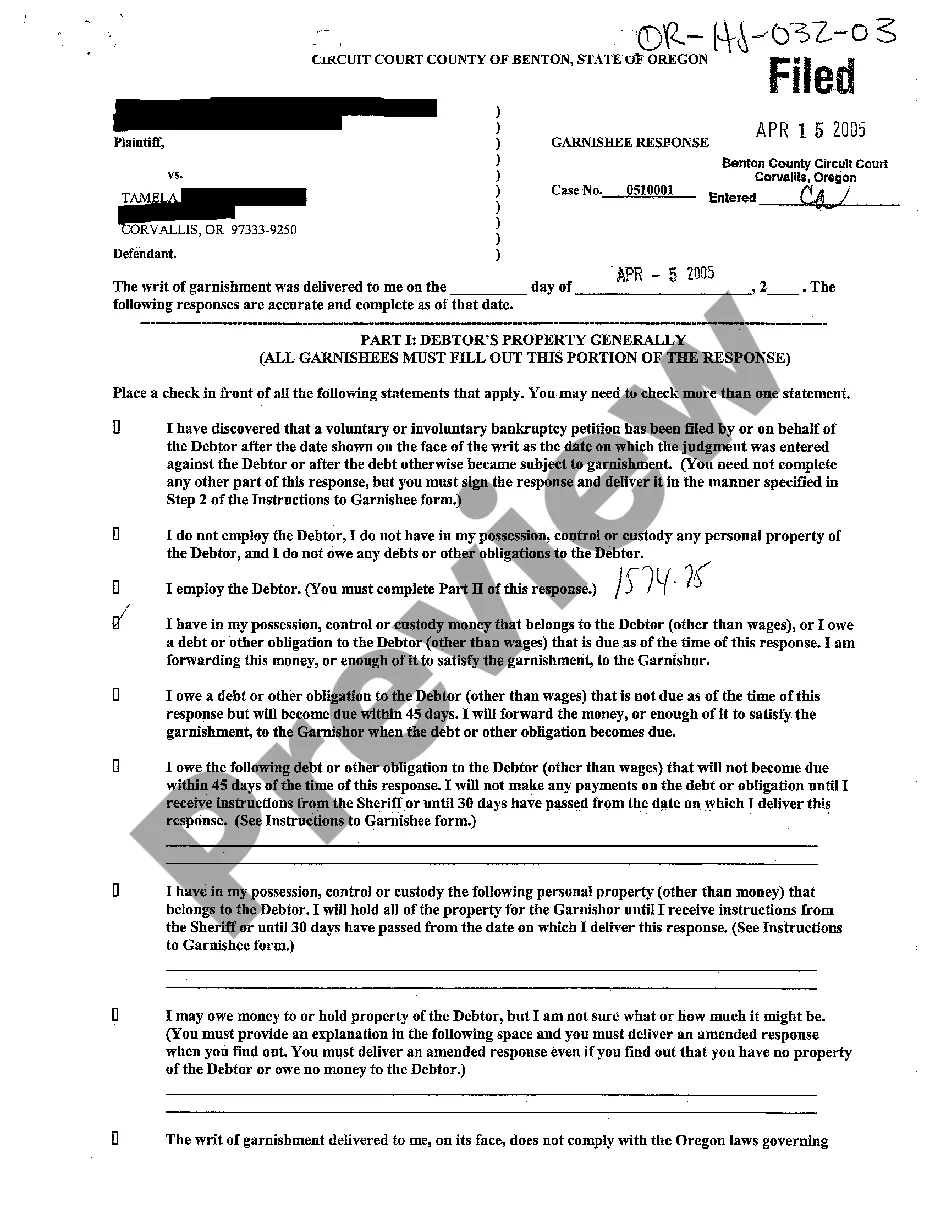

Oregon Garnishee Response Debtor's Property Generally

Description

How to fill out Oregon Garnishee Response Debtor's Property Generally?

When it comes to submitting Oregon Garnishee Response Debtor's Property Generally, you almost certainly think about an extensive procedure that requires finding a ideal sample among a huge selection of similar ones then having to pay a lawyer to fill it out to suit your needs. On the whole, that’s a sluggish and expensive choice. Use US Legal Forms and choose the state-specific form in just clicks.

In case you have a subscription, just log in and click Download to find the Oregon Garnishee Response Debtor's Property Generally template.

If you don’t have an account yet but need one, follow the point-by-point guide below:

- Be sure the file you’re downloading applies in your state (or the state it’s needed in).

- Do it by reading through the form’s description and by clicking the Preview function (if available) to find out the form’s information.

- Simply click Buy Now.

- Find the proper plan for your financial budget.

- Sign up for an account and choose how you want to pay out: by PayPal or by credit card.

- Save the file in .pdf or .docx format.

- Get the file on your device or in your My Forms folder.

Skilled lawyers draw up our samples to ensure that after saving, you don't have to bother about editing and enhancing content material outside of your individual information or your business’s info. Sign up for US Legal Forms and receive your Oregon Garnishee Response Debtor's Property Generally document now.

Form popularity

FAQ

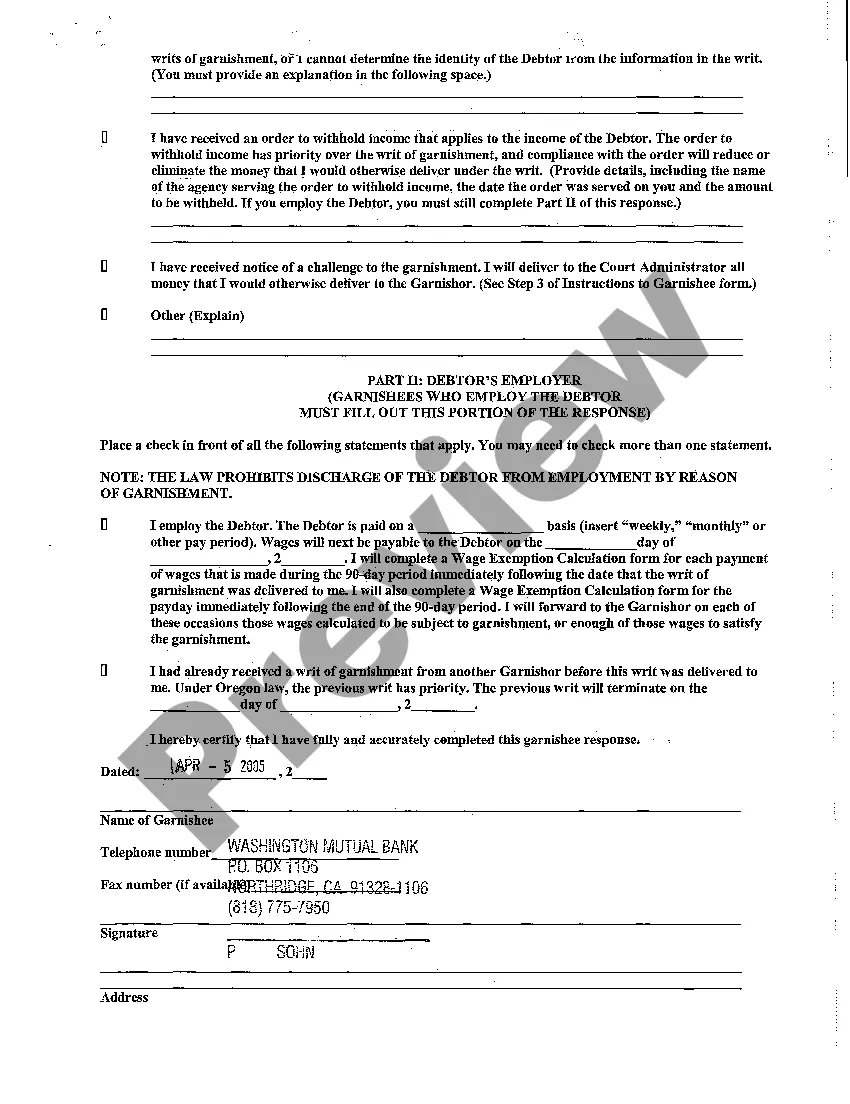

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

File a claim in your county courthouse. A SUMMONS is delivered to you. Default judgment is awarded if no settlement can be reached. Apply for a Writ of Garnishment.

Garnishment is a drastic measure for collecting a debt. A court order of garnishment allows a creditor to take the property of a debtor when the debtor does not possess the property. A garnishment action is taken against the debtor as defendant and the property holder as garnishee.

In Oregon, ORS 18.385 says basically that the MAXIMUM subject to GARNISHMENT is 25% of an employee's DISPOSABLE INCOME (AFTER-TAX, TAKE-HOME). Unless the employee is left is less than $218 per week!

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.