Oregon Sample Deed of Trust

Description

How to fill out Oregon Sample Deed Of Trust?

Creating documents isn't the most easy job, especially for people who almost never deal with legal paperwork. That's why we advise using accurate Oregon Sample Deed of Trust samples created by professional lawyers. It gives you the ability to stay away from troubles when in court or handling official organizations. Find the documents you want on our website for high-quality forms and accurate information.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you are in, the Download button will immediately appear on the template page. Soon after getting the sample, it will be saved in the My Forms menu.

Users with no an active subscription can easily create an account. Utilize this brief step-by-step help guide to get the Oregon Sample Deed of Trust:

- Ensure that the document you found is eligible for use in the state it’s necessary in.

- Confirm the document. Make use of the Preview feature or read its description (if offered).

- Buy Now if this form is the thing you need or go back to the Search field to get another one.

- Choose a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after doing these simple actions, you can complete the form in your favorite editor. Recheck filled in data and consider asking a legal representative to review your Oregon Sample Deed of Trust for correctness. With US Legal Forms, everything gets much easier. Test it now!

Form popularity

FAQ

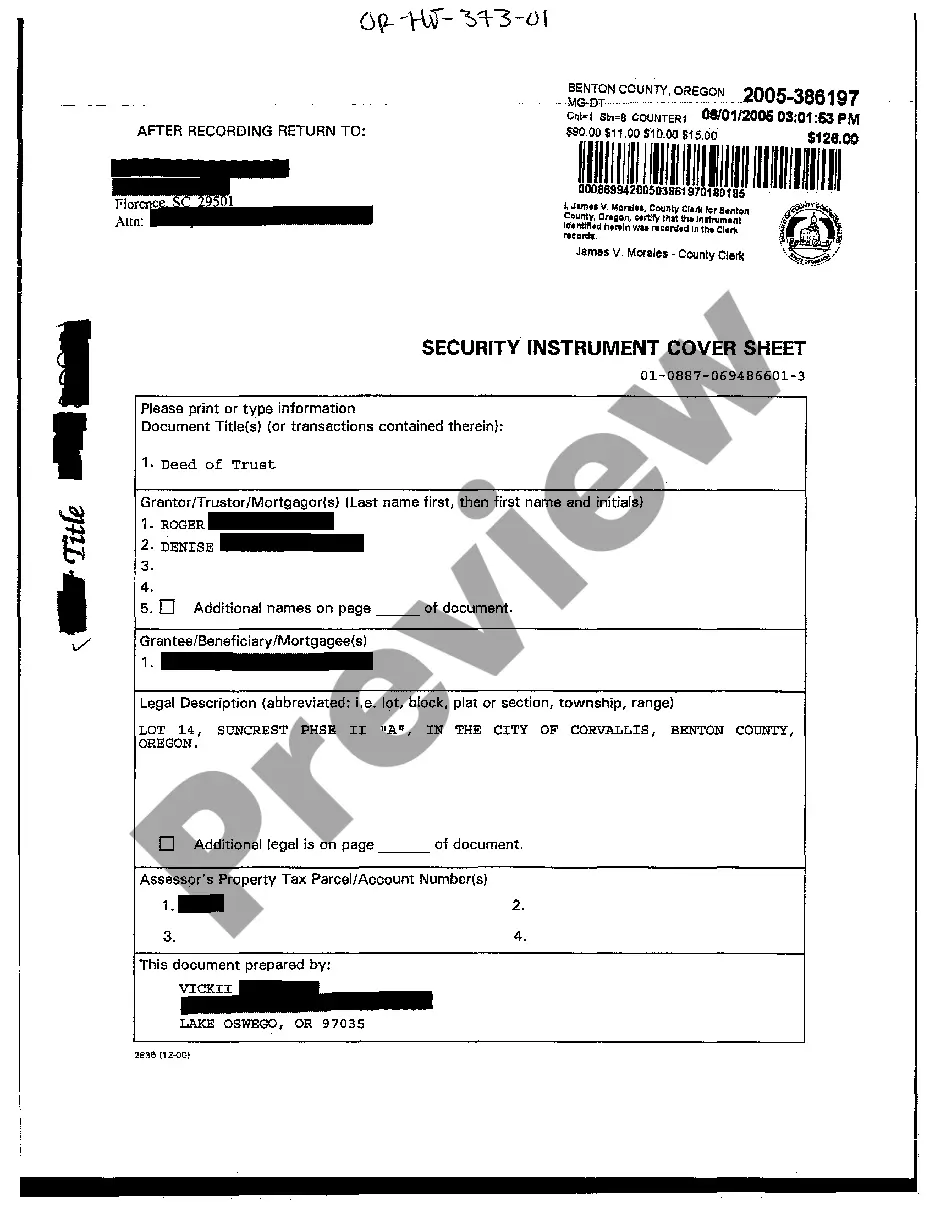

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

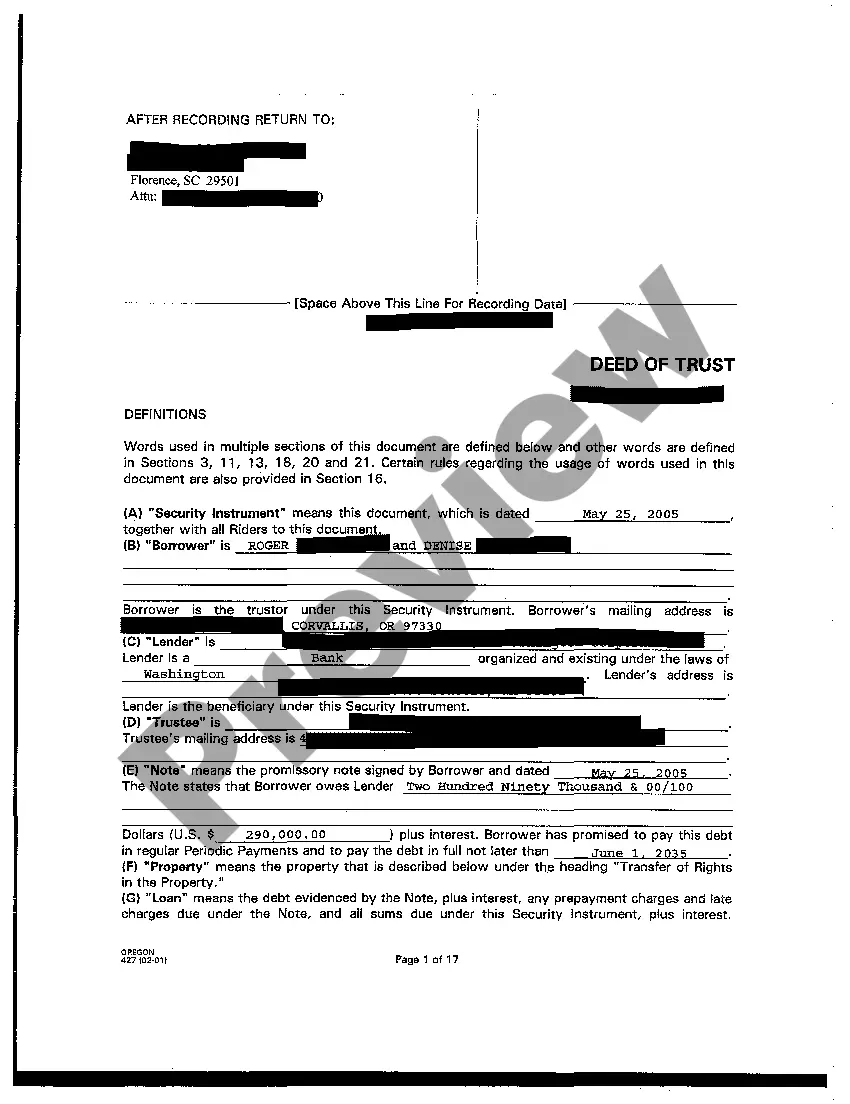

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

A deed of trust is a written instrument with three parties: The trustor, who is the borrower and homeowner. The beneficiary, who is the lender. The trustee, who is a third party such as an insurance company or escrow management agency that holds actual title to the property in trust for the beneficiary.

How much each person contributes to the deposit, and how much will be repaid to them. What percentage of the property each person will own, and how the money will be split if the property is sold. How much each person will pay towards the mortgage, and how the mortgage will ultimately be paid off.