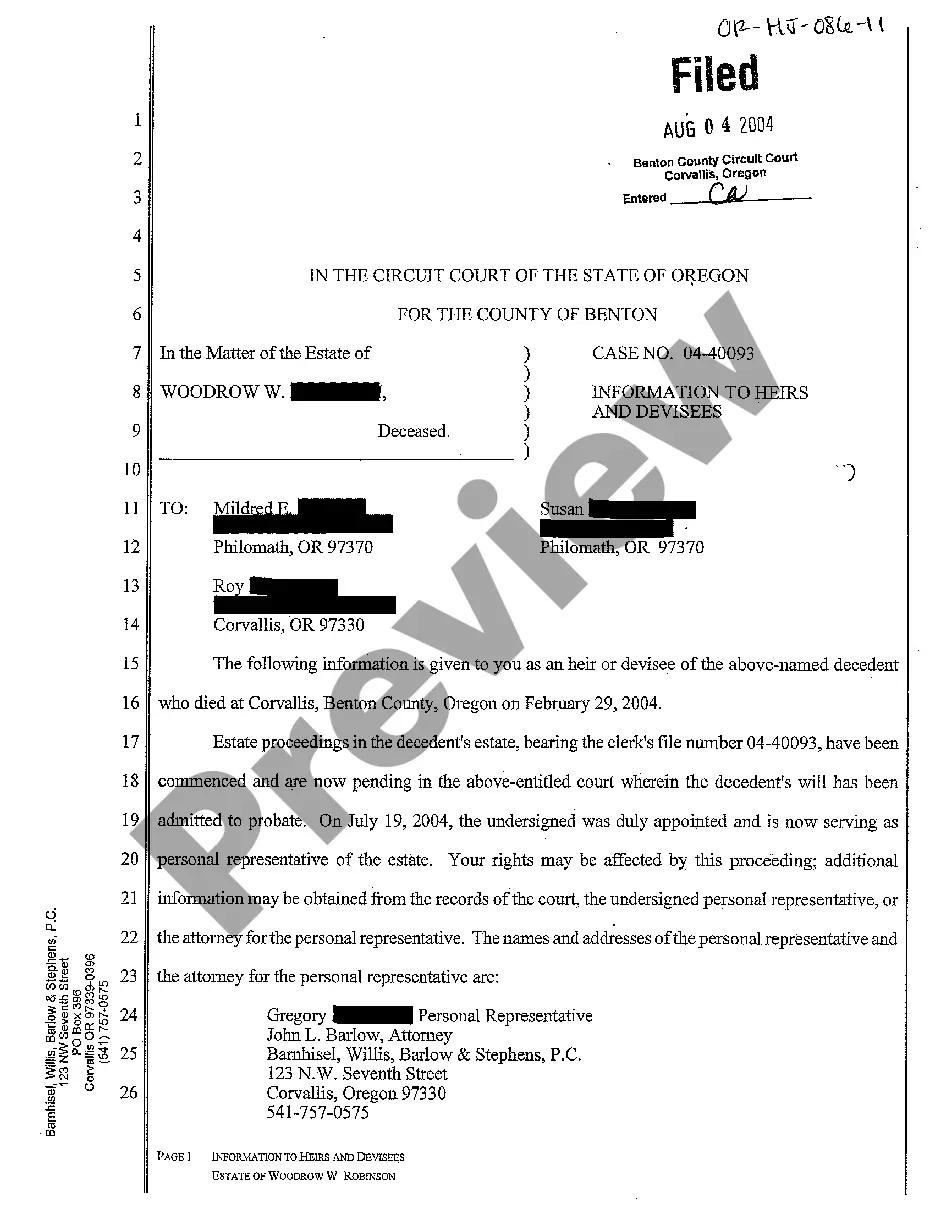

Oregon Information to Heirs and Devisees

Description

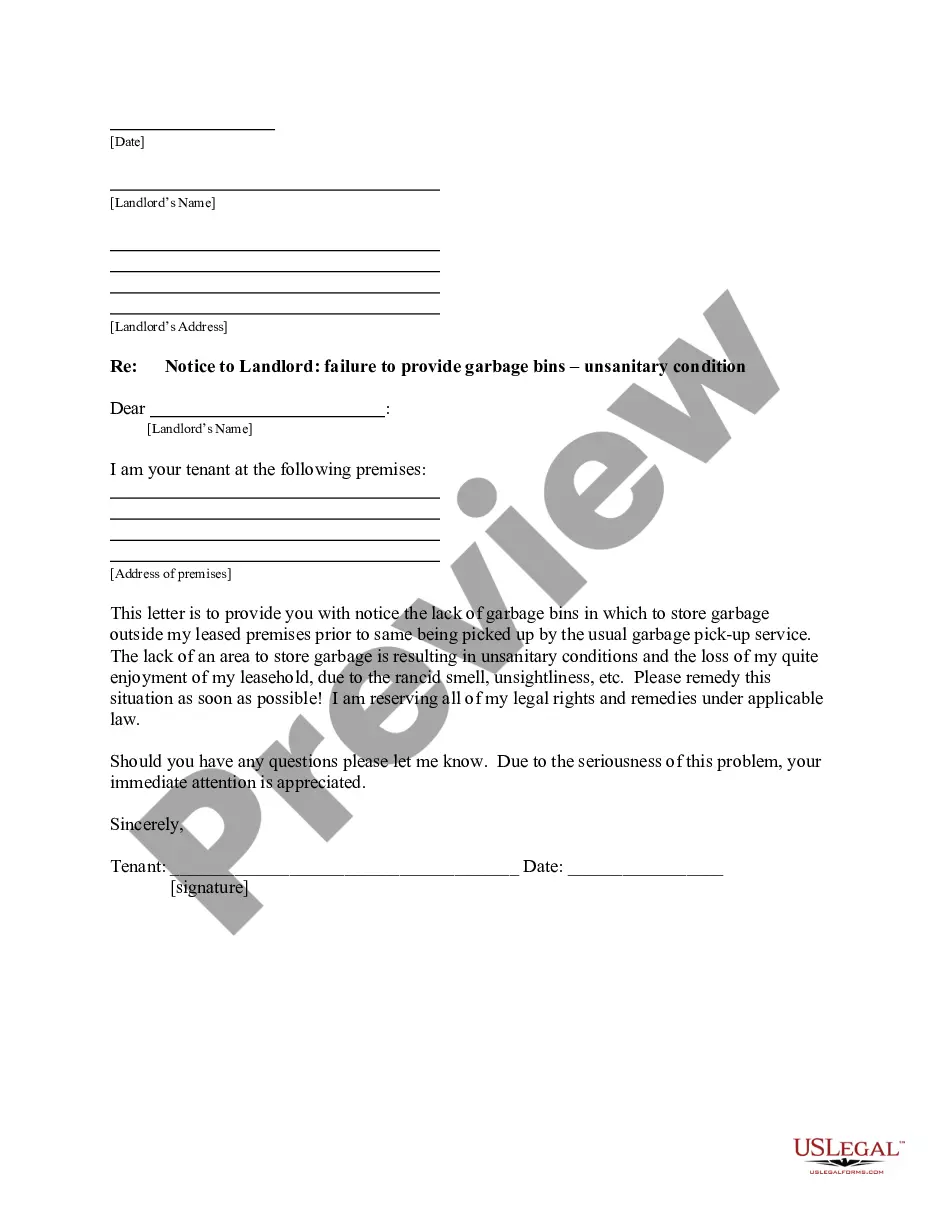

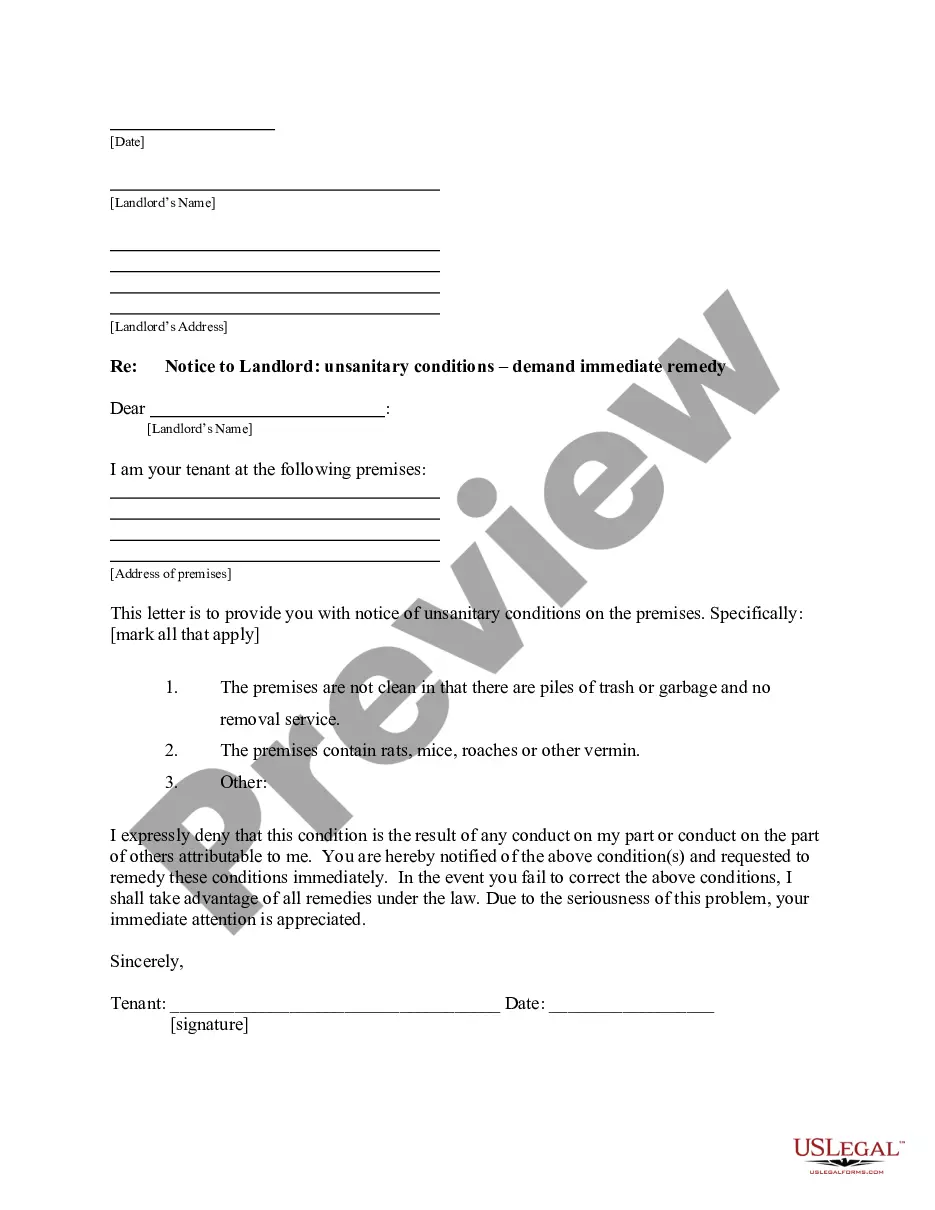

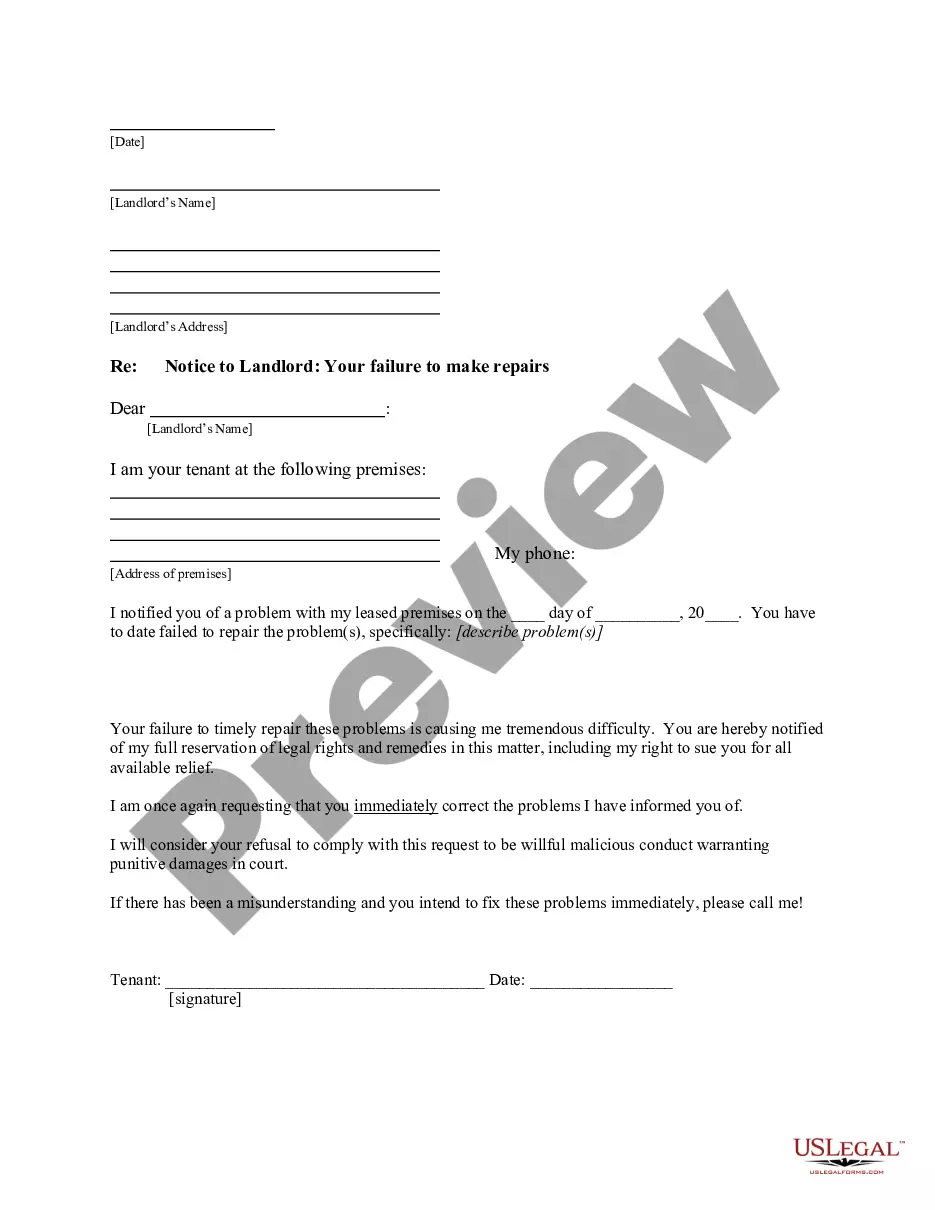

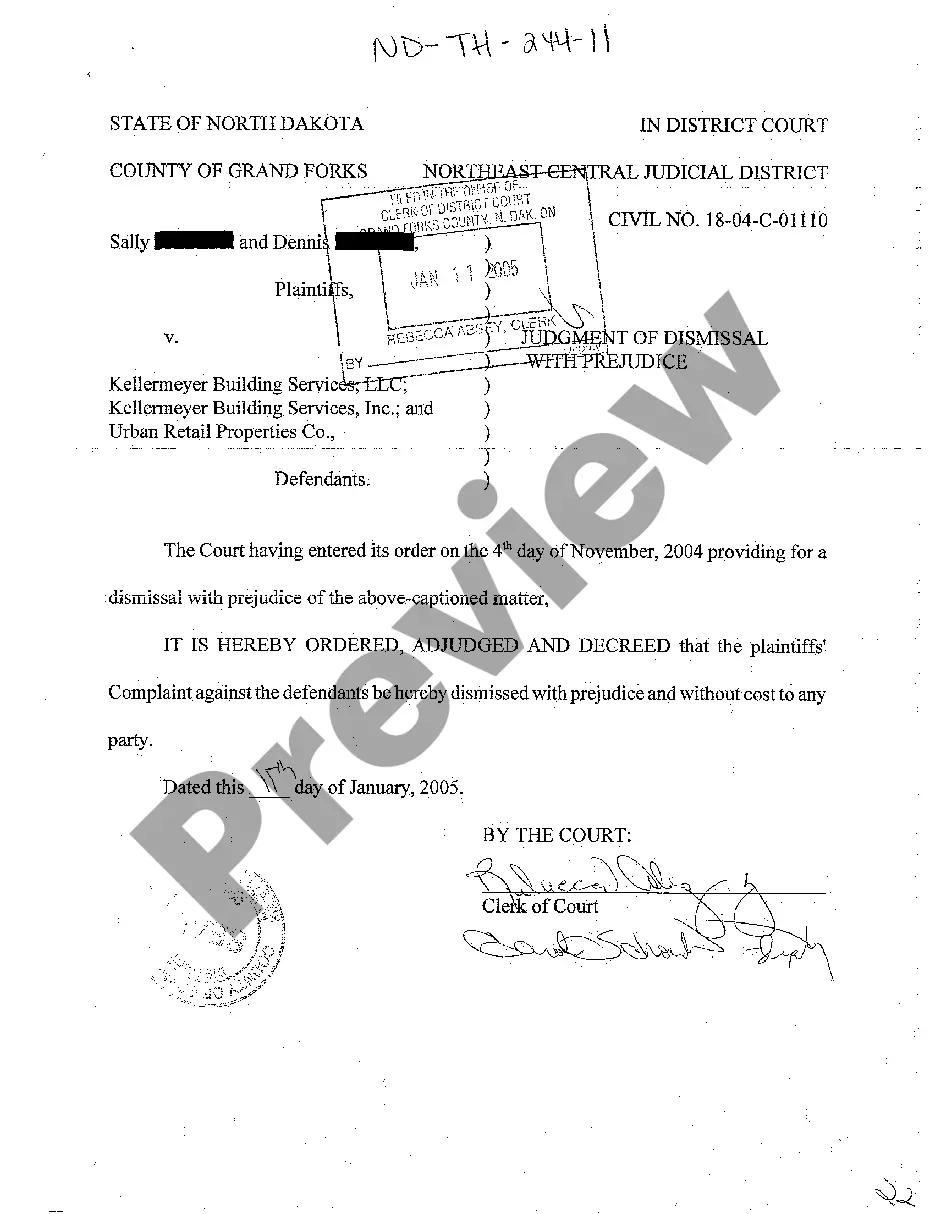

How to fill out Oregon Information To Heirs And Devisees?

When it comes to completing Oregon Information to Heirs and Devisees, you most likely visualize a long process that consists of getting a ideal sample among countless similar ones and then needing to pay out a lawyer to fill it out to suit your needs. Generally speaking, that’s a slow-moving and expensive choice. Use US Legal Forms and select the state-specific template in a matter of clicks.

If you have a subscription, just log in and then click Download to find the Oregon Information to Heirs and Devisees sample.

If you don’t have an account yet but want one, stick to the point-by-point guide listed below:

- Be sure the document you’re saving applies in your state (or the state it’s required in).

- Do it by looking at the form’s description and through visiting the Preview function (if available) to view the form’s information.

- Click on Buy Now button.

- Select the proper plan for your budget.

- Sign up to an account and select how you want to pay: by PayPal or by card.

- Save the file in .pdf or .docx format.

- Get the document on your device or in your My Forms folder.

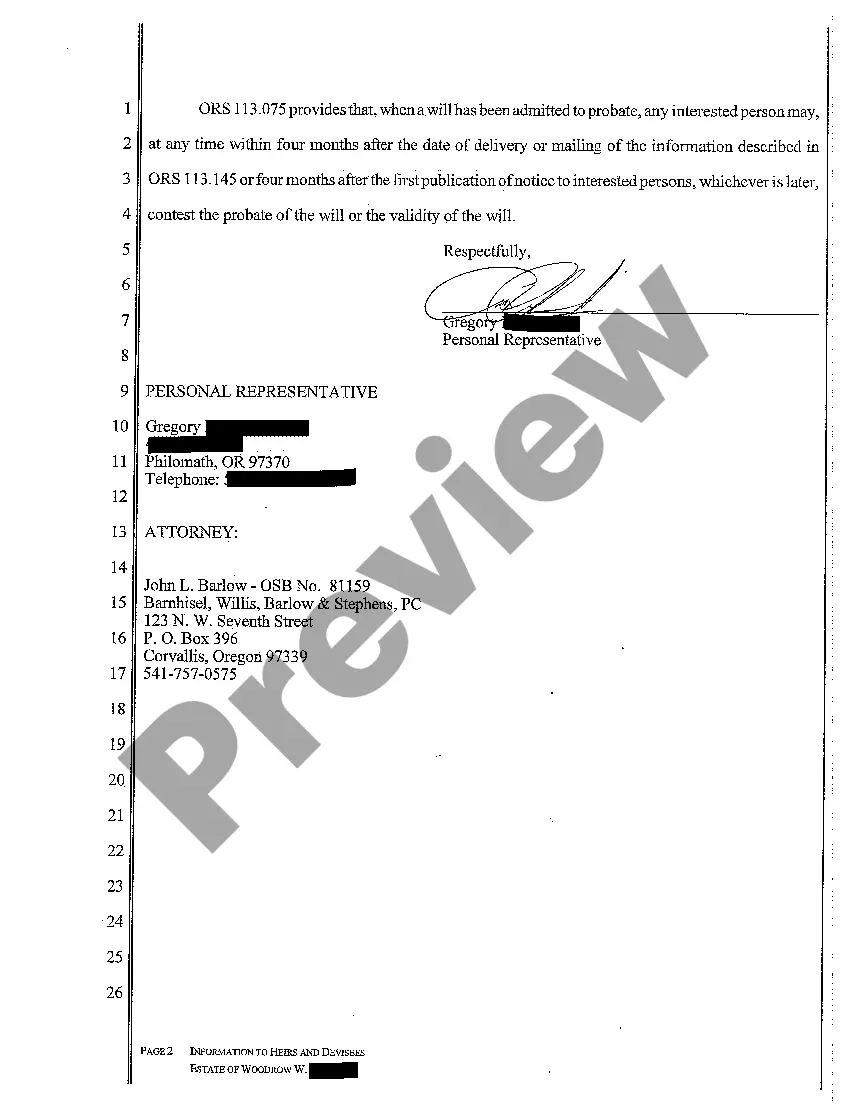

Skilled attorneys work on creating our templates to ensure after saving, you don't have to worry about editing content outside of your individual info or your business’s details. Be a part of US Legal Forms and get your Oregon Information to Heirs and Devisees example now.

Form popularity

FAQ

Oregon has a simplified probate process for small estates. To use it, you (as an inheritor) file a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.

Attorneys' fees in Oregon are based on the number of hours billed and the lawyer's hourly rate. For the simplest of probates, the fees can be around $2000. In general, probate legal fees will run between $3,000 and $5,000. If the estate is large, complex or has unusual assets, the costs can be much higher.

By way of introduction, an estate is a small estate if the total value of the assets that need to be administered does not exceed the following values: $200,000 for real property and $75,000 for personal property. Small estates can be administered through a formal probate proceeding, just like larger estates.

Probate is not always necessary. If the deceased person owned bank accounts or property with another person, the surviving co-owner often will then own that property automatically.Settle a dispute between people who claim they are entitled to assets of the deceased person.

Under Oregon law, a small estate affidavit can be filed if the estate has no more than $75,000 in personal property and no more that $200,000 in real property. These limits may be subject to change. A larger estate may require probate.

Probate is required when an estate's assets are solely in the deceased's name. In most cases, if the deceased owned property that had no other names attached, an estate must go through probate in order to transfer the property into the name(s) of any beneficiaries.

If Probate is needed but you don't apply for it, the beneficiaries won't be able to receive their inheritance. Instead the deceased person's assets will be frozen and held in a state of limbo. No one will have the legal authority to access, sell or transfer them.

Under Oregon law, a small estate affidavit can be filed if the estate has no more than $75,000 in personal property and no more that $200,000 in real property. These limits may be subject to change. A larger estate may require probate.