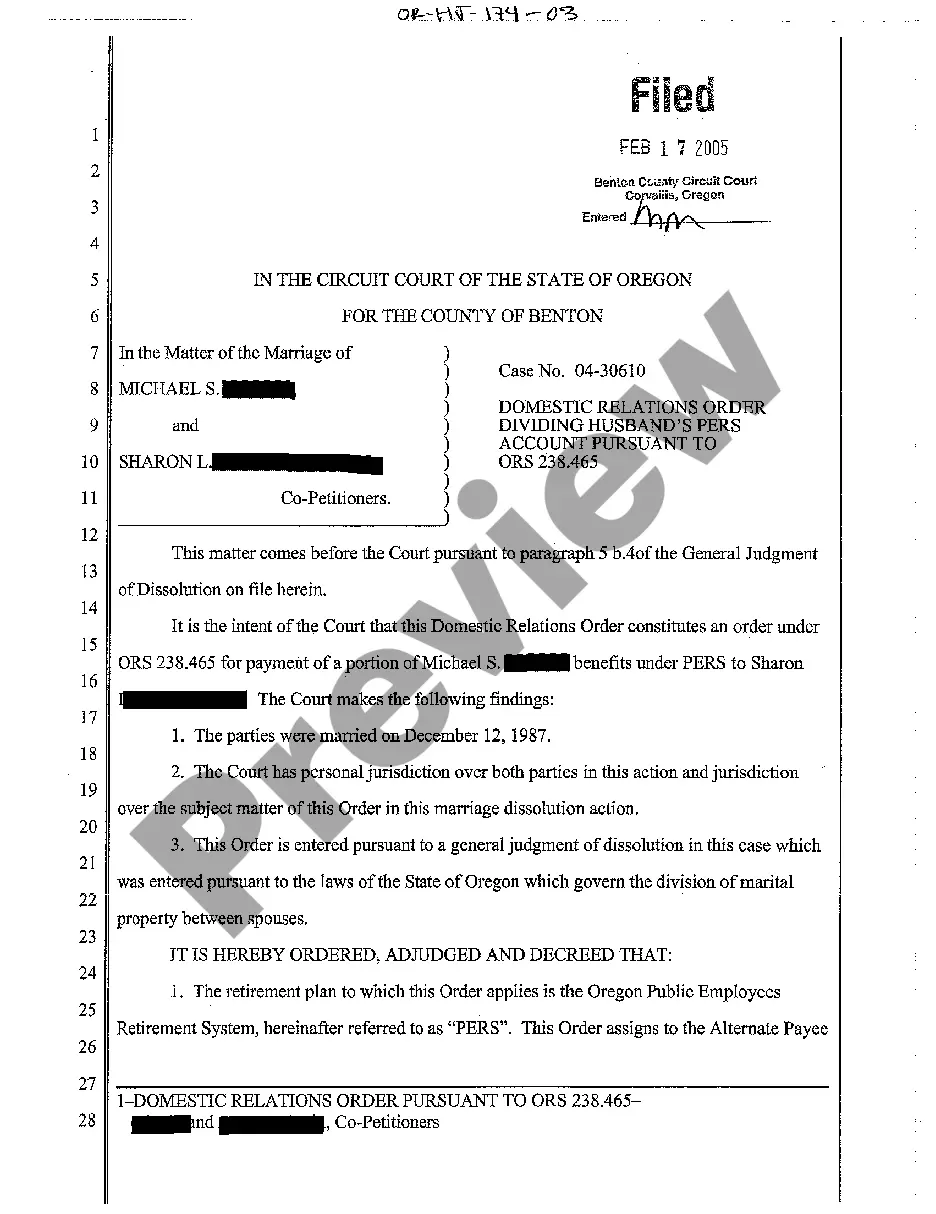

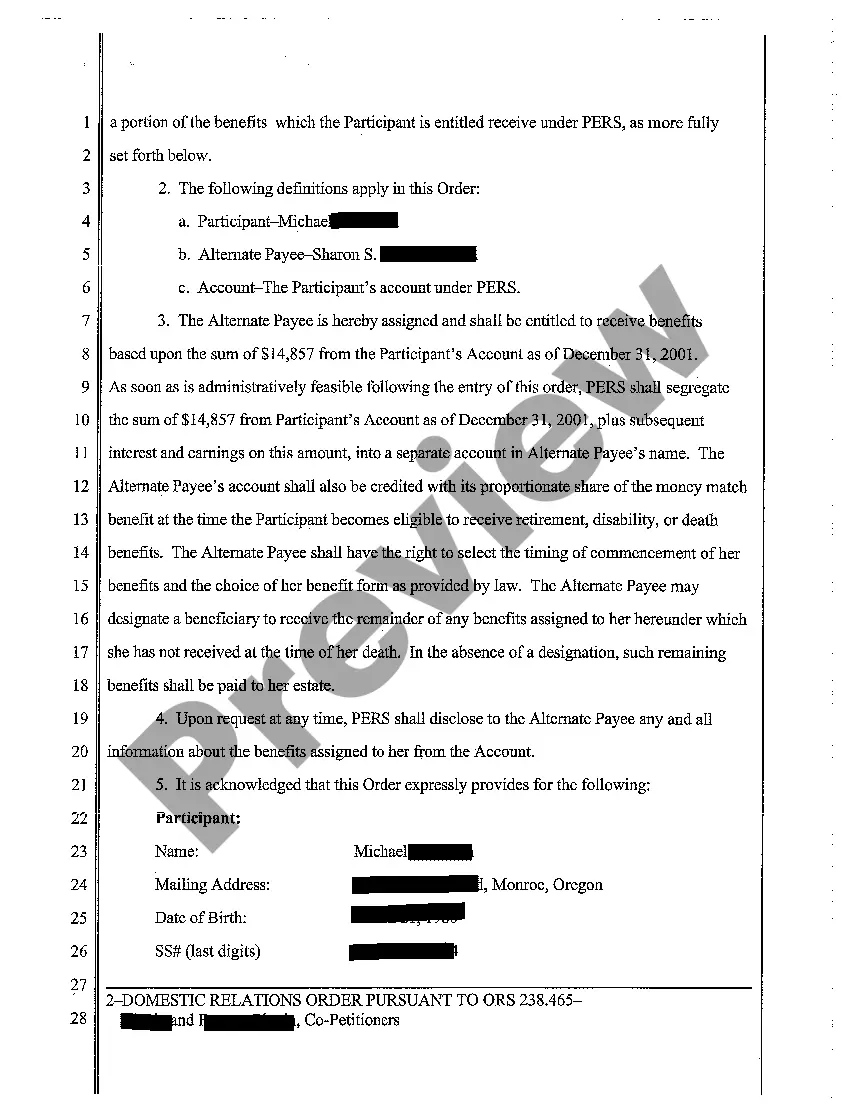

Oregon Domestic Relations Order Dividing Husband's PERS Account Pursuant to ORS 238.465

Description Oregon Pers Forms

How to fill out Oregon Domestic Relations Order Dividing Husband's PERS Account Pursuant To ORS 238.465?

Creating papers isn't the most simple task, especially for people who almost never deal with legal paperwork. That's why we recommend utilizing accurate Oregon Domestic Relations Order Dividing Husband's PERS Account Pursuant to ORS 238.465 samples created by skilled lawyers. It gives you the ability to stay away from troubles when in court or working with official institutions. Find the samples you need on our website for top-quality forms and exact information.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you are in, the Download button will automatically appear on the file page. Right after downloading the sample, it will be saved in the My Forms menu.

Customers without an activated subscription can quickly create an account. Make use of this simple step-by-step guide to get your Oregon Domestic Relations Order Dividing Husband's PERS Account Pursuant to ORS 238.465:

- Make certain that the document you found is eligible for use in the state it’s required in.

- Verify the document. Utilize the Preview feature or read its description (if available).

- Click Buy Now if this form is what you need or go back to the Search field to find another one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a required format.

Right after completing these easy actions, it is possible to complete the form in a preferred editor. Recheck completed data and consider requesting a legal professional to examine your Oregon Domestic Relations Order Dividing Husband's PERS Account Pursuant to ORS 238.465 for correctness. With US Legal Forms, everything becomes much easier. Test it now!

Form popularity

FAQ

The short and simple answer: the spouse who is on the receiving end of their portion of the retirement assets should file the QDRO.

This means that 75% of the pension value would be considered a marital asset. So if you had $200,000 total in a pension, that amount would be multiplied by 75%, meaning the marital value would be $150,000 to be divided. The pension owner would keep the other $50,000 as a separate asset.

Many states, such as New Jersey, Pennsylvania, New York, and California, use a coverture approach in terms of dividing a pension in a deferred distribution scheme (QDRO).The coverture fraction is defined by marital service divided by total service.

A QDRO will instruct the plan administrator on how to pay the non-employee spouse's share of the plan benefits. A QDRO allows the funds in a retirement account to be separated and withdrawn without penalty and deposited into the non-employee spouse's retirement account (typically an IRA).

During divorce proceedings, both parties will identify the assets that need to be divided, including retirement plans. If you're awarded part of your former spouse's retirement account (either through a property settlement or via a judge), the court will issue a QDRO that may have been drafted by your divorce attorney.

Answers: "The QDRO is written as a "stipulation" which means "agreement" between you and your former spouse. Therefore, you must both sign it, in addition to the Judge's signature.Generally, both parties' signatures are required in order to file the QDRO at court.

To be more precise, federal law does not contain a time limit for filing a QDRO, though there may be legal or procedural arguments under the divorce laws of a particular state that make it difficult if you or your attorney makes the request long after the divorce.

The document must be signed by both parties, and any attorneys on record. If the Respondent has not appeared in the case (filed a response and become an active party) their signature will need to be notarized. This is a court requirement to make sure the signatures are in fact those of the parties.

It typically takes a minimum of two months from start to finish to obtain a qualified domestic relations order, or QDRO. But it can also take up to two years because, like answers to all legal questions, it depends on the facts and circumstances of your situation.