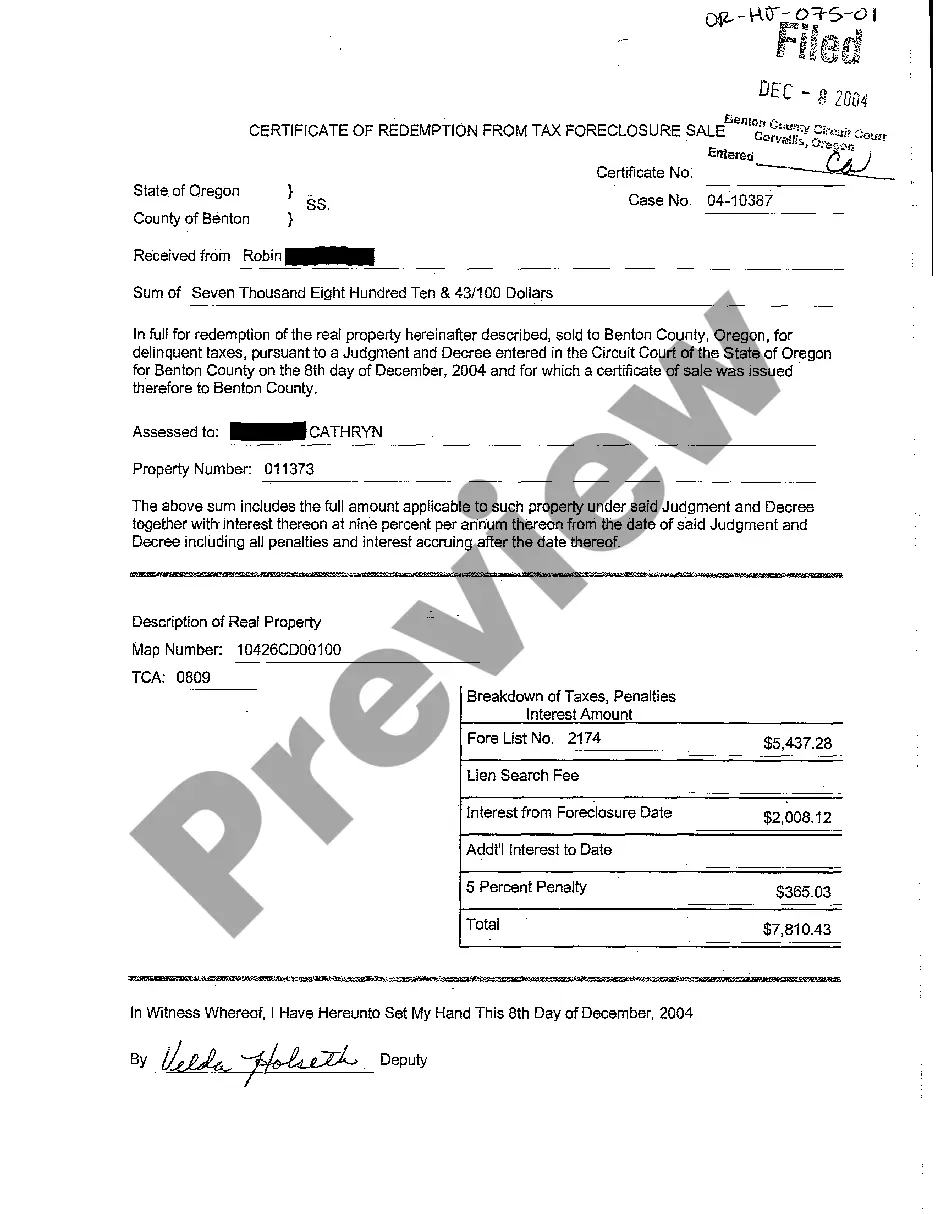

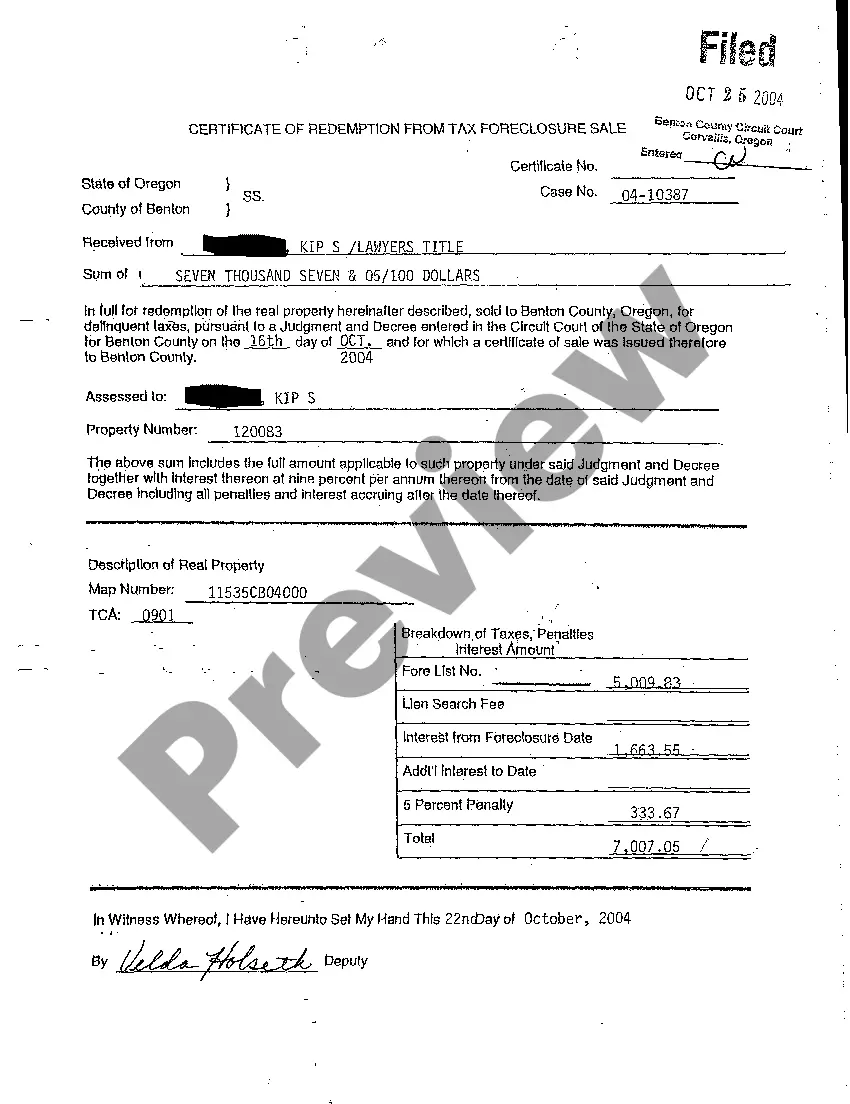

Oregon Certificate of Redemption from Tax Foreclosure Sale

Description Tax Lien Certificates Oregon

How to fill out Oregon Certificate Of Redemption From Tax Foreclosure Sale?

In terms of completing Oregon Certificate of Redemption from Tax Foreclosure Sale, you almost certainly imagine a long procedure that consists of finding a suitable sample among hundreds of very similar ones then having to pay a lawyer to fill it out to suit your needs. Generally speaking, that’s a sluggish and expensive choice. Use US Legal Forms and select the state-specific form in just clicks.

In case you have a subscription, just log in and click on Download button to have the Oregon Certificate of Redemption from Tax Foreclosure Sale sample.

In the event you don’t have an account yet but need one, follow the point-by-point manual listed below:

- Make sure the document you’re saving is valid in your state (or the state it’s needed in).

- Do it by reading through the form’s description and through clicking on the Preview option (if readily available) to see the form’s information.

- Click Buy Now.

- Pick the proper plan for your budget.

- Sign up to an account and choose how you want to pay out: by PayPal or by card.

- Download the document in .pdf or .docx file format.

- Find the file on your device or in your My Forms folder.

Skilled legal professionals draw up our samples to ensure after saving, you don't have to worry about editing content material outside of your personal details or your business’s information. Sign up for US Legal Forms and get your Oregon Certificate of Redemption from Tax Foreclosure Sale example now.

Foreclosure Certificate Form popularity

FAQ

County and municipal governments create a tax lien certificate that states how much is owed in property taxes, along with any interest or penalties due. These certificates can then go to auction for investors, allowing the governments to collect payment on the past-due taxes, interest, and penalties.

When you buy a tax lien, you're responsible for paying the outstanding lien amount, plus interest or penalties due. Then, the state or municipality pays you principal and interest when the property owner makes their property tax paymentthis is how you earn money with tax lien investing.

People who own real property have to pay property taxes. The government uses the money that property taxes generate to pay for schools, public services, libraries, roads, parks, and the like.When Oregon homeowners don't pay their property taxes, the overdue amount becomes a lien on the property.

Contact the local county registrar's or tax recorder's office. Choose the properties you wish to pay the lien on. Obtain the tax lien certificate with the expiration date and a receipt for the sale. Seize the property if the tax lien expires and the owner has not paid the lien plus the interest.

When homeowners fail to pay their property taxes, some tax jurisdictions choose to hold tax deed home sales to make back the money they are owed. Interested buyers can register to participate as a bidder on these homes in a tax deed auction.

County and municipal governments create a tax lien certificate that states how much is owed in property taxes, along with any interest or penalties due. These certificates can then go to auction for investors, allowing the governments to collect payment on the past-due taxes, interest, and penalties.

Property tax liens can be a viable investment alternative for experienced investors familiar with the real estate market. Those who know what they are doing and take the time to research the properties upon which they buy liens can generate substantial profits over time.

Worthless Property. Sometimes owners stop paying their property taxes because the property is worthless. Foreclosure Risks. When you purchase a tax lien, state statutes limit the amount of time you have to foreclose on the property before the lien expires worthless. Municipal Fines and Costs. Bankruptcy.

The unpaid taxes are auctioned off at a tax lien sale. The highest bidder gets the lien against the property. The tax collector uses the money earned at the tax lien sale to compensate for unpaid back taxes. The homeowner has to pay back the lien holder, plus interest, or face foreclosure.