Oregon Complaint for Insurance Subrogation after Motor Vehicle Accident

Description

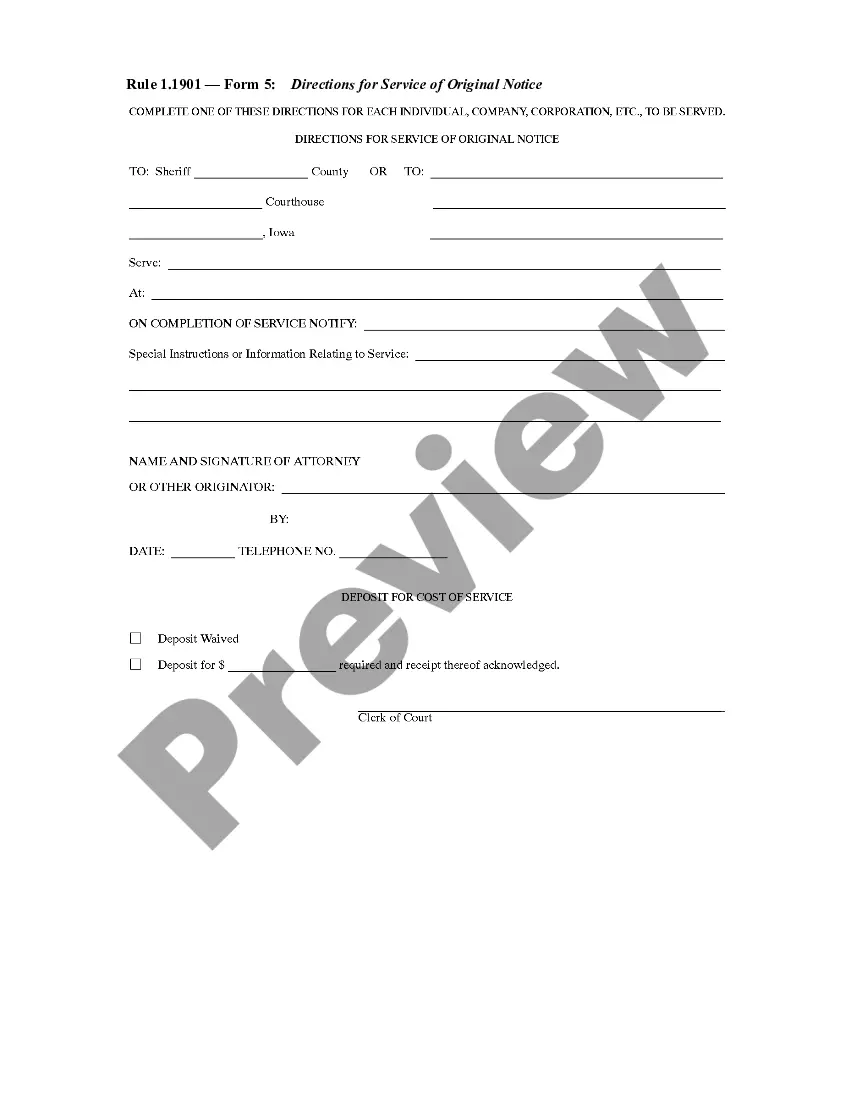

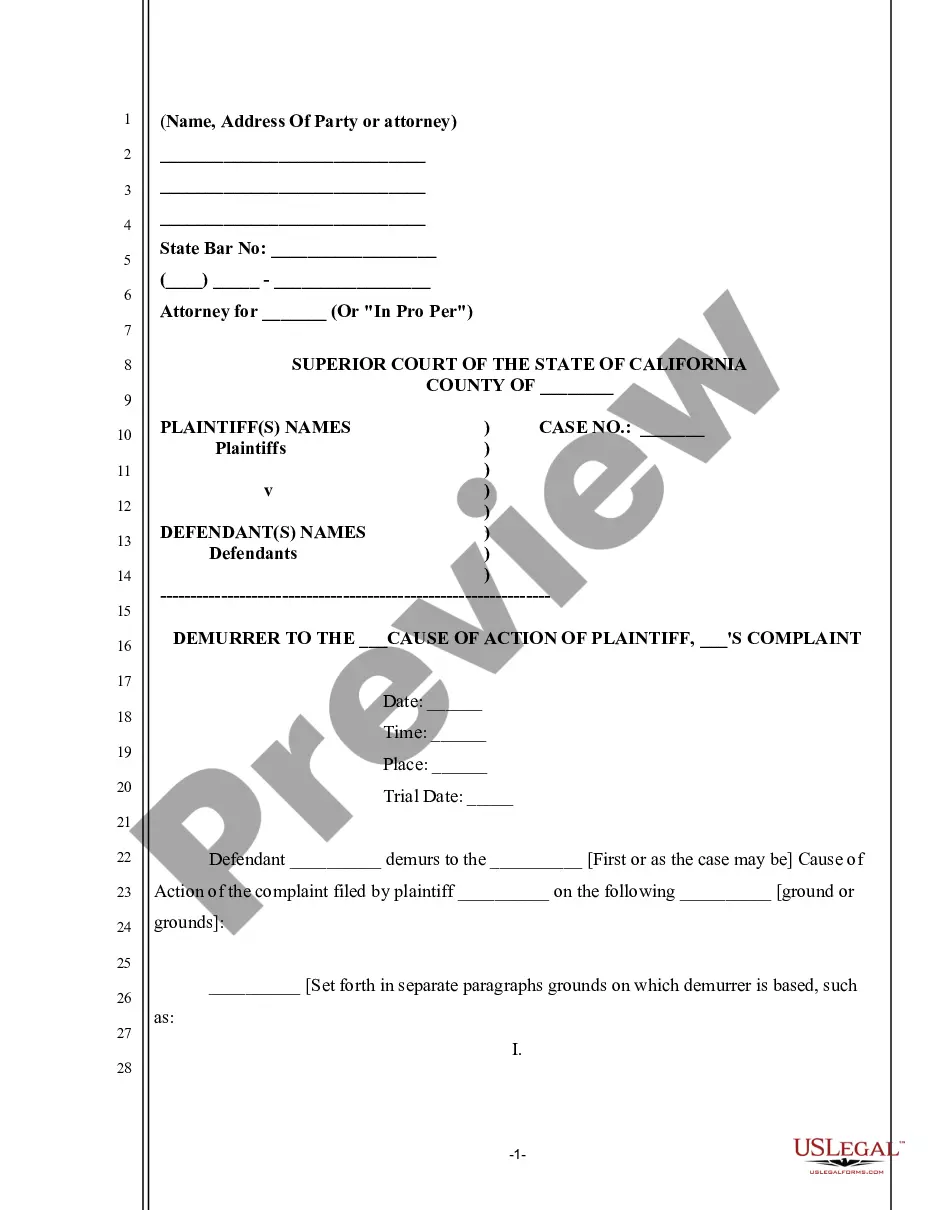

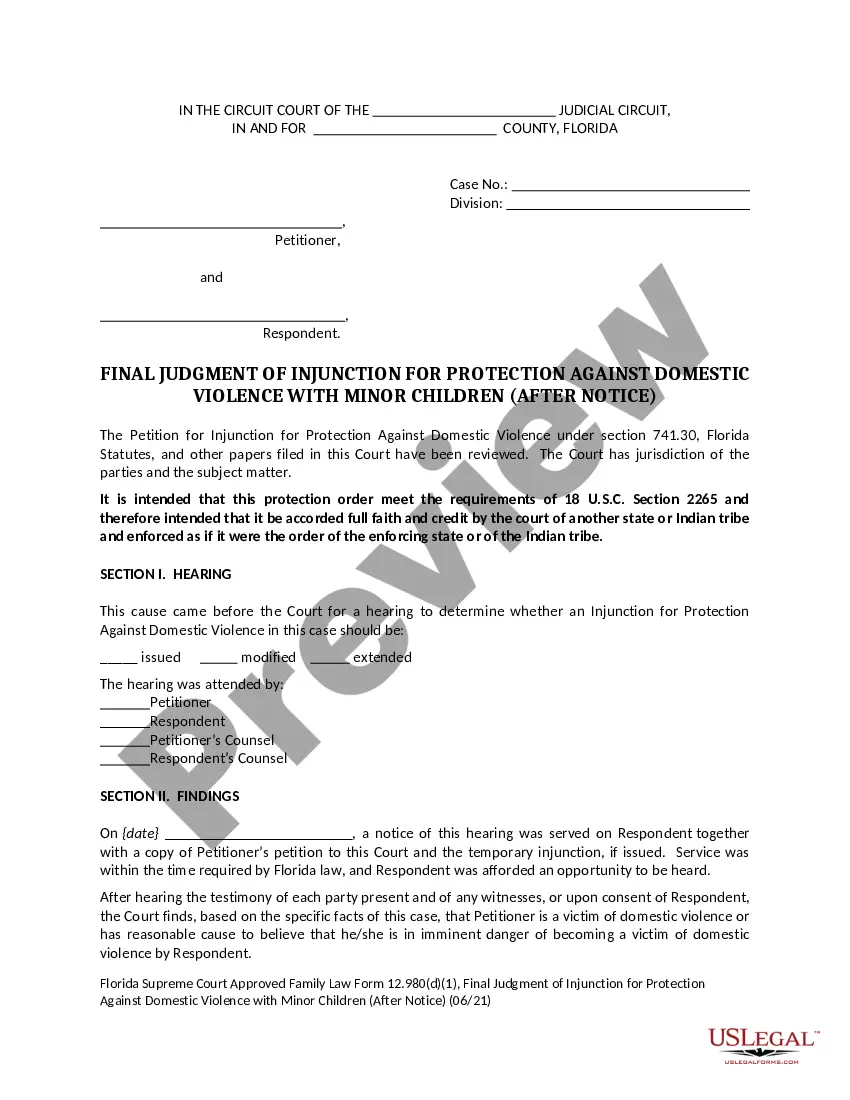

How to fill out Oregon Complaint For Insurance Subrogation After Motor Vehicle Accident?

In terms of completing Oregon Complaint for Insurance Subrogation after Motor Vehicle Accident, you probably visualize a long procedure that involves choosing a perfect sample among countless very similar ones after which being forced to pay out a lawyer to fill it out to suit your needs. In general, that’s a slow and expensive option. Use US Legal Forms and select the state-specific template within clicks.

In case you have a subscription, just log in and click on Download button to get the Oregon Complaint for Insurance Subrogation after Motor Vehicle Accident sample.

In the event you don’t have an account yet but need one, follow the point-by-point guideline listed below:

- Make sure the document you’re saving applies in your state (or the state it’s required in).

- Do it by looking at the form’s description and through visiting the Preview function (if offered) to see the form’s content.

- Click Buy Now.

- Select the appropriate plan for your financial budget.

- Subscribe to an account and choose how you would like to pay: by PayPal or by credit card.

- Save the document in .pdf or .docx format.

- Get the document on the device or in your My Forms folder.

Skilled lawyers work on drawing up our templates so that after saving, you don't have to worry about editing and enhancing content material outside of your individual info or your business’s info. Sign up for US Legal Forms and receive your Oregon Complaint for Insurance Subrogation after Motor Vehicle Accident sample now.

Form popularity

FAQ

Most states give you two to three years to settle your car accident insurance claim. If you file after the statute of limitations has passed, the court will reject your claim, even if you are only a few days late. This harsh response is based on the reality that as time passes, memories fade and records get lost.

Oregon is a tort state that requires drivers to have no-fault insurance, which means drivers must use personal injury protection (PIP) insurance to pay for their own injuries after an accident but are not limited when it comes to suing an at-fault driver for compensation.

Personal injury claims in Oregon have a statute of limitations requiring you to either settle your claim or file a lawsuit within two years. This means you have two years from the date of the injury to settle your claim with the insurance company or go to civil court and file a lawsuit.

Does an Insurance Company Have a Time Limit to Pay a Claim After a Car Accident? An insurance company is required to pay or deny a claim within a reasonable period of time. If the claim is being denied, the insurance company should provide a reason for this. There is no set definition of what is a reasonable time.

As per the time limits set by the Insurance Regulatory and Development Authority (IRDA) of India, insurers should settle death claim within 30 days. This condition applies to all claims where the insurer does not see the need to investigate the cause of death.

The insurance company can rescind its offer at any time prior to your acceptance. Practically speaking they usually do not unless something develops or is uncovered that hurts your claim. But technically yes, an offer can always be rescinded prior to your acceptance.

It usually takes 30 days for insurance to pay out after a car accident. Most car insurance companies try to resolve accident claims as quickly as possible, which typically leads to a payout within a month of a claim being filed.

Do I need to declare a non-fault claim? Yes, you need to declare all accidents that you're involved in, regardless of who, or what, was at fault. Pretty much all insurance providers will have a clause in their policy requiring you to declare any incidences you're involved in while driving in the past 5 years.

Don't make any statements right after an accident. Don't admit fault. Don't say you are uninjured. Don't give an official statement or recorded statement. Don't accept a settlement without consulting an attorney. Stick to the facts. Medical records.