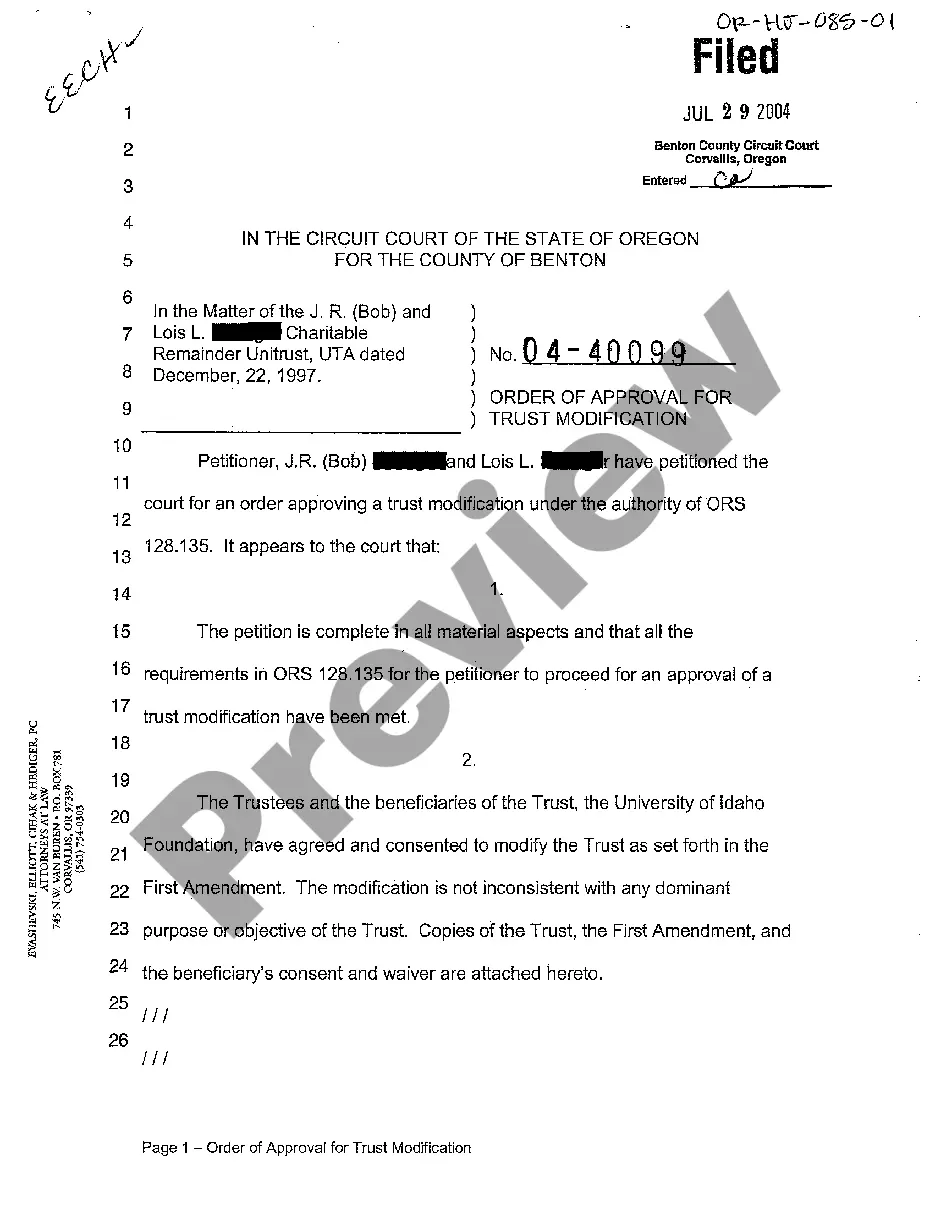

Oregon Order of Approval for Trust Modification

Description

How to fill out Oregon Order Of Approval For Trust Modification?

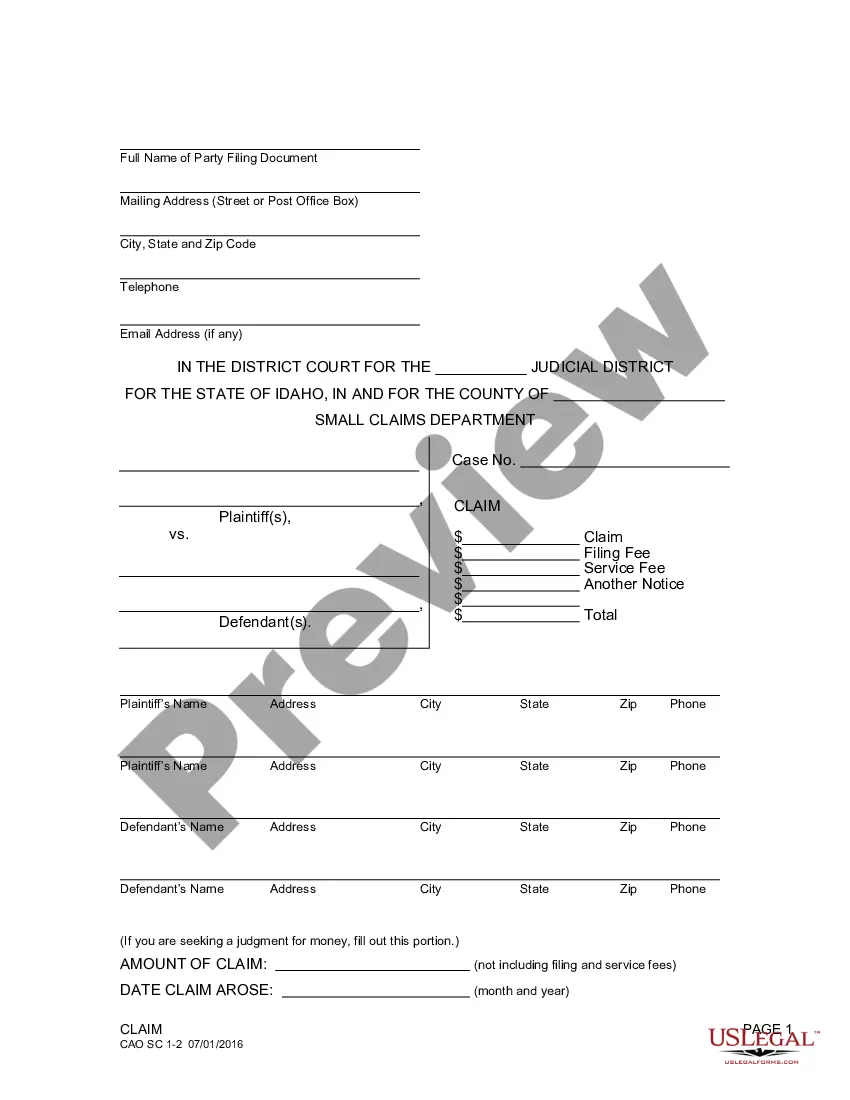

When it comes to completing Oregon Order of Approval for Trust Modification, you most likely imagine an extensive process that consists of getting a ideal form among a huge selection of very similar ones and then needing to pay legal counsel to fill it out to suit your needs. On the whole, that’s a slow-moving and expensive choice. Use US Legal Forms and pick out the state-specific document in just clicks.

If you have a subscription, just log in and click Download to have the Oregon Order of Approval for Trust Modification template.

In the event you don’t have an account yet but need one, stick to the step-by-step guideline listed below:

- Be sure the document you’re getting is valid in your state (or the state it’s required in).

- Do this by reading through the form’s description and by clicking on the Preview option (if readily available) to view the form’s information.

- Click on Buy Now button.

- Select the suitable plan for your financial budget.

- Subscribe to an account and select how you want to pay out: by PayPal or by card.

- Save the document in .pdf or .docx file format.

- Get the file on the device or in your My Forms folder.

Professional lawyers work on drawing up our samples to ensure that after downloading, you don't have to bother about editing and enhancing content outside of your personal information or your business’s info. Sign up for US Legal Forms and get your Oregon Order of Approval for Trust Modification sample now.

Form popularity

FAQ

A court can, when given reasons for a good cause, amend the terms of irrevocable trust when a trustee and/or a beneficiary petitions the court for a modification.Such modification provisions are common with charitable trusts, to allow modifications when federal tax law changes.

Regardless of whether the trust is revocable or irrevocable, any assets transferred into the trust are no longer owned by the grantor.In such cases, the terms of your trust will supersede the terms of your will, because your will can only affect the assets you owned at the time of your death.

Of course you can, however, "Codicil" is an amendment to a will. Amending a trust called "Amendment" to the trust, even if it is just amending a trustee's name. It needs to be notarized and some specific language to be sufficient.

Find living trust forms online. Be as clear as possible. Include specific language. Have the amendment notarized. Keep your trust document and amendment together in a safe place. Alternatively, do what is called a restatement of the trust. Revoke your trust.

In most cases, a trustee cannot remove a beneficiary from a trust. This power of appointment generally is intended to allow the surviving spouse to make changes to the trust for their own benefit, or the benefit of their children and heirs.

Generally, a successor trustee cannot change or amend a trust. Most trusts are initially managed by their creator or original trustee, while they are still alive and competent. But after their passing, a successor trustee must step in to take legal title to assets and administer the trust according to its terms.

Generally speaking, beneficiaries have a right to see trust documents which set out the terms of the trusts, the identity of the trustees and the assets within the trust as well as the trust deed, any deeds of appointment/retirement and trust accounts.

An irrevocable trust is a trust with terms and provisions that cannot be changed. However, under certain circumstances, changes to an irrevocable trust can be made and a trust can even be terminated. A material purpose of the trust no longer exists.

Just about any writing will suffice to make a valid Trust amendment. Having the writing typed is not legally required. That's really the point of Trust amendments, to allow a Settlor to express his or her intent as easily as possible. As long as the Trust terms are followed, any writing will do.