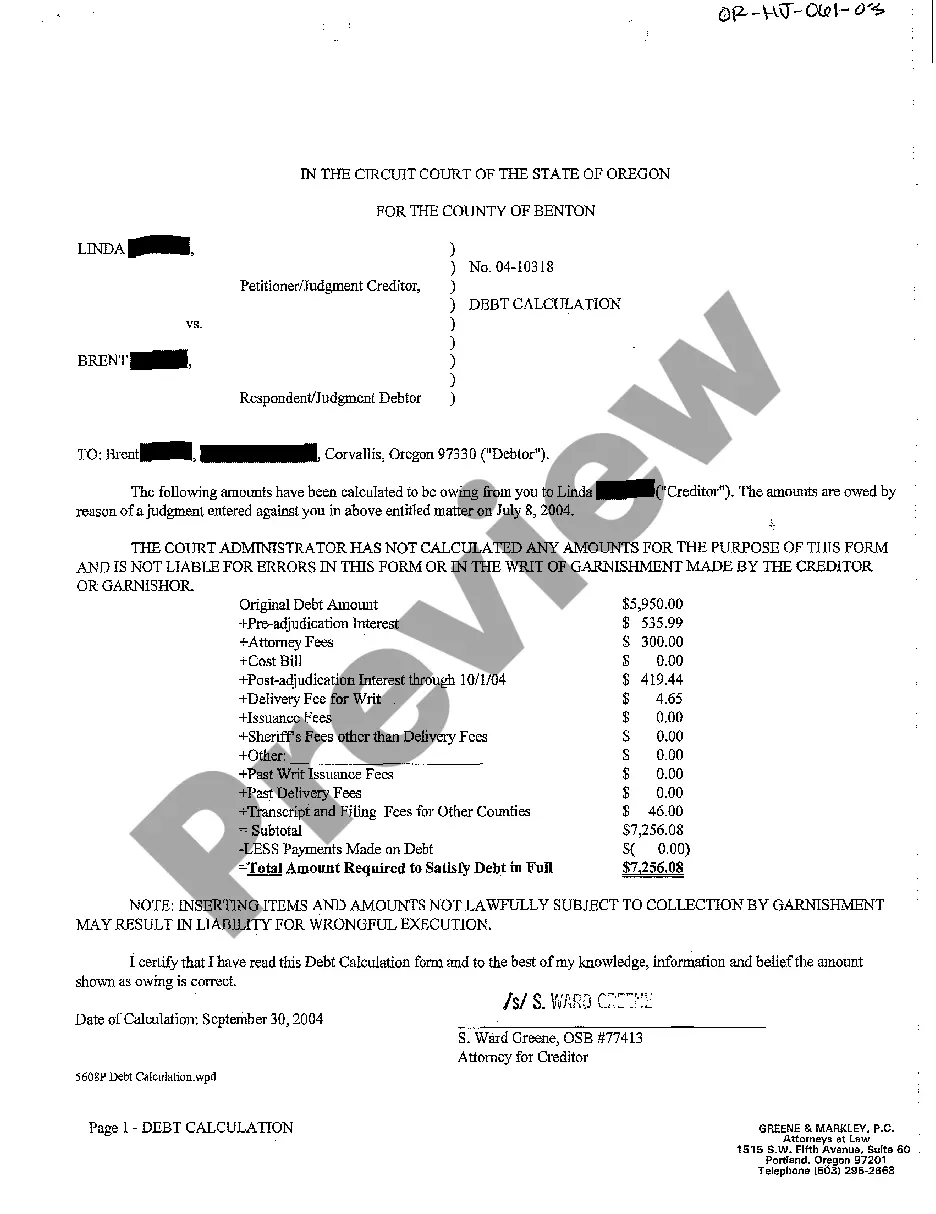

Oregon Debt Calculation

Description

How to fill out Oregon Debt Calculation?

In terms of submitting Oregon Debt Calculation, you almost certainly think about an extensive process that consists of finding a perfect sample among a huge selection of very similar ones after which needing to pay out an attorney to fill it out to suit your needs. In general, that’s a sluggish and expensive option. Use US Legal Forms and choose the state-specific document in a matter of clicks.

In case you have a subscription, just log in and click Download to get the Oregon Debt Calculation template.

If you don’t have an account yet but want one, follow the point-by-point guideline listed below:

- Make sure the file you’re downloading applies in your state (or the state it’s required in).

- Do it by reading the form’s description and also by clicking on the Preview function (if offered) to view the form’s content.

- Simply click Buy Now.

- Pick the appropriate plan for your financial budget.

- Subscribe to an account and choose how you would like to pay: by PayPal or by credit card.

- Save the file in .pdf or .docx file format.

- Find the file on the device or in your My Forms folder.

Skilled attorneys work on creating our templates to ensure that after downloading, you don't need to bother about editing content material outside of your individual details or your business’s information. Join US Legal Forms and receive your Oregon Debt Calculation example now.

Form popularity

FAQ

A wage garnishment lasts for 90 days and can be renewed by the creditor multiple times until the entire debt you owe is satisfied. A garnishment can intercept 25% of your net paycheck so long as you retain a certain minimum amount of money about $220 per week of work.

In Oregon, ORS 18.385 says basically that the MAXIMUM subject to GARNISHMENT is 25% of an employee's DISPOSABLE INCOME (AFTER-TAX, TAKE-HOME). Unless the employee is left is less than $218 per week!

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

In general, if you have a contractual debt in Oregon that you have not repaid, the creditor has six years to pursue you with legal action before the Oregon statute of limitations expires. This applies to medical, credit card and mortgage debt.

Federal Wage Garnishment Limits for Judgment Creditors If a judgment creditor is garnishing your wages, federal law provides that it can take no more than: 25% of your disposable income, or. the amount that your income exceeds 30 times the federal minimum wage, whichever is less.

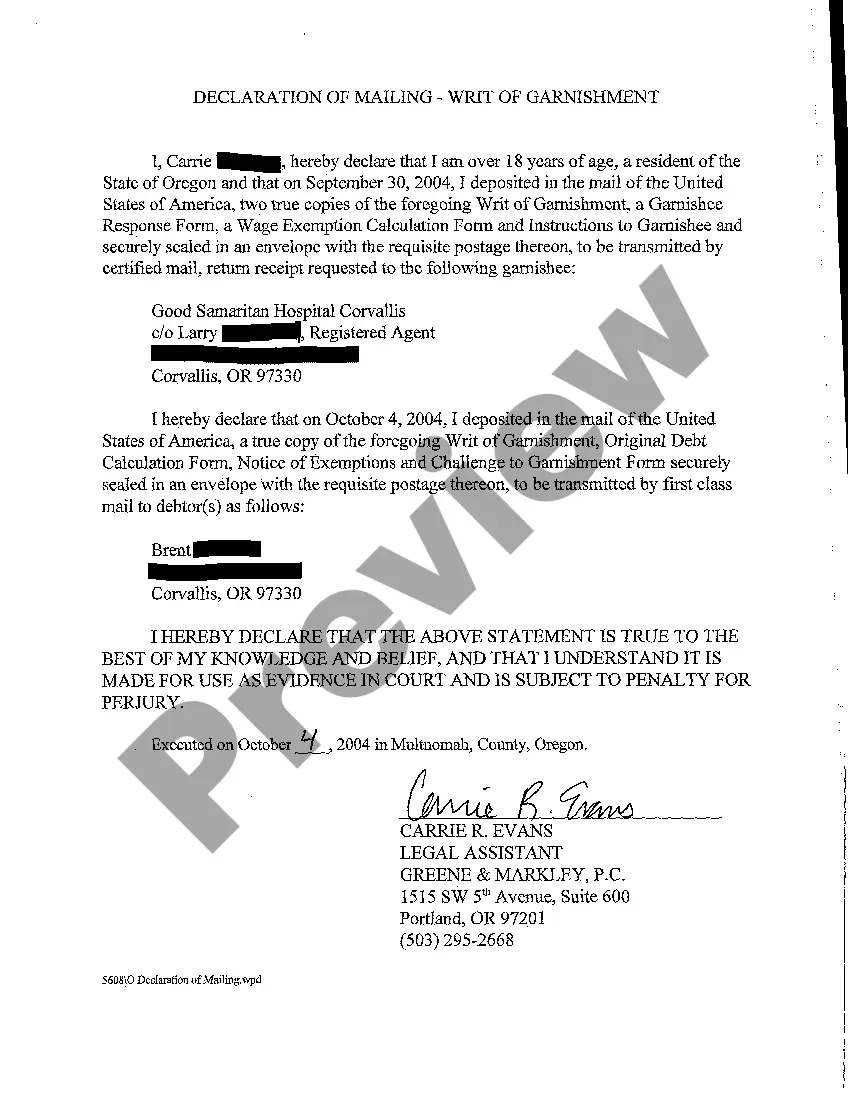

File a claim in your county courthouse. A SUMMONS is delivered to you. Default judgment is awarded if no settlement can be reached. Apply for a Writ of Garnishment.

Oregon judgments expire after 10 years from the date of entry by a court, unless a creditor (i.e., you or your attorney) files a certificate within that 10 year time period to have enforcement of the judgment extended for another 10 years.

To figure the exact withholding that you should send to the IRS, subtract taxes and existing child support garnishment, if applicable, from the employee's gross pay. Then, subtract voluntary deductions, such as health insurance or 401k that were being withheld before the levy was received.