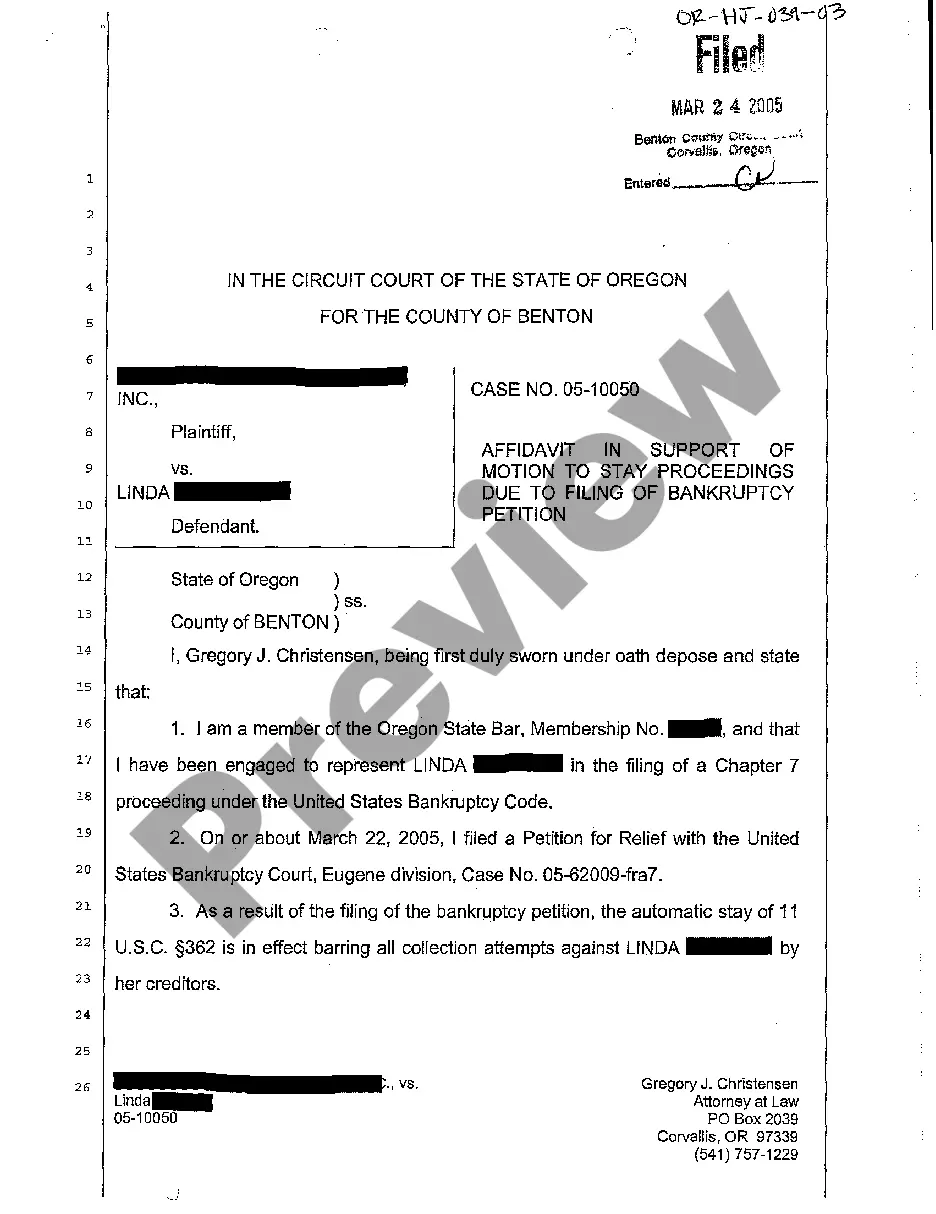

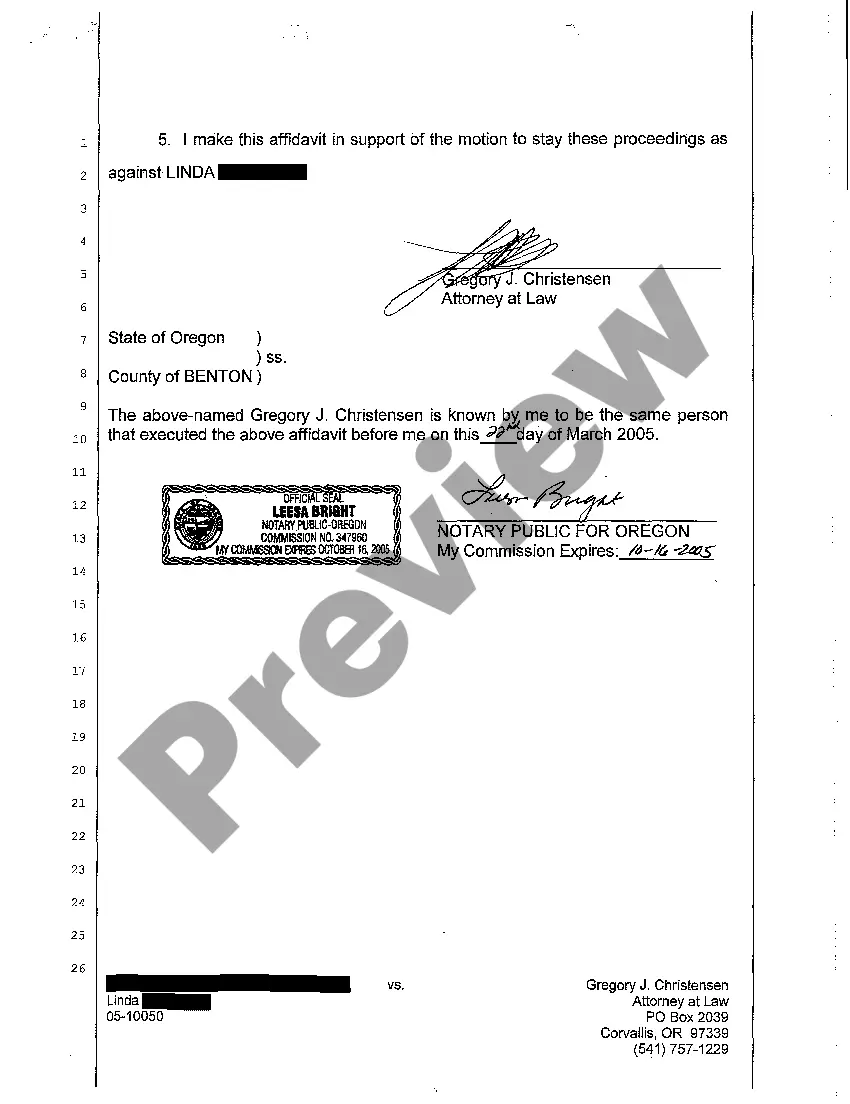

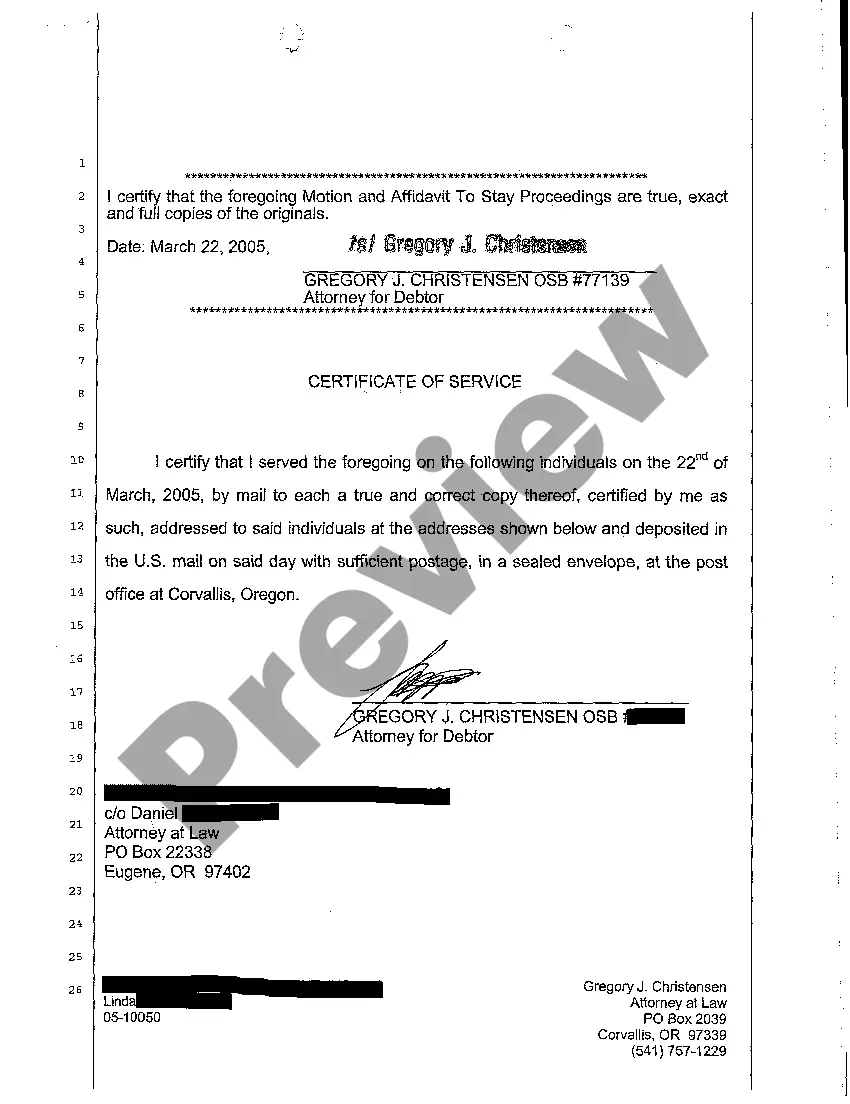

Oregon Affidavit in Support of Motion to Stay Proceedings Due to Filing of Chapter 7 Bankruptcy Petition

Description

How to fill out Oregon Affidavit In Support Of Motion To Stay Proceedings Due To Filing Of Chapter 7 Bankruptcy Petition?

When it comes to completing Oregon Affidavit in Support of Motion to Stay Proceedings Due to Filing of Chapter 7 Bankruptcy Petition, you probably think about an extensive process that involves choosing a ideal sample among a huge selection of similar ones then being forced to pay out legal counsel to fill it out to suit your needs. On the whole, that’s a sluggish and expensive choice. Use US Legal Forms and pick out the state-specific document within clicks.

For those who have a subscription, just log in and click on Download button to find the Oregon Affidavit in Support of Motion to Stay Proceedings Due to Filing of Chapter 7 Bankruptcy Petition sample.

If you don’t have an account yet but need one, stick to the step-by-step guideline listed below:

- Be sure the file you’re getting is valid in your state (or the state it’s required in).

- Do it by looking at the form’s description and by clicking the Preview function (if offered) to find out the form’s content.

- Click on Buy Now button.

- Select the appropriate plan for your budget.

- Join an account and choose how you want to pay: by PayPal or by credit card.

- Save the file in .pdf or .docx format.

- Find the record on your device or in your My Forms folder.

Professional attorneys work on creating our templates so that after downloading, you don't need to worry about enhancing content outside of your individual details or your business’s details. Join US Legal Forms and receive your Oregon Affidavit in Support of Motion to Stay Proceedings Due to Filing of Chapter 7 Bankruptcy Petition sample now.

Form popularity

FAQ

A motion for relief from the automatic stay, also called a stay relief motion, is a request a creditor can submit to the bankruptcy court to ask for permission to take certain collection actions against the person who filed bankruptcy. Usually, you'll see these motions filed by secured creditors.

However, under certain circumstances, creditors can ask the court to allow them to go ahead with collections in spite of the bankruptcy filing. This is called a Motion for Relief from Automatic Stay, and a successful one often negates the whole purpose of filing for Chapter 7 bankruptcy in the first place.

The automatic stay goes into effect for only 30 days after you file bankruptcy. Two or more previous bankruptcy cases dismissed within the past year.

The moment you file your bankruptcy case, an automatic stay goes into effect. The stay prohibits almost all creditors from initiating or continuing any collection activities against you. A creditor cannot call you, send you collection letters, file a lawsuit, or otherwise attempt to collect its debt from you.

In most cases, the automatic stay is in effect immediately when you file your Chapter 7 bankruptcy petition. That means you can expect the constant telephone calls, hateful letters, and fear of lawsuits to end as soon as you file your bankruptcy forms.

Two Bankruptcies Within One Year: Stay Limited to 30 Days. Three Bankruptcies Within One Year: No Automatic Stay. Asking the Court to Impose the Stay or Extend It Beyond 30 days. Joint Bankruptcy Filings. If the Stay Is Not In Effect: What Can Creditors Take?

Upon filing a petition, an automatic stay is imposed. The stay requires creditors to cease actions against the debtor and the debtor's property as described in 11 U.S.C.Creditors may file a motion under 11 U.S.C. § 362 requesting the stay be lifted to allow them to pursue a particular piece of property.

2d 206, 207 (2d Cir. 1986) (Since the purpose of the stay is to protect creditors as well as the debtor, the debtor may not waive the automatic stay); Matter of Pease, 195 B.R. 431, 434 (Bankr.

In this case, the automatic stay will last only 30 days unless you, your case trustee, the U.S. trustee, or your creditor request that the stay remain in effect, and you can prove good faith (e.g., you followed all bankruptcy rules and did not commit fraud) in your most recent filing.