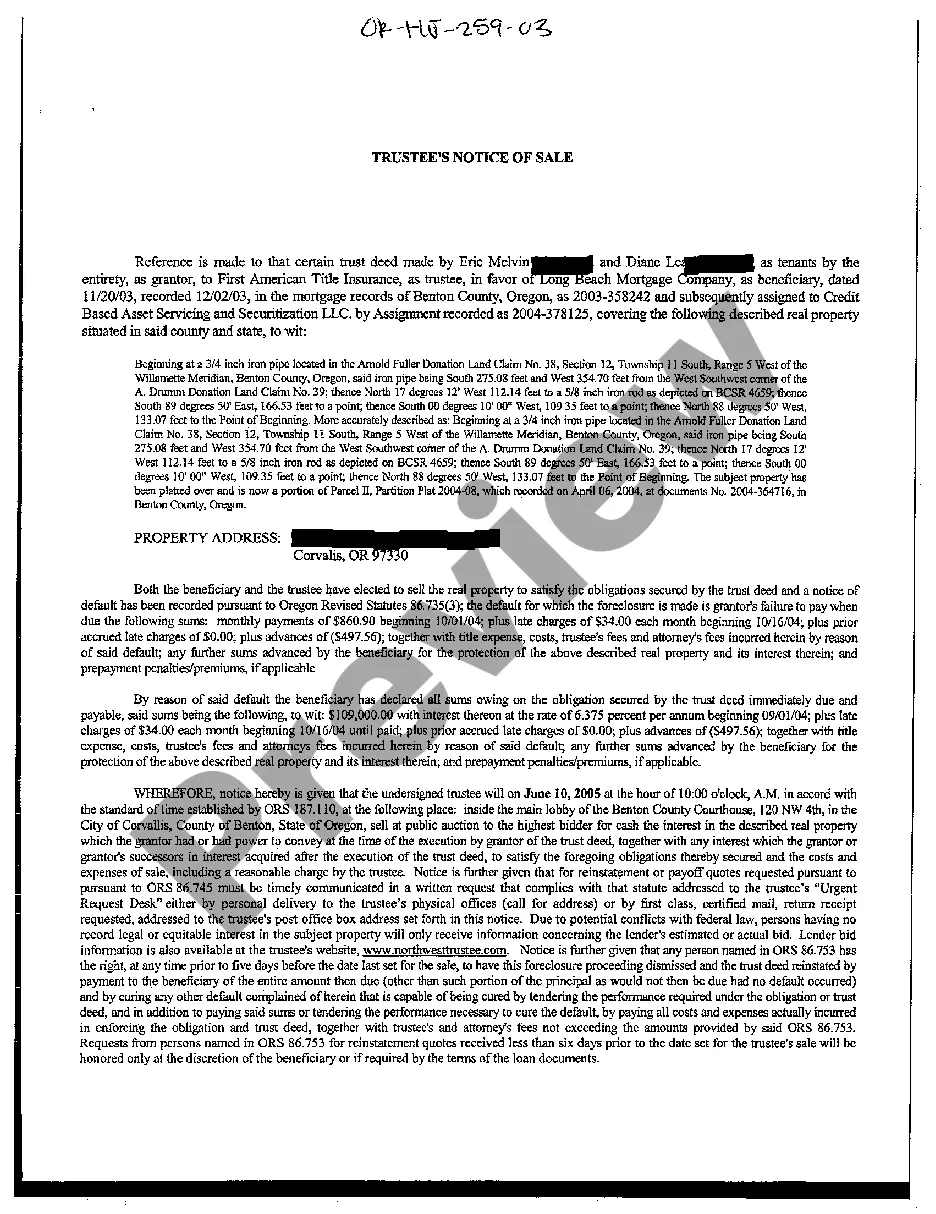

Oregon Trustee's Notice of Sale

Description

How to fill out Oregon Trustee's Notice Of Sale?

The work with papers isn't the most uncomplicated task, especially for people who rarely work with legal paperwork. That's why we advise making use of correct Oregon Trustee's Notice of Sale templates made by professional attorneys. It allows you to avoid difficulties when in court or dealing with formal organizations. Find the samples you want on our website for top-quality forms and accurate explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you are in, the Download button will immediately appear on the file webpage. After downloading the sample, it will be saved in the My Forms menu.

Users with no an active subscription can quickly get an account. Use this brief step-by-step help guide to get your Oregon Trustee's Notice of Sale:

- Ensure that the document you found is eligible for use in the state it is required in.

- Verify the file. Utilize the Preview feature or read its description (if offered).

- Click Buy Now if this file is the thing you need or use the Search field to get a different one.

- Choose a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

After finishing these straightforward actions, you are able to complete the form in your favorite editor. Check the filled in info and consider asking a legal professional to review your Oregon Trustee's Notice of Sale for correctness. With US Legal Forms, everything becomes easier. Test it now!

Form popularity

FAQ

Generally, a homeowner has to be at least 120 days delinquent before a mortgage servicer starts a foreclosure. Applying for a foreclosure avoidance option, called loss mitigation, might delay the start date even further.

A Notice of Trustee's Sale informs homeowners and mortgage borrowers of record that their home will be sold at a trustee's sale on a specific date and at a specific location. The actual sale typically completes a non-judicial foreclosure in states allowing this type of foreclosure process.

The length of the entire foreclosure process depends on state law and other factors, including whether negotiations are taking place between the lender and the borrower in an effort to stop the foreclosure. Overall, completing the foreclosure process can take from 6 months to more than a year.

A deed of trust acts as an agreement between youthe homebuyerand your lender. It states not just that you'll repay the loan, but that a third party called the trustee will hold legal title to the property until you do. A deed of trust is the security for your loan, and it's recorded in the public records.

Oregon borrowers can expect that the foreclosure process will take approximately six months to complete if everything goes smoothly during the foreclosure. Court delays, borrower objects or a borrower's filing for bankruptcy can delay the process.

The OTDA provides that a nonjudicial foreclosure may not be initiated unless "the trust deed, any assignments of the trust deed by the trustee or the beneficiary and any appointment of a successor trustee are recorded in the mortgage records in the counties in which the property described in the deed is situated."

Banks and other lenders typically use a trust deed. A trust deed can be foreclosed by a lawsuit in the circuit court of the county where the property is located. This type of foreclosure is referred to as a judicial foreclosure and is now common for residential loans in Oregon.

In Oregon, lenders may foreclose on deeds of trusts or mortgages in default using either a judicial or non-judicial foreclosure process. The judicial process of foreclosure, which involves filing a lawsuit to obtain a court order to foreclose, is used when no power of sale is present in the mortgage or deed of trust.

It takes several months for a lender to foreclose on a California property. If everything goes according to schedule, the process typically takes approximately 120 days about four months but the process can take as long as 200 or more days to conclude.