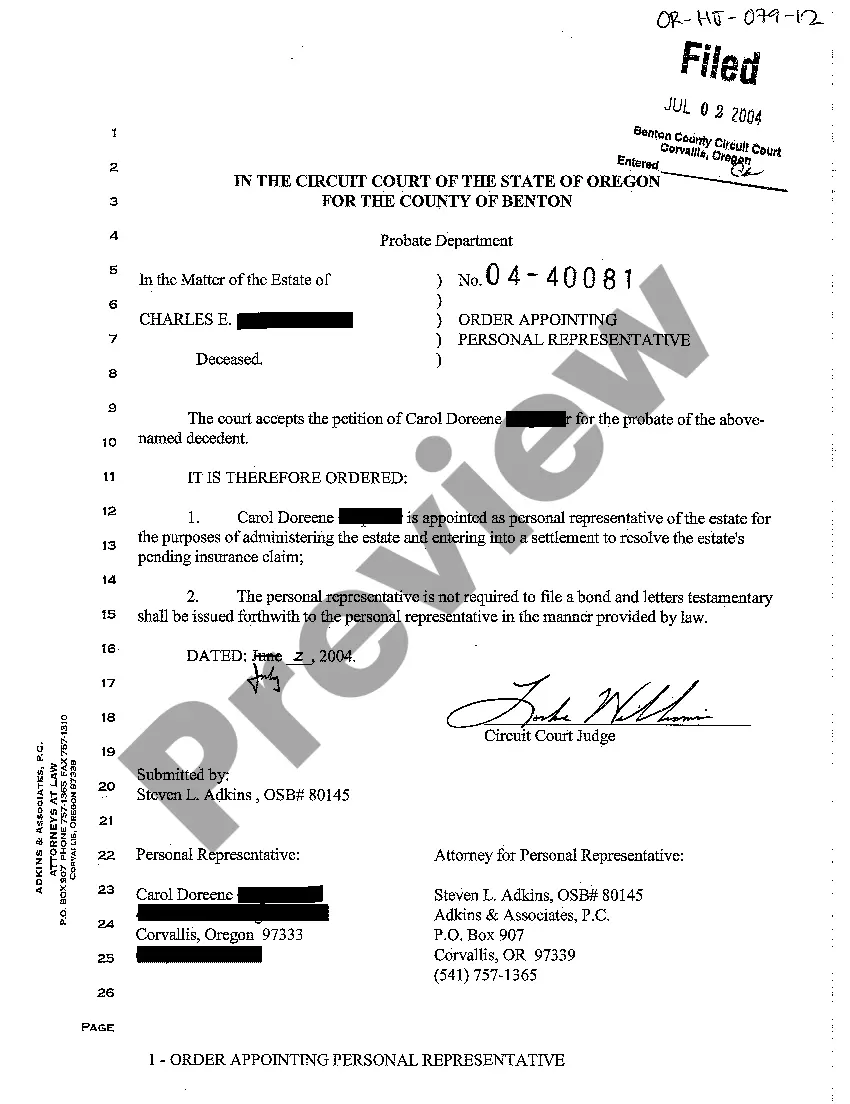

Oregon Order Appointing Personal Representative

Description

How to fill out Oregon Order Appointing Personal Representative?

When it comes to completing Oregon Order Appointing Personal Representative, you probably visualize an extensive process that consists of choosing a ideal sample among countless very similar ones and then needing to pay an attorney to fill it out to suit your needs. Generally speaking, that’s a slow-moving and expensive choice. Use US Legal Forms and choose the state-specific template within just clicks.

If you have a subscription, just log in and then click Download to get the Oregon Order Appointing Personal Representative sample.

If you don’t have an account yet but need one, stick to the step-by-step guideline listed below:

- Be sure the document you’re downloading is valid in your state (or the state it’s needed in).

- Do it by reading the form’s description and also by visiting the Preview function (if accessible) to find out the form’s content.

- Simply click Buy Now.

- Select the suitable plan for your budget.

- Sign up to an account and choose how you would like to pay: by PayPal or by card.

- Save the file in .pdf or .docx format.

- Get the file on your device or in your My Forms folder.

Skilled lawyers work on drawing up our samples to ensure that after saving, you don't need to worry about editing content outside of your personal information or your business’s information. Join US Legal Forms and receive your Oregon Order Appointing Personal Representative example now.

Form popularity

FAQ

An administrator is the person appointed by the court to administer the deceased person's estate where the deceased did not have a Will, no executor is appointed, or the appointed executors do not or cannot act. Executors and administrators are both commonly referred to as a legal personal representative (LPR).

By way of introduction, an estate is a small estate if the total value of the assets that need to be administered does not exceed the following values: $200,000 for real property and $75,000 for personal property. Small estates can be administered through a formal probate proceeding, just like larger estates.

Determine who has priority to serve. State law establishes the qualifications for an administrator and sets the order of priority that the court must follow in making an appointment. Prepare to file a petition to administer. Collect the necessary information. File the petition with the court.

You can administer an estate even if the deceased died without a will or failed to specify an executor. If your relationship to the deceased doesn't make you the probate court's default choice for administrator, you'll need to get permission from the relatives ahead of you in the priority order.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

Locate Documents. Record the preferences of the testator. Check status of property and accounts. Confirm beneficiaries are correct. Make a list of personal possessions. Create a schedule of assets. Make a list of credit cards and debts. Electronic access to information.

An executor is someone named in your will, or appointed by the court, who is given the legal responsibility to take care of any remaining financial obligations. Typical duties include: Distributing assets according to the will. Maintaining property until the estate is settled (e.g., upkeep of a house)

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.

A personal representative usually is named in a will. However, courts sometimes appoint a personal representative. Usually, whether or not the deceased left a will, the probate court will issue a finding of fact that a will has or has not been filed and a personal representative or administrator has been appointed.