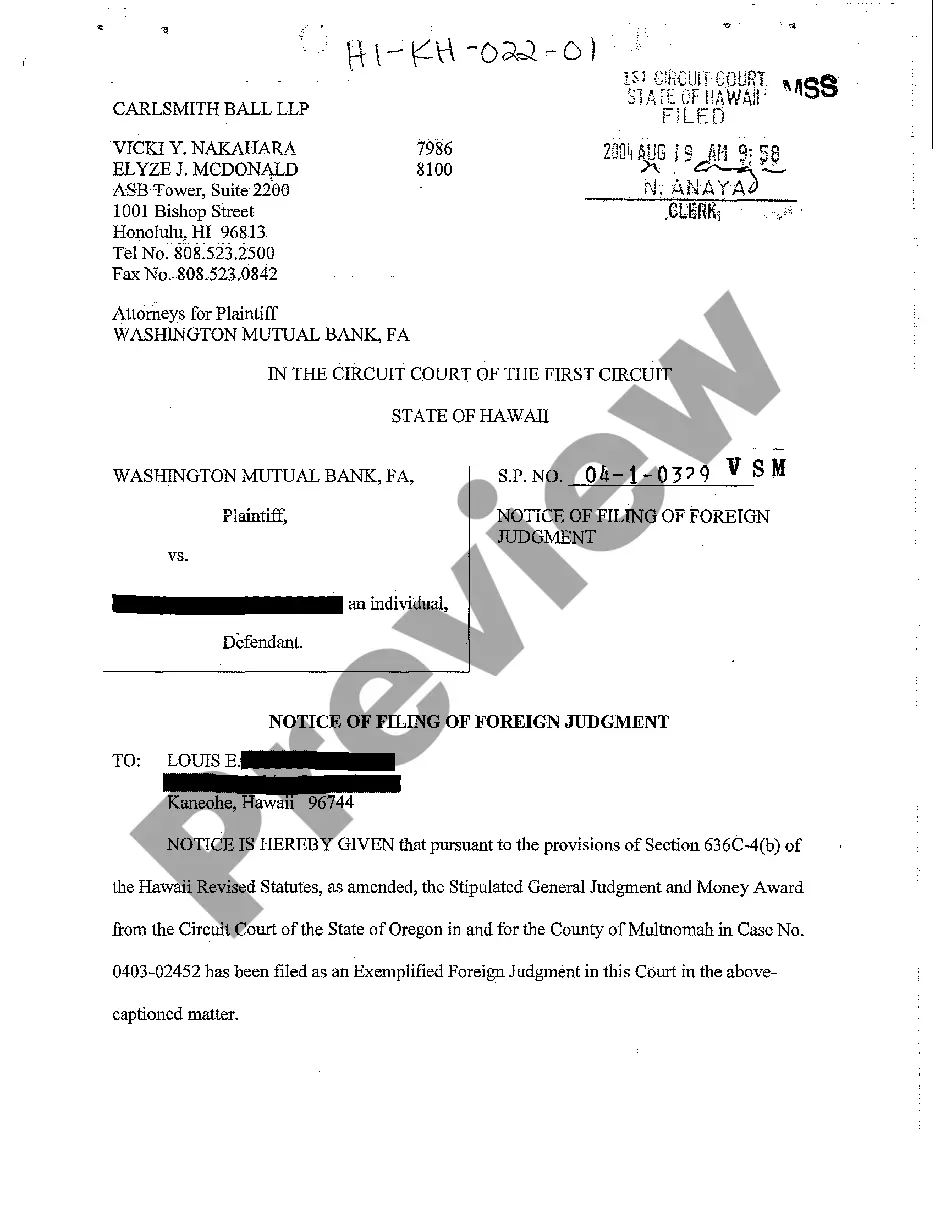

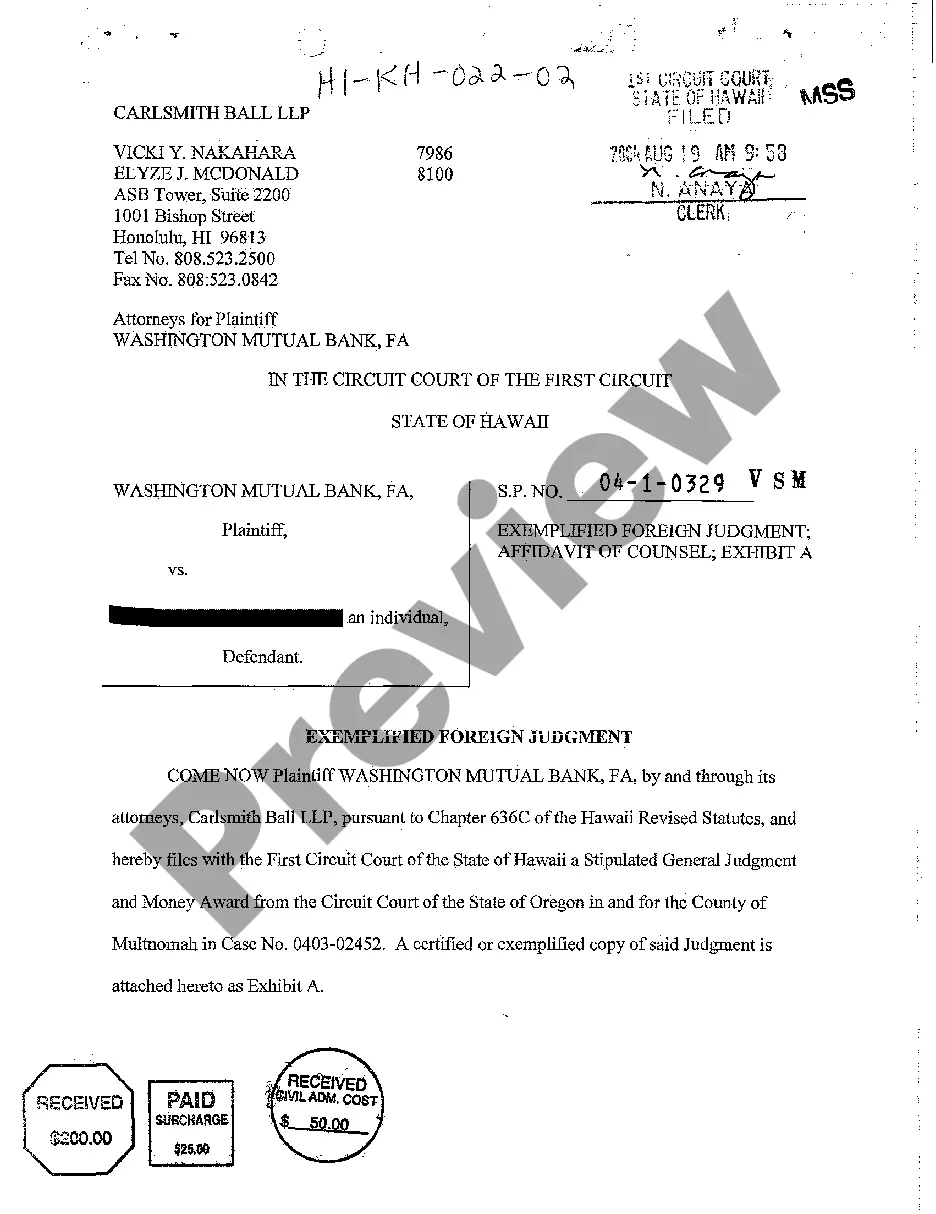

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to start the ordering procedure or look for another template utilizing the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

Once you’ve signed up and purchased your subscription, you can use your Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan as many times as you need or for as long as it remains active where you live. Edit it with your favorite offline or online editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.