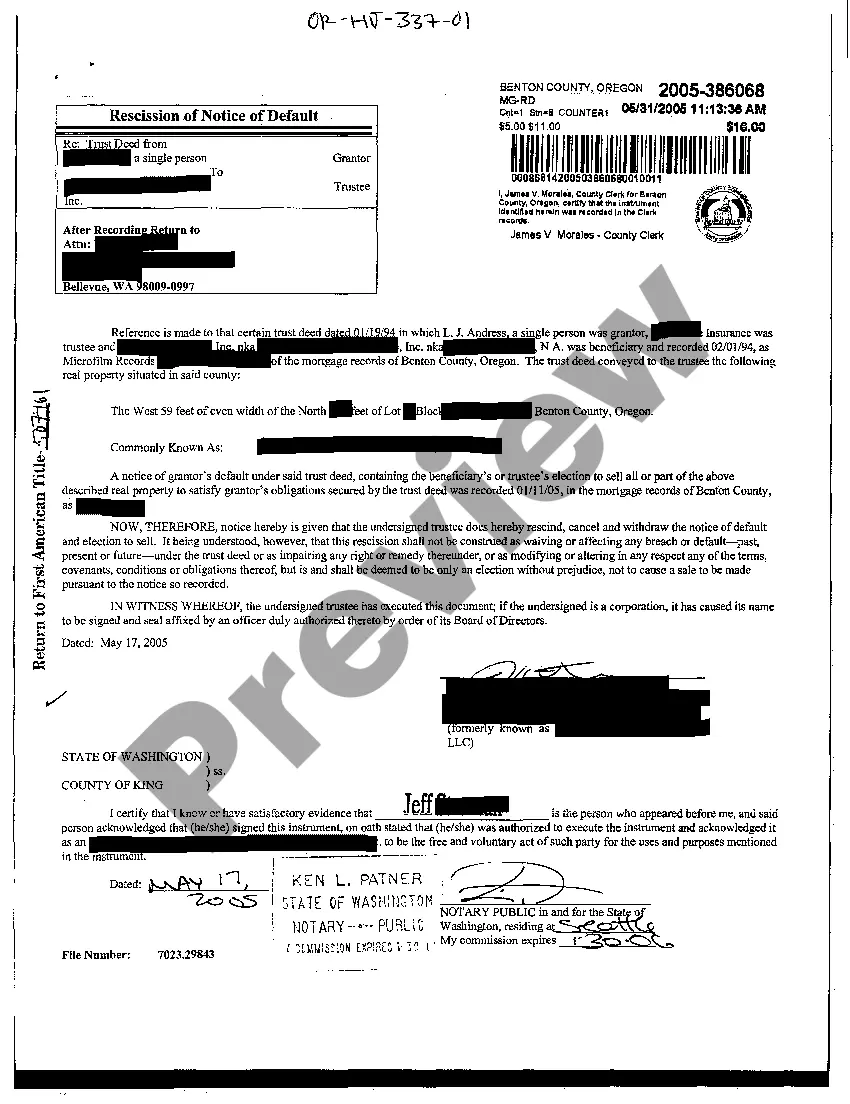

Oregon Rescission of Notice of Default

Description

How to fill out Oregon Rescission Of Notice Of Default?

Creating documents isn't the most simple job, especially for those who rarely deal with legal papers. That's why we recommend making use of correct Oregon Rescission of Notice of Default samples created by skilled attorneys. It allows you to eliminate problems when in court or working with formal institutions. Find the templates you want on our website for top-quality forms and exact explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. As soon as you are in, the Download button will automatically appear on the file webpage. After downloading the sample, it’ll be saved in the My Forms menu.

Customers without an activated subscription can easily get an account. Look at this simple step-by-step help guide to get the Oregon Rescission of Notice of Default:

- Ensure that the sample you found is eligible for use in the state it’s necessary in.

- Confirm the document. Utilize the Preview option or read its description (if readily available).

- Click Buy Now if this template is what you need or go back to the Search field to get another one.

- Select a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after doing these simple steps, it is possible to fill out the sample in your favorite editor. Check the completed data and consider asking a legal representative to examine your Oregon Rescission of Notice of Default for correctness. With US Legal Forms, everything becomes much simpler. Give it a try now!

Form popularity

FAQ

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.

You can bring your loan current and stave off the foreclosure sale filing by paying the past due amount, plus penalties.You typically have to reinstate at least five days before the lender's deadline or risk the lender rejecting your payment and proceeding with a sale.

A notice of rescission is a form given with the intention of terminating a contract, provided that the contract entered into is a voidable one. It releases the parties from obligations set forth in the contract, effectively restoring them to the positions they were in before the contract existed.

The notice of default doesn't affect your credit file, but when the account defaults this will be recorded.If the debt is regulated by the Consumer Credit Act, you must be sent a default notice warning letter and have time to act on it before the default is recorded on your credit file.

Negotiate With Your Lender. If you are having financial difficulties, the worst thing that you can do is bury your head in the sand. Request a Forbearance. Modify Your Loan. Make a Claim. Get a Housing Counselor. Declare Bankruptcy. Use A Foreclosure Defense Strategy. Make Them Produce The Not.

After the lender files the Notice of Default, you get 90 days to bring your past-due bill current. After the 90 days pass, the lender files a Notice of Sale with the clerk. The Notice of Sale displays the location, date and time of the sale. It lists the trustee's name and contact information.

A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before the sale, or filing for bankruptcy. (Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.)

File for Bankruptcy Protection to Avoid ForeclosureIf your foreclosure sale is scheduled to take place in a matter of days, you can stop the foreclosure in its tracks by filing for bankruptcy. Upon your filing, something called an automatic stay goes into place.