Oregon Quitclaim Deed from Trust to Trust

Description Oregon Quick Claim Deed

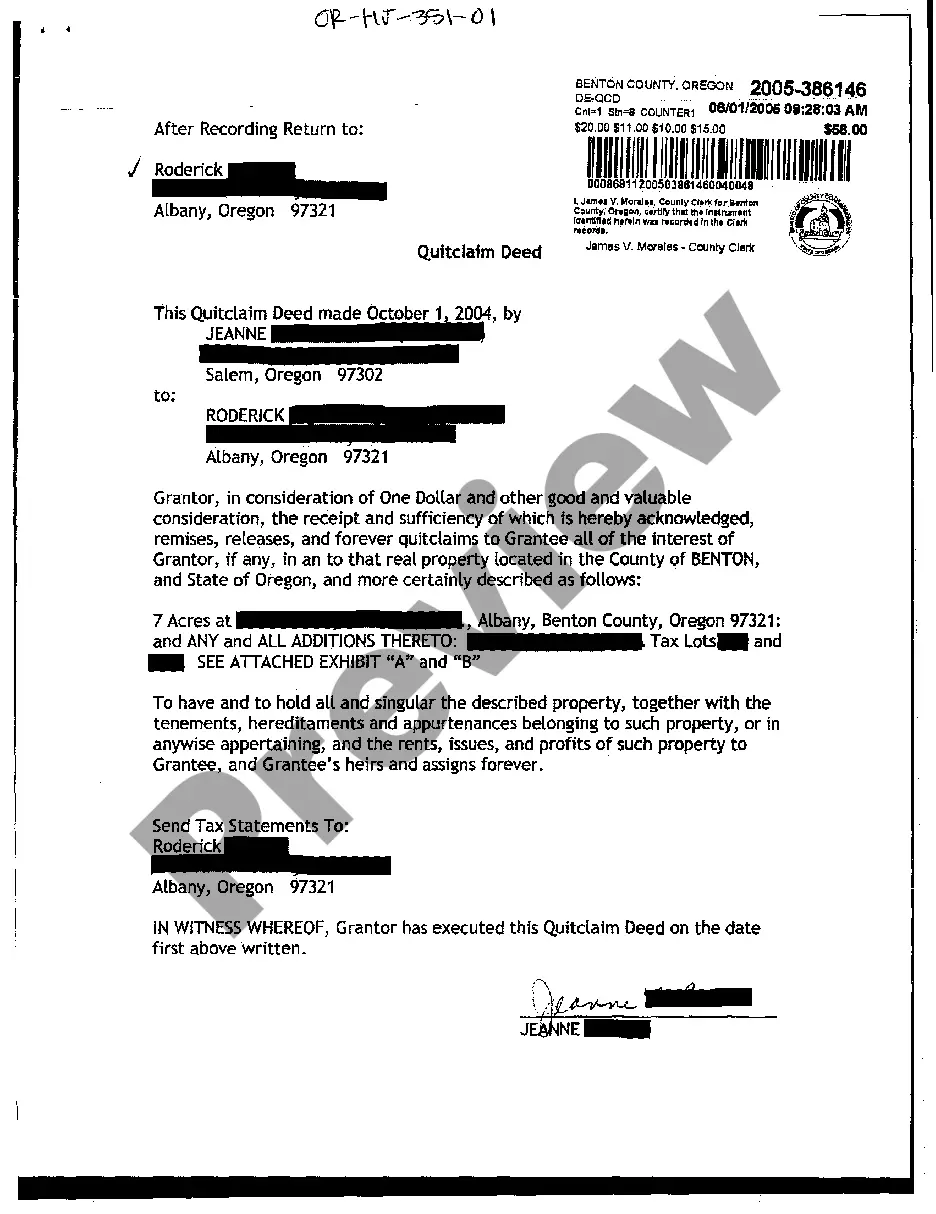

How to fill out Oregon Quitclaim Deed From Trust To Trust?

The work with papers isn't the most simple process, especially for people who almost never work with legal papers. That's why we advise utilizing accurate Oregon Quitclaim Deed from Trust to Trust samples made by professional attorneys. It allows you to stay away from troubles when in court or dealing with official institutions. Find the samples you require on our site for high-quality forms and correct information.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you are in, the Download button will automatically appear on the template page. Soon after getting the sample, it’ll be saved in the My Forms menu.

Customers with no an activated subscription can easily get an account. Utilize this simple step-by-step help guide to get the Oregon Quitclaim Deed from Trust to Trust:

- Be sure that the form you found is eligible for use in the state it’s necessary in.

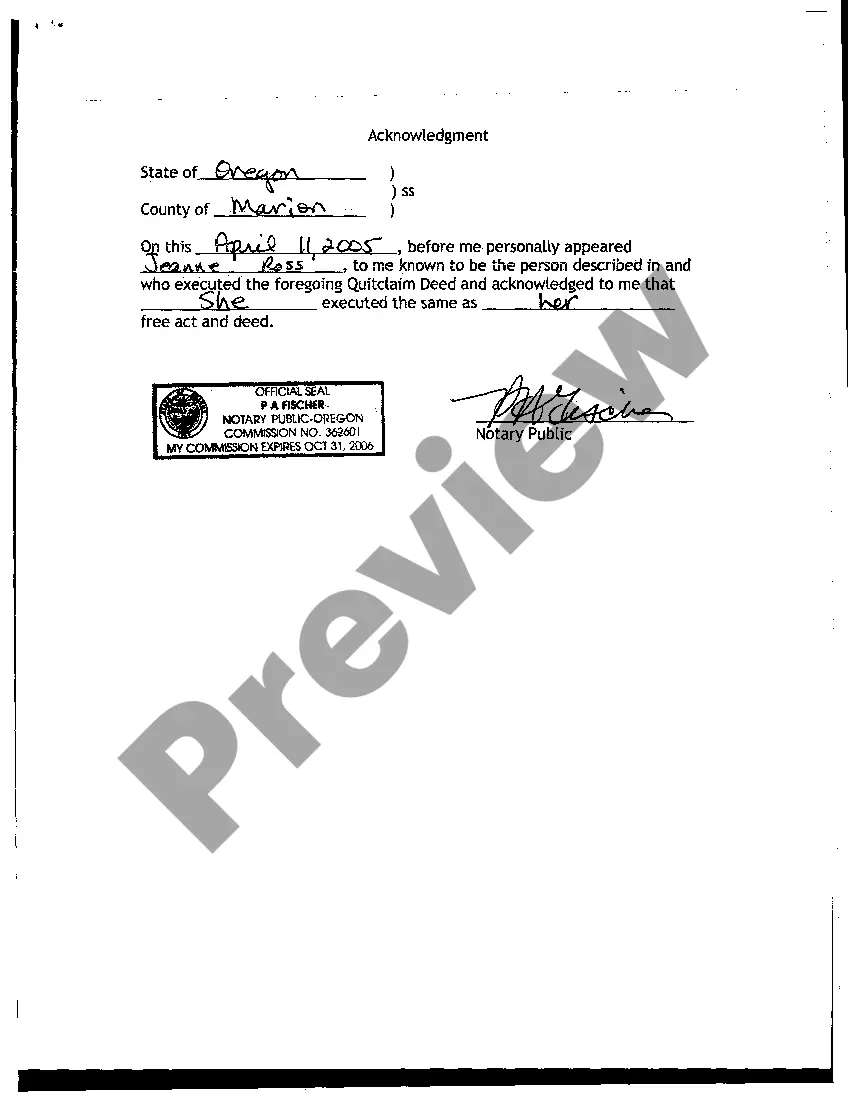

- Verify the file. Utilize the Preview option or read its description (if available).

- Buy Now if this form is what you need or return to the Search field to get another one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a required format.

After doing these straightforward steps, you can complete the sample in your favorite editor. Double-check completed info and consider requesting a lawyer to examine your Oregon Quitclaim Deed from Trust to Trust for correctness. With US Legal Forms, everything gets easier. Give it a try now!

Oregon Quit Claim Deed Form Form popularity

FAQ

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

The act of transferring a property that is owned by an individual into a trust, will see the trust liable to pay stamp duty on acquisition of the asset. Additionally, the individual who is transferring ownership to the trust, will be liable to pay capital gains tax on the disposal of the asset.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.