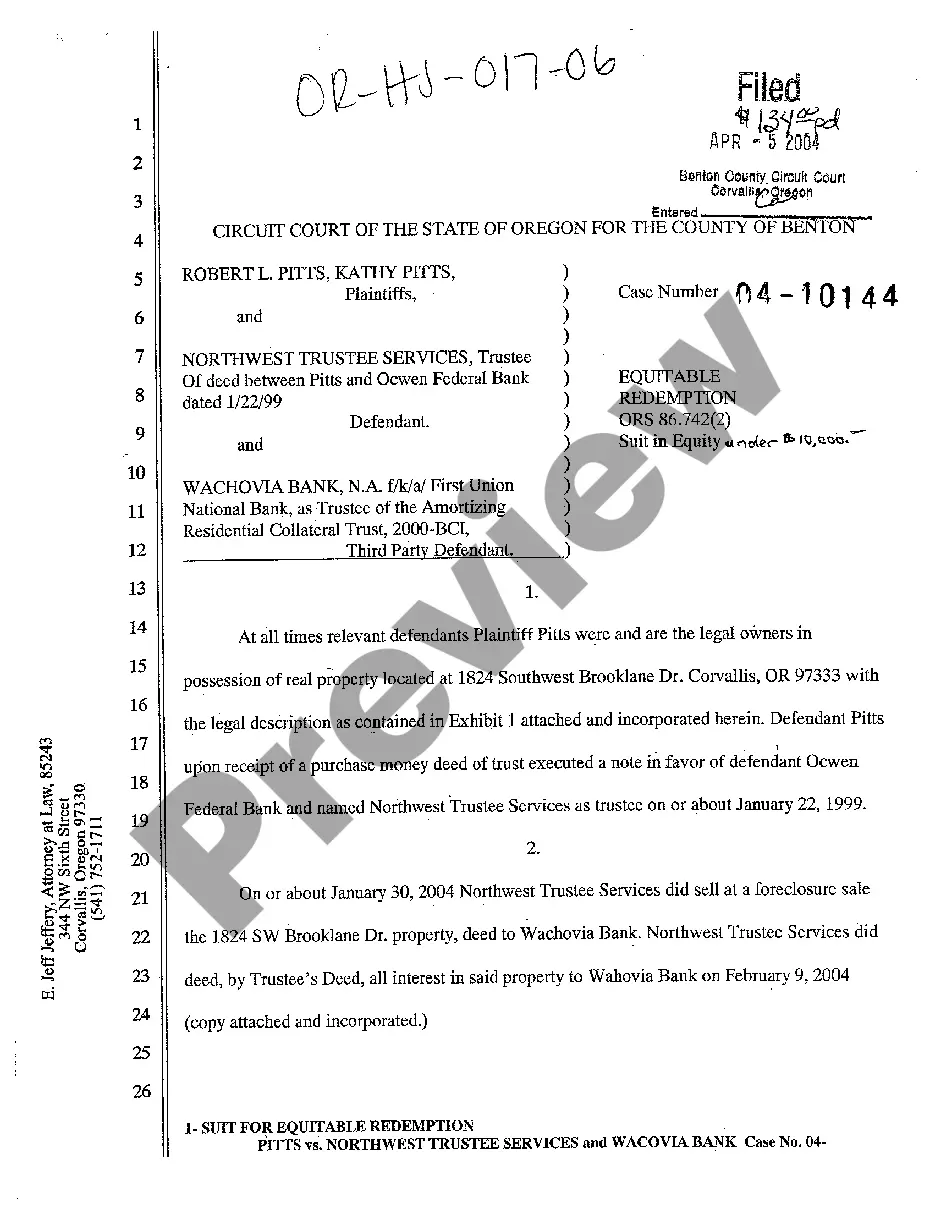

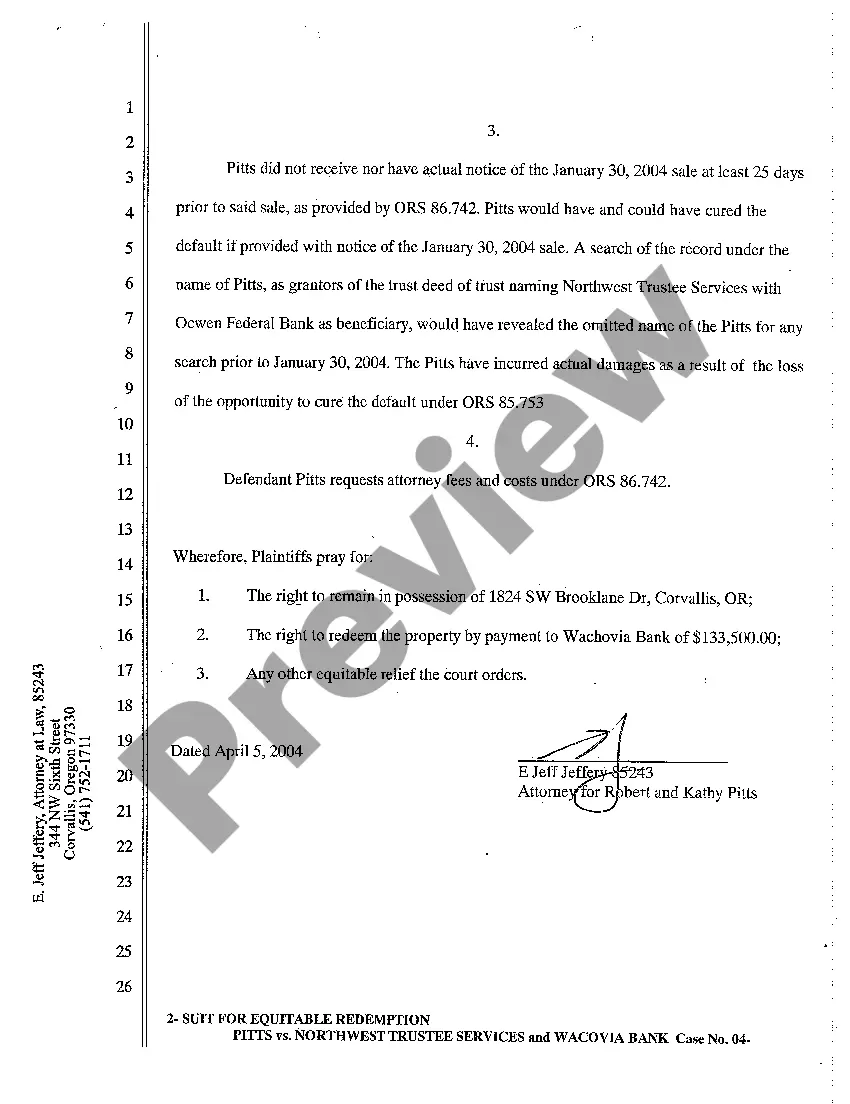

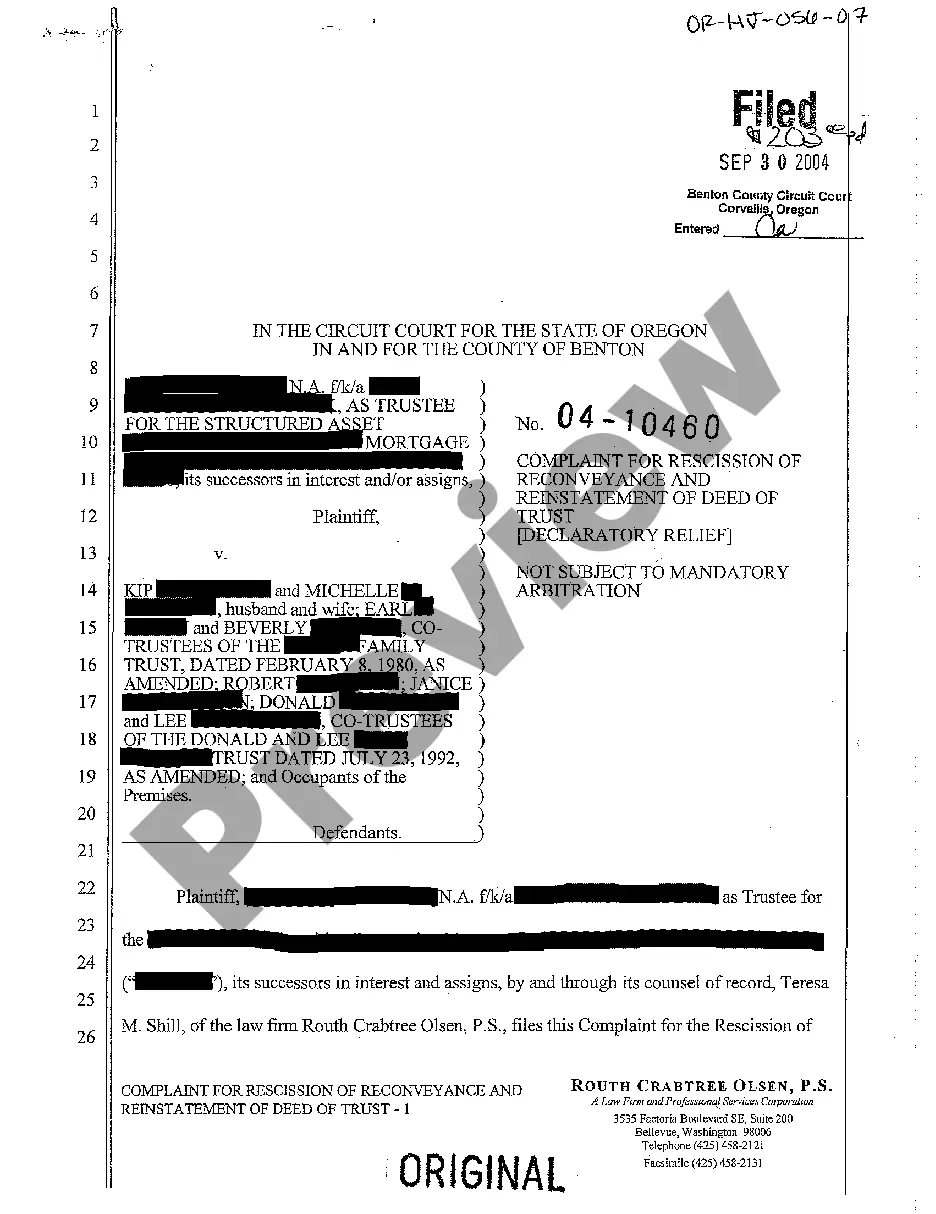

Oregon Complaint for Equitable Redemption

Description

How to fill out Oregon Complaint For Equitable Redemption?

Among numerous free and paid samples that you find on the web, you can't be certain about their accuracy. For example, who made them or if they are qualified enough to take care of what you need them to. Keep relaxed and make use of US Legal Forms! Locate Oregon Complaint for Equitable Redemption samples developed by skilled attorneys and get away from the high-priced and time-consuming procedure of looking for an lawyer and then paying them to draft a document for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you are searching for. You'll also be able to access all of your earlier saved files in the My Forms menu.

If you are using our website for the first time, follow the instructions listed below to get your Oregon Complaint for Equitable Redemption quick:

- Ensure that the document you find applies where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the purchasing process or look for another sample using the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

Once you’ve signed up and paid for your subscription, you can use your Oregon Complaint for Equitable Redemption as many times as you need or for as long as it continues to be active in your state. Edit it in your favorite offline or online editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

The process, known as "statutory redemption," allows mortgagors (homeowners) a limited amount of time, often one year, to reclaim (or redeem) the property if they are able to pay what the property sold for at the foreclosure sale.

Learn about the right of redemption. A "redemption period" is a specific amount of time given to borrowers in foreclosure during which they can pay to redeem their property.pay off the total debt, including the principal balance, plus costs and interest, before the sale to stop the foreclosure, or.

Redemption is a period after your home has already been sold at a foreclosure sale when you can still reclaim your home. You will need to pay the outstanding mortgage balance and all costs incurred during the foreclosure process. Many states have some type of redemption period.

In Oregon, lenders may foreclose on deeds of trusts or mortgages in default using either a judicial or non-judicial foreclosure process. The judicial process of foreclosure, which involves filing a lawsuit to obtain a court order to foreclose, is used when no power of sale is present in the mortgage or deed of trust.

Right of redemption is a legal process that allows a delinquent mortgage borrower to reclaim their home or other property subject to foreclosure if they are able to repay their obligations in time.

Oregon borrowers can expect that the foreclosure process will take approximately six months to complete if everything goes smoothly during the foreclosure. Court delays, borrower objects or a borrower's filing for bankruptcy can delay the process.

Yes, within one year after foreclosure sale only if foreclosing lender is purchaser at such sale. Borrower must give written notice of intent to redeem at the sale or within ten days before the sale. Borrower must post a redemption bond within 20 days of the sale.

Yes you can waive your right to redemption. Mortgage companies often will pay you for a waiver of your redemption rights in certain circumstances.

State Statutory Redemption Laws The redemption period in states that allow it ranges from just 30 days to as high as two years. Many states reduce the redemption period if the property has been abandoned, while borrowers may waive their redemption rights in many states.