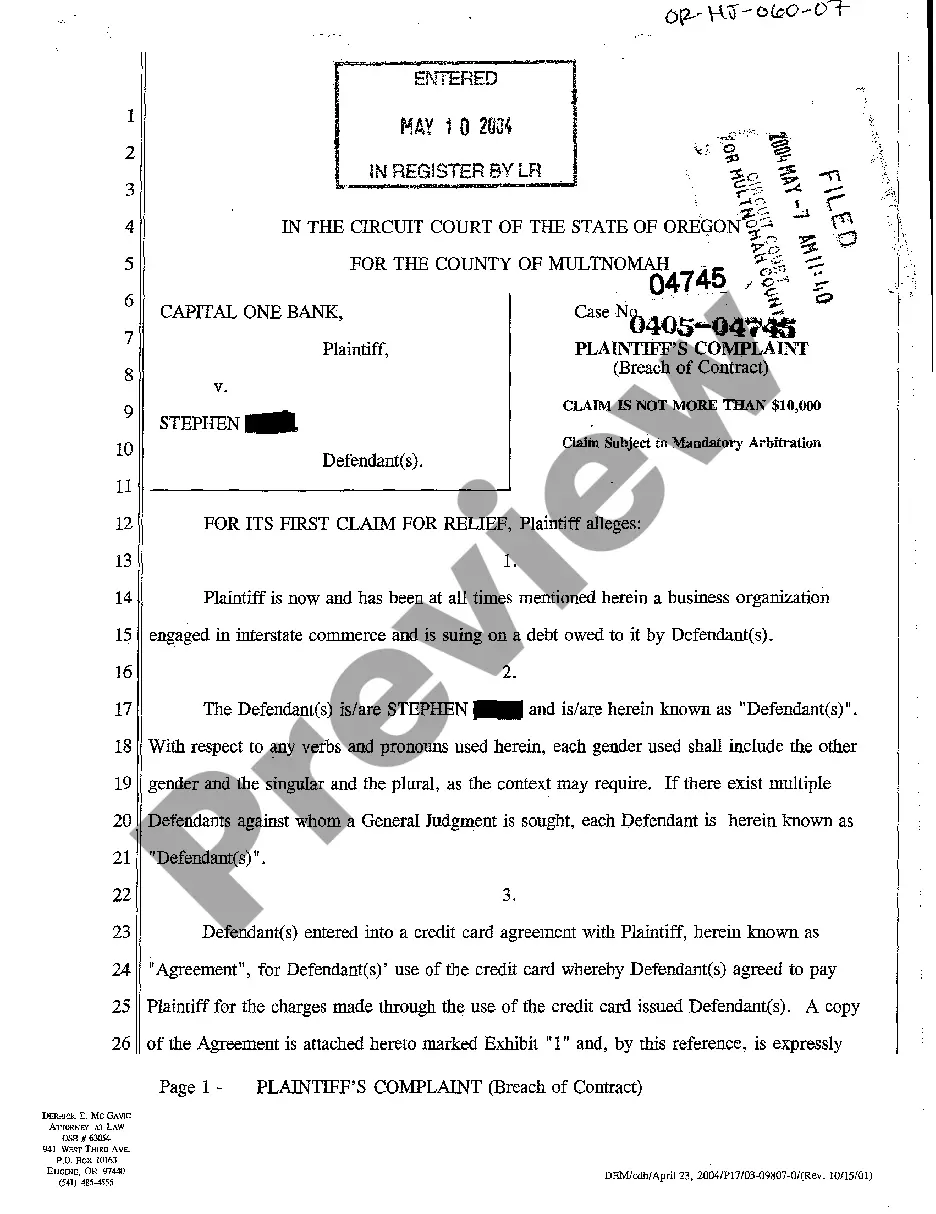

Oregon Plaintiff's Complaint for Breach of Credit Card Agreement

Description

How to fill out Oregon Plaintiff's Complaint For Breach Of Credit Card Agreement?

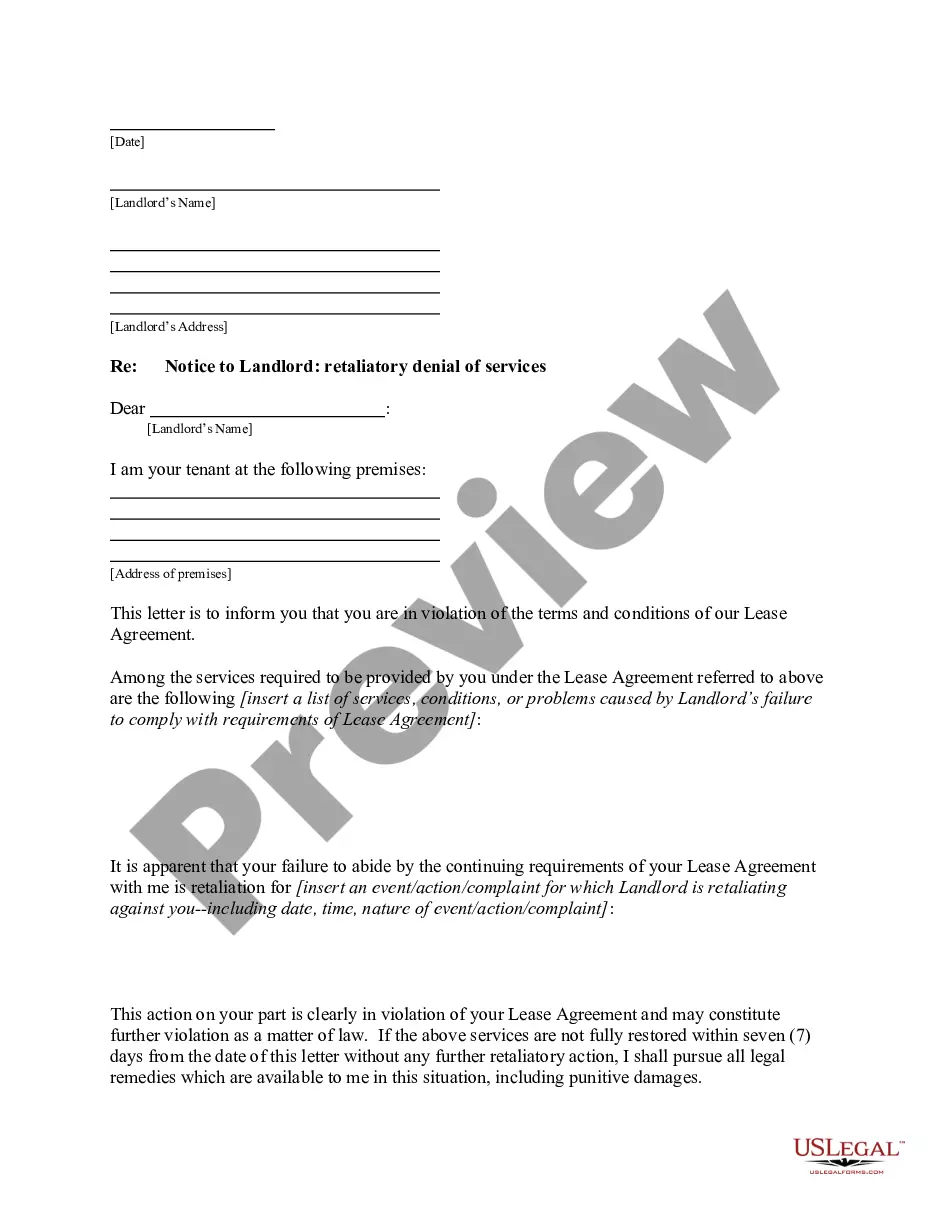

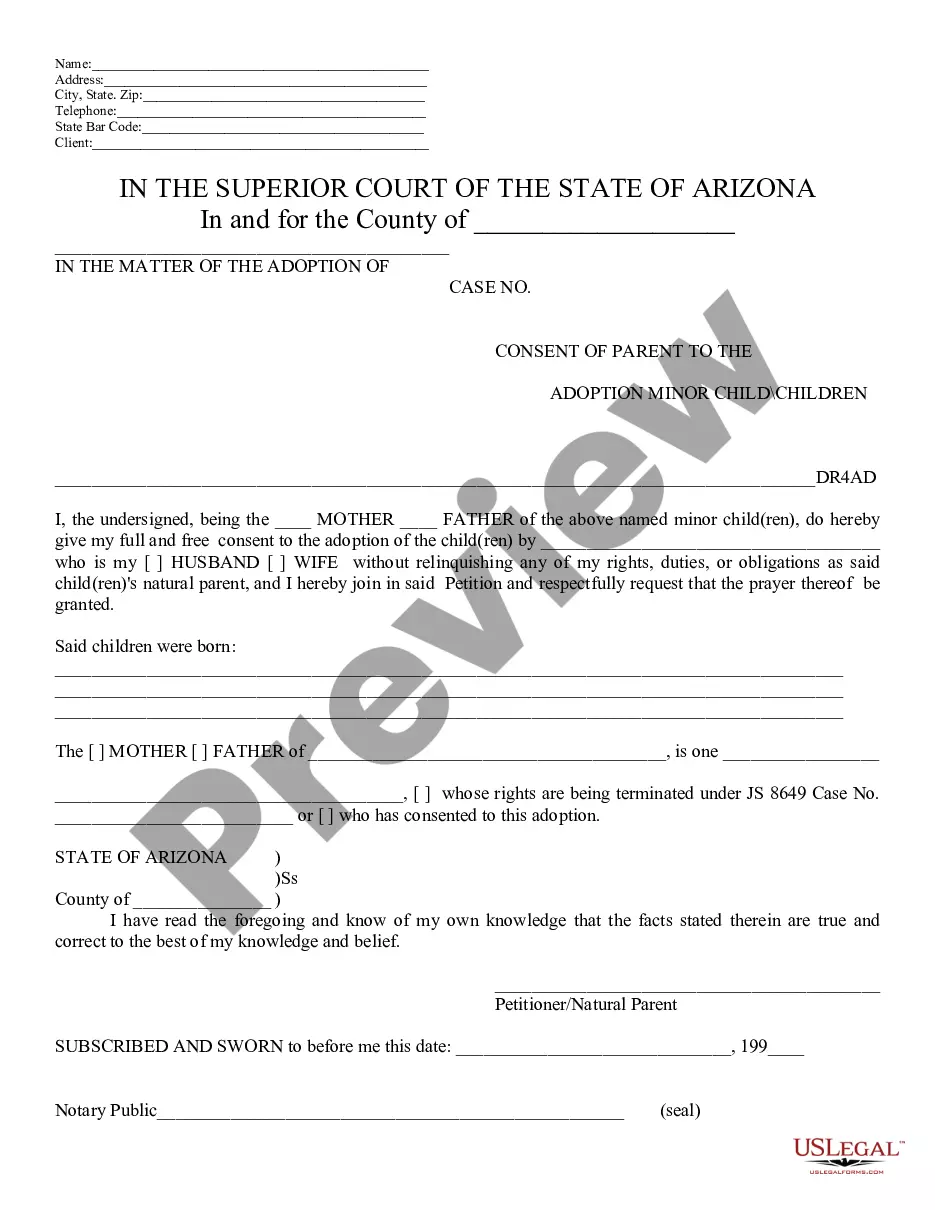

When it comes to submitting Oregon Plaintiff's Complaint for Breach of Credit Card Agreement, you probably imagine an extensive process that involves finding a suitable form among a huge selection of very similar ones then being forced to pay out an attorney to fill it out to suit your needs. In general, that’s a sluggish and expensive option. Use US Legal Forms and choose the state-specific document within just clicks.

For those who have a subscription, just log in and click Download to find the Oregon Plaintiff's Complaint for Breach of Credit Card Agreement template.

In the event you don’t have an account yet but need one, follow the step-by-step guideline listed below:

- Make sure the document you’re getting is valid in your state (or the state it’s required in).

- Do so by looking at the form’s description and by clicking on the Preview function (if offered) to view the form’s content.

- Click on Buy Now button.

- Choose the proper plan for your budget.

- Subscribe to an account and select how you want to pay: by PayPal or by card.

- Save the file in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

Skilled attorneys work on creating our samples to ensure after saving, you don't have to worry about enhancing content outside of your personal details or your business’s details. Be a part of US Legal Forms and get your Oregon Plaintiff's Complaint for Breach of Credit Card Agreement sample now.

Form popularity

FAQ

In most states, this ranges from $1.500 to $15,000. It's a fairly simple process, with the judgment taking place right away and limited right of appeal.

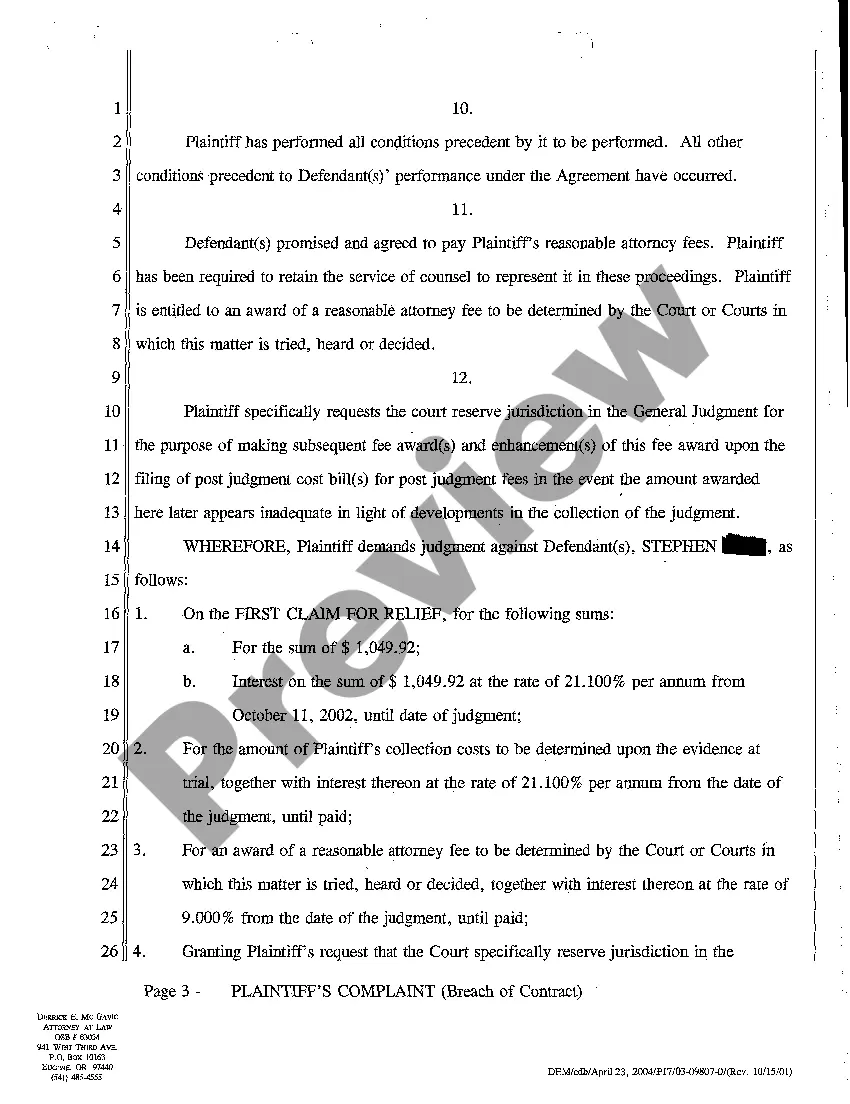

Consider the Statute of Limitations. Breach of Contract Must Be Material & Cause Damage. Mediation & Arbitration. Determine the Appropriate Court to File Your Lawsuit. Determine How You Will Serve the Defendant. Prepare Your Complaint and Documentation. Hiring an Attorney.

When drafting an answer, one must: (1) follow the local, state, and federal court rules; (2) research the legal claims in the adversary's complaint; (3) respond to the adversary's factual allegations; and (4) assert affirmative defenses, counterclaims, cross-claims, or third-party claims, if applicable.

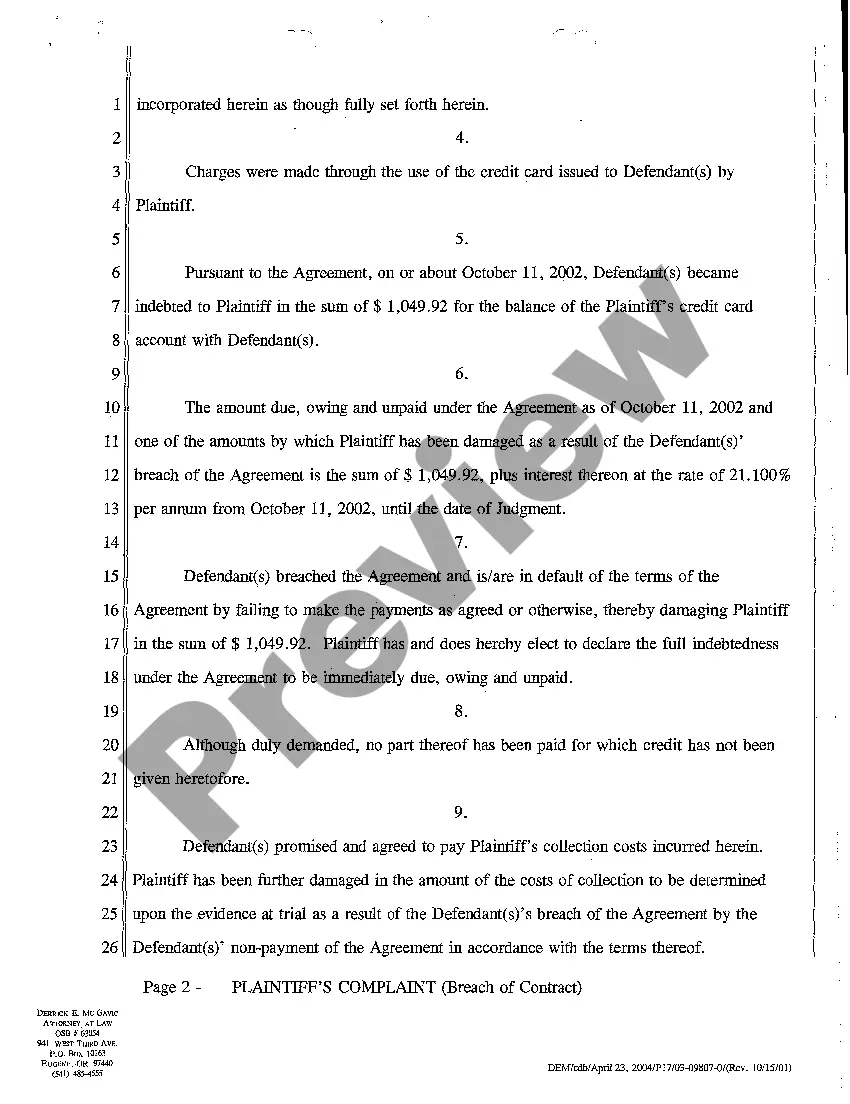

To sue for breach of contract, you must be able to show: Prove that there was a contract in existence It would need to be proven that a legally binding contract was in place and that it had been breached.

Don't ignore it. If you do this, the court will simply rule in the issuer or debt collector's favor. Try to work things out. Answer the summons. Consult an attorney. Go to court. Respond to the ruling.

Read the summons and make sure you know the date you must answer by. Read the complaint carefully. Write your answer. Sign and date the answer. Make copies for the plaintiff and yourself. Mail a copy to the plaintiff. File your answer with the court by the date on the summons.

You may file a claim for breach of contract in any court where there is proper jurisdiction and venue, unless the contract otherwise dictates where the claim must be filed. But, if that part of the contract is ruled to be unenforceable, then you may file the action in state court or federal court.

2006) (The elements of a breach of contract claim are: (1) the existence of a valid contract; (2) the plaintiff's performance or tendered performance; (3) the defendant's breach of the contract; and (4) damages as a result of the breach.)

Create an Answer document. Respond to each issue of the complaint. Assert your affirmative defenses. File one copy of the Answer document with the court and serve the plaintiff with another copy.