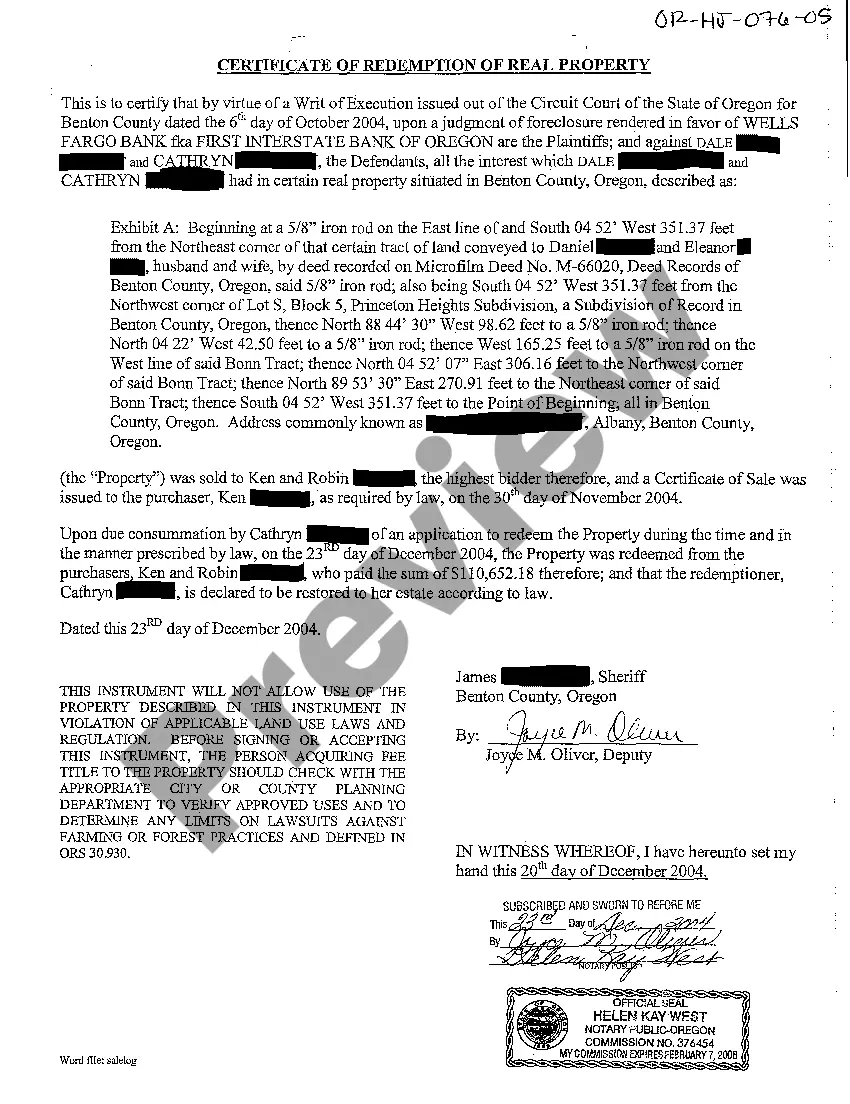

Oregon Certificate of Redemption of Real Property

Description

How to fill out Oregon Certificate Of Redemption Of Real Property?

In terms of submitting Oregon Certificate of Redemption of Real Property, you probably think about a long procedure that requires choosing a ideal form among numerous very similar ones then needing to pay out legal counsel to fill it out for you. Generally speaking, that’s a slow and expensive choice. Use US Legal Forms and choose the state-specific template within just clicks.

If you have a subscription, just log in and click on Download button to find the Oregon Certificate of Redemption of Real Property sample.

In the event you don’t have an account yet but want one, follow the point-by-point manual below:

- Be sure the file you’re saving is valid in your state (or the state it’s needed in).

- Do so by reading the form’s description and also by visiting the Preview option (if available) to find out the form’s information.

- Click on Buy Now button.

- Find the proper plan for your financial budget.

- Subscribe to an account and choose how you would like to pay out: by PayPal or by credit card.

- Save the document in .pdf or .docx file format.

- Find the file on the device or in your My Forms folder.

Professional lawyers work on creating our templates to ensure that after saving, you don't have to worry about enhancing content material outside of your individual details or your business’s info. Be a part of US Legal Forms and get your Oregon Certificate of Redemption of Real Property sample now.

Form popularity

FAQ

Redemption is a period after your home has already been sold at a foreclosure sale when you can still reclaim your home. You will need to pay the outstanding mortgage balance and all costs incurred during the foreclosure process. Many states have some type of redemption period.

The amount of property taxes collected from you (the buyer) on the Closing Disclosure (CD) will be more than three months. BUT the sellers will reimburse you for their prorated portion of property taxes and your out of pocket net will be three months.

It takes several months for a lender to foreclose on a California property. If everything goes according to schedule, the process typically takes approximately 120 days about four months but the process can take as long as 200 or more days to conclude.

Generally, a homeowner has to be at least 120 days delinquent before a mortgage servicer starts a foreclosure. Applying for a foreclosure avoidance option, called loss mitigation, might delay the start date even further.

In Oregon, lenders may foreclose on deeds of trusts or mortgages in default using either a judicial or non-judicial foreclosure process. The judicial process of foreclosure, which involves filing a lawsuit to obtain a court order to foreclose, is used when no power of sale is present in the mortgage or deed of trust.

If you fall behind in making the property tax payments for your home, you might end up losing the place. The taxing authority could sell your home, perhaps through a foreclosure process, to satisfy the debt. Or the taxing authority might sell the tax lien that it holds, and the purchaser might be able to foreclose.

The length of the entire foreclosure process depends on state law and other factors, including whether negotiations are taking place between the lender and the borrower in an effort to stop the foreclosure. Overall, completing the foreclosure process can take from 6 months to more than a year.

Oregon is basically not a tax lien state. What happens is the county will eventually foreclose and then auction off the property. Oregon counties do not sell tax liens or certificates.

Oregon borrowers can expect that the foreclosure process will take approximately six months to complete if everything goes smoothly during the foreclosure. Court delays, borrower objects or a borrower's filing for bankruptcy can delay the process.

The right of redemption allows individuals who have defaulted on their mortgages the ability to reclaim their property by paying the amount due (plus interest and penalties) before the foreclosure process begins, or, in some states, even after a foreclosure sale (for the foreclosure price, plus interest and penalties).