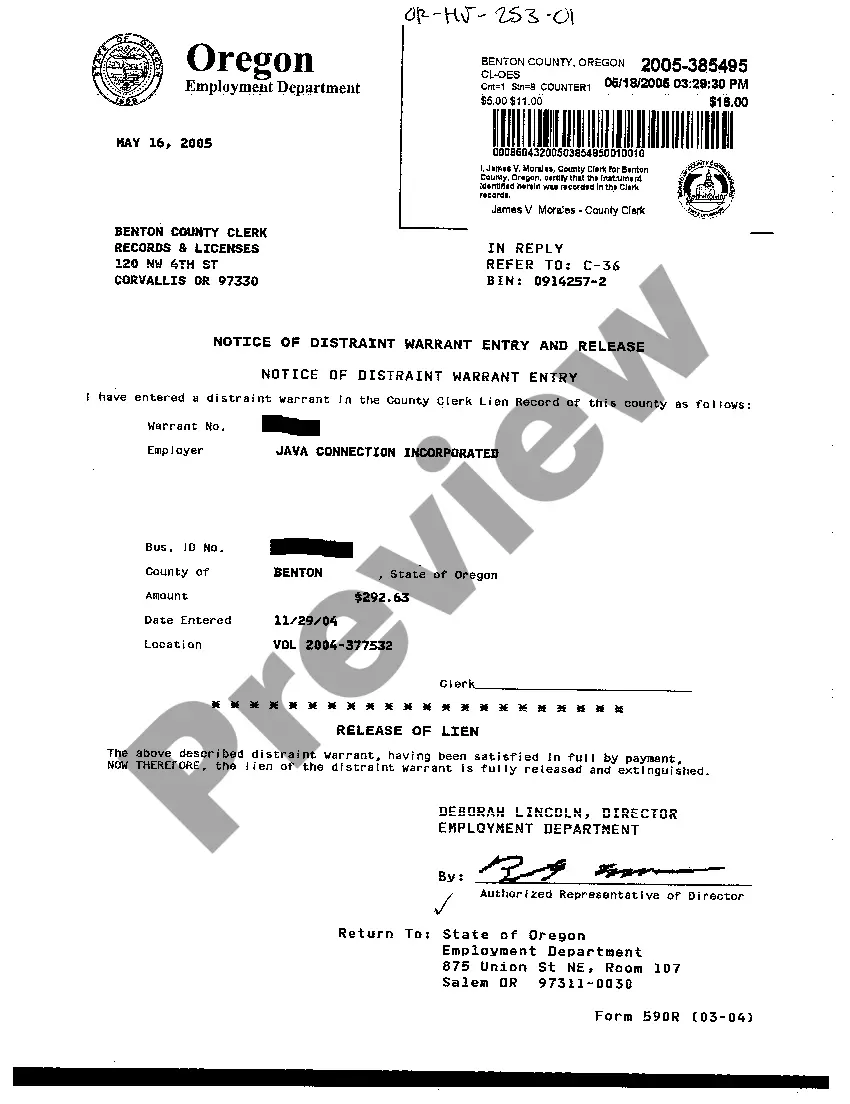

Oregon Notice of Distraint Warrant Entry and Release for a Corporation

Description Distraint Warrant Oregon

How to fill out Oregon Notice Of Distraint Warrant Entry And Release For A Corporation?

The work with papers isn't the most uncomplicated job, especially for those who almost never work with legal papers. That's why we advise utilizing correct Oregon Notice of Distraint Warrant Entry and Release for a Corporation templates created by professional attorneys. It gives you the ability to avoid difficulties when in court or dealing with official institutions. Find the documents you need on our website for top-quality forms and accurate information.

If you’re a user with a US Legal Forms subscription, just log in your account. As soon as you’re in, the Download button will immediately appear on the template web page. After getting the sample, it’ll be stored in the My Forms menu.

Users with no a subscription can quickly get an account. Use this simple step-by-step guide to get your Oregon Notice of Distraint Warrant Entry and Release for a Corporation:

- Make certain that the document you found is eligible for use in the state it is needed in.

- Verify the file. Make use of the Preview feature or read its description (if offered).

- Buy Now if this template is what you need or go back to the Search field to find a different one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after finishing these straightforward steps, you can fill out the form in an appropriate editor. Double-check completed details and consider requesting a lawyer to review your Oregon Notice of Distraint Warrant Entry and Release for a Corporation for correctness. With US Legal Forms, everything becomes easier. Try it out now!

Distraint Notice Form popularity

FAQ

Electronic payment using Revenue Online. Choose to pay directly from your bank account or by credit card, service provider fees may apply. Mail a check or money order. ACH Credit. Submit your application by going to Revenue Online and clicking on Apply for ACH credit under Tools.

200b200bElectronic payment using Revenue Online. Mail a check or money order. ACH Credit.

Contribute to a Retirement Account. Open a Health Savings Account. Use Your Side Hustle to Claim Business Deductions. Claim a Home Office Deduction. Write Off Business Travel Expenses, Even While on Vacation.

When you file, you should include unemployment income on your tax return.The downside of not making as many payments means you have a reduced student loan interest deduction, which could cause you to owe taxes instead of getting a refund.

Call us at 503-945-8200. Or sign in to Revenue Online.

Oregon. Oregon's statute is three years after the return is filed, regardless of whether it's filed on or after the due date. 6feff So if the return is filed earlier than April 15, the limitations period will end earlier, as well.

Distraint warrant: This is not a warrant for your arrest. Rather, it's a legal document that establishes our right to collect the tax debt from you. Federal offset letter: If you have tax debt, your federal tax refund or certain federal payments may be sent to us to apply to your debt.

If you are in a two-earner family, or you have more than one job, it's possible that you will still owe tax even if you claim zero allowances. This is because both the federal and Oregon withholding formulas are based on each person or family having just one job and filing a simple tax return each year.

You might owe state taxes because you have a different personal tax situation. Usually, if you got a refund the previous year, you should be able to have another one this year as long as you have the same situation.Therefore, if you owe taxes, the withholding situation that came into place may tell you why.