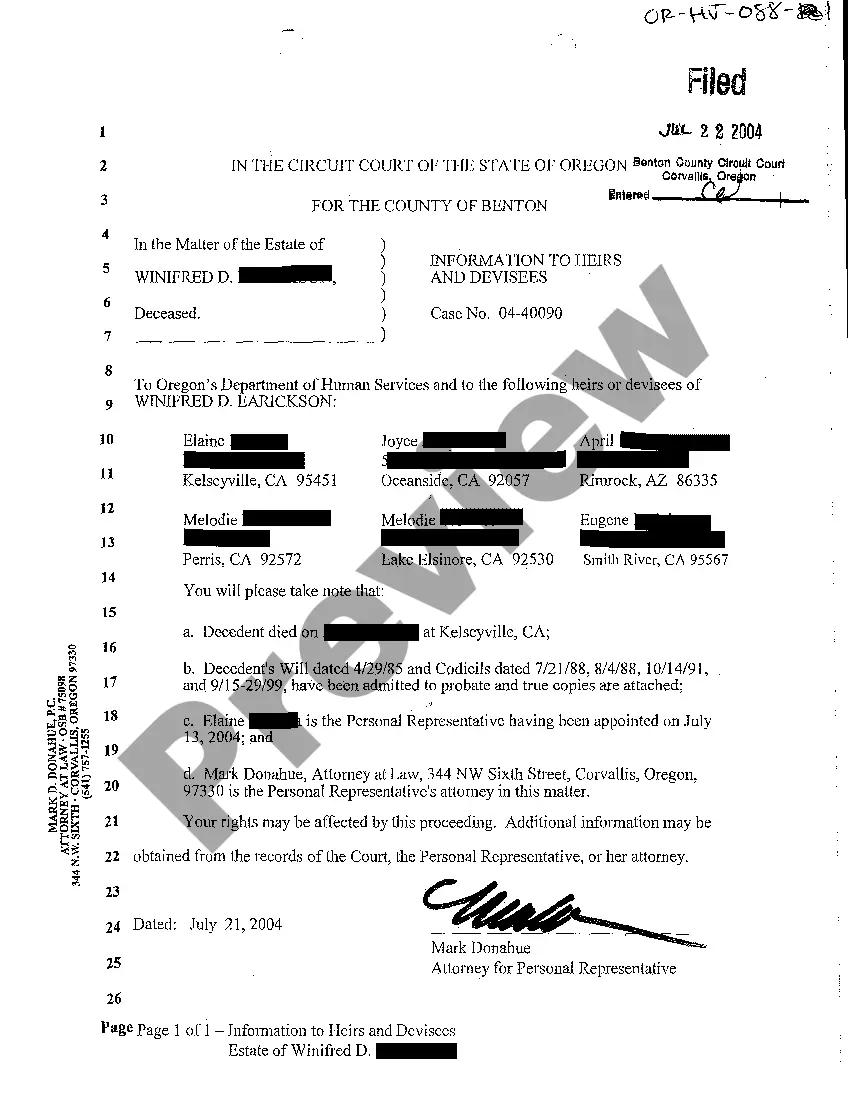

Oregon Information to Heirs and Devisees

Description

How to fill out Oregon Information To Heirs And Devisees?

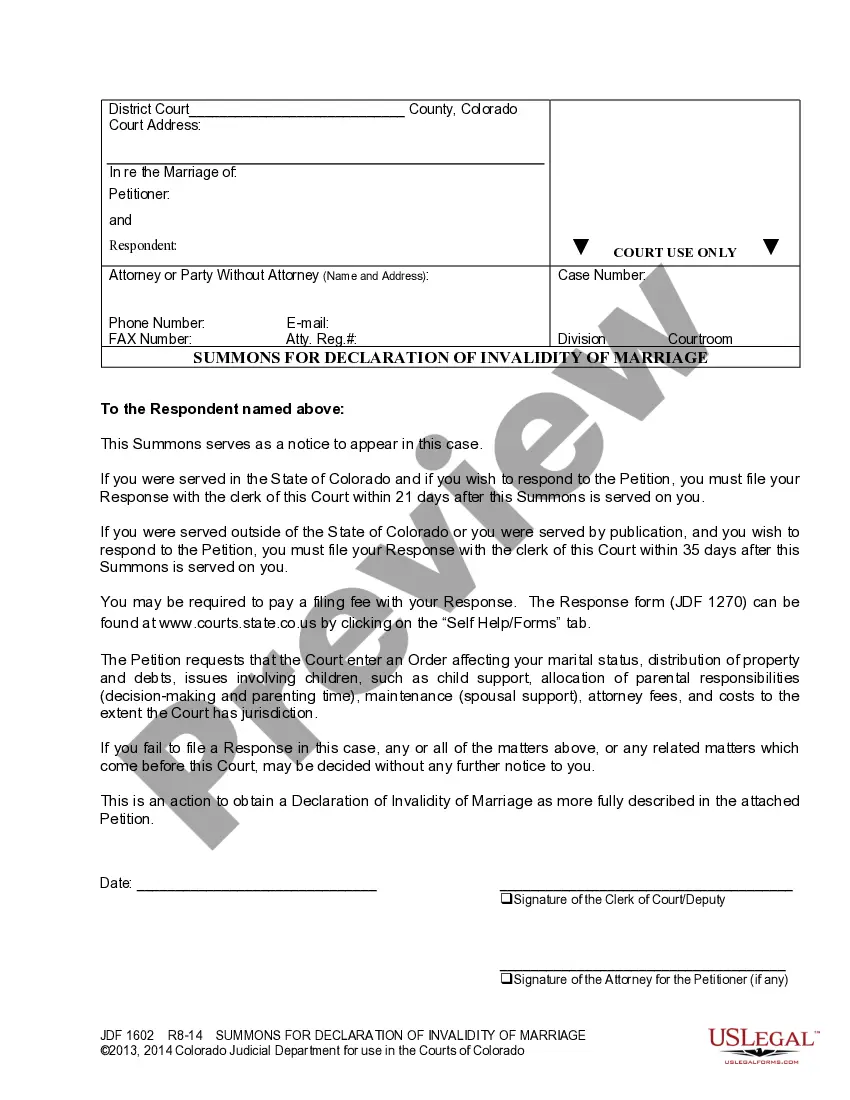

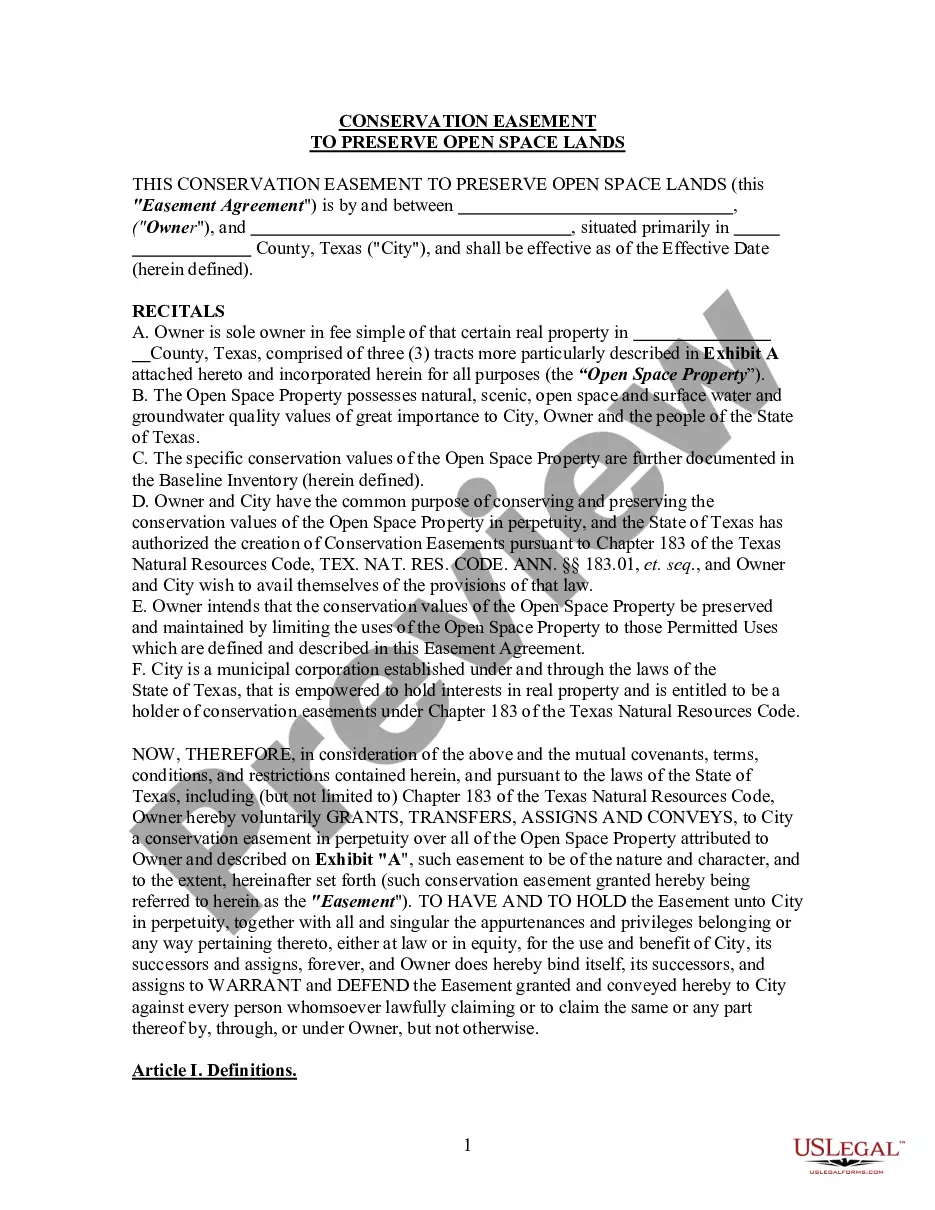

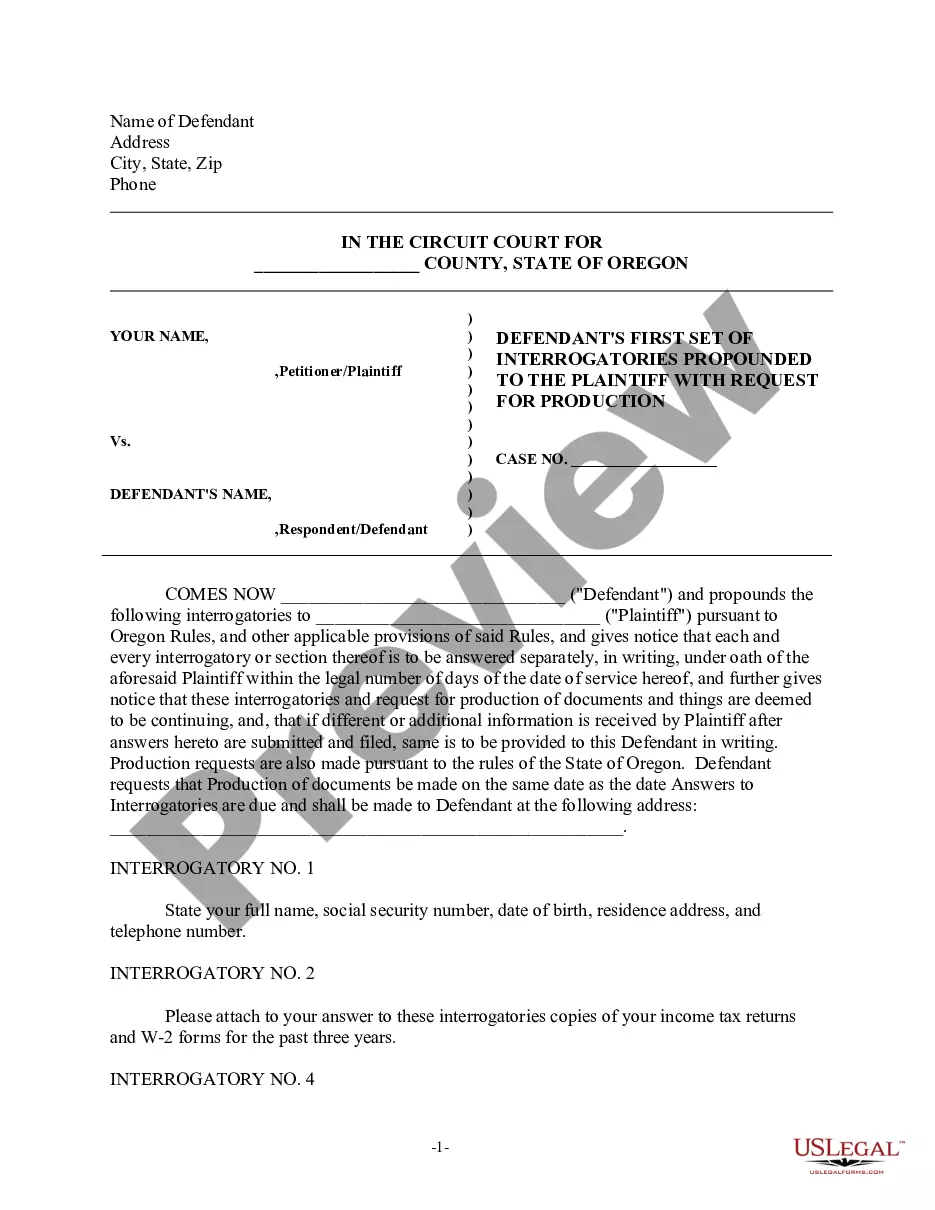

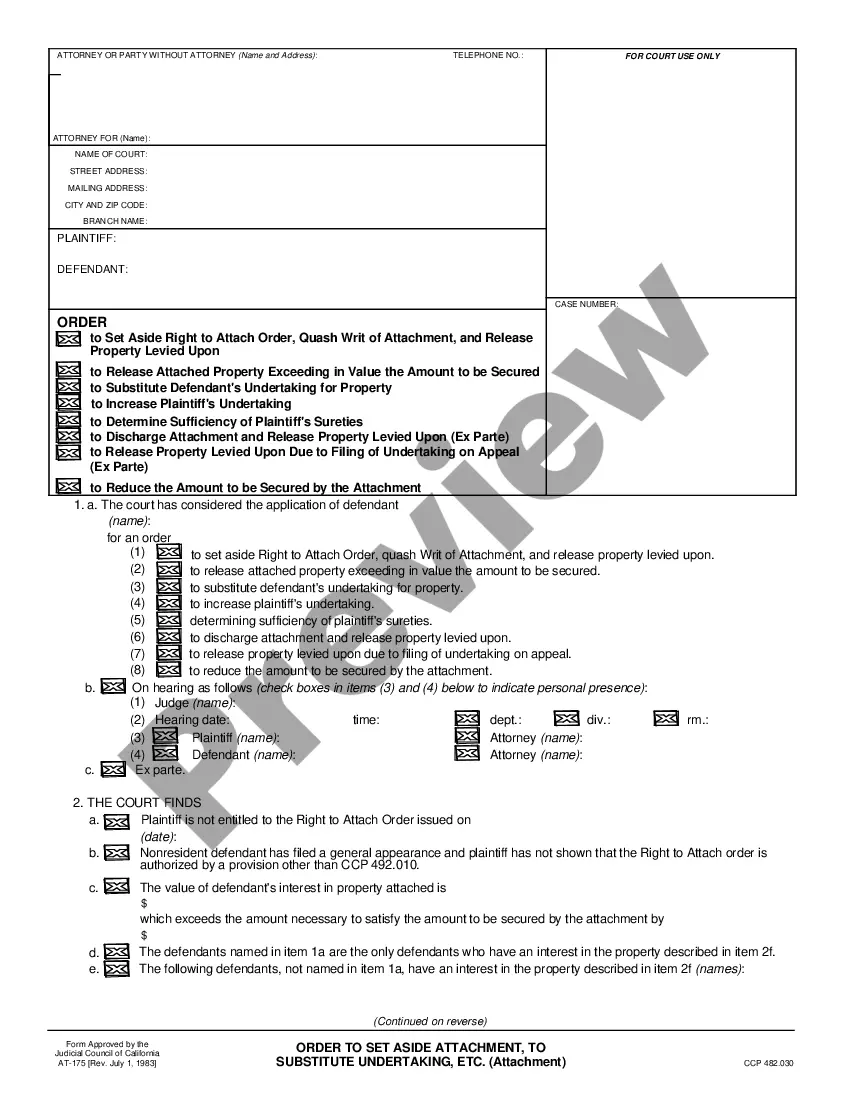

When it comes to filling out Oregon Information to Heirs and Devisees, you probably think about an extensive process that involves choosing a ideal sample among a huge selection of very similar ones and then needing to pay a lawyer to fill it out to suit your needs. On the whole, that’s a slow-moving and expensive choice. Use US Legal Forms and select the state-specific form within clicks.

In case you have a subscription, just log in and click on Download button to find the Oregon Information to Heirs and Devisees template.

If you don’t have an account yet but want one, follow the point-by-point guideline listed below:

- Make sure the document you’re saving applies in your state (or the state it’s needed in).

- Do it by reading through the form’s description and also by clicking on the Preview option (if readily available) to view the form’s information.

- Click Buy Now.

- Find the suitable plan for your financial budget.

- Sign up for an account and select how you want to pay: by PayPal or by credit card.

- Download the document in .pdf or .docx file format.

- Get the record on your device or in your My Forms folder.

Professional legal professionals work on creating our templates to ensure after downloading, you don't have to bother about enhancing content material outside of your individual details or your business’s info. Be a part of US Legal Forms and receive your Oregon Information to Heirs and Devisees document now.

Form popularity

FAQ

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

How Long Does Probate in Oregon Take? The timeline for probate can vary, but it will last at least four months because creditors must have time to file a claim against the estate.

By way of introduction, an estate is a small estate if the total value of the assets that need to be administered does not exceed the following values: $200,000 for real property and $75,000 for personal property. Small estates can be administered through a formal probate proceeding, just like larger estates.

Fortunately, not all property needs to go through this legal process before it passes to your heirs.The quick rule of thumb is probate is not required when the estate is small, or the property is designed to pass outside of probate. It doesn't matter if you leave a will.

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

Some states, like Oregon and Florida for instance, have no stated time limit for an executor to submit the will. Other states such as Texas, have a window of four years after death to begin the probate process.

You must petition the probate court to admit any will to probate and to appoint you as the personal representative. The petition contains some basic background information of the decedent and this information is described in ORS 113.035 -Petition for appointment of personal representative and probate of will.

No probate is necessary. Joint tenancy often works well when couples (married or not) acquire real estate, vehicles, bank accounts or other valuable property together. In Oregon, each co-owner must own an equal share.