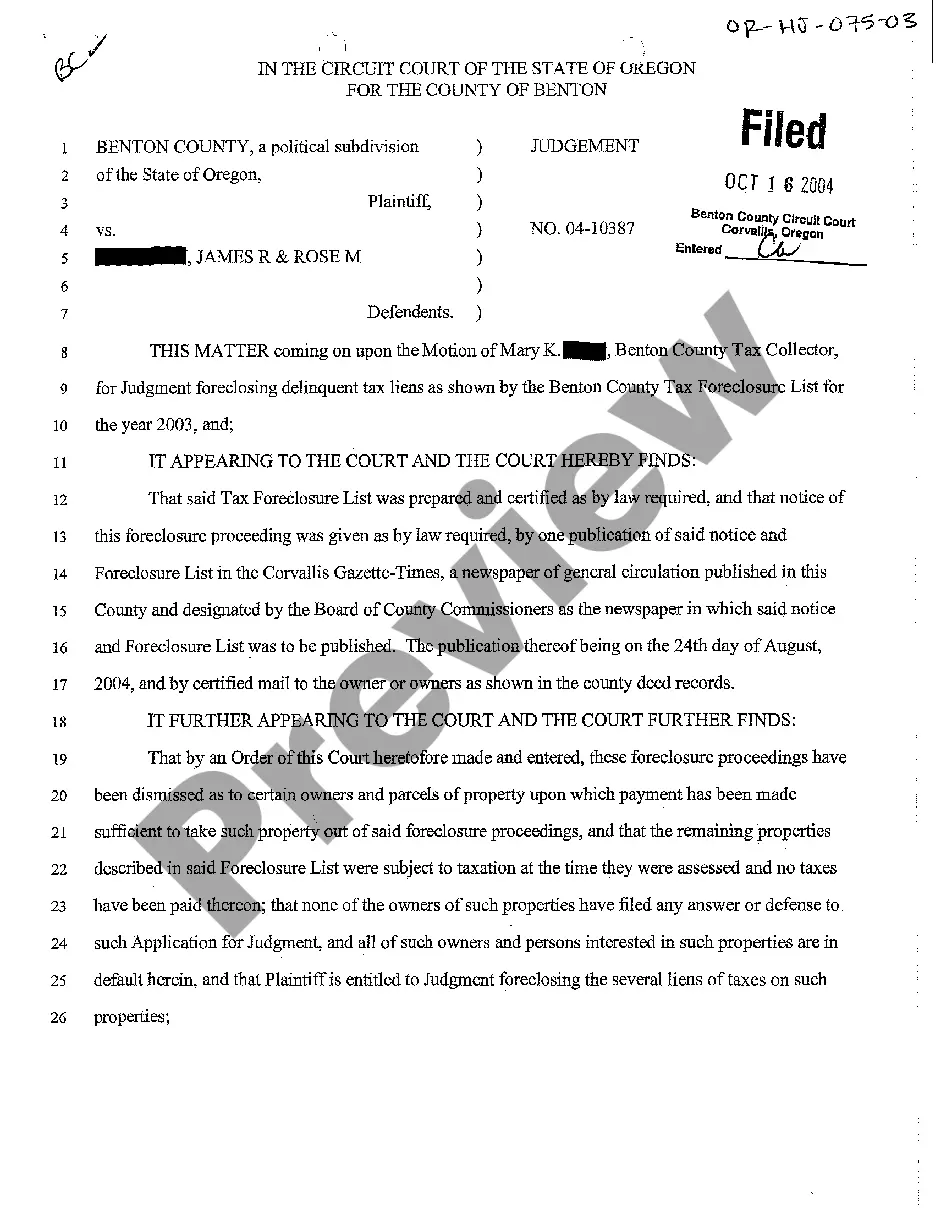

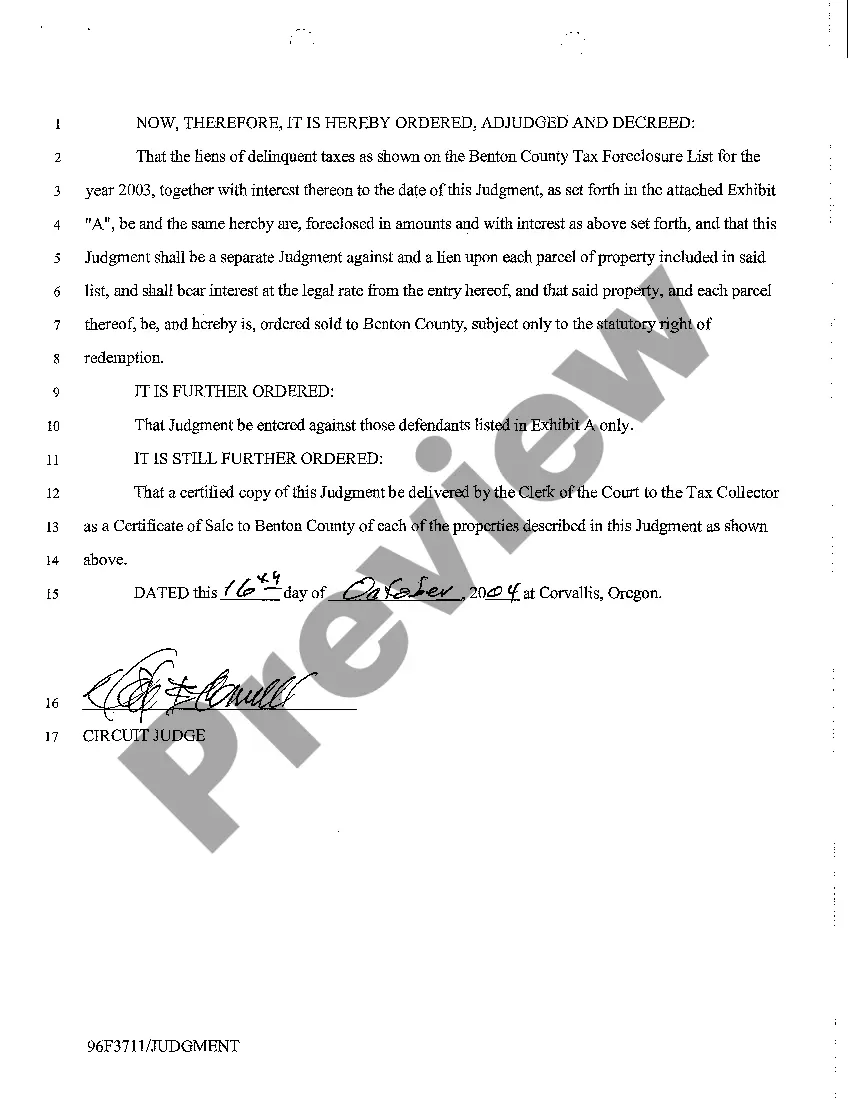

Oregon Judgment Establishing Foreclosure Liens on Disputed Property

Description

How to fill out Oregon Judgment Establishing Foreclosure Liens On Disputed Property?

In terms of completing Oregon Judgment Establishing Foreclosure Liens on Disputed Property, you almost certainly visualize an extensive process that involves choosing a suitable sample among countless similar ones then being forced to pay an attorney to fill it out for you. Generally, that’s a sluggish and expensive option. Use US Legal Forms and choose the state-specific form in a matter of clicks.

In case you have a subscription, just log in and click Download to get the Oregon Judgment Establishing Foreclosure Liens on Disputed Property sample.

In the event you don’t have an account yet but need one, stick to the point-by-point manual below:

- Make sure the document you’re downloading is valid in your state (or the state it’s required in).

- Do this by reading through the form’s description and also by visiting the Preview option (if available) to see the form’s content.

- Click Buy Now.

- Select the proper plan for your budget.

- Join an account and select how you want to pay: by PayPal or by card.

- Download the document in .pdf or .docx file format.

- Find the record on the device or in your My Forms folder.

Professional attorneys work on drawing up our templates to ensure after saving, you don't need to worry about modifying content material outside of your individual info or your business’s details. Join US Legal Forms and receive your Oregon Judgment Establishing Foreclosure Liens on Disputed Property document now.

Form popularity

FAQ

If the judgment creditor does not immediately file an Acknowledgement of Satisfaction of Judgment (EJ-100) when the judgment is satisfied, the judgment debtor may make a formal written demand for the creditor to do so. The judgment creditor has 15 days after receiving the debtor's request to serve the acknowledgement.

In order to vacate a judgment in California, You must file a motion with the court asking the judge to vacate or set aside the judgment. Among other things, you must tell the judge why you did not respond to the lawsuit (this can be done by written declaration).

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

There are a few ways you can satisfy or avoid a lien altogether. The firstand most obviousoption is to repay the debt. If you pay off your obligation, the creditor will remove the lien. This is done by filing a release through the same place the lien was recordedthe county or state.

Step 1: Determine if you have the right to file a lien. Step 2: Send notice of right to lien. Step 3: Prepare the lien document. Step 4: File the lien. Step 5: Send notice of lien. Step 6: Secure payment. Step 7: Release the lien.

Judgments are no longer factored into credit scores, though they are still public record and can still impact your ability to qualify for credit or loans.You should pay legitimate judgments and dispute inaccurate judgments to ensure these do not affect your finances unduly.

With the judgment in hand, a judgment creditor can place a judgment lien on your real estate and occasionally on personal property depending on the state in which you live.

Once a judgment is paid, whether in installments or a lump sum, a judgment creditor (the person who won the case) must acknowledge that the judgment has been paid by filing a Satisfaction of Judgment form with the court clerk.