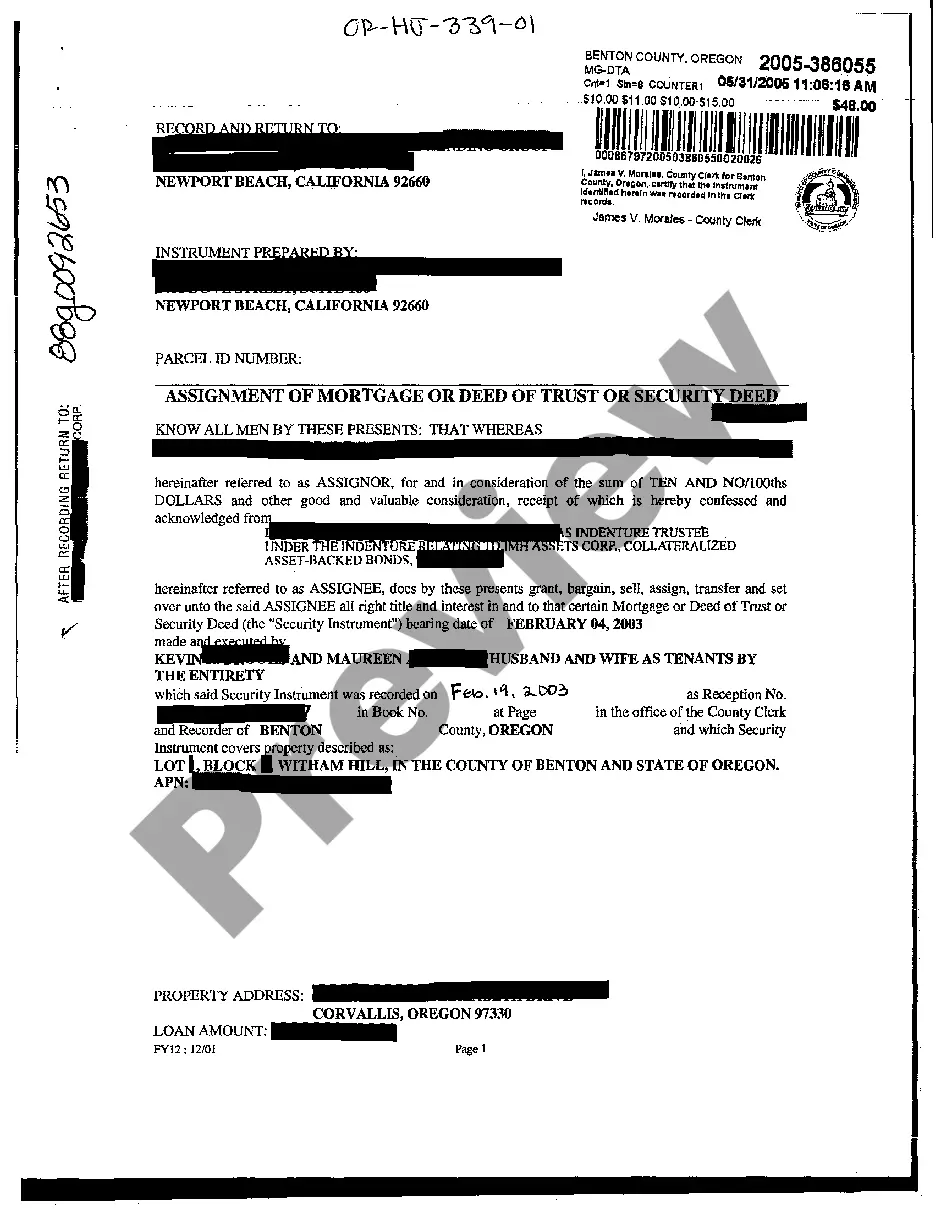

Oregon Assignment of Mortgage or Deed of Trust or Security Deed

Description

How to fill out Oregon Assignment Of Mortgage Or Deed Of Trust Or Security Deed?

The work with papers isn't the most easy job, especially for those who almost never deal with legal papers. That's why we recommend using correct Oregon Assignment of Mortgage or Deed of Trust or Security Deed samples created by professional lawyers. It allows you to stay away from problems when in court or working with official organizations. Find the documents you require on our website for high-quality forms and accurate explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. When you’re in, the Download button will immediately appear on the template web page. Soon after getting the sample, it will be saved in the My Forms menu.

Customers with no an active subscription can easily get an account. Follow this brief step-by-step guide to get your Oregon Assignment of Mortgage or Deed of Trust or Security Deed:

- Make sure that the sample you found is eligible for use in the state it is required in.

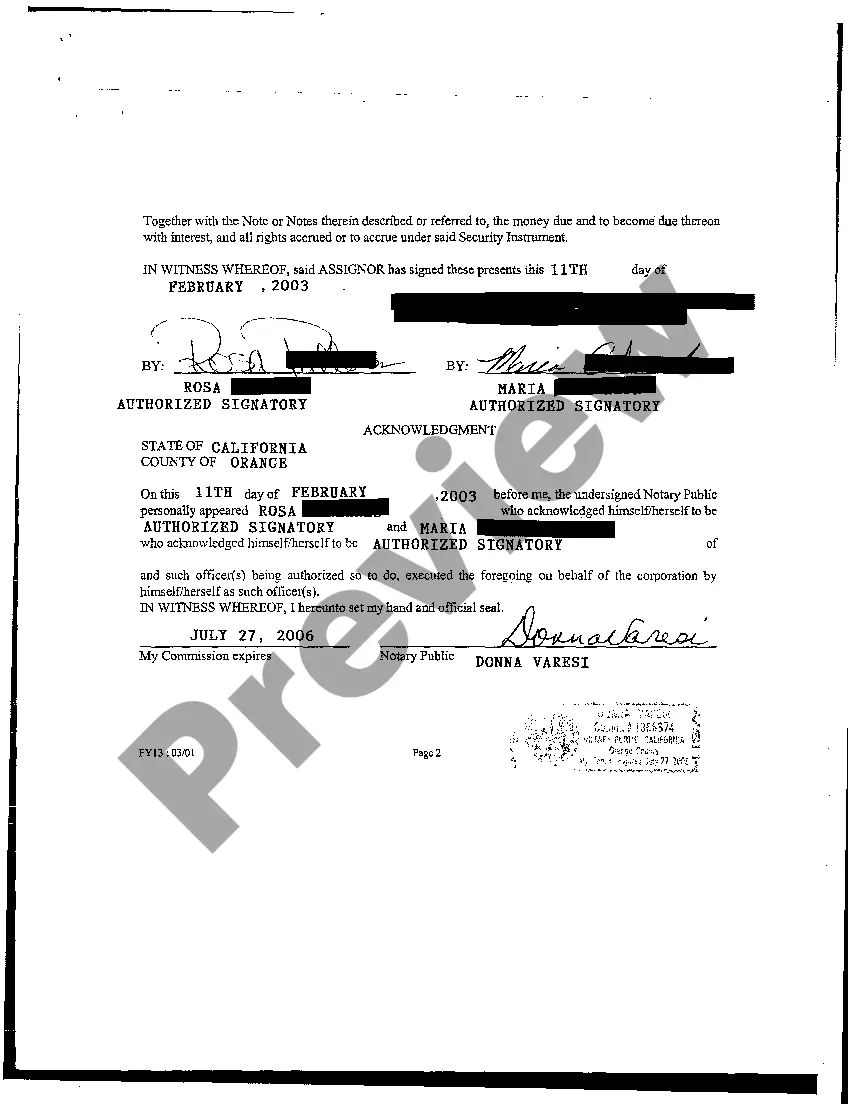

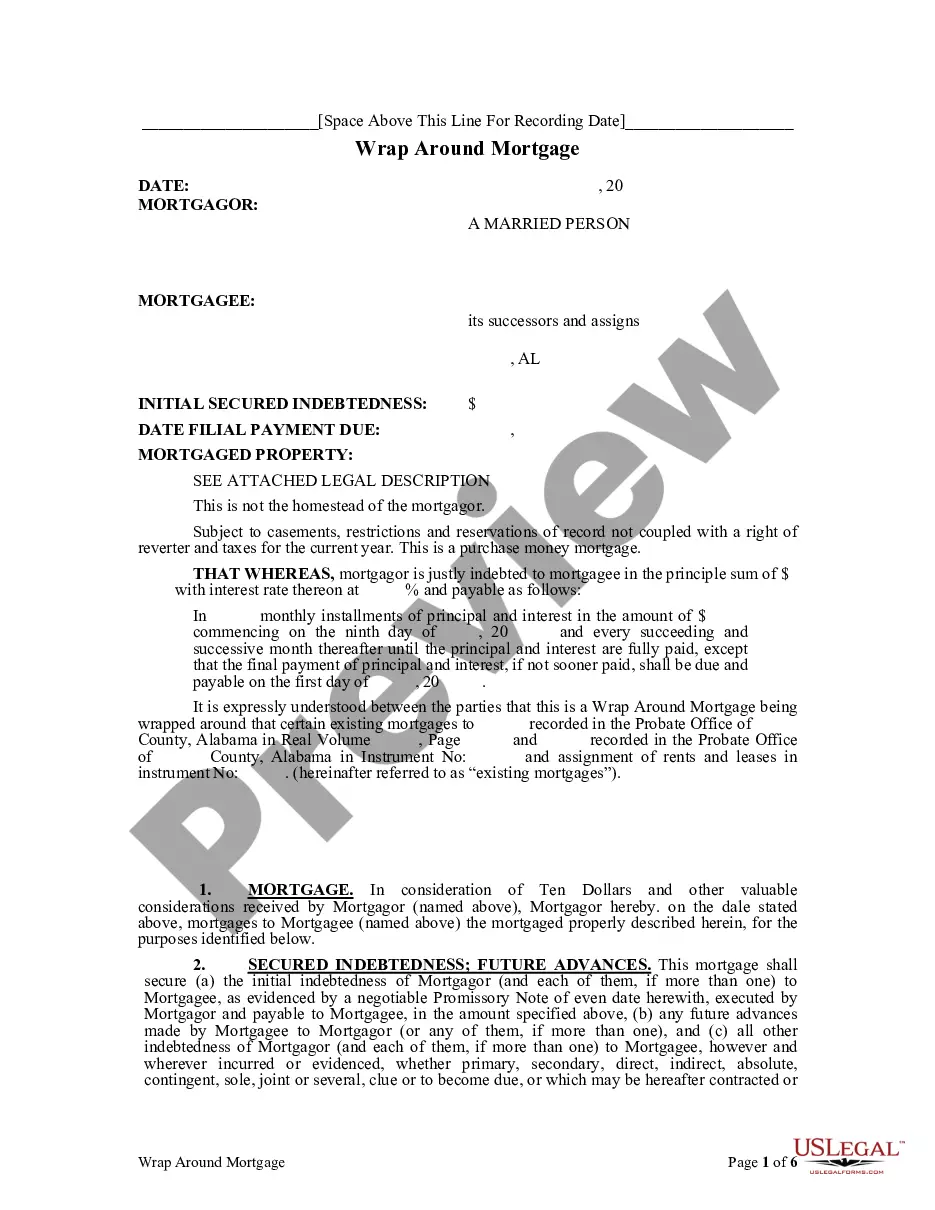

- Verify the file. Use the Preview feature or read its description (if offered).

- Click Buy Now if this form is the thing you need or go back to the Search field to find another one.

- Choose a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after finishing these easy actions, you can complete the form in a preferred editor. Recheck completed data and consider requesting a lawyer to review your Oregon Assignment of Mortgage or Deed of Trust or Security Deed for correctness. With US Legal Forms, everything gets much simpler. Give it a try now!

Form popularity

FAQ

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. It states that the home buyer will repay the loan and that the mortgage lender will hold the legal title to the property until the loan is fully paid.

If you or another party to the deed of trust already own the property and you enter into a deed of trust to regulate an arrangement there is usually no reason to inform your mortgage lender.Therefore the mortgage company's position is secure and they need not be concerned with a deed of trust.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note. Assignment of the mortgage agreement occurs when the mortgagee (the bank or lender) transfers its rights under the agreement to another party.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

A trust deed is a legally binding arrangement and covers unsecured debts only, such as credit cards and personal loans. It does not therefore apply to your mortgage or any hire purchase agreements.

The one major difference in some areas between the two is that the security deed is held by the lender whereas a trust deed is usually held by a third party.The mortgage requires a judicial action for foreclosure to take place; while the security or trust deed is a nonjudicial action where no court is involved.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.