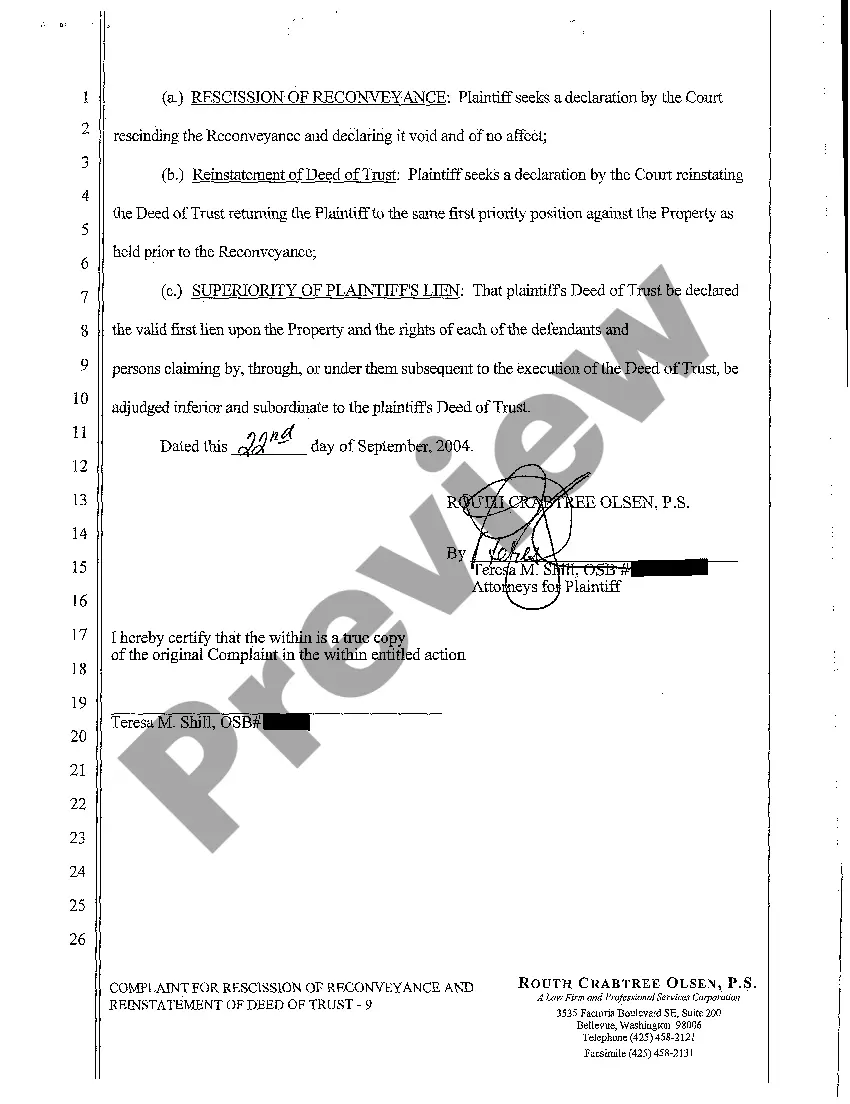

Oregon Complaint for Rescission of Reconveyance and Reinstatement of Deed of Trust Declaratory Relief

Description

How to fill out Oregon Complaint For Rescission Of Reconveyance And Reinstatement Of Deed Of Trust Declaratory Relief?

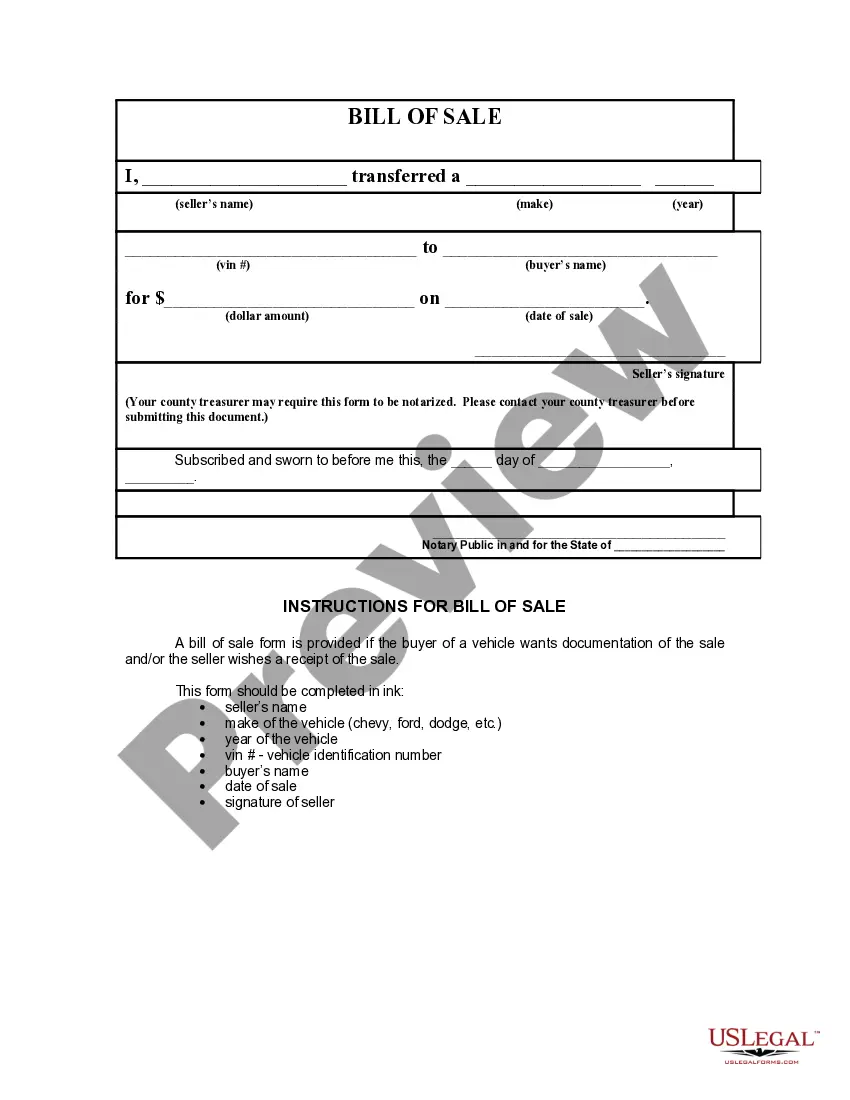

In terms of submitting Oregon Complaint for Rescission of Reconveyance and Reinstatement of Deed of Trust Declaratory Relief, you almost certainly imagine an extensive process that involves finding a ideal form among a huge selection of very similar ones and then needing to pay a lawyer to fill it out for you. In general, that’s a sluggish and expensive option. Use US Legal Forms and choose the state-specific template in a matter of clicks.

In case you have a subscription, just log in and click Download to get the Oregon Complaint for Rescission of Reconveyance and Reinstatement of Deed of Trust Declaratory Relief form.

If you don’t have an account yet but need one, follow the step-by-step guide listed below:

- Be sure the document you’re downloading is valid in your state (or the state it’s required in).

- Do it by reading the form’s description and through clicking the Preview option (if available) to find out the form’s information.

- Click Buy Now.

- Pick the proper plan for your budget.

- Sign up to an account and choose how you want to pay: by PayPal or by card.

- Save the file in .pdf or .docx file format.

- Find the document on your device or in your My Forms folder.

Professional lawyers draw up our templates so that after saving, you don't need to bother about editing and enhancing content material outside of your individual info or your business’s info. Be a part of US Legal Forms and get your Oregon Complaint for Rescission of Reconveyance and Reinstatement of Deed of Trust Declaratory Relief example now.

Form popularity

FAQ

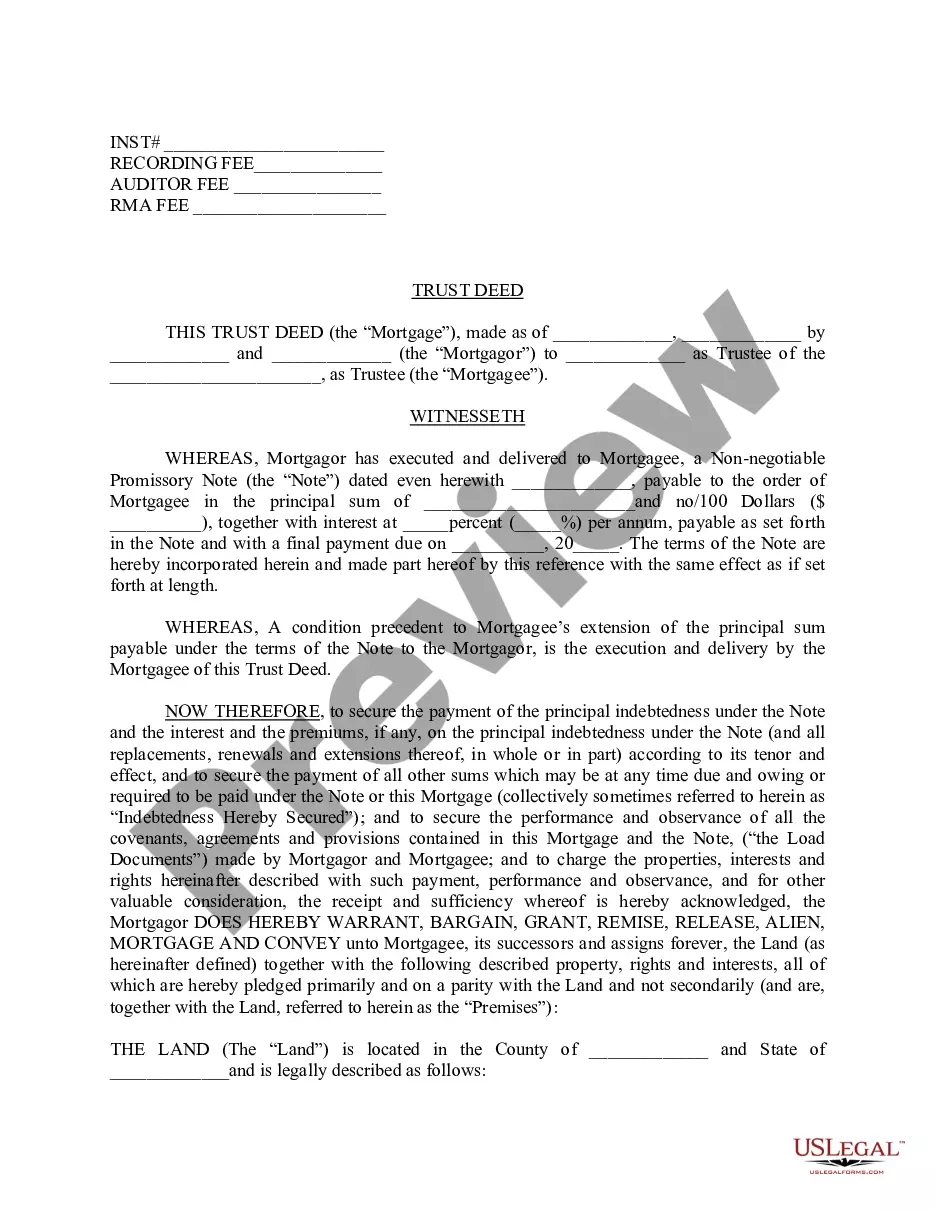

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form. is completed and signed by the trustee, whose signature must be notarized.

Reconveyance is the transfer of a title to the borrower after a mortgage has been fully paid.

Reconveyance Fee: When you refinance your mortgage, expect to pay a number of fees. A loan reconveyance fee is a typical charge when you refinance a mortgage.The overall fee covers the cost of removing your current lender's lien from your property title and have it be recorded at the County Recorder's office.

A mortgage holder issues a deed of reconveyance to indicate that the borrower has been released from the mortgage debt. The deed transfers the property title from the lender, also called the beneficiary, to the borrower. This document is most commonly used when a mortgage has been paid in full.

Upon the return receipt of the Address Verification Letter, the property reconveyance process will begin. Once all the paperwork has been received by the Administrative Office, it may take up to thirty (30) calendar days to process. The deeds of trust are processed in the sequence received.

Reconveyance is the transfer of a title to the borrower after a mortgage has been fully paid.

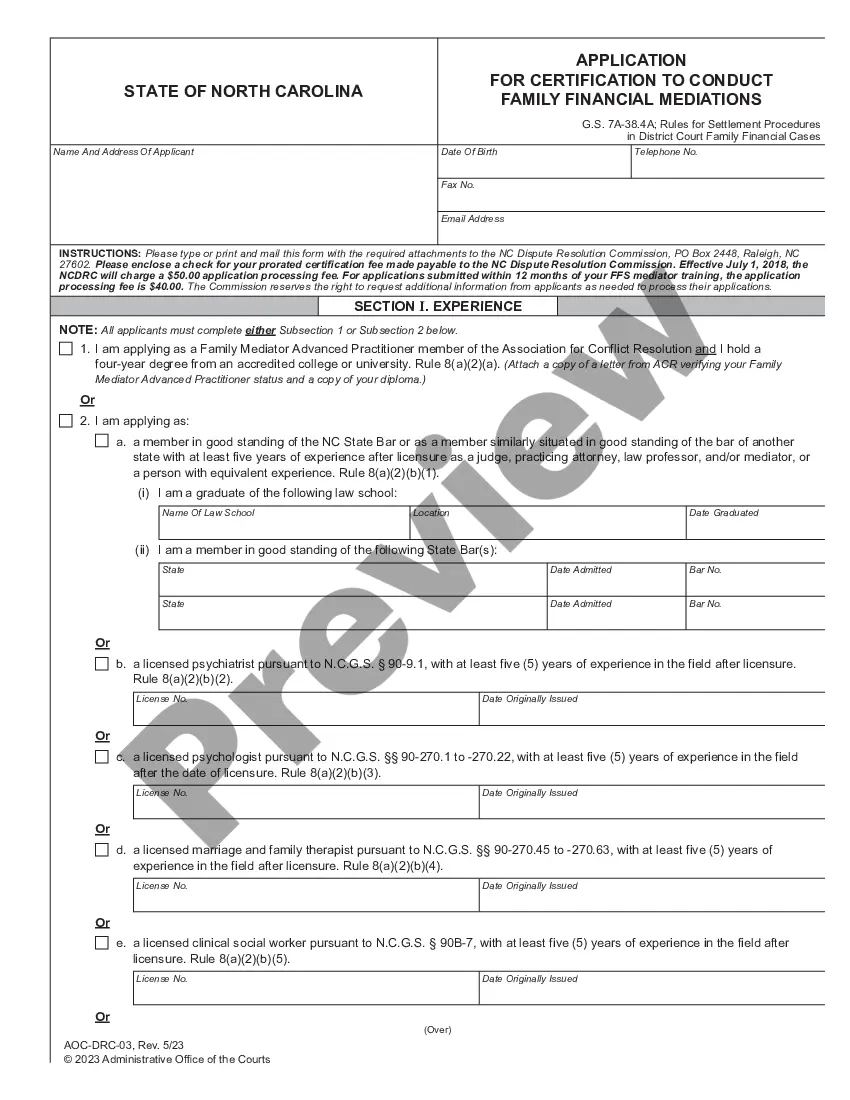

Section 112 of Act 496 allows cancellation of certificate of title upon petition by a registered owner (or co-owner) when, among other specific grounds, registered interest have terminated and new ones have arisen or upon any other reasonable ground.

Reconveyance is the transfer of a title to the borrower after a mortgage has been fully paid.

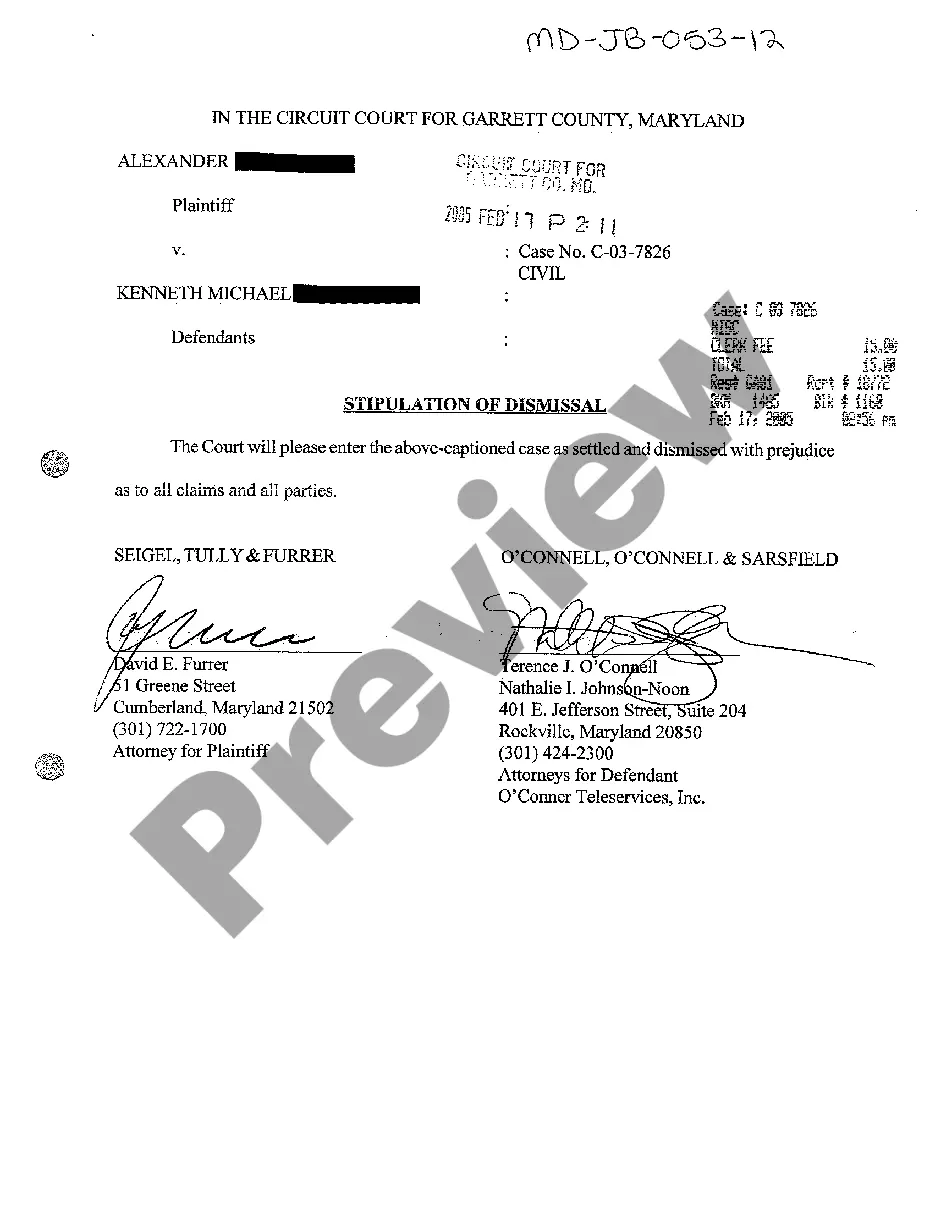

An action for reconveyance, on the other hand, is a legal and equitable remedy granted to the rightful owner of land which has been wrongfully or erroneously registered in the name of another for the purpose of compelling the latter to transfer or reconvey the land to him.