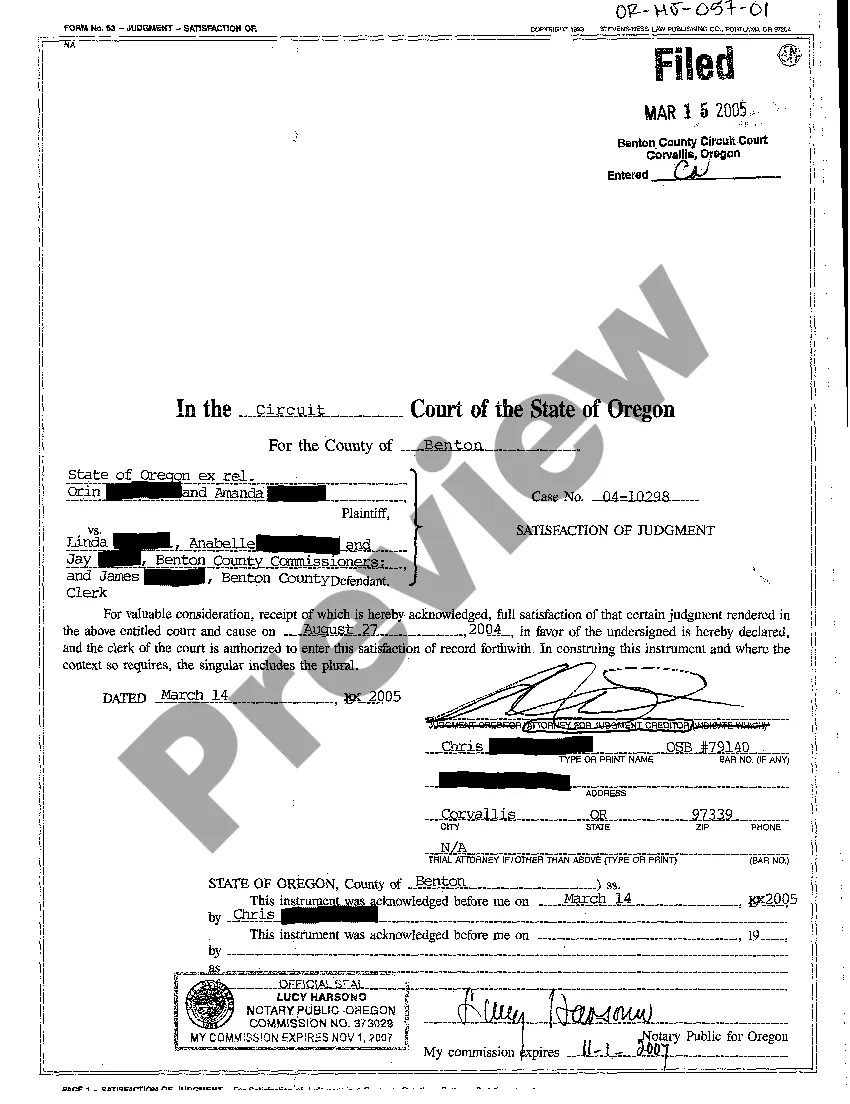

Oregon Satisfaction of Judgment

Description

How to fill out Oregon Satisfaction Of Judgment?

In terms of submitting Oregon Satisfaction of Judgment, you probably visualize an extensive procedure that requires choosing a ideal sample among a huge selection of very similar ones then needing to pay legal counsel to fill it out for you. Generally speaking, that’s a slow-moving and expensive choice. Use US Legal Forms and select the state-specific document within just clicks.

In case you have a subscription, just log in and then click Download to have the Oregon Satisfaction of Judgment sample.

In the event you don’t have an account yet but need one, stick to the step-by-step guide listed below:

- Make sure the file you’re saving is valid in your state (or the state it’s required in).

- Do so by looking at the form’s description and through clicking the Preview option (if readily available) to view the form’s information.

- Click on Buy Now button.

- Pick the proper plan for your financial budget.

- Sign up for an account and select how you would like to pay: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Get the document on your device or in your My Forms folder.

Professional lawyers work on creating our samples to ensure after downloading, you don't need to bother about modifying content material outside of your personal information or your business’s information. Join US Legal Forms and get your Oregon Satisfaction of Judgment example now.

Form popularity

FAQ

You may ask your judgment creditor to file a satisfaction of judgment form. The length of time gives to the creditor to file the form varies from state to state, but it is usually between 14 and 30 days after your request.

A Satisfaction of Judgment is a document signed by one party acknowledge receipt of the payment. The Satisfaction of Judgment is then filed with the court. This is beneficial to the paying party for multiple reasons. One, the court is put on notice that the debt has been satisfied.

Once a judgment is paid, whether in installments or a lump sum, a judgment creditor (the person who won the case) must acknowledge that the judgment has been paid by filing a Satisfaction of Judgment form with the court clerk.

A document signed by the party who is owed money under a court judgment (called the judgment creditor) stating that the full amount due on the judgment has been paid.

You will need one original, notarized copy for the judgment debtor. If you recorded an abstract of judgment to place a lien against the debtor's real property, you will need an original, notarized copy of your Acknowledgment of Satisfaction of Judgment (EJ-100) for each county where you placed a lien.