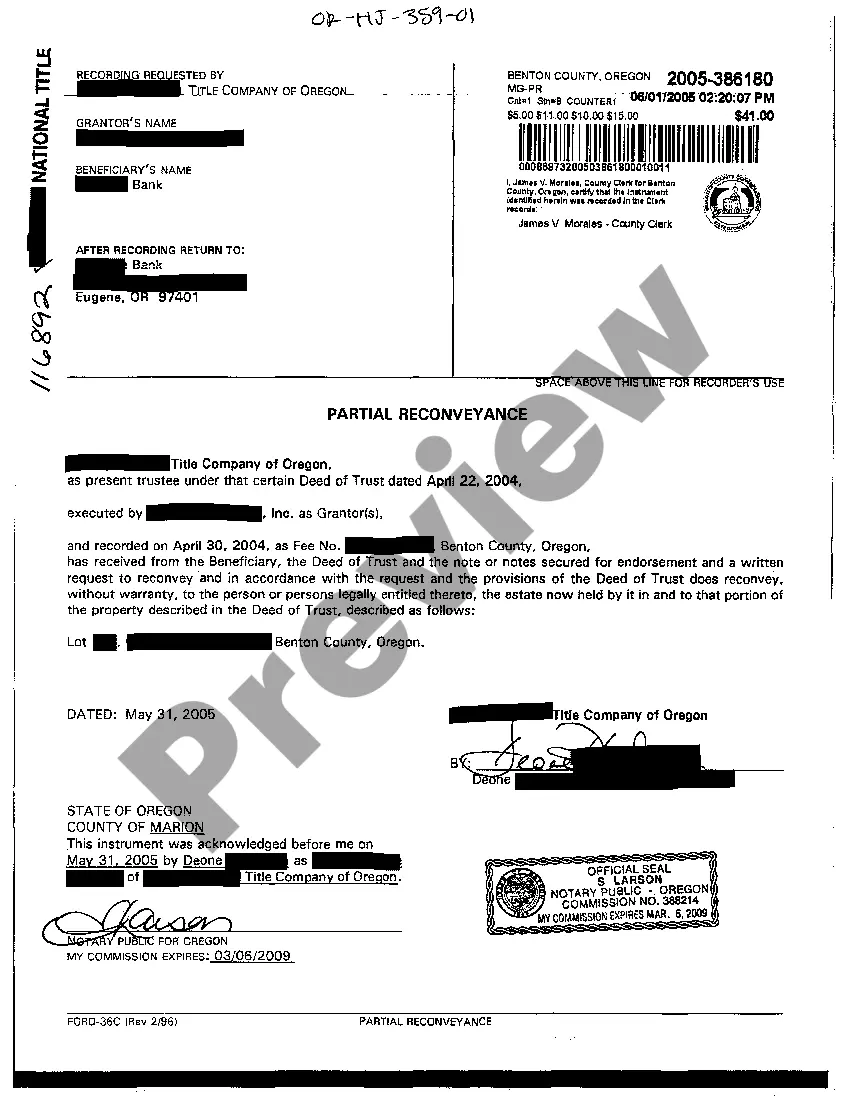

Oregon Partial Reconveyance

Description

How to fill out Oregon Partial Reconveyance?

Creating documents isn't the most straightforward process, especially for those who rarely deal with legal paperwork. That's why we advise using accurate Oregon Partial Reconveyance samples created by professional attorneys. It allows you to stay away from difficulties when in court or handling formal organizations. Find the templates you want on our site for top-quality forms and accurate information.

If you’re a user having a US Legal Forms subscription, simply log in your account. As soon as you’re in, the Download button will automatically appear on the template web page. Soon after getting the sample, it’ll be saved in the My Forms menu.

Users without an active subscription can quickly get an account. Follow this simple step-by-step guide to get the Oregon Partial Reconveyance:

- Make certain that the form you found is eligible for use in the state it is required in.

- Verify the file. Make use of the Preview feature or read its description (if offered).

- Click Buy Now if this form is what you need or return to the Search field to find another one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a required format.

Right after completing these simple actions, you are able to fill out the sample in a preferred editor. Check the filled in information and consider requesting an attorney to review your Oregon Partial Reconveyance for correctness. With US Legal Forms, everything becomes much simpler. Try it now!

Form popularity

FAQ

(2) Beneficiary means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).

An action for reconveyance, on the other hand, is a legal and equitable remedy granted to the rightful owner of land which has been wrongfully or erroneously registered in the name of another for the purpose of compelling the latter to transfer or reconvey the land to him.

A form of partial reconveyance of real property in California by a trustee under a deed of trust for use when the beneficiary (lender) agrees to release a portion of the real property from the lien of the deed of trust while the trustor's (borrower's) obligations are not yet fully satisfied.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form. is completed and signed by the trustee, whose signature must be notarized.

The property's title remains in the trust until the loan is paid off, or satisfied, then it is released from the trust. To complete the release, the lender prepares a deed of reconveyance. This document states that the conditions of the loan have been met and you have no further financial obligations to the lender.

A mortgage holder issues a deed of reconveyance to indicate that the borrower has been released from the mortgage debt. The deed transfers the property title from the lender, also called the beneficiary, to the borrower. This document is most commonly used when a mortgage has been paid in full.

The act or process of reconveying property. A discharge acts as a reconveyance of the legal title from the mortgagee to the holder of the equity. 2. rare, archaic. the act or process of conveying something or someone back to their original location.

Upon the return receipt of the Address Verification Letter, the property reconveyance process will begin. Once all the paperwork has been received by the Administrative Office, it may take up to thirty (30) calendar days to process. The deeds of trust are processed in the sequence received.