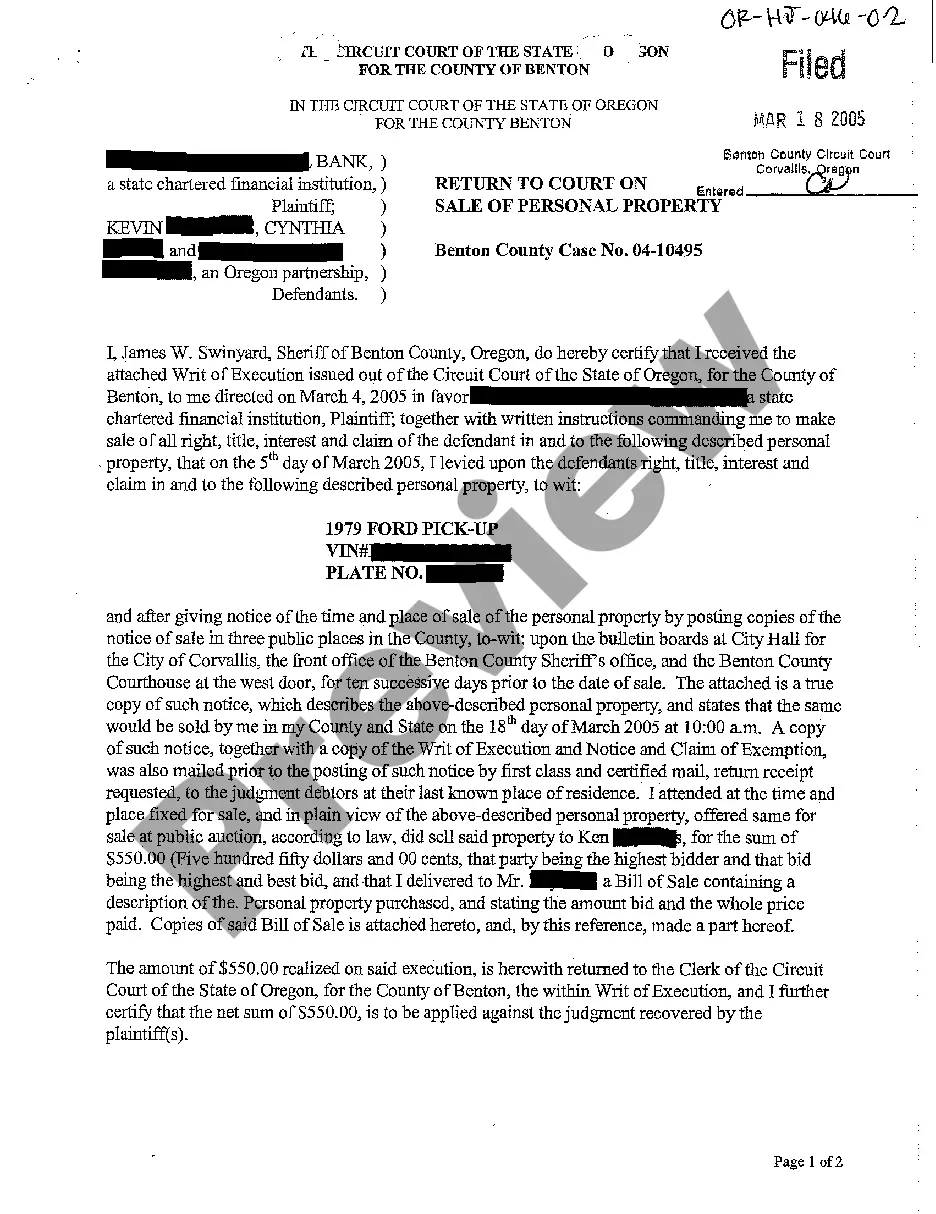

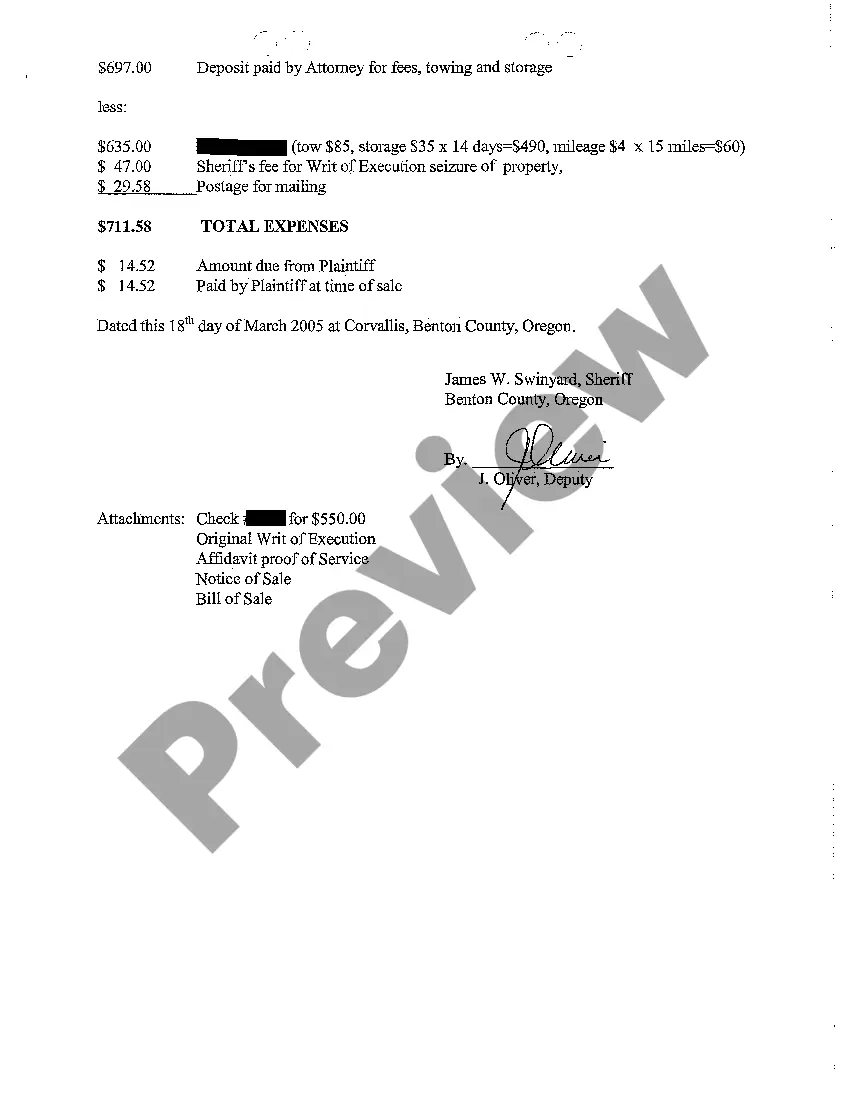

Oregon Return to Court on Sale of Personal Property

Description

How to fill out Oregon Return To Court On Sale Of Personal Property?

Among countless paid and free samples that you can find on the internet, you can't be certain about their accuracy. For example, who created them or if they are skilled enough to deal with what you need these to. Keep relaxed and utilize US Legal Forms! Get Oregon Return to Court on Sale of Personal Property templates developed by professional attorneys and get away from the high-priced and time-consuming procedure of looking for an attorney and then having to pay them to draft a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the file you’re looking for. You'll also be able to access all of your earlier saved samples in the My Forms menu.

If you’re making use of our service for the first time, follow the guidelines below to get your Oregon Return to Court on Sale of Personal Property easily:

- Make certain that the file you see applies where you live.

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or look for another sample using the Search field located in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted file format.

Once you’ve signed up and purchased your subscription, you may use your Oregon Return to Court on Sale of Personal Property as many times as you need or for as long as it continues to be active in your state. Revise it in your favored editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

Tangible personal property exists physically (i.e., you can touch it) and can be used or consumed. Clothing, vehicles, jewelry, and business equipment are examples of tangible personal property. Sales and use taxes apply when tangible personal property is used or consumed in Illinois.

Two common strategies to reduce the Oregon estate tax are the use of a credit-shelter or bypass trust and lifetime gifting: Credit-Shelter or Bypass Trust. A married couple moving to Oregon can update their estate planning to include the use of a credit-shelter or bypass trust at the first spouse's death.

What is considered business personal property? Essentially, any item a company uses to conduct business, and that the business may take with them if they moved locations, such as furniture, machinery, supplies, tools, etc., is considered business personal property.

Examples of tangible personal property include vehicles, furniture, boats, and collectibles. Personal property can be intangible, as in the case of stocks and bonds. Just as some loansmortgages, for exampleare secured by real property, such as a house, some loans are secured by personal property.

Personal Property - Any property other than real estate. The distinguishing factor between personal property and real property is that personal property is movable and not fixed permanently to one location, such as land or buildings.

In Maryland there is a tax on business owned personal property which is imposed and collected by the local governments.Personal property generally includes furniture, fixtures, office and industrial equipment, machinery, tools, supplies, inventory and any other property not classified as real property.

Oregon has a graduated estate tax. It starts at 10% and goes up to 16%. The amount the estate is taxed depends on how much the estate is worth after the $1 million exemption and any other exemptions are taken.

If you're a resident of Oregon and leave an estate of more than $1 million, your estate may have to pay Oregon estate tax. The $1 million exemption is the current figure; the law in effect at your death will apply to your estate.

Basically, personal property is any property that is not real property. Personal property is not permanently attached to land. In most cases, it is moveable and does not last as long as real property. Personal property includes vehicles, farm equipment, jewelry, household goods, stocks, and bonds.