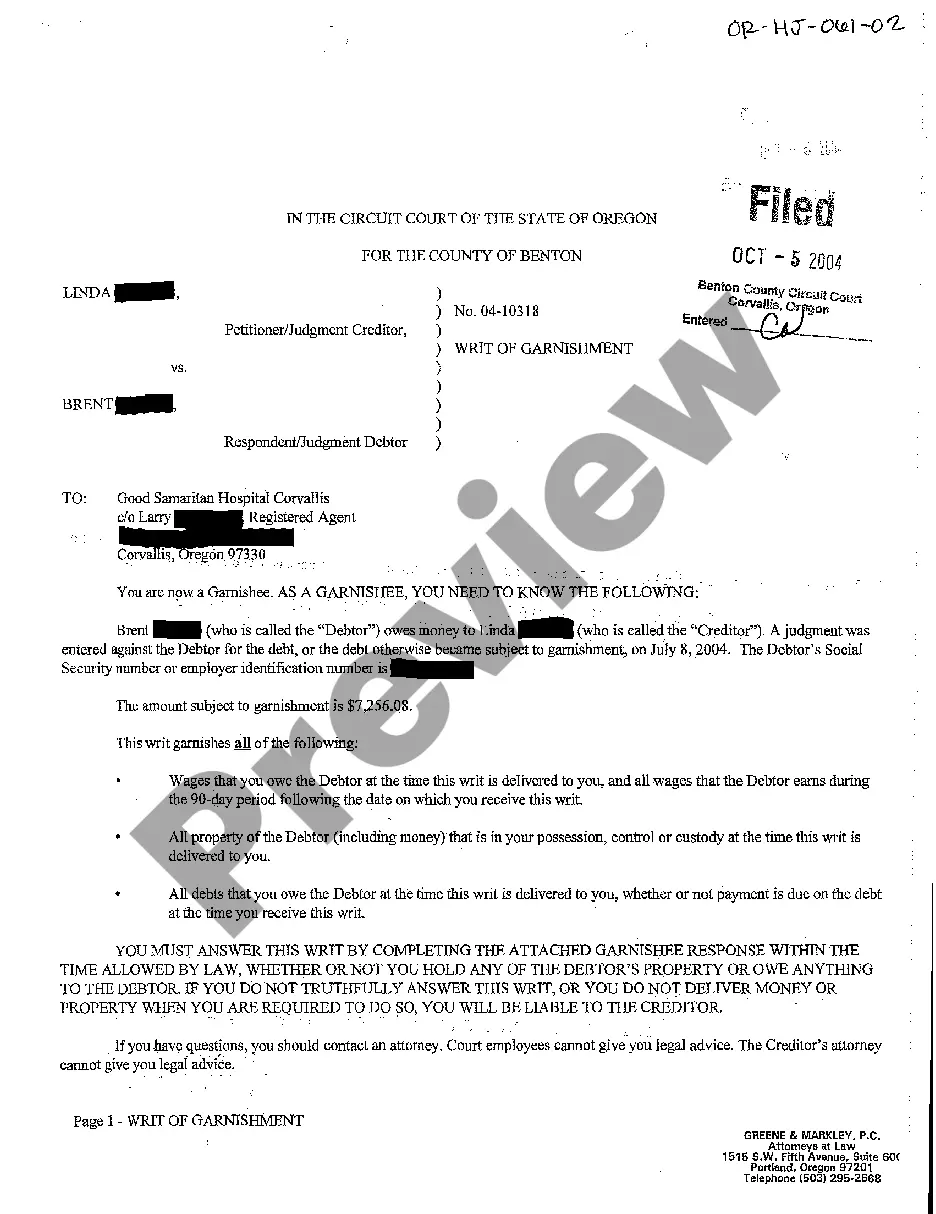

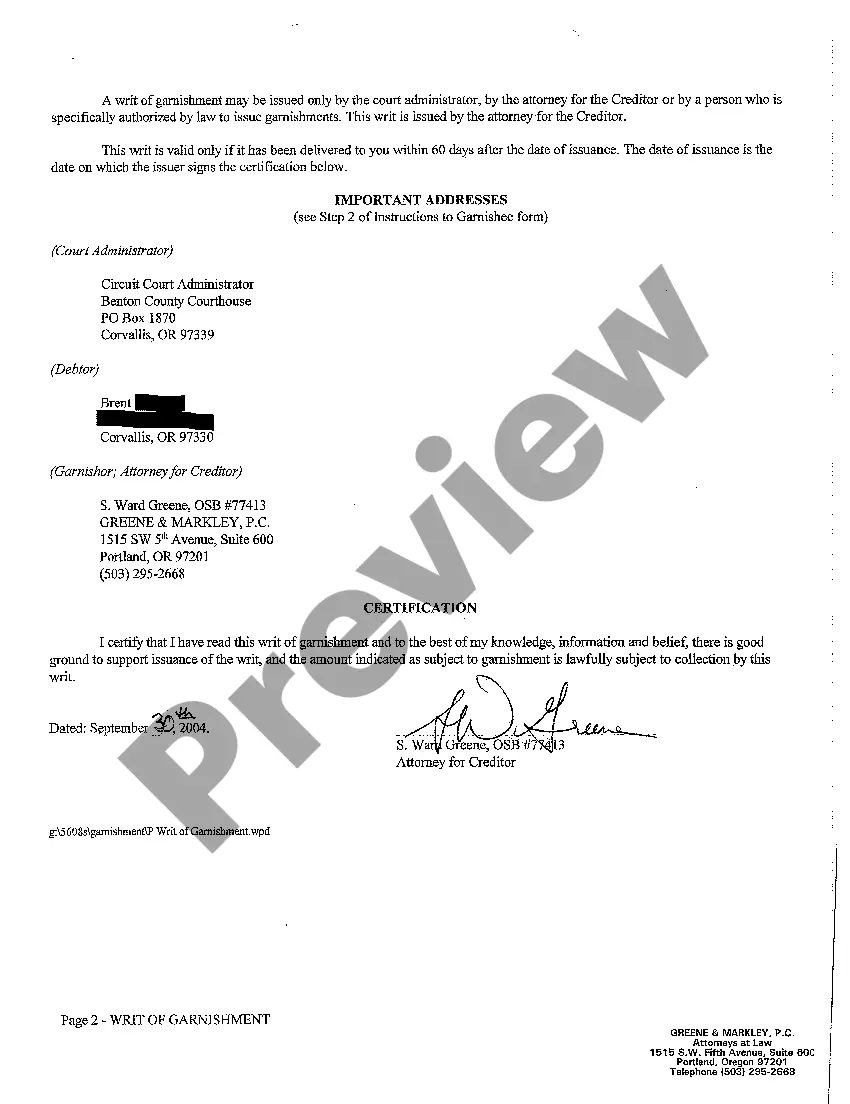

Oregon Writ of Garnishment

Description Oregon Writ Of Garnishment

How to fill out Oregon Writ Of Garnishment?

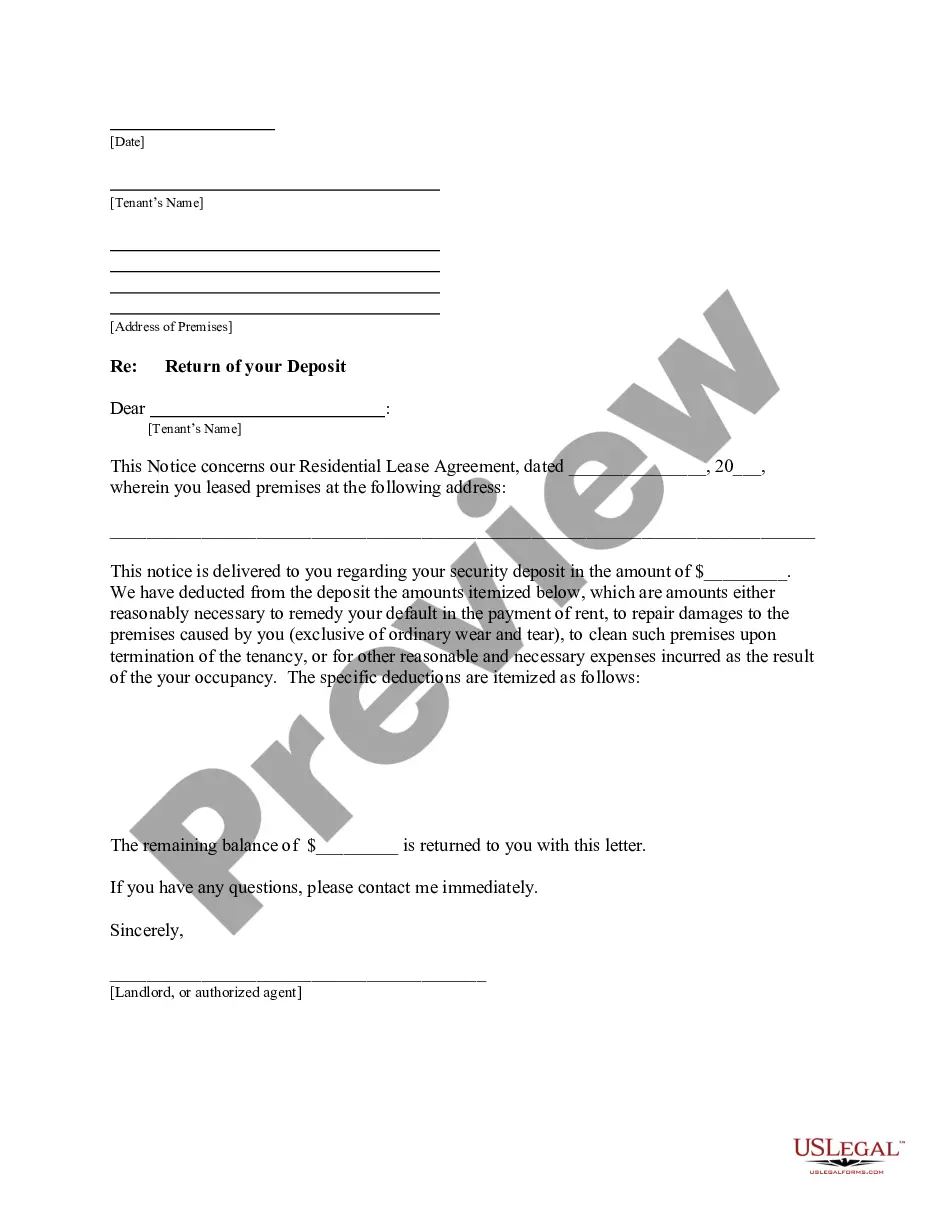

When it comes to completing Oregon Writ of Garnishment, you almost certainly imagine an extensive process that requires choosing a appropriate form among numerous similar ones and after that having to pay out a lawyer to fill it out for you. Generally speaking, that’s a slow and expensive choice. Use US Legal Forms and select the state-specific document within just clicks.

If you have a subscription, just log in and click on Download button to have the Oregon Writ of Garnishment sample.

In the event you don’t have an account yet but need one, keep to the step-by-step manual listed below:

- Be sure the file you’re saving applies in your state (or the state it’s needed in).

- Do so by reading through the form’s description and through visiting the Preview function (if accessible) to see the form’s content.

- Click Buy Now.

- Find the suitable plan for your budget.

- Sign up to an account and select how you would like to pay out: by PayPal or by credit card.

- Save the file in .pdf or .docx file format.

- Find the document on your device or in your My Forms folder.

Professional lawyers work on creating our samples to ensure that after saving, you don't need to bother about editing content material outside of your personal details or your business’s details. Be a part of US Legal Forms and receive your Oregon Writ of Garnishment example now.

Form popularity

FAQ

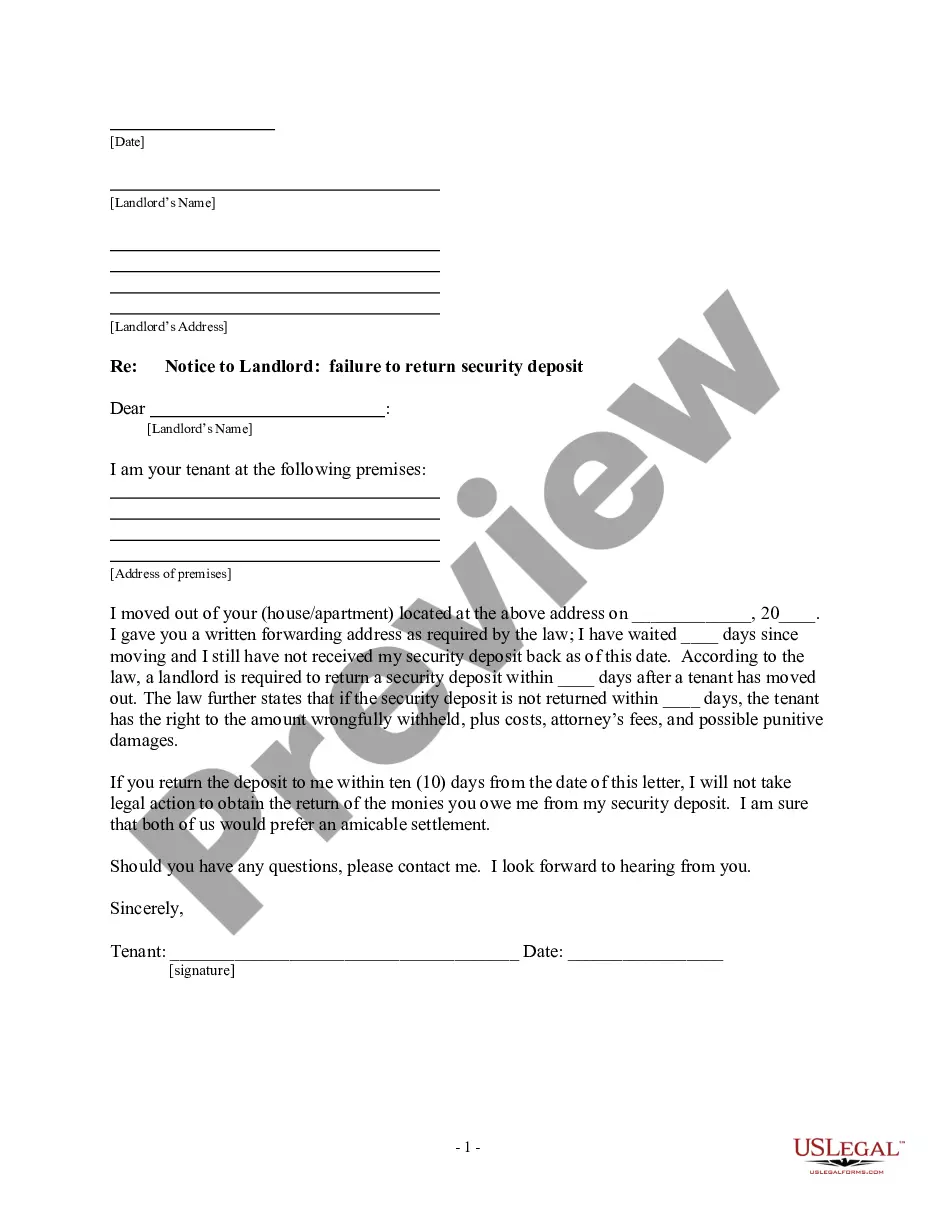

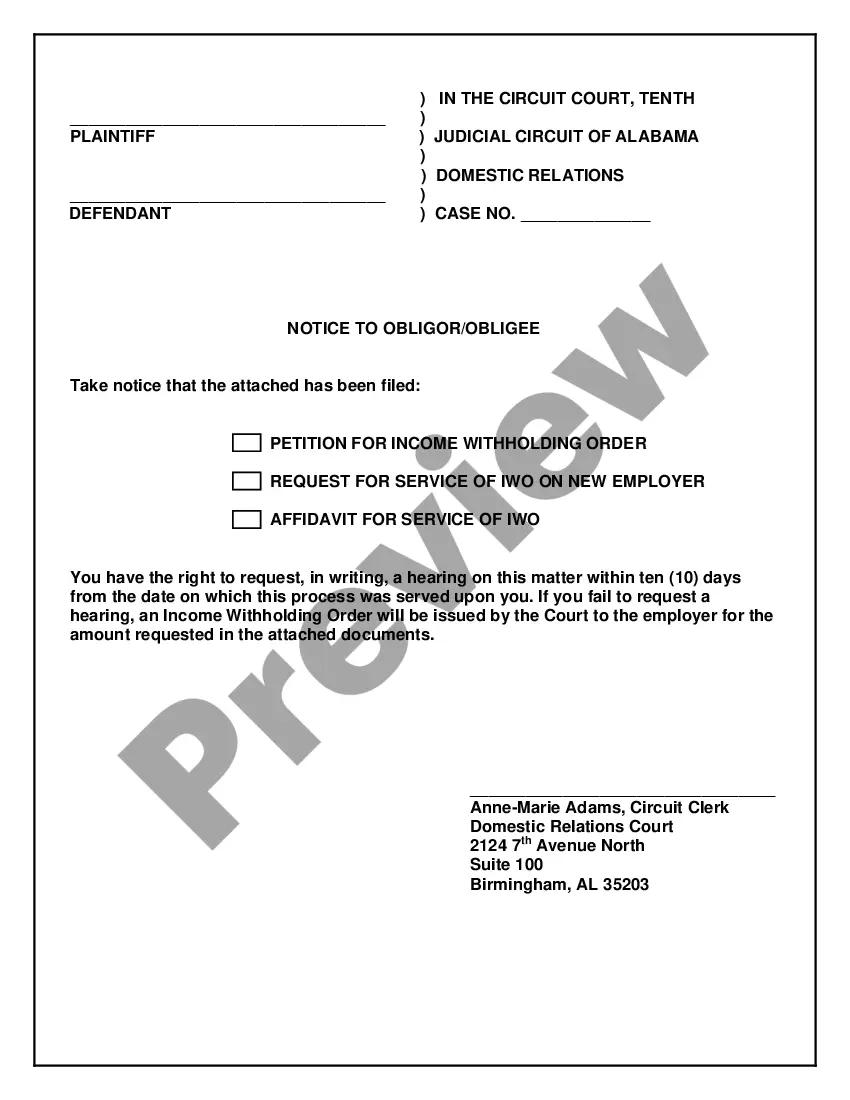

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

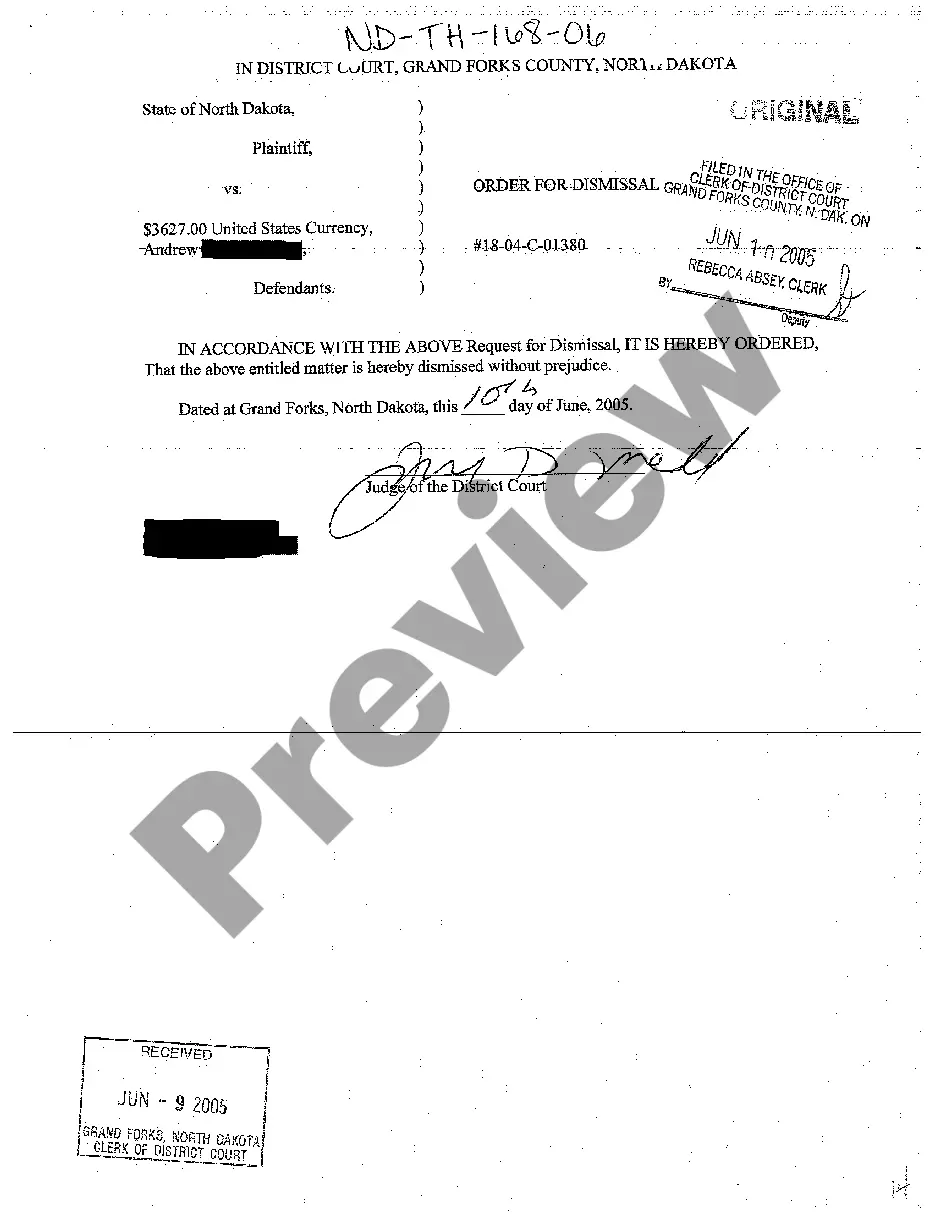

The Order dissolves the existing writ of garnishment. It means that whatever was being garnished, wages or bank accounts, are no longer subject to the writ of garnishment.

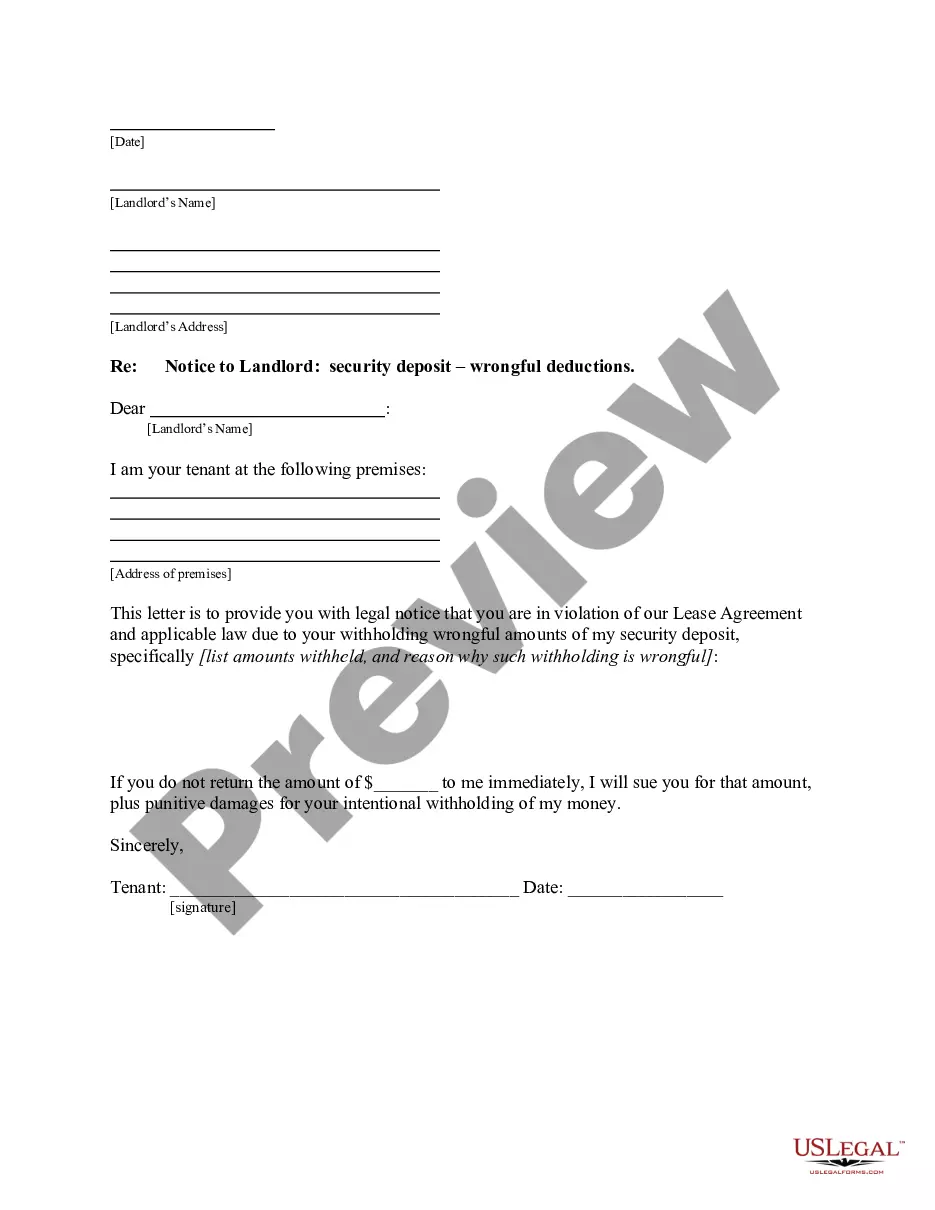

Option 1) Challenge the Wage Garnishments. Option 2) Negotiate a Payment Plan. Option 3) Contact a Credit Counseling Service. Option 4) Consider a Debt Consolidation Loan. Option 5) Look into a Debt Settlement Program.

A wage garnishment lasts for 90 days and can be renewed by the creditor multiple times until the entire debt you owe is satisfied. A garnishment can intercept 25% of your net paycheck so long as you retain a certain minimum amount of money about $220 per week of work.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.