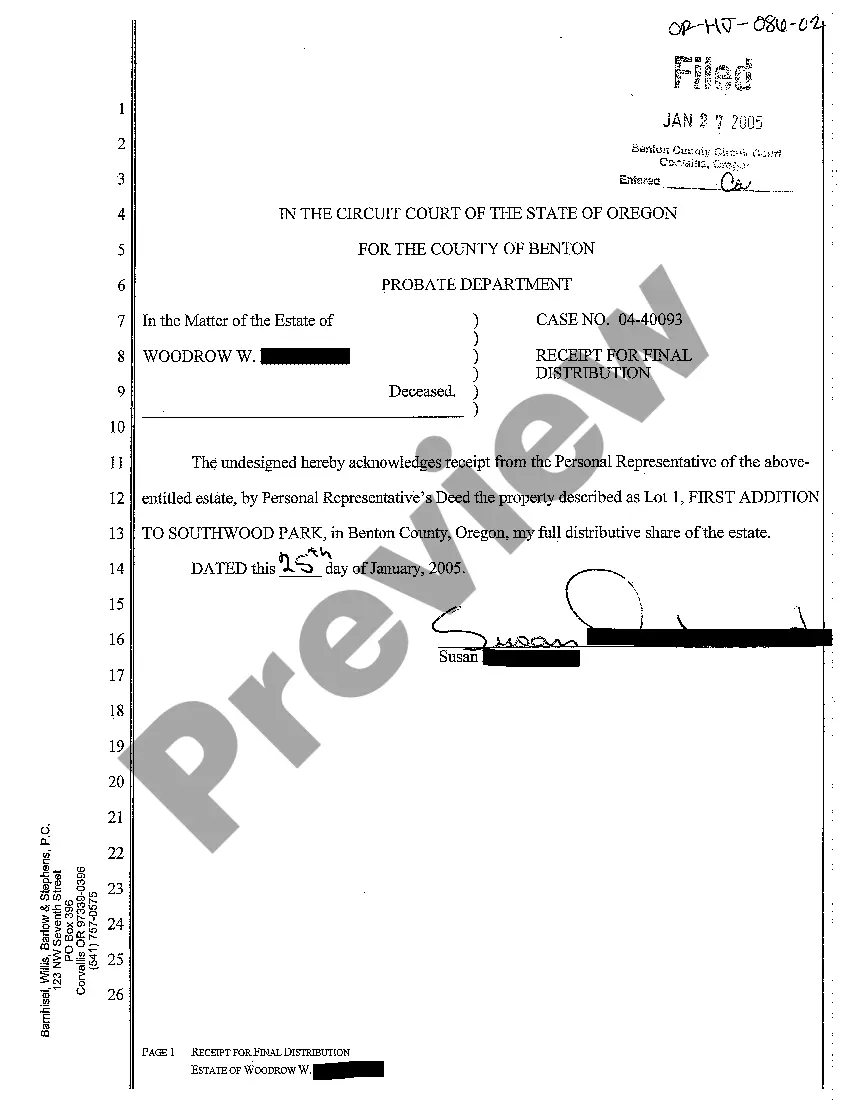

Oregon Receipt for Final Distribution

Description Final Distribution Of Estate Letter

How to fill out Oregon Receipt For Final Distribution?

In terms of submitting Oregon Receipt for Final Distribution, you most likely think about an extensive procedure that requires finding a perfect form among a huge selection of very similar ones and then having to pay out a lawyer to fill it out for you. On the whole, that’s a slow and expensive choice. Use US Legal Forms and choose the state-specific form within just clicks.

If you have a subscription, just log in and click Download to find the Oregon Receipt for Final Distribution template.

If you don’t have an account yet but need one, follow the point-by-point guideline listed below:

- Make sure the file you’re getting applies in your state (or the state it’s required in).

- Do it by reading through the form’s description and also by visiting the Preview option (if available) to view the form’s content.

- Click Buy Now.

- Pick the appropriate plan for your budget.

- Sign up for an account and select how you want to pay out: by PayPal or by credit card.

- Save the file in .pdf or .docx format.

- Get the document on your device or in your My Forms folder.

Skilled lawyers work on creating our templates to ensure after downloading, you don't need to worry about enhancing content material outside of your individual info or your business’s info. Sign up for US Legal Forms and receive your Oregon Receipt for Final Distribution sample now.

Receipt Of Distribution Form popularity

FAQ

After the Grant of Probate has been issued, our Probate Solicitors estimate that for a straightforward estate, it will take another 3 to 6 months before the funds can be distributed to the beneficiaries.

An order for final distribution in California probate is conclusive to the rights of heirs and devisees in a decedent's estate. The order also releases the personal representative from claims by heirs and devisees, unless, of course, there is fraud or misrepresentation present.

Beneficiaries are entitled to receive a financial accounting of the trust, including bank statements, regularly. When statements are not received as requested, a beneficiary must submit a written demand to the trustee.The court will review the trust account for any discrepancies or irregular activity.

What is Decree of Distribution? A final judgment issued by the probate court that is conclusive as to the rights of the legatees, devisees and heirs (all beneficiaries) and details their respective shares under the will or intestate estate.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

From Longman Business DictionaryRelated topics: Finance 02ccfinal distri02c8bution singular the last DIVIDEND paid during a financial year, if a company pays dividends more than once during the year 2192 distribution.

A final decree is one which completely disposes of a suit and finally settles all questions in the controversy between parties and nothing further remains to be decided thereafter.

Obtaining and filing receipts In the case of real property, the Personal Representative should record a certified copy of the Judgment of Final Distribution in the county in which the real property is located. Recordation of the order is considered to be a Receipt from Distributee for the property.