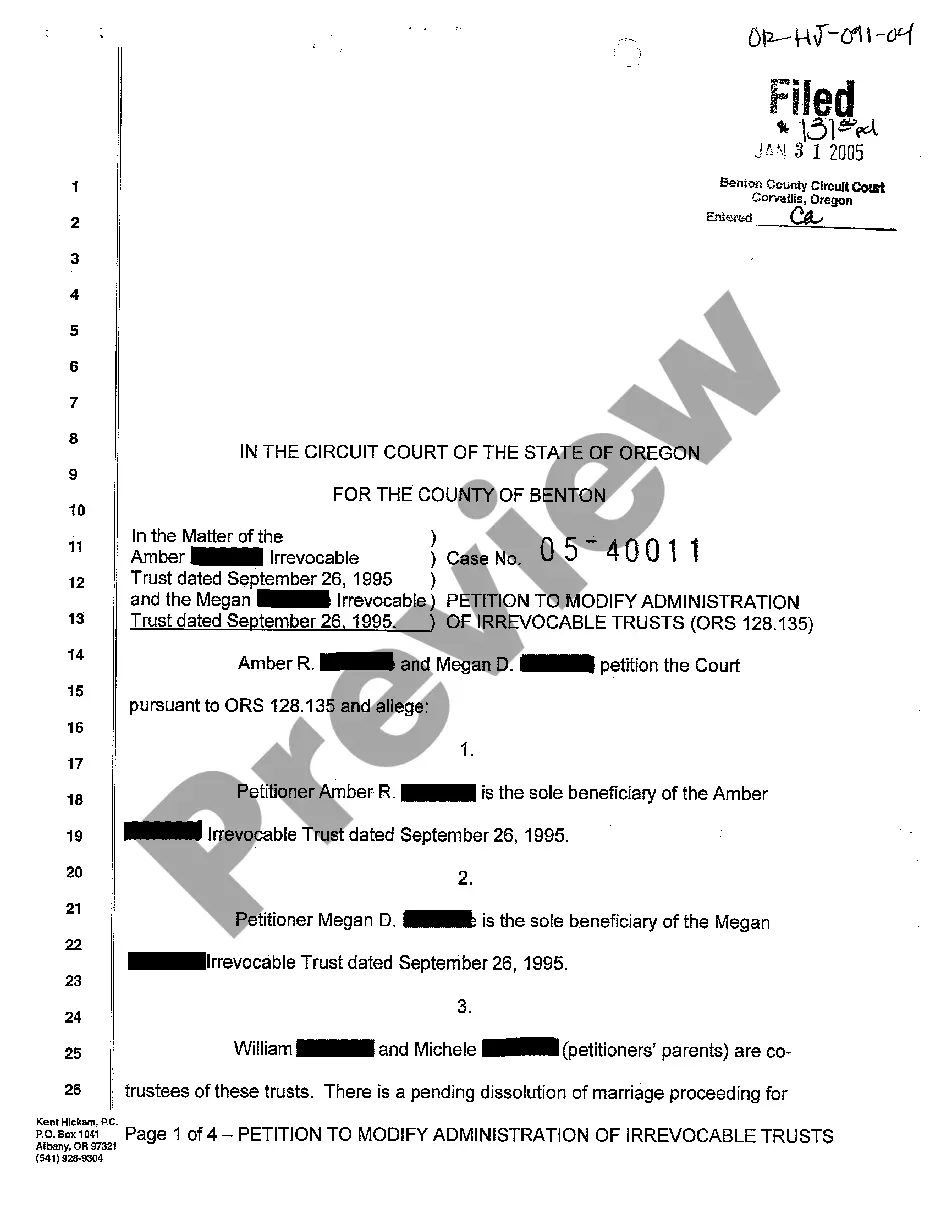

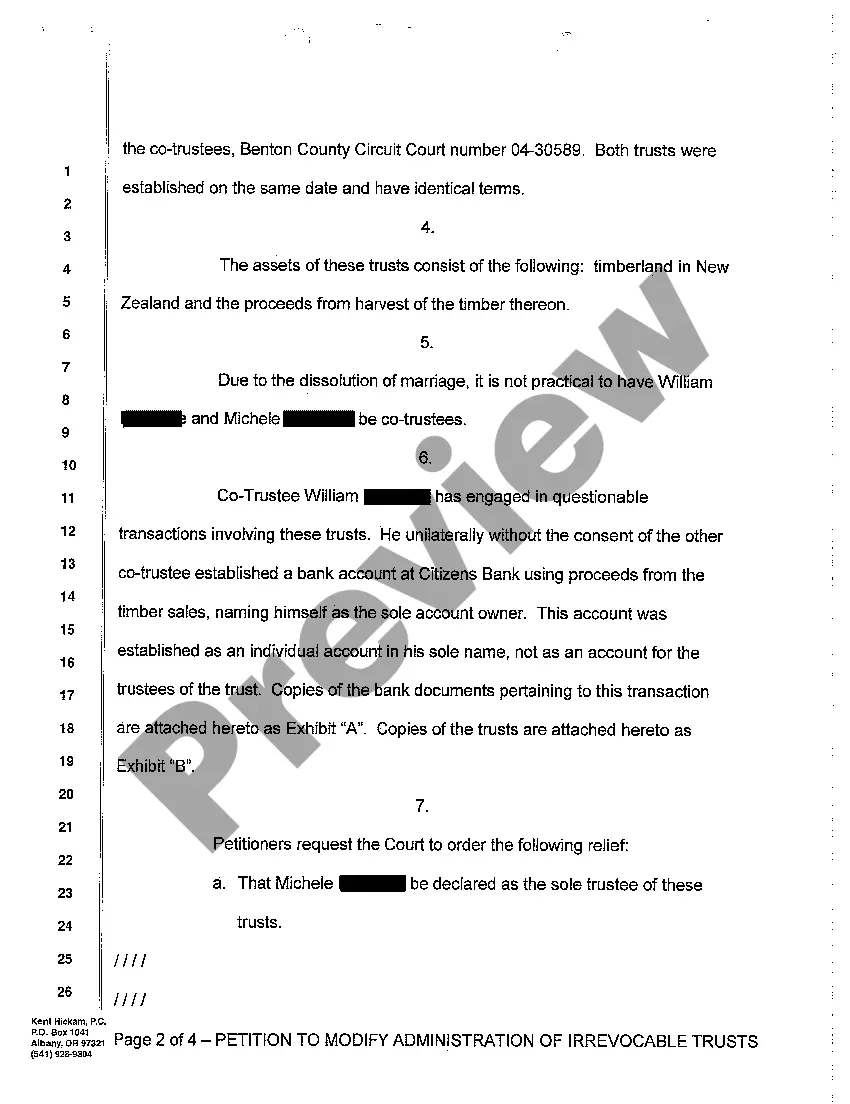

Oregon Petition to Modify Administration of Irrevocable Trusts

Description

How to fill out Oregon Petition To Modify Administration Of Irrevocable Trusts?

When it comes to submitting Oregon Petition to Modify Administration of Irrevocable Trusts, you probably visualize an extensive procedure that consists of getting a ideal sample among a huge selection of very similar ones and after that having to pay out legal counsel to fill it out to suit your needs. Generally, that’s a slow-moving and expensive choice. Use US Legal Forms and choose the state-specific template in just clicks.

In case you have a subscription, just log in and click Download to get the Oregon Petition to Modify Administration of Irrevocable Trusts template.

In the event you don’t have an account yet but want one, follow the point-by-point manual listed below:

- Be sure the file you’re getting applies in your state (or the state it’s needed in).

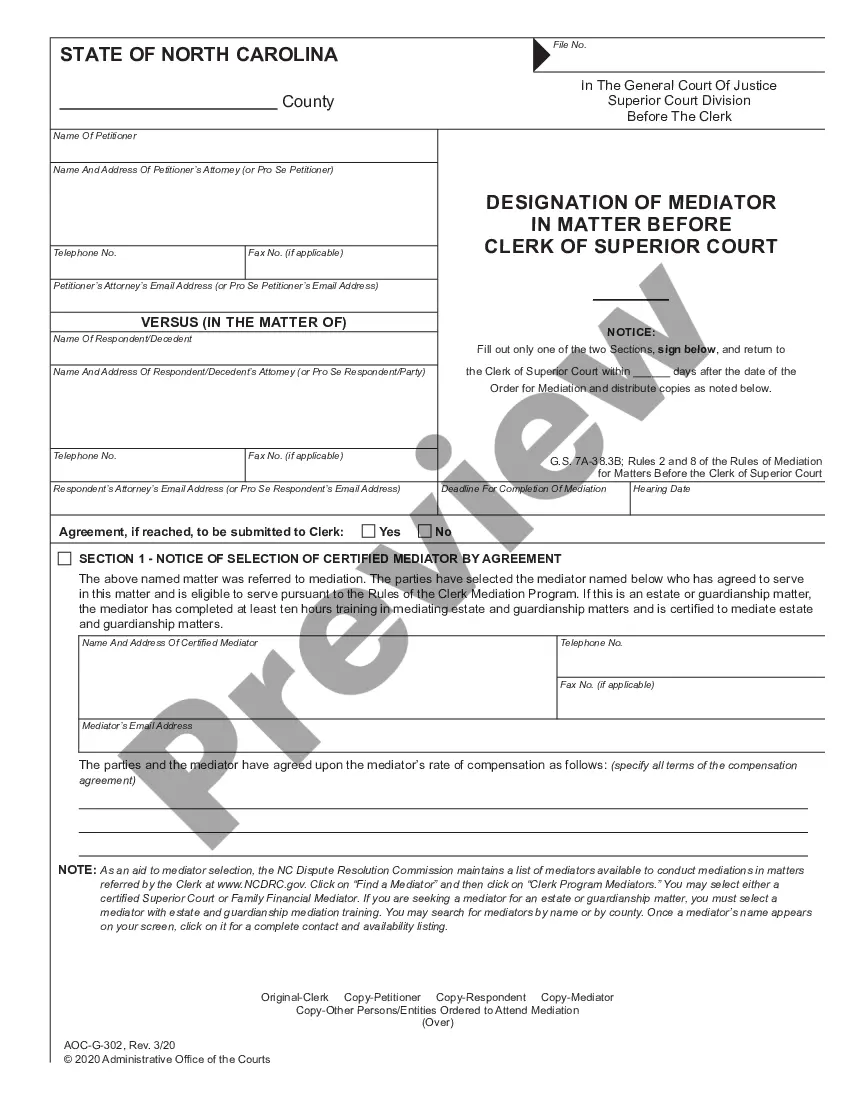

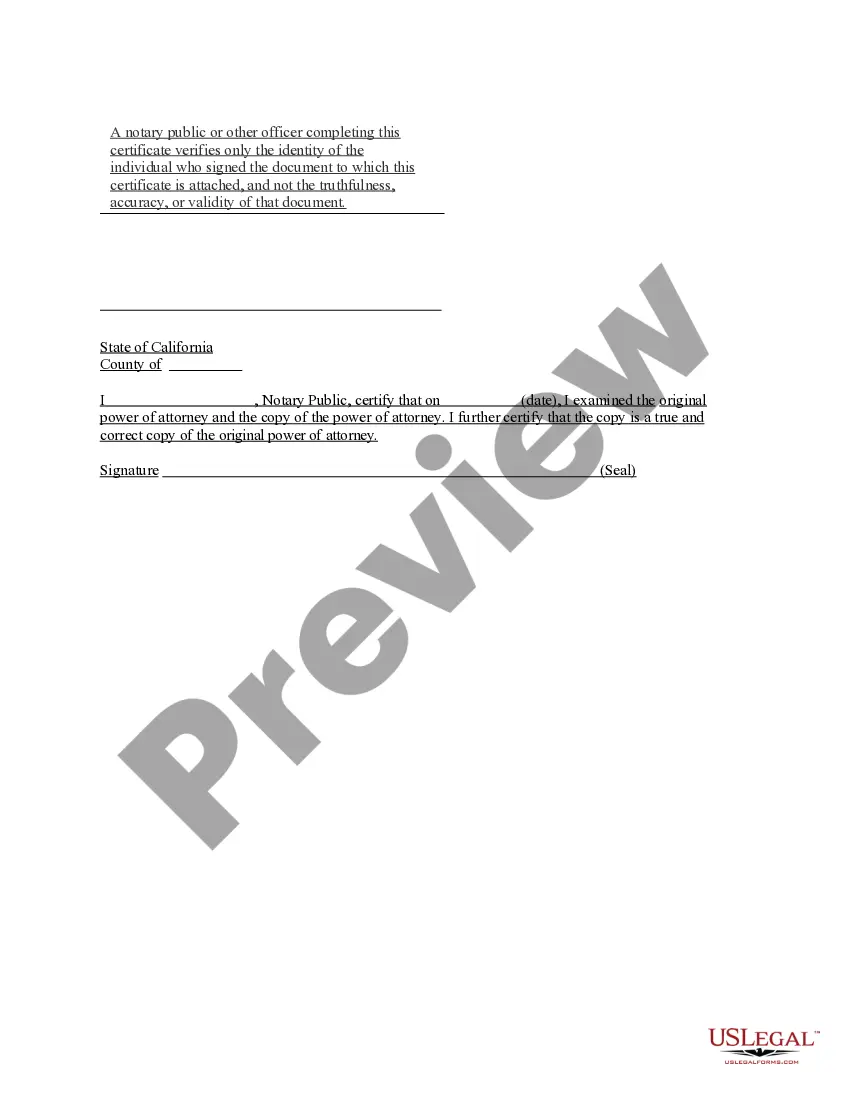

- Do it by reading through the form’s description and by visiting the Preview function (if accessible) to see the form’s information.

- Simply click Buy Now.

- Find the appropriate plan for your financial budget.

- Sign up to an account and choose how you would like to pay out: by PayPal or by credit card.

- Save the document in .pdf or .docx file format.

- Find the document on your device or in your My Forms folder.

Professional attorneys draw up our templates to ensure that after saving, you don't have to worry about enhancing content outside of your personal information or your business’s info. Be a part of US Legal Forms and get your Oregon Petition to Modify Administration of Irrevocable Trusts example now.

Form popularity

FAQ

Like a will, a living trust can be altered whenever you wish.After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

First, an irrevocable trust involves three individuals: the grantor, a trustee and a beneficiary. The grantor creates the trust and places assets into it. Upon the grantor's death, the trustee is in charge of administering the trust.

Read the Documents Carefully. Some agreements contain language that allows a trustee to dissolve the trust if its purpose is no longer feasible. Petition the Court. In some cases, a court agrees to break an irrevocable trust if the trustee or beneficiaries petition for assistance. Dispose of the Trust's Assets.

Regardless of whether the trust is revocable or irrevocable, any assets transferred into the trust are no longer owned by the grantor.In such cases, the terms of your trust will supersede the terms of your will, because your will can only affect the assets you owned at the time of your death.

Exploring Challenges by Heirs Heirs cannot revoke an irrevocable trust if they're not also beneficiaries, but they can challenge or contest it.You can file a trust challenge either during the trustmaker's lifetime or after his death, but you can only contest a will after the testator has died.

An irrevocable trust is a type of trust where its terms cannot be modified, amended or terminated without the permission of the grantor's named beneficiary or beneficiaries.Irrevocable trusts cannot be modified after they are created, or at least they are very difficult to modify.

Can an irrevocable trust be changed? Often, the answer is no. By definition and design, an irrevocable trust is just thatirrevocable. It can't be amended, modified, or revoked after it's formed.

As discussed above, irrevocable trusts are not completely irrevocable; they can be modified or dissolved, but the settlor may not do so unilaterally. The most common mechanisms for modifying or dissolving an irrevocable trust are modification by consent and judicial modification.

An irrevocable trust is like a turnstile: Once you go through it, you can't go back.In the event that you are sued, your trust's assets are generally safe. This doesn't mean, though, that an irrevocable trust can't be sued for other reasons such as estate disputes or fraud.