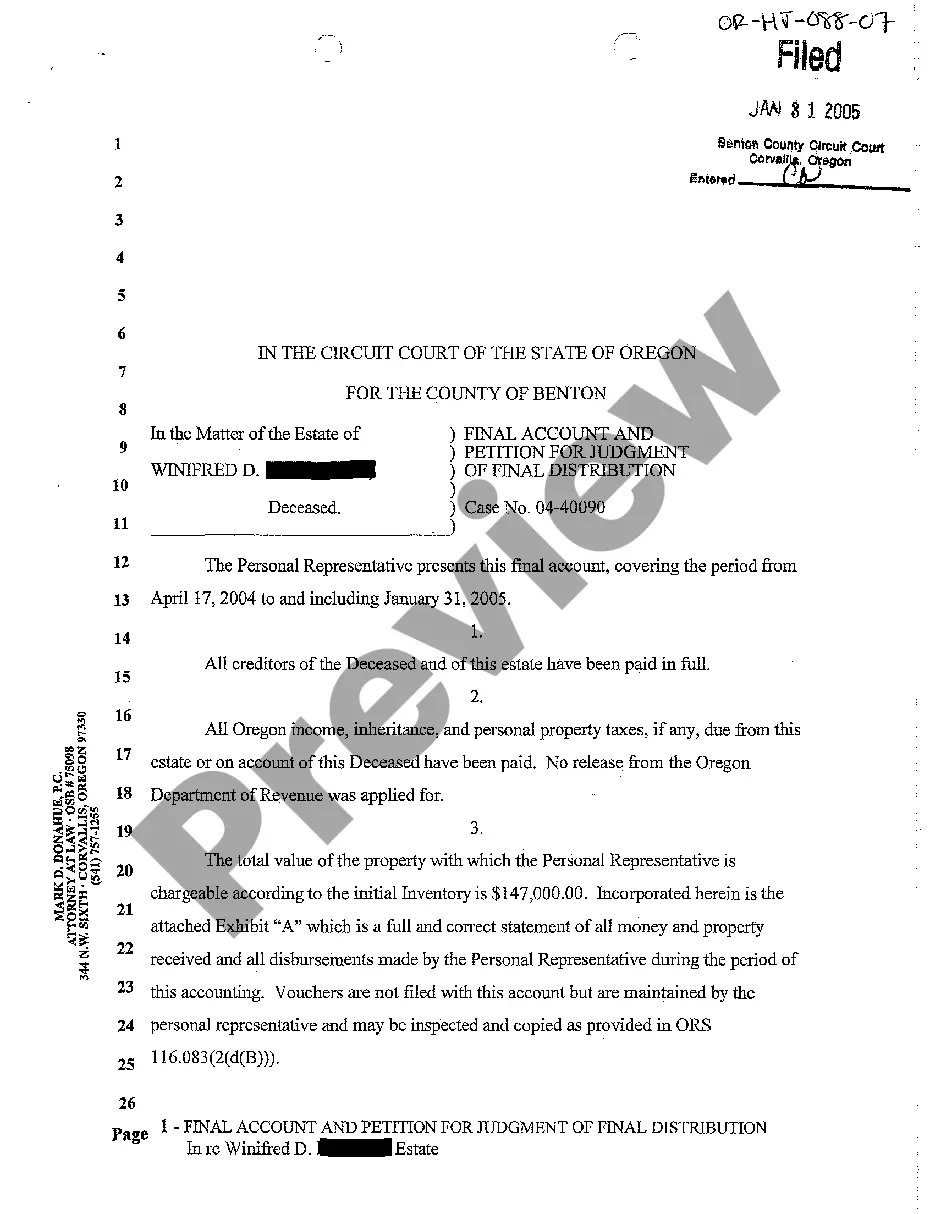

Oregon Final Account and Petition for Judgment of Final Distribution

Description

How to fill out Oregon Final Account And Petition For Judgment Of Final Distribution?

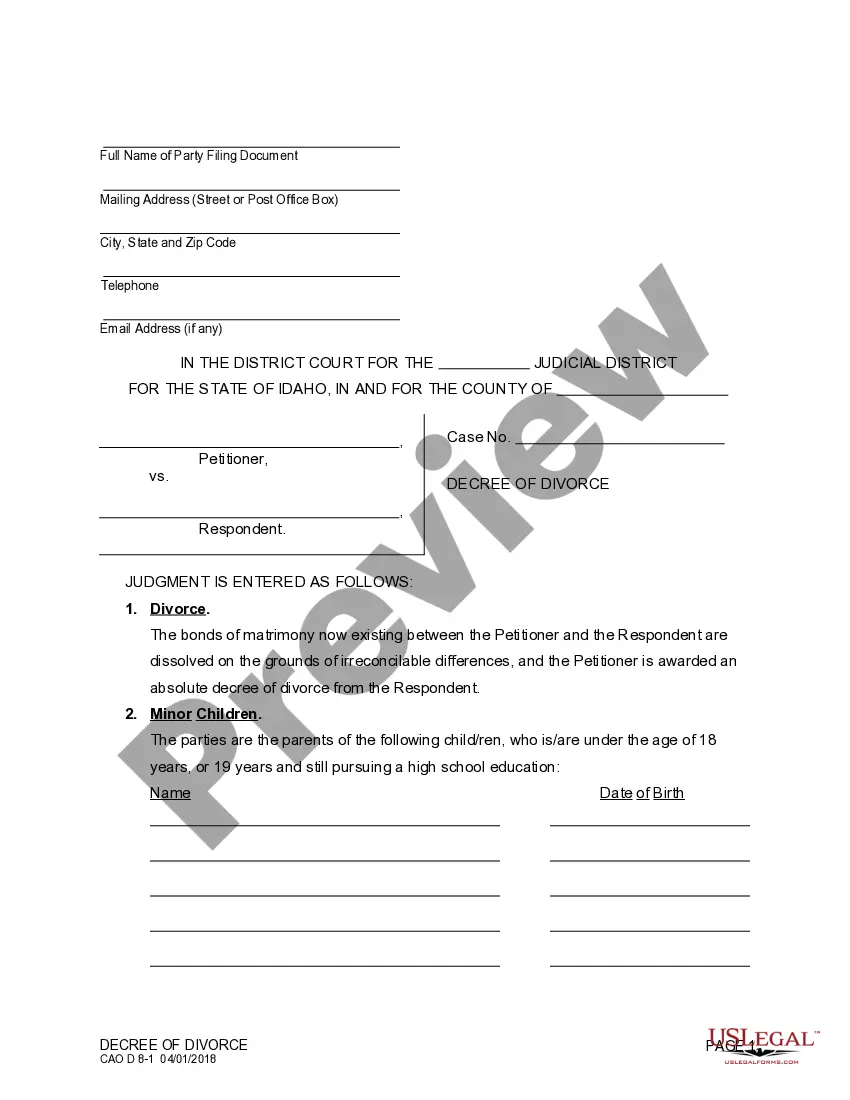

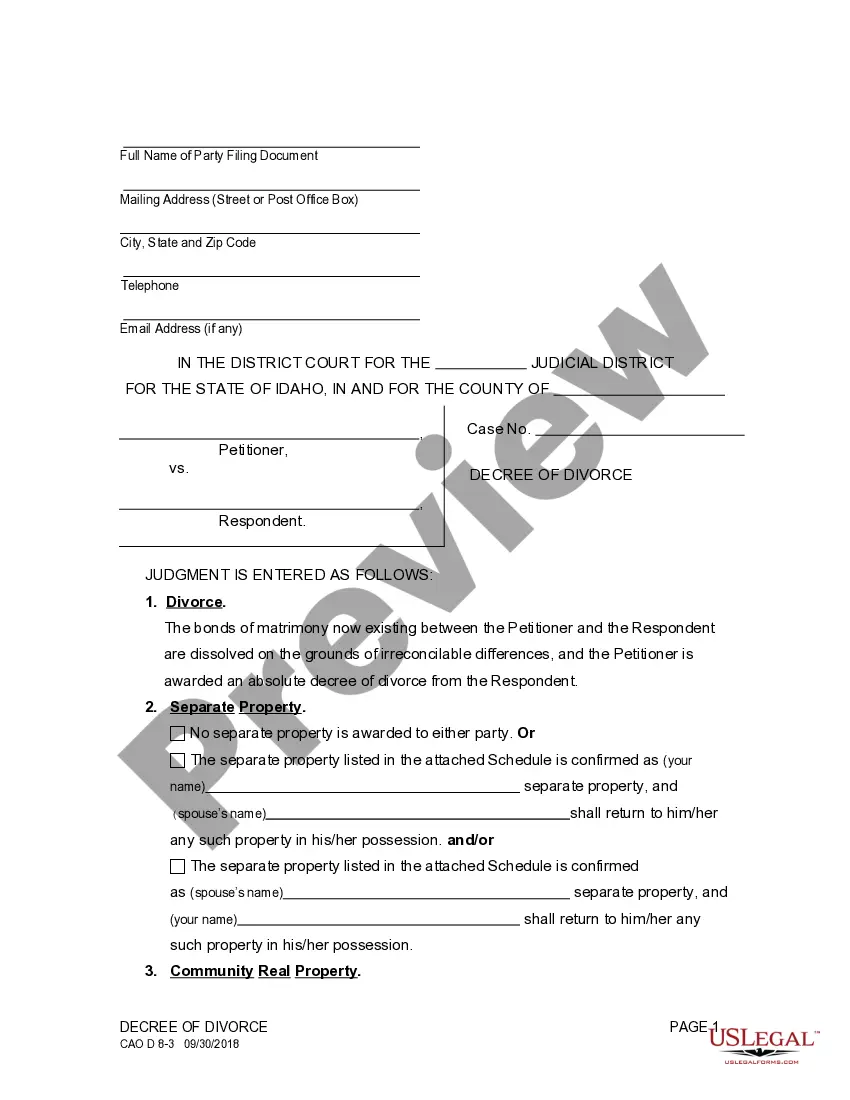

When it comes to filling out Oregon Final Account and Petition for Judgment of Final Distribution, you most likely visualize a long process that requires getting a suitable sample among numerous similar ones and after that being forced to pay out legal counsel to fill it out for you. Generally speaking, that’s a slow and expensive option. Use US Legal Forms and pick out the state-specific template within just clicks.

For those who have a subscription, just log in and then click Download to get the Oregon Final Account and Petition for Judgment of Final Distribution sample.

In the event you don’t have an account yet but need one, keep to the step-by-step guideline below:

- Make sure the file you’re downloading applies in your state (or the state it’s needed in).

- Do so by reading through the form’s description and also by clicking the Preview function (if offered) to see the form’s information.

- Simply click Buy Now.

- Find the suitable plan for your budget.

- Sign up for an account and select how you want to pay out: by PayPal or by credit card.

- Save the document in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

Professional attorneys draw up our templates to ensure after saving, you don't have to worry about editing and enhancing content outside of your personal details or your business’s details. Be a part of US Legal Forms and receive your Oregon Final Account and Petition for Judgment of Final Distribution document now.

Form popularity

FAQ

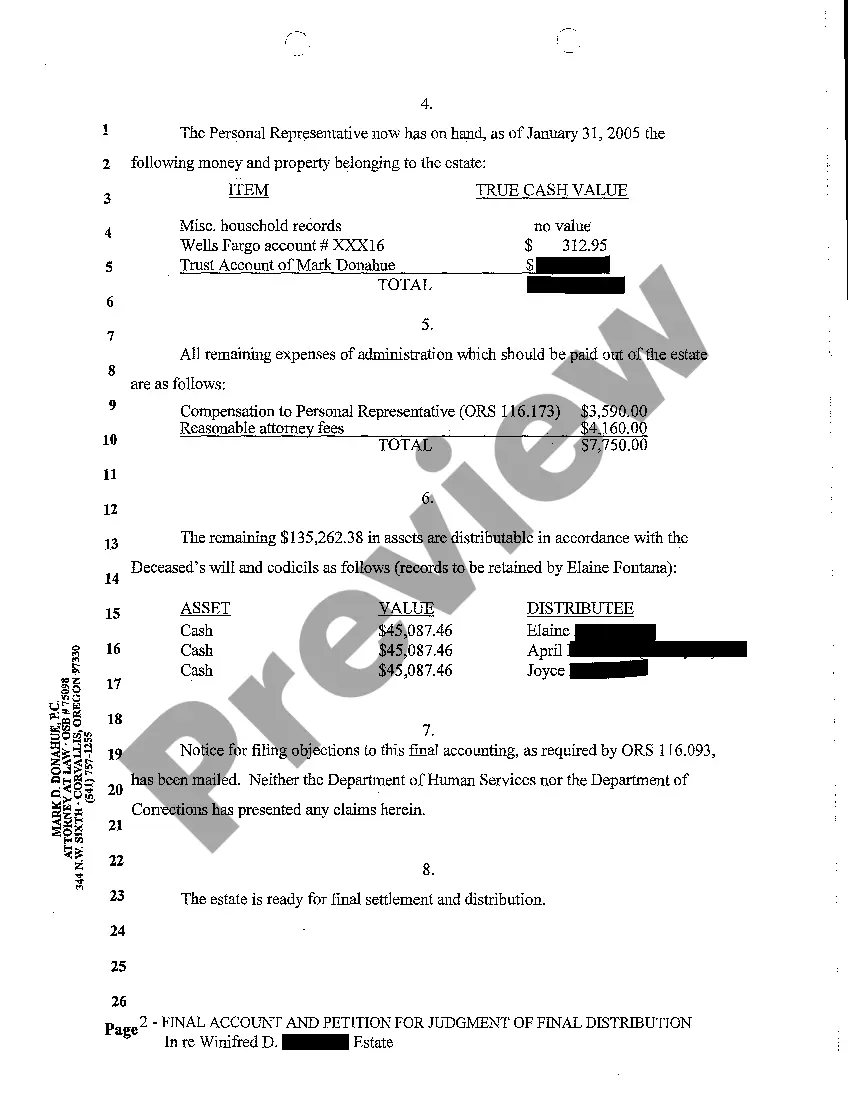

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

The final accounting is a form filed with the court that summarizes the financial changes since the initial inventory.It also will list the sale of any assets that were listed in the inventory. If any property was sold for less than the appraised value, it may be necessary to explain the difference.

After the Grant of Probate has been issued, our Probate Solicitors estimate that for a straightforward estate, it will take another 3 to 6 months before the funds can be distributed to the beneficiaries.

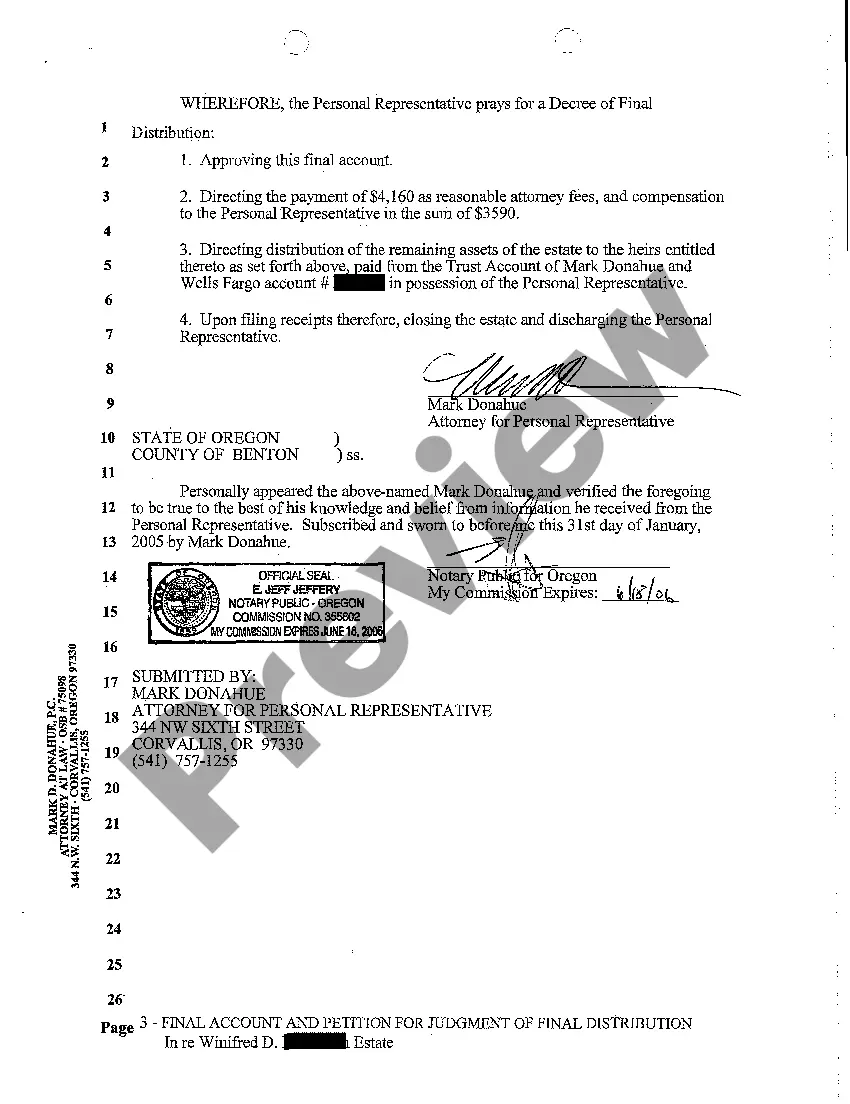

An order for final distribution in California probate is conclusive to the rights of heirs and devisees in a decedent's estate. The order also releases the personal representative from claims by heirs and devisees, unless, of course, there is fraud or misrepresentation present.

You must petition the probate court to admit any will to probate and to appoint you as the personal representative. The petition contains some basic background information of the decedent and this information is described in ORS 113.035 -Petition for appointment of personal representative and probate of will.

When the executor has paid off the debts, filed the taxes and sold any property needed to pay bills, he can submit a final estate accounting to the probate court. Once the probate court approves the accounting, he can distribute assets to you and other beneficiaries according to the terms of the will.

From Longman Business DictionaryRelated topics: Finance 02ccfinal distri02c8bution singular the last DIVIDEND paid during a financial year, if a company pays dividends more than once during the year 2192 distribution.

What is Decree of Distribution? A final judgment issued by the probate court that is conclusive as to the rights of the legatees, devisees and heirs (all beneficiaries) and details their respective shares under the will or intestate estate.

A final decree is one which completely disposes of a suit and finally settles all questions in the controversy between parties and nothing further remains to be decided thereafter.