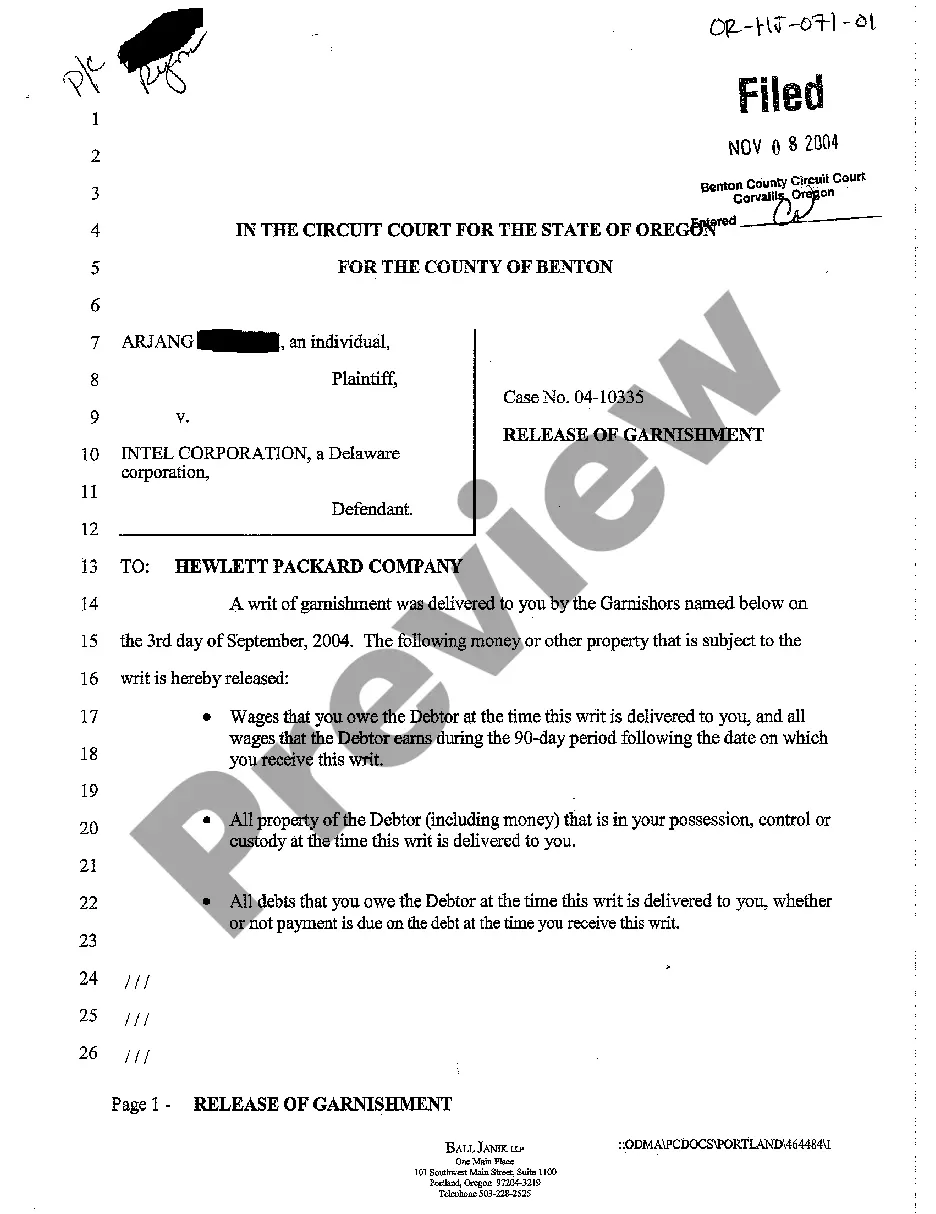

Oregon Release of Garnishment

Description What Is Release Of Garnishment

How to fill out Oregon Release Of Garnishment?

In terms of filling out Oregon Release of Garnishment, you almost certainly imagine a long procedure that involves choosing a appropriate form among countless very similar ones and after that having to pay out a lawyer to fill it out to suit your needs. On the whole, that’s a slow and expensive choice. Use US Legal Forms and choose the state-specific document within clicks.

In case you have a subscription, just log in and click on Download button to find the Oregon Release of Garnishment template.

If you don’t have an account yet but want one, stick to the step-by-step manual listed below:

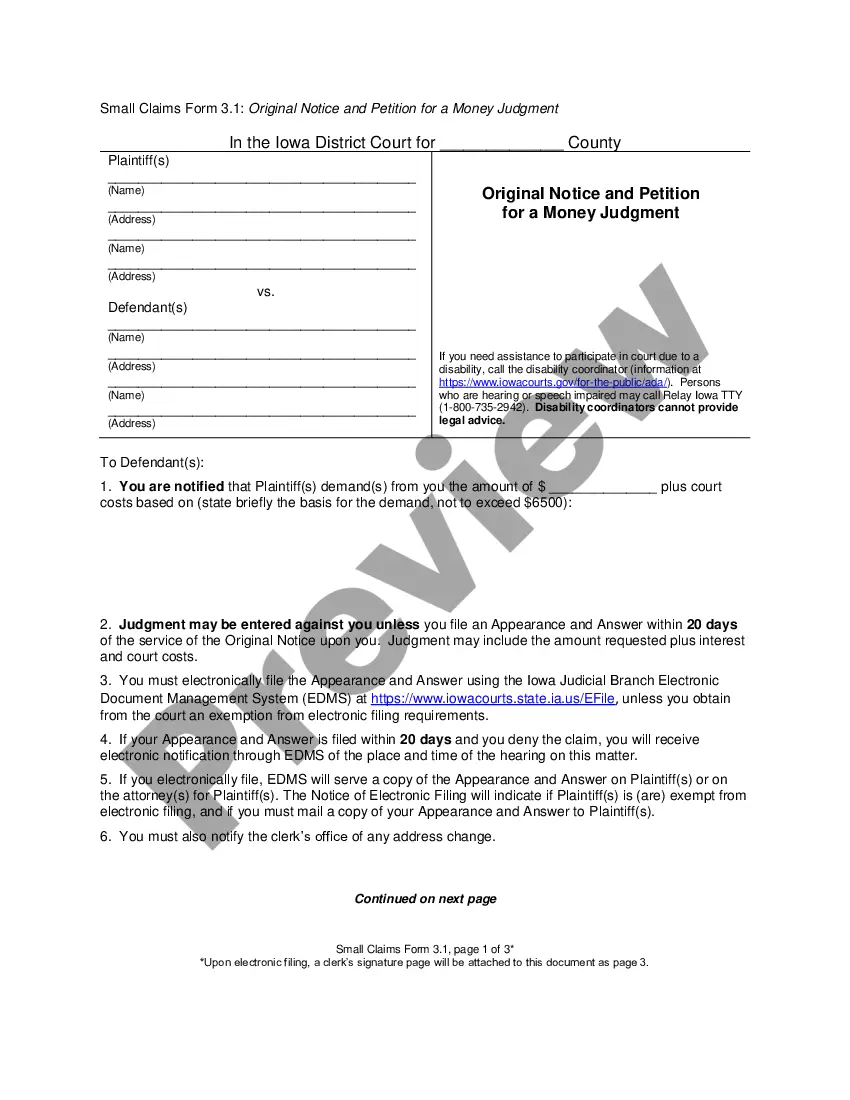

- Be sure the document you’re saving is valid in your state (or the state it’s required in).

- Do this by looking at the form’s description and also by clicking the Preview function (if readily available) to find out the form’s content.

- Click Buy Now.

- Find the proper plan for your financial budget.

- Sign up for an account and select how you want to pay out: by PayPal or by credit card.

- Save the document in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

Professional legal professionals draw up our samples to ensure that after saving, you don't need to bother about modifying content material outside of your personal information or your business’s information. Join US Legal Forms and receive your Oregon Release of Garnishment example now.

Form popularity

FAQ

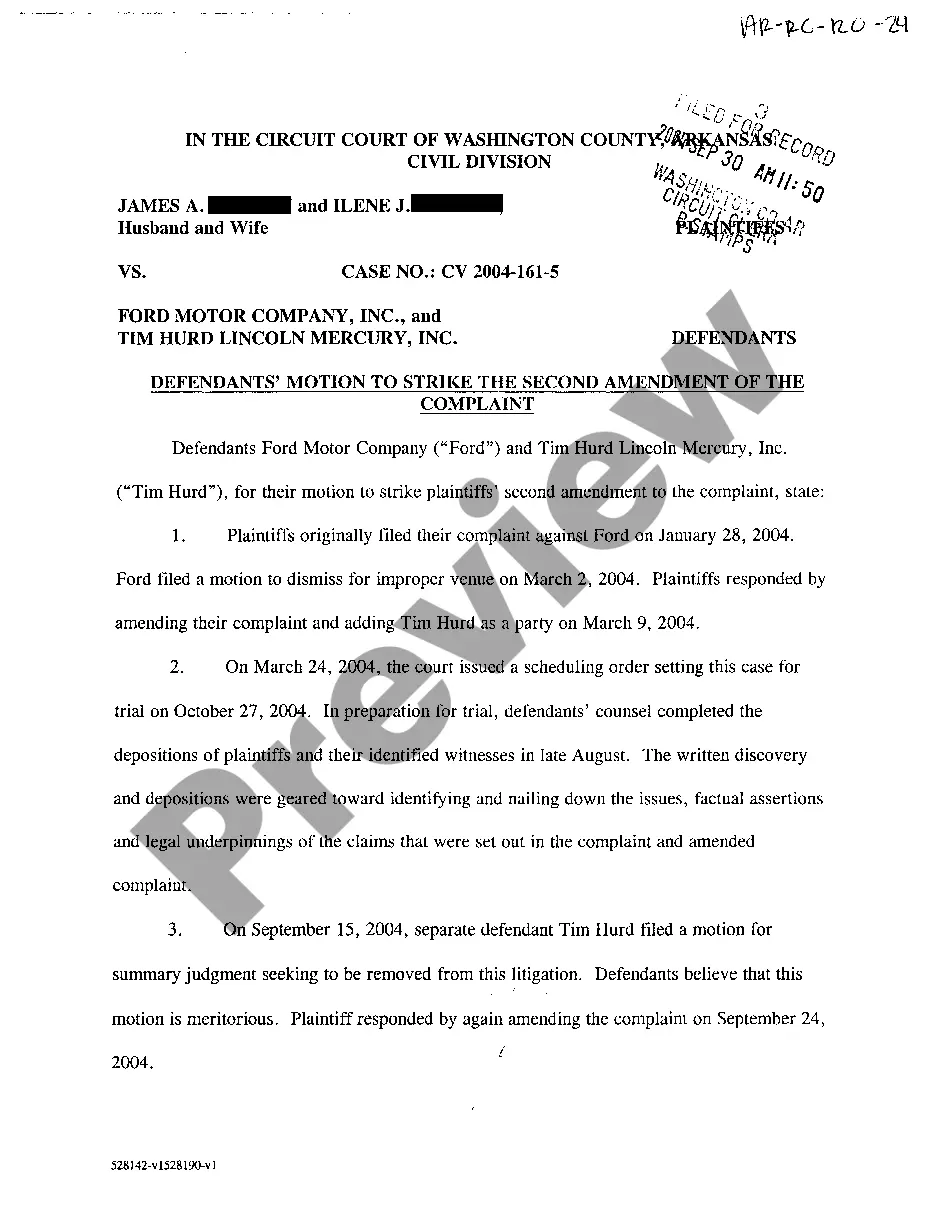

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

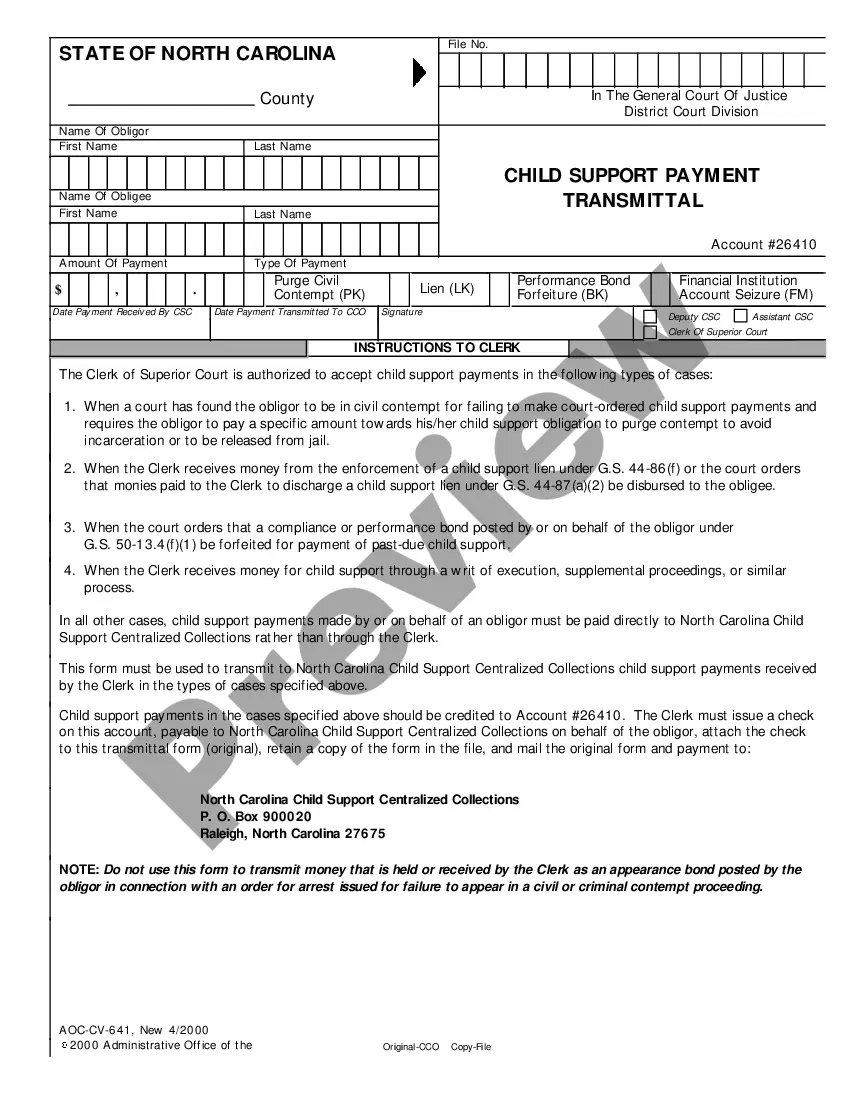

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

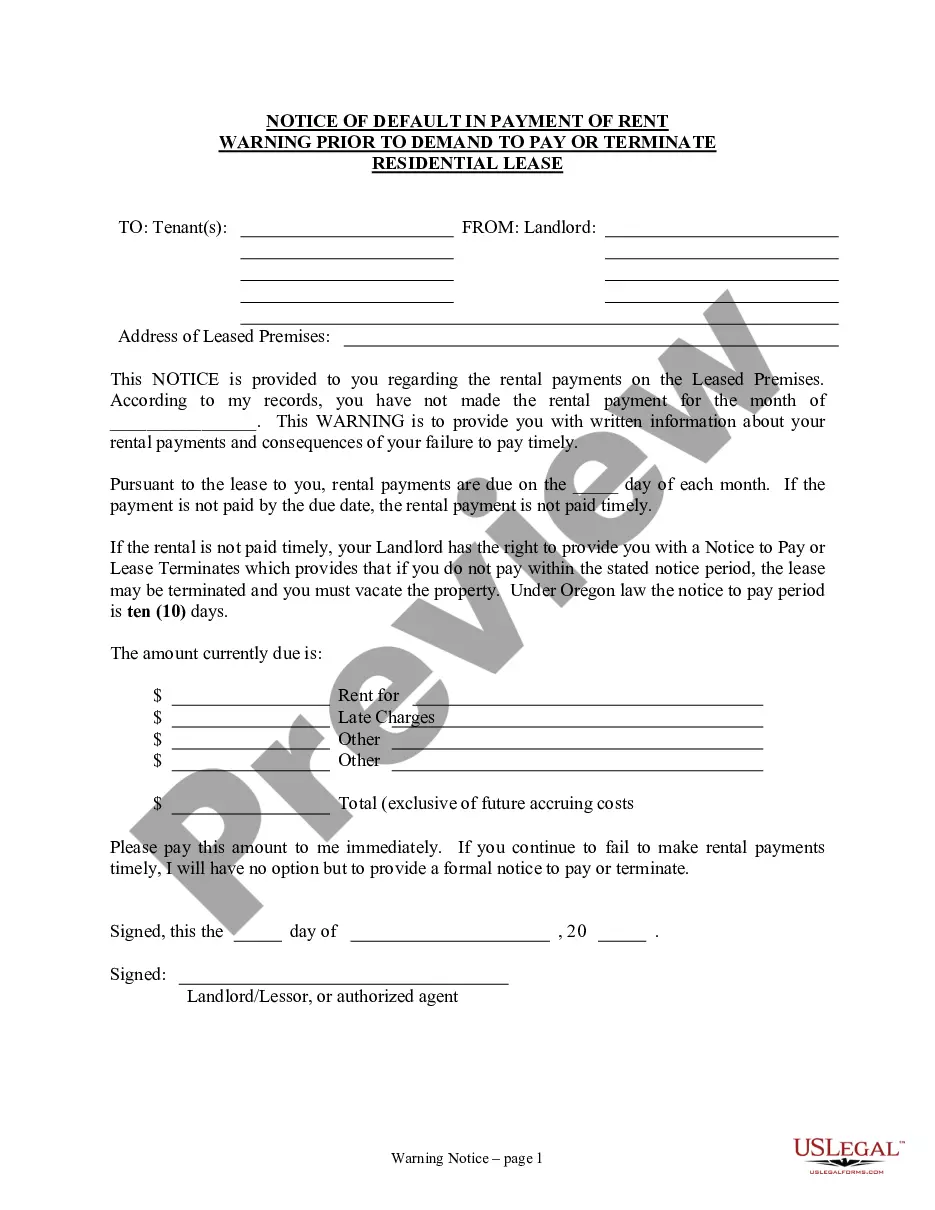

It releases your garnishment! When a creditor sues you, they eventually get a judgment in court. With this judgment, they can send a letter to your employer so that they can garnish your wages.A release of garnishment would stop any future garnishments.

File a claim in your county courthouse. A SUMMONS is delivered to you. Default judgment is awarded if no settlement can be reached. Apply for a Writ of Garnishment.

A wage garnishment lasts for 90 days and can be renewed by the creditor multiple times until the entire debt you owe is satisfied. A garnishment can intercept 25% of your net paycheck so long as you retain a certain minimum amount of money about $220 per week of work.

Quitting your current job will not erase the debt it will only leave you without the money to pay it. Once you find another job, the creditor can file to have your wages garnished there. You're best off staying employed where you are.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.