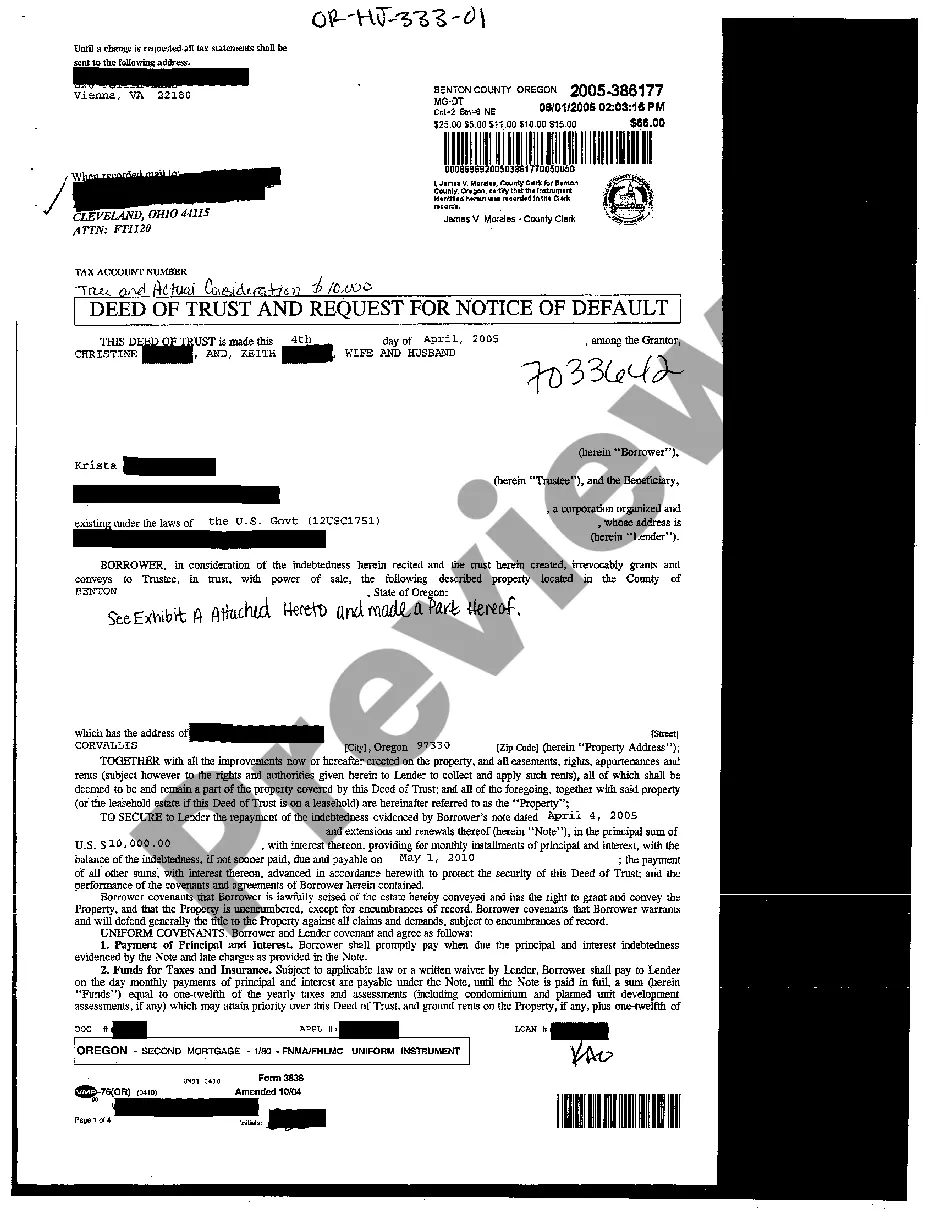

Oregon Deed of Trust and Request for Notice of Default

Description Notice Of Trust

How to fill out Oregon Deed Of Trust And Request For Notice Of Default?

The work with papers isn't the most simple process, especially for those who almost never deal with legal papers. That's why we recommend using accurate Oregon Deed of Trust and Request for Notice of Default templates created by skilled lawyers. It allows you to avoid problems when in court or handling formal institutions. Find the documents you want on our website for high-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you’re in, the Download button will automatically appear on the template webpage. Soon after getting the sample, it’ll be saved in the My Forms menu.

Customers without a subscription can quickly create an account. Follow this short step-by-step help guide to get the Oregon Deed of Trust and Request for Notice of Default:

- Make sure that file you found is eligible for use in the state it’s required in.

- Verify the document. Utilize the Preview feature or read its description (if readily available).

- Buy Now if this file is the thing you need or go back to the Search field to find a different one.

- Choose a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

After doing these straightforward actions, you can complete the sample in an appropriate editor. Recheck completed information and consider requesting an attorney to review your Oregon Deed of Trust and Request for Notice of Default for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

Form popularity

FAQ

Only the debts of a grantor or a beneficiary can result in a lien on trust assets. If the grantor or beneficiary also happens to be a trustee, it is their position as grantor or beneficiary that allows the lien to attach. There are two types of living trusts: Revocable Trusts.

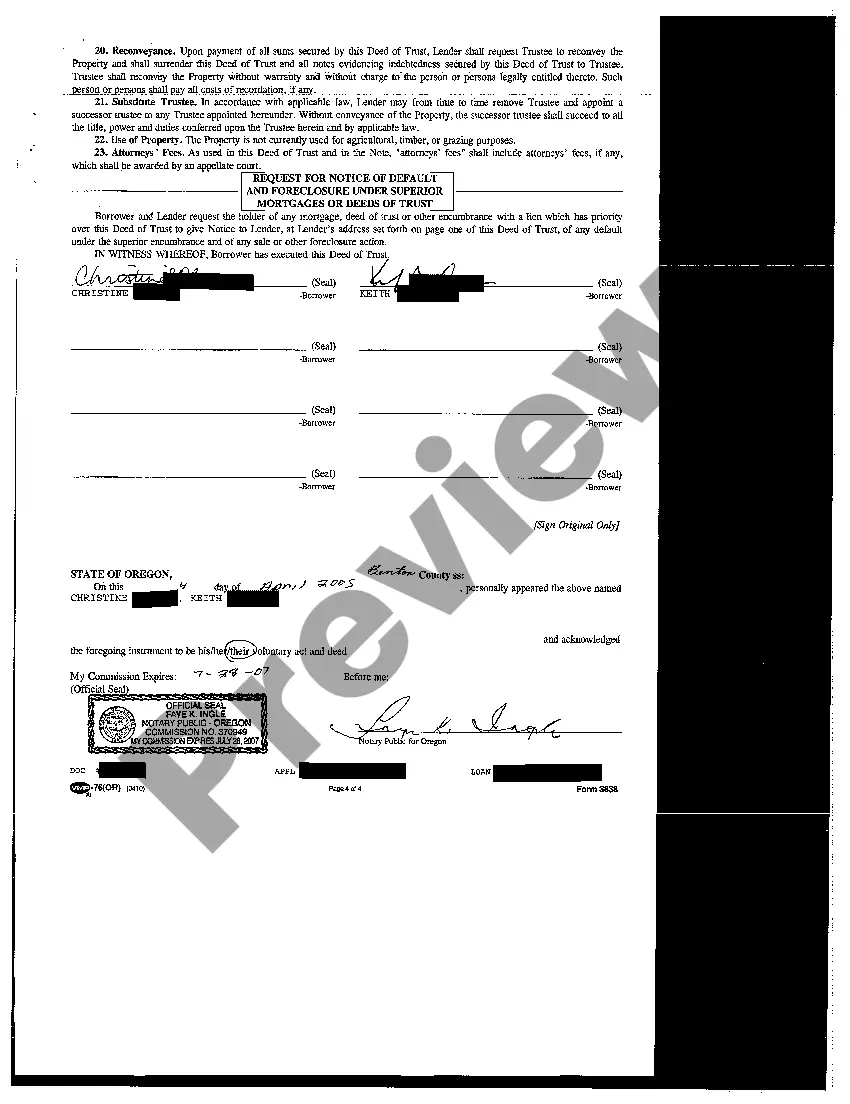

Deed of Trust are also voluntary liens, which require the notarized signature of the debtor. Remember, liens are attached to the property and not to a person.

The OTDA provides that a nonjudicial foreclosure may not be initiated unless "the trust deed, any assignments of the trust deed by the trustee or the beneficiary and any appointment of a successor trustee are recorded in the mortgage records in the counties in which the property described in the deed is situated."

Banks and other lenders typically use a trust deed. A trust deed can be foreclosed by a lawsuit in the circuit court of the county where the property is located. This type of foreclosure is referred to as a judicial foreclosure and is now common for residential loans in Oregon.

Neither a deed of trust or a contract for deed is a true deed. A deed is a document used to transfer title to real estate; deeds of trust and contracts for deeds are arrangements for buying land, each legally different from a mortgage.

The most common examples for voluntary liens are mortgages on a home and liens placed on cars that are financed. Voluntary liens can be placed on any type of property with value. The point of the voluntary lien is for a lender to secure collateral for a debt or service rendered.

A Declaration of Trust, also known as a Deed of Trust, is a legally-binding document recording the financial arrangements between joint property owners, and/or anyone else with a financial interest in the property.

Some use deeds of trust instead, which are similar documents, but they have some fundamental differences.With a deed of trust, however, the lender must act through a go-between called the trustee. The beneficiary and the trustee can't be the same person or entity.

(2) Beneficiary means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).