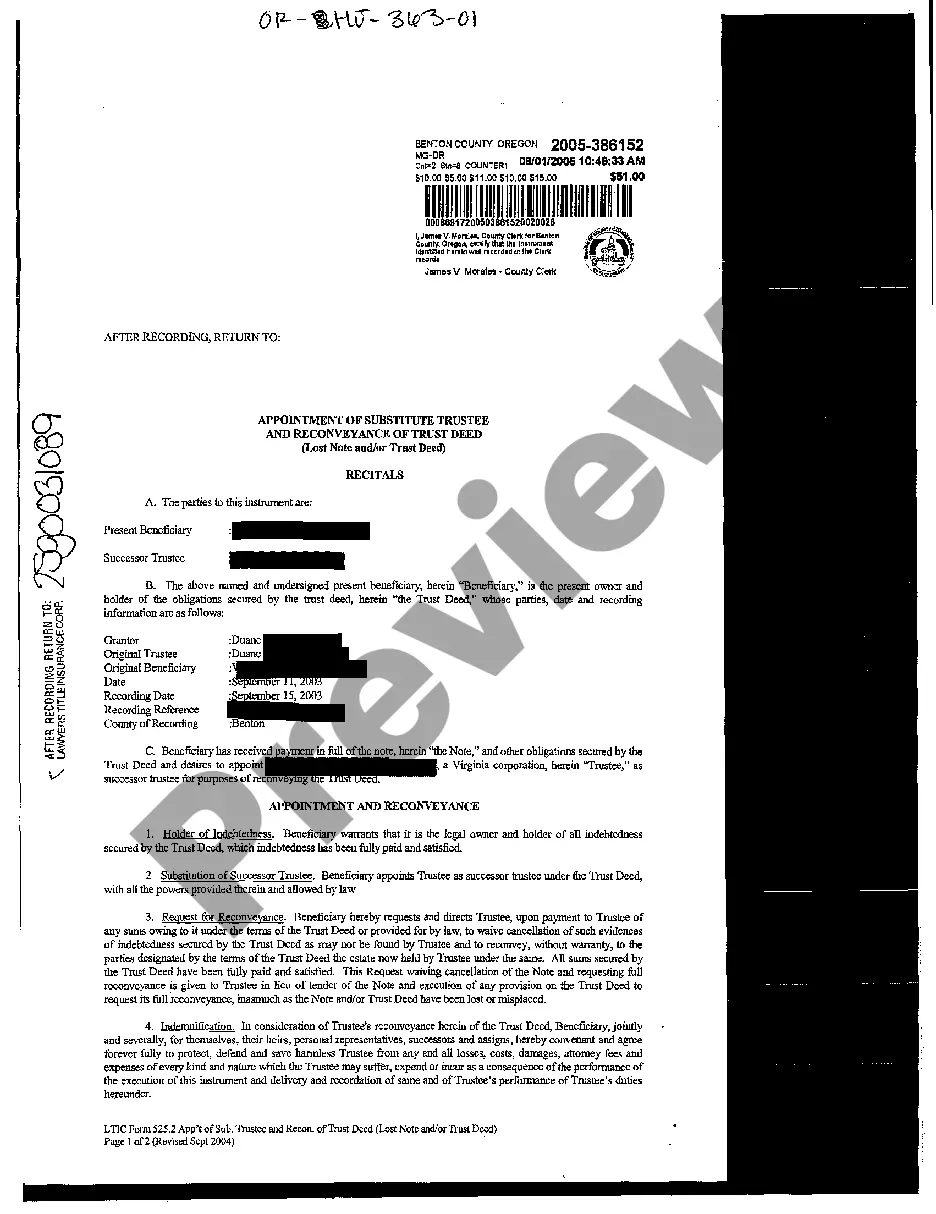

Oregon Appointment of Substitute Trustee and Reconveyance of Trust Deed

Description

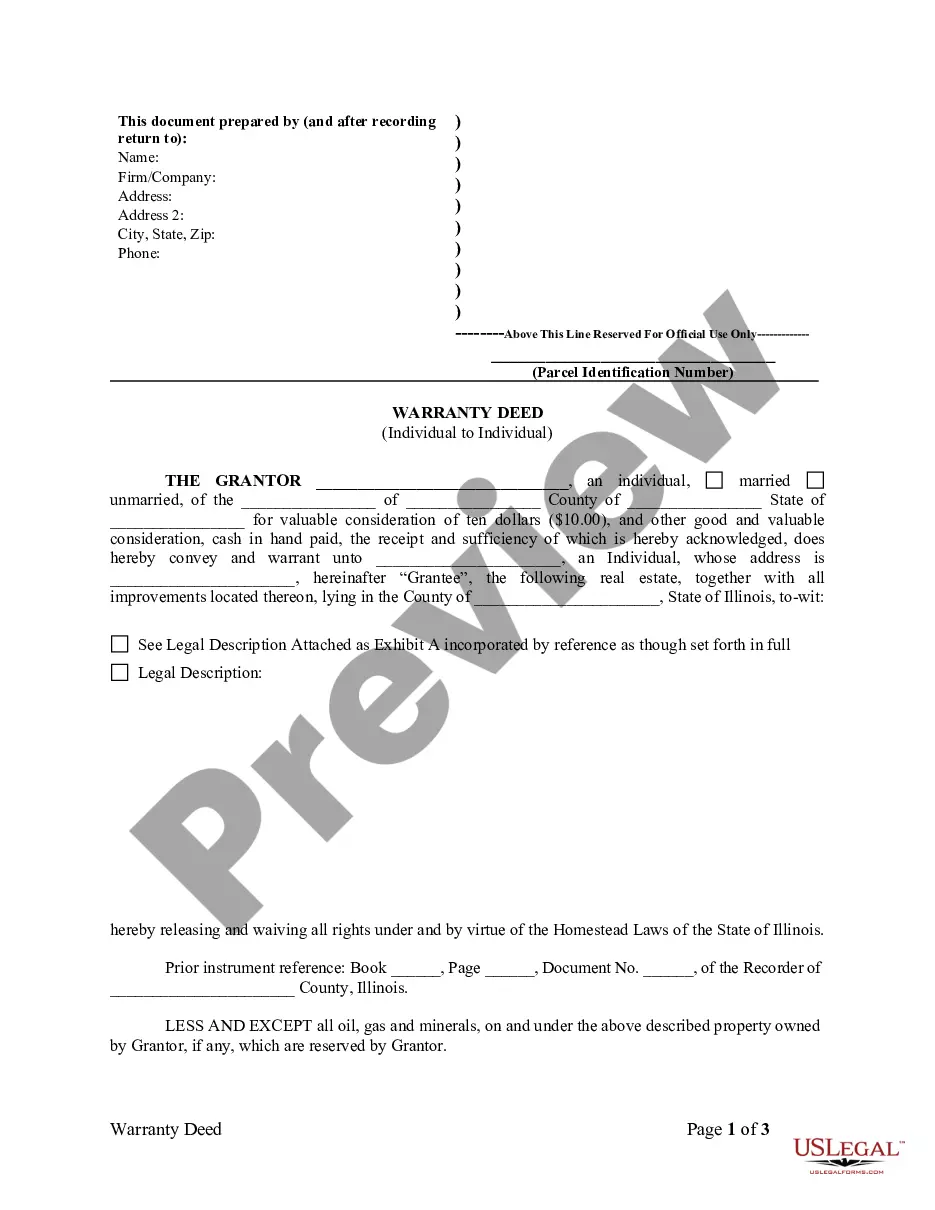

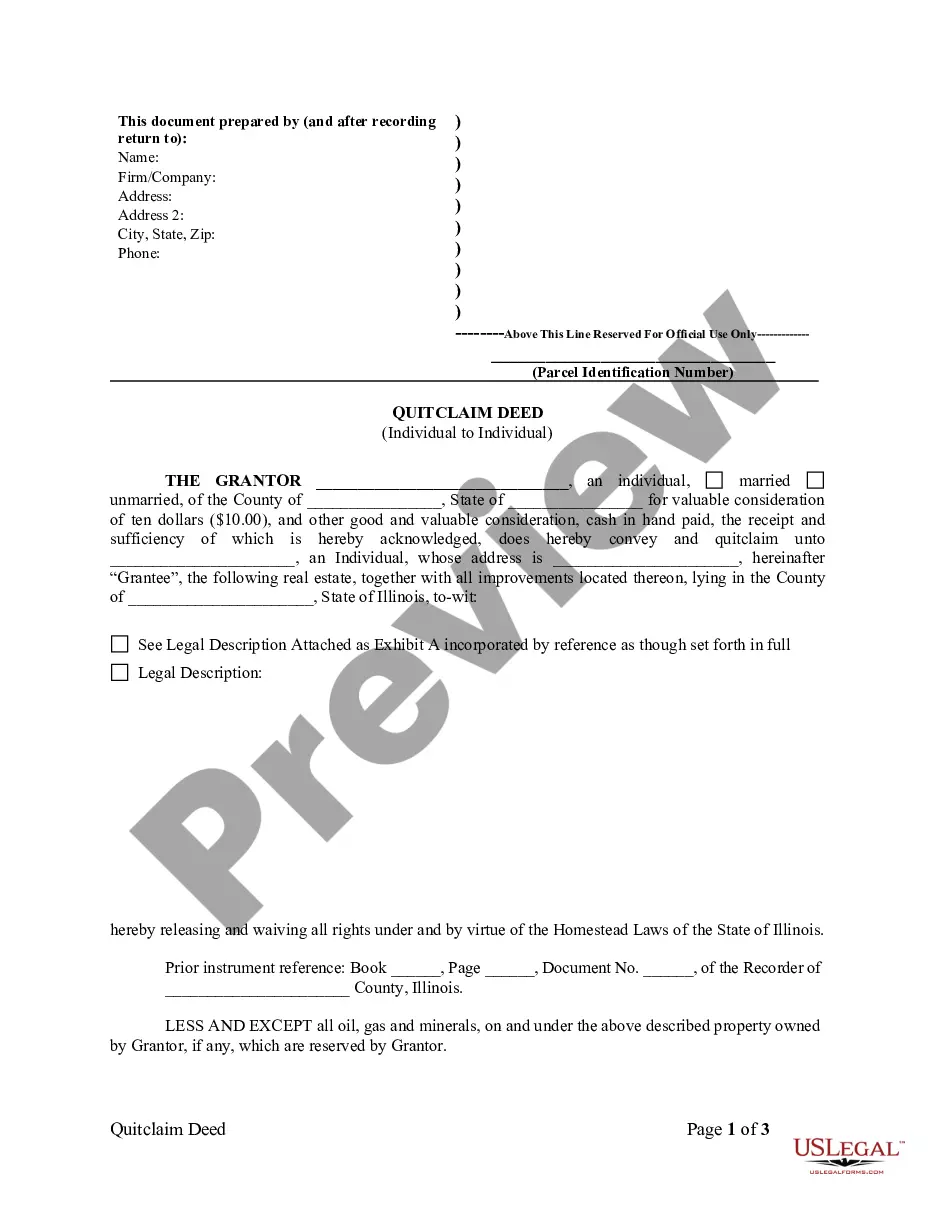

How to fill out Oregon Appointment Of Substitute Trustee And Reconveyance Of Trust Deed?

The work with papers isn't the most straightforward process, especially for those who almost never deal with legal paperwork. That's why we advise making use of accurate Oregon Appointment of Substitute Trustee and Reconveyance of Trust Deed samples created by skilled attorneys. It allows you to avoid problems when in court or working with official institutions. Find the samples you need on our website for top-quality forms and correct descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. As soon as you are in, the Download button will immediately appear on the template webpage. After accessing the sample, it will be stored in the My Forms menu.

Customers with no an activated subscription can quickly get an account. Use this brief step-by-step help guide to get your Oregon Appointment of Substitute Trustee and Reconveyance of Trust Deed:

- Make sure that the document you found is eligible for use in the state it’s necessary in.

- Confirm the document. Make use of the Preview feature or read its description (if offered).

- Buy Now if this sample is what you need or go back to the Search field to get a different one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After finishing these simple steps, you can complete the form in your favorite editor. Check the completed information and consider asking a legal representative to review your Oregon Appointment of Substitute Trustee and Reconveyance of Trust Deed for correctness. With US Legal Forms, everything gets much simpler. Try it now!

Form popularity

FAQ

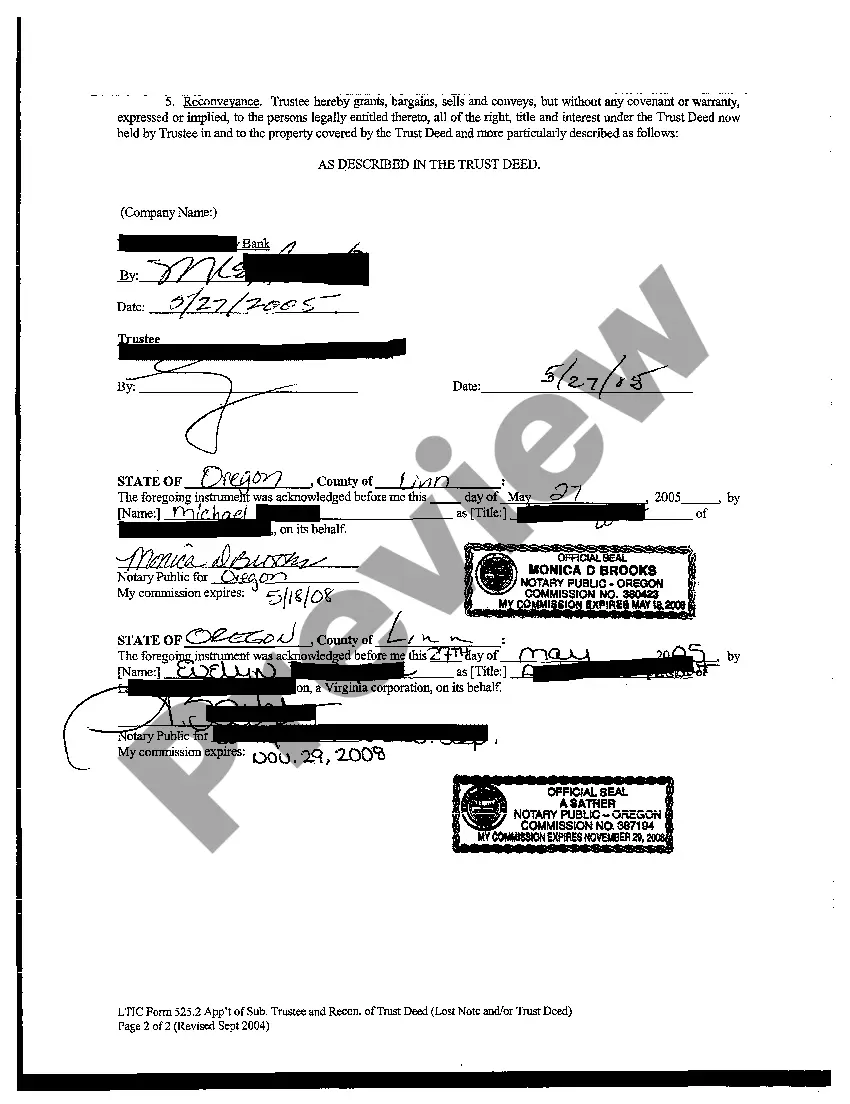

Is completed and signed by the trustee, whose signature must be notarized. Full Reconveyance form can be purchased at most office supply or stationery stores. Usually the trustee named on your Deed of Trust will also have forms available and will issue the Full Reconveyance.

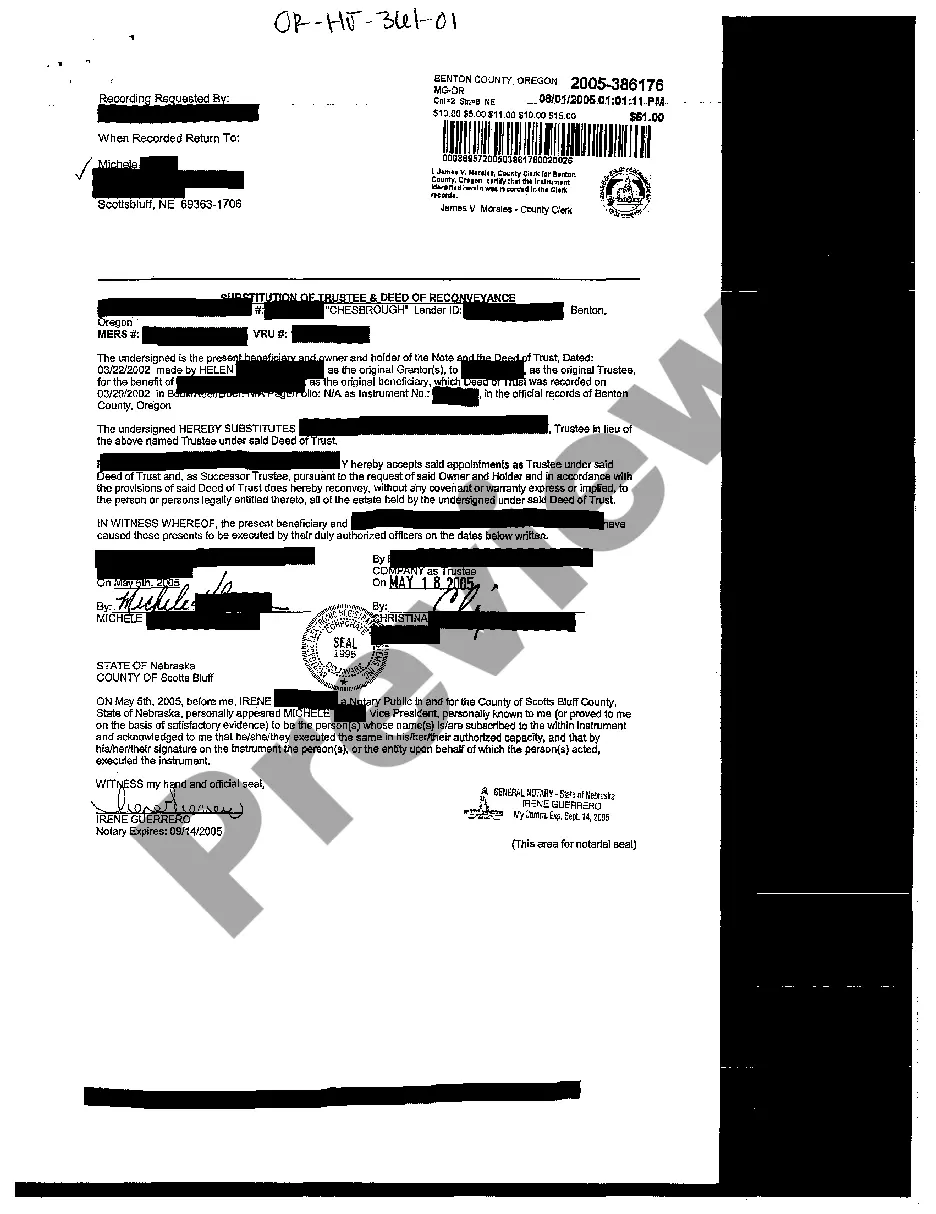

How do you file a Deed of Reconveyance? A Deed of Reconveyance should be filed with your local county recorder or recorder of deeds once it has been signed by a notary public (such as an attorney). Once the document has been filed, the debt that was registered to the property will be considered paid off.

Substitute Trustee Person appointed by the current mortgagee or mortgage servicer to exercise the power of sale in lieu of the original trustee designated in the deed of trust. Simple Terms This is the person who conducts the sale at the foreclosure auction.

Only until the debt is paid off by the borrower can a deed of reconveyance then be used to clear the deed of trust from the title to the property. The document is signed by the trustee, whose signature must be notarized.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

A mortgage holder issues a deed of reconveyance to indicate that the borrower has been released from the mortgage debt. The deed transfers the property title from the lender, also called the beneficiary, to the borrower. This document is most commonly used when a mortgage has been paid in full.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.