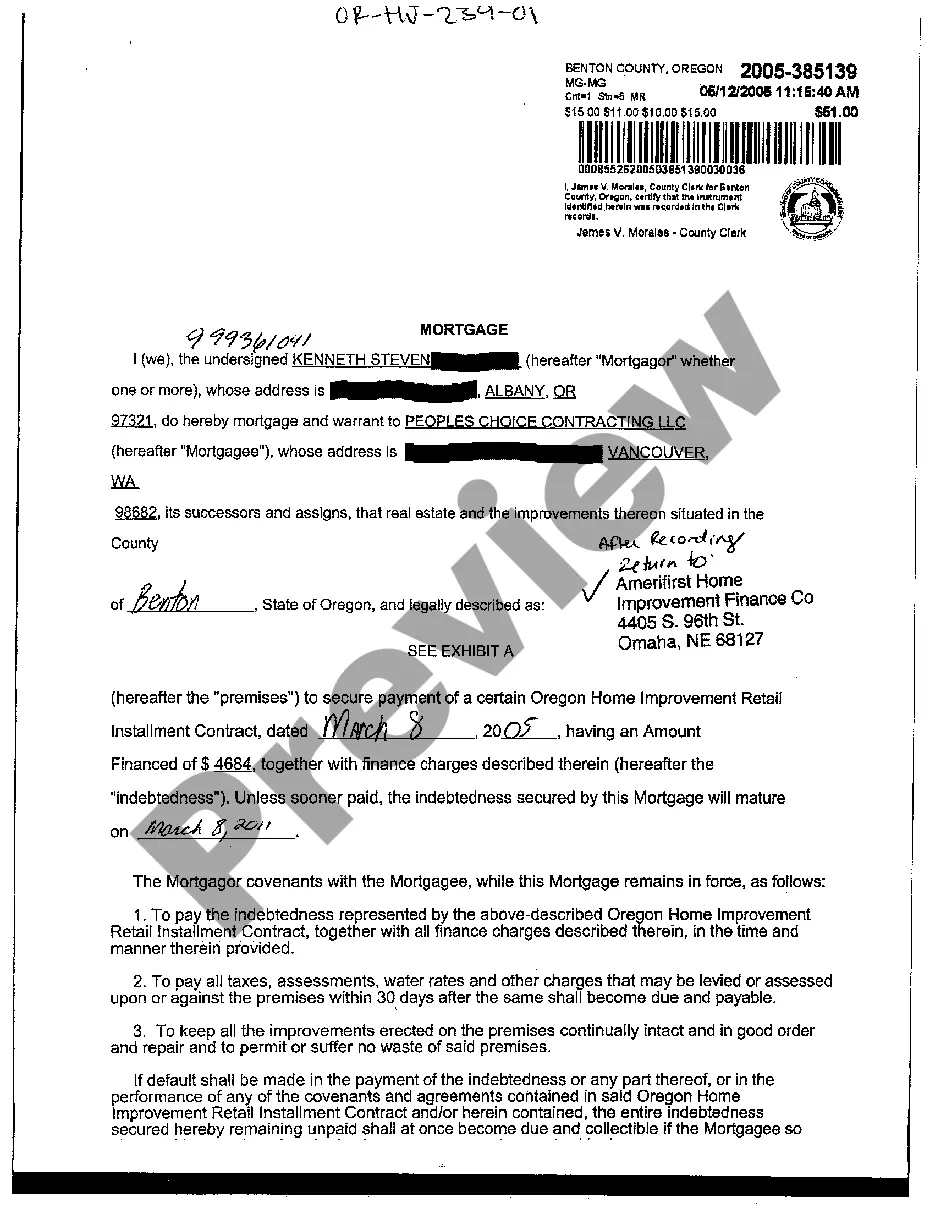

Oregon Sample Mortgage for an Individual

Description

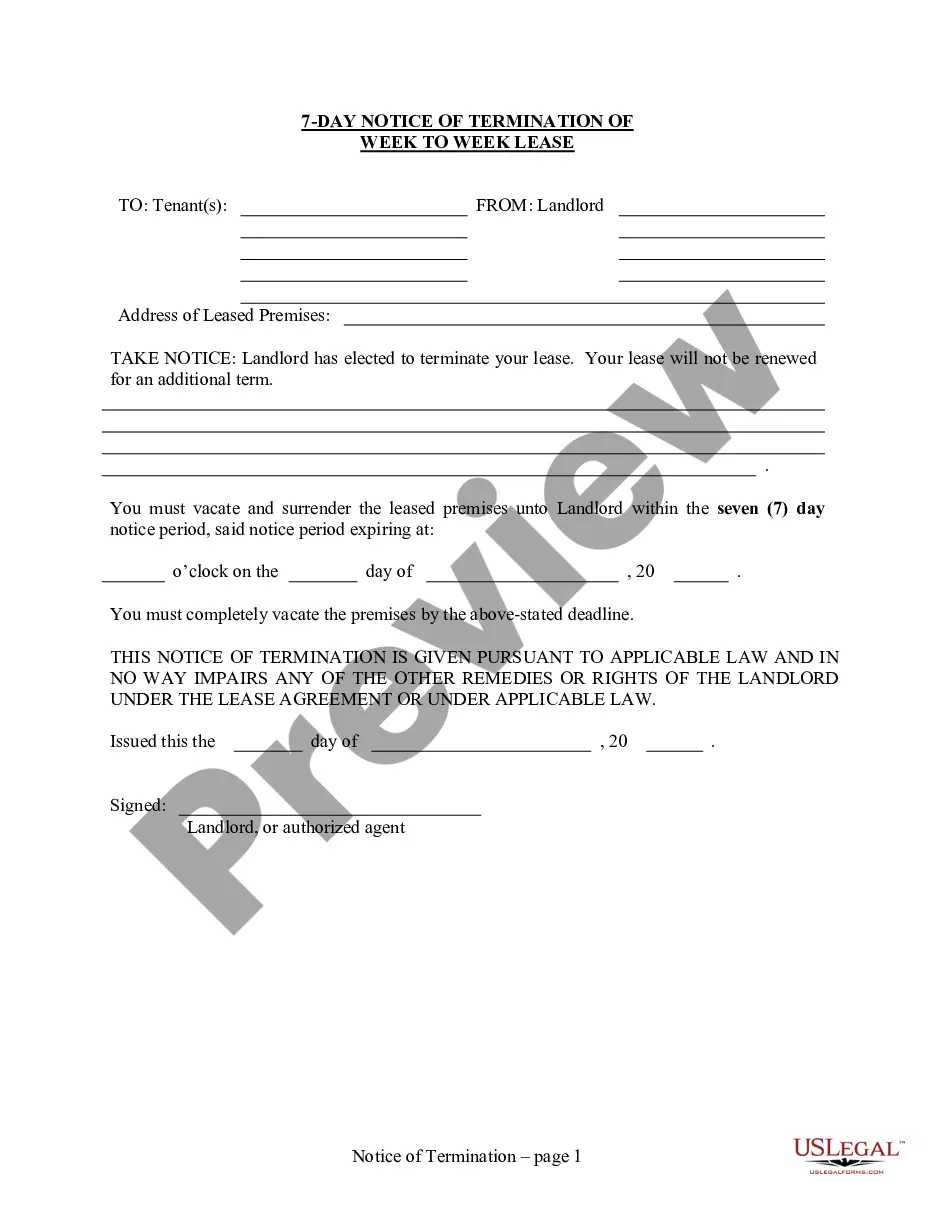

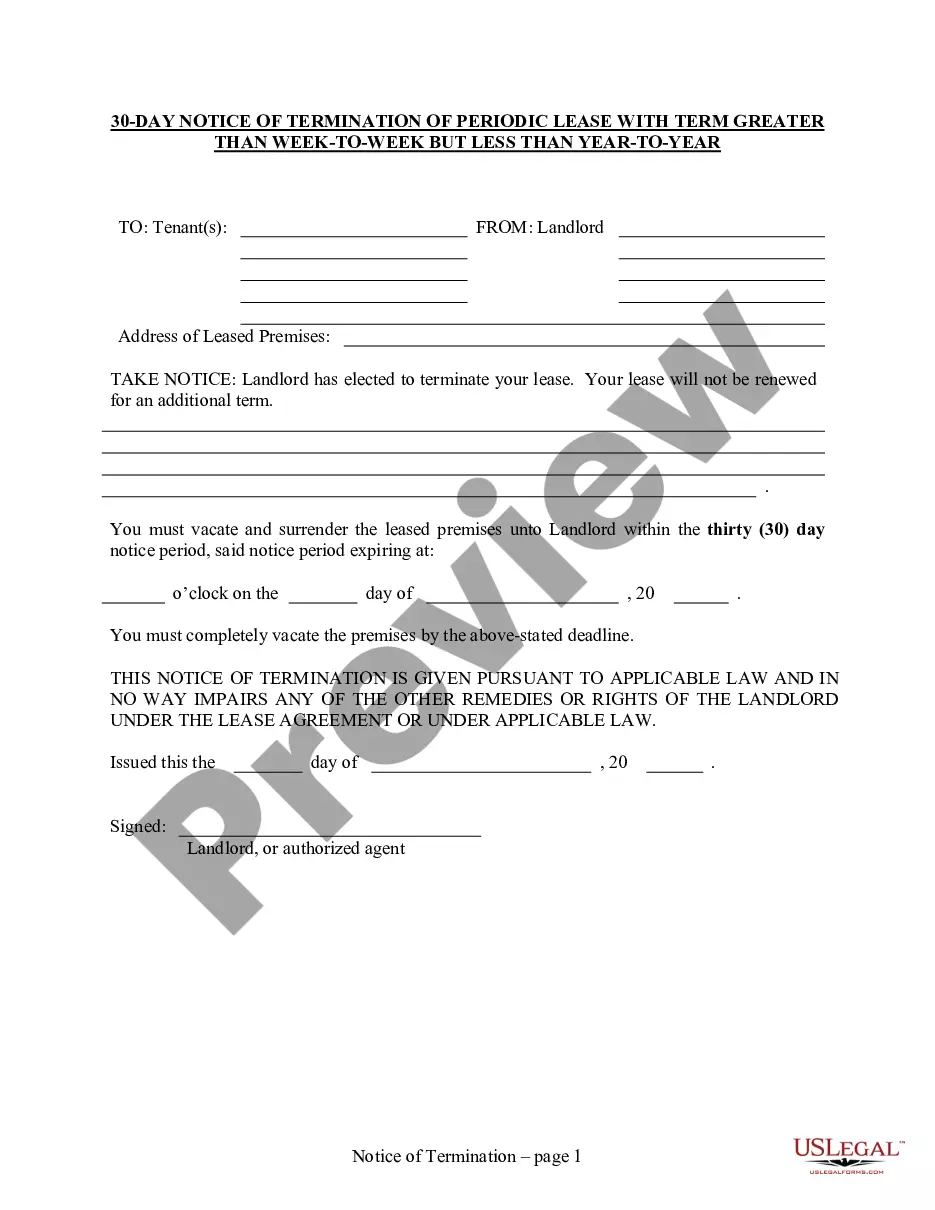

How to fill out Oregon Sample Mortgage For An Individual?

Creating papers isn't the most straightforward task, especially for those who almost never deal with legal paperwork. That's why we recommend making use of correct Oregon Sample Mortgage for an Individual templates made by skilled attorneys. It gives you the ability to prevent problems when in court or working with official organizations. Find the samples you require on our website for top-quality forms and accurate information.

If you’re a user with a US Legal Forms subscription, just log in your account. When you’re in, the Download button will immediately appear on the template page. Right after accessing the sample, it will be saved in the My Forms menu.

Users without an active subscription can easily create an account. Utilize this simple step-by-step help guide to get your Oregon Sample Mortgage for an Individual:

- Be sure that the form you found is eligible for use in the state it is required in.

- Confirm the file. Utilize the Preview feature or read its description (if readily available).

- Click Buy Now if this sample is what you need or utilize the Search field to get another one.

- Choose a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after completing these straightforward actions, you are able to complete the sample in your favorite editor. Double-check completed details and consider requesting a legal representative to examine your Oregon Sample Mortgage for an Individual for correctness. With US Legal Forms, everything becomes much easier. Give it a try now!

Form popularity

FAQ

The average mortgage payment is just over $1,500 per month, according to the U.S. Census Bureau. That might seem like a high price to pay.

A Mortgage Agreement is a pledge by a borrower that they will relinquish their claim to the property if they cannot pay their loan. Contrary to common belief, a Mortgage Agreement isn't the loan itself; it's a lien on the property.A Mortgage Agreement is the remedy in case the loan isn't repaid.

The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

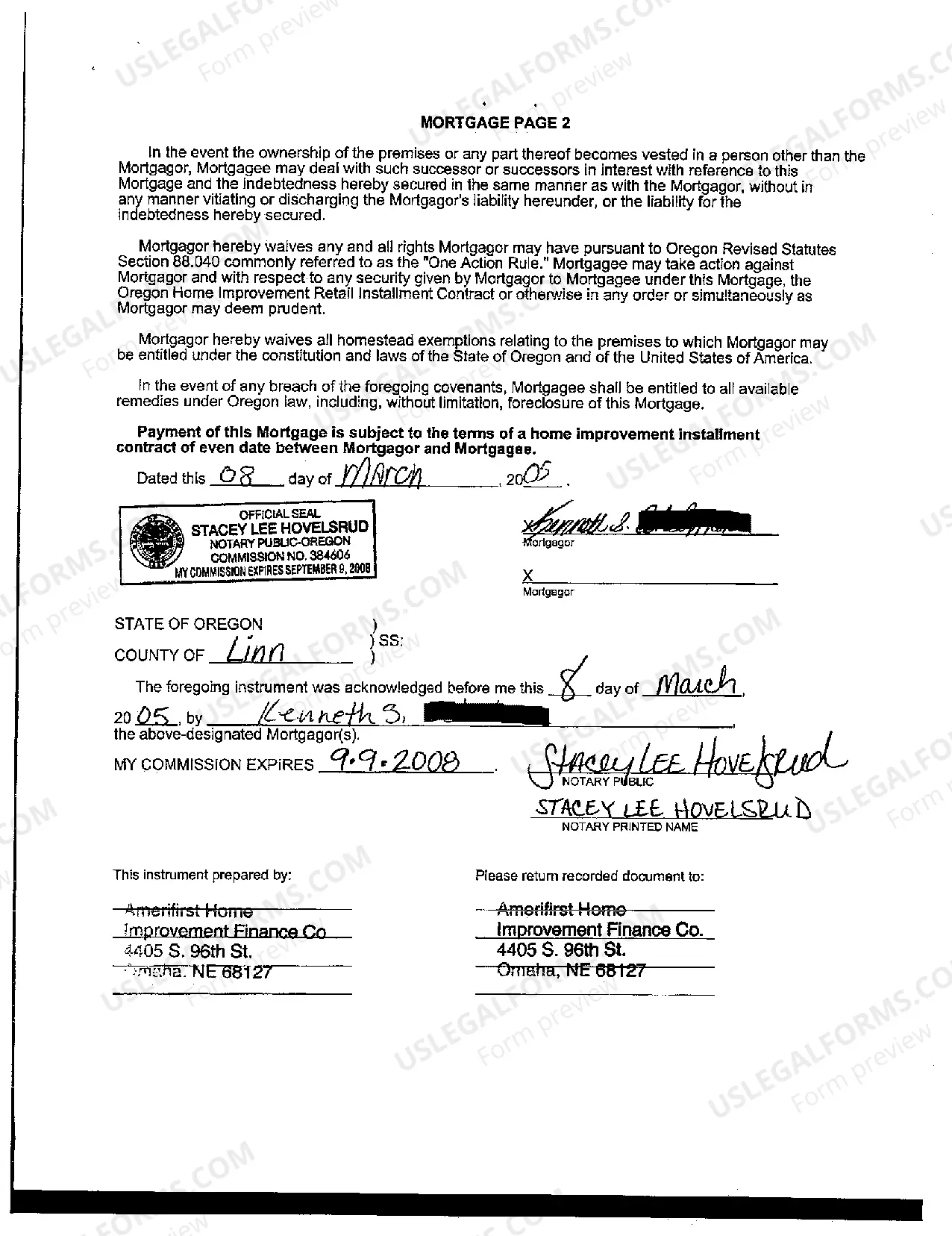

Execute the mortgage documents. Affidavit to be sworn by two witnesses in the deed. Visit the notary public who will get the document notarized. Pay for the stamp duty. Pay for the registration in the Registrar of Deeds office. Obtain the title for the mortgage.

If you own a computer and have a sheet of paper, you can create your own mortgage to finance the purchase of real estate. No one checks your credit, and you don't need a cash down payment.There is a huge market of investors who buy privately created mortgages and trust deeds (often referred to as paper).

A down payment of 3% (generally the minimum for a conventional mortgage) for a median-priced home in Oregon would come to around $11,920. A down payment of 3.5% (which is the minimum for an FHA loan) would be around $13,907.

(2) Beneficiary means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).

For a $200,000, 30-year mortgage with a 4% interest rate, you'd pay around $954 per month.

Must-haves to qualify for a mortgage A reliable source of income. A debt-to-income ratio that falls within permissible guidelines. A fair or good credit score. A down payment.