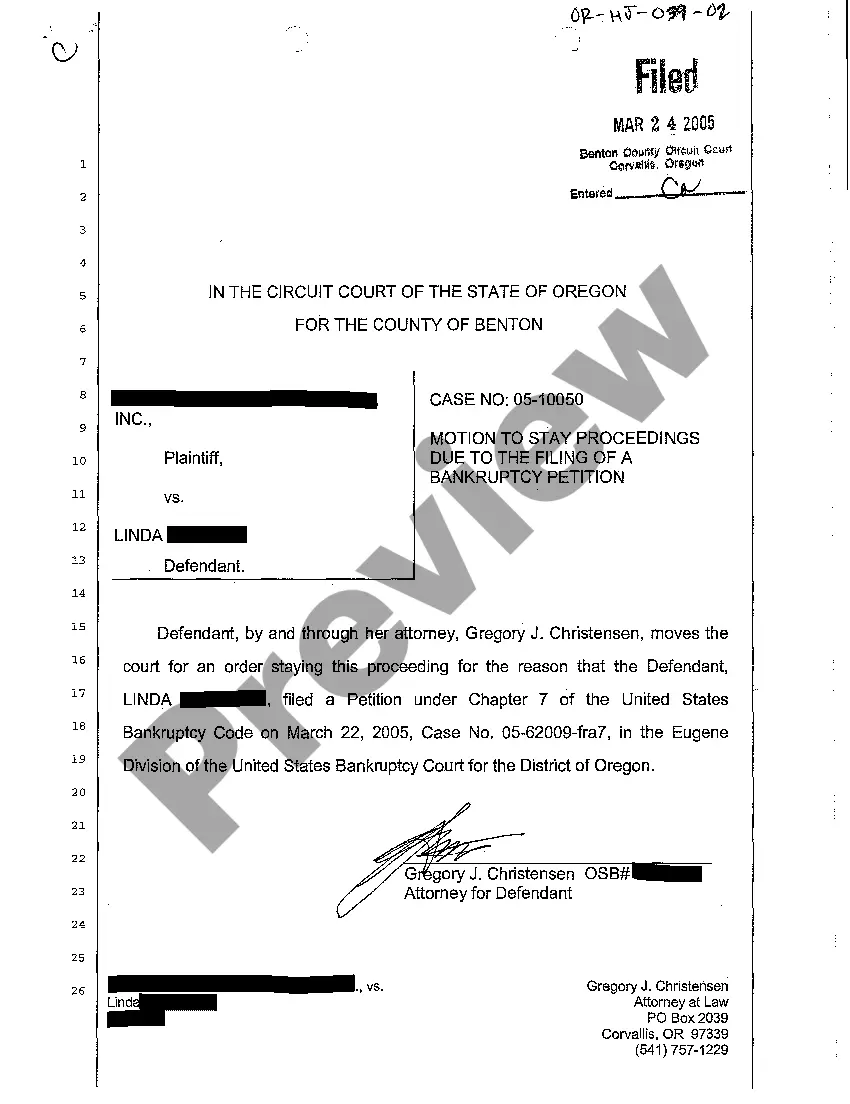

Oregon Motion to Stay Proceedings Due to the Filing of a Chapter 7 Bankruptcy Petition

Description

How to fill out Oregon Motion To Stay Proceedings Due To The Filing Of A Chapter 7 Bankruptcy Petition?

In terms of submitting Oregon Motion to Stay Proceedings Due to the Filing of a Chapter 7 Bankruptcy Petition, you most likely visualize a long process that requires choosing a suitable sample among countless similar ones and after that needing to pay a lawyer to fill it out to suit your needs. Generally, that’s a sluggish and expensive option. Use US Legal Forms and select the state-specific form within clicks.

For those who have a subscription, just log in and click Download to get the Oregon Motion to Stay Proceedings Due to the Filing of a Chapter 7 Bankruptcy Petition sample.

In the event you don’t have an account yet but want one, follow the point-by-point guideline below:

- Be sure the document you’re downloading is valid in your state (or the state it’s needed in).

- Do it by reading through the form’s description and by visiting the Preview option (if accessible) to view the form’s content.

- Click on Buy Now button.

- Select the proper plan for your financial budget.

- Sign up to an account and choose how you want to pay out: by PayPal or by card.

- Download the file in .pdf or .docx file format.

- Find the document on your device or in your My Forms folder.

Professional lawyers work on drawing up our samples so that after downloading, you don't need to bother about editing content outside of your individual info or your business’s information. Join US Legal Forms and get your Oregon Motion to Stay Proceedings Due to the Filing of a Chapter 7 Bankruptcy Petition document now.

Form popularity

FAQ

However, under certain circumstances, creditors can ask the court to allow them to go ahead with collections in spite of the bankruptcy filing. This is called a Motion for Relief from Automatic Stay, and a successful one often negates the whole purpose of filing for Chapter 7 bankruptcy in the first place.

In this case, the automatic stay will last only 30 days unless you, your case trustee, the U.S. trustee, or your creditor request that the stay remain in effect, and you can prove good faith (e.g., you followed all bankruptcy rules and did not commit fraud) in your most recent filing.

You do have the right to change your mind after filing bankruptcy, but this can be a lengthy and sometimes complicated process. If you filed a Chapter 7 bankruptcy, the court is more likely to dismiss your case as long as doing so wouldn't harm your creditors.

The automatic stay goes into effect for only 30 days after you file bankruptcy. Two or more previous bankruptcy cases dismissed within the past year.

However, under certain circumstances, creditors can ask the court to allow them to go ahead with collections in spite of the bankruptcy filing. This is called a Motion for Relief from Automatic Stay, and a successful one often negates the whole purpose of filing for Chapter 7 bankruptcy in the first place.

There is no set time. If you file the bankruptcy and get court approval for the short sale, you will be able to stay in the home until title is transferred to the new owner. As a practical matter, you will want to move and clean up the property at least a few days before the escrow closes.

Once they get a court order lifting the automatic stay, the creditor is allowed to move forward with the foreclosure or repossession of the property that secures the debt. The creditor does, however, still need to follow state law for their collection or eviction proceedings.

When you file for Chapter 7 or Chapter 13 bankruptcy, the automatic stay immediately goes into effect. The automatic stay prohibits most creditors from continuing with collection activities, which can provide welcome relief to debtors as well the opportunity to regroup during bankruptcy.

Generally, a debtor can only withdraw their Chapter 7 bankruptcy if they have a valid reason and the circumstances rise to a level deemed to be good cause. Additionally, the debtor must show the Court that creditors will not be prejudiced by the dismissal of the case and that the dismissal is in the debtor's own best