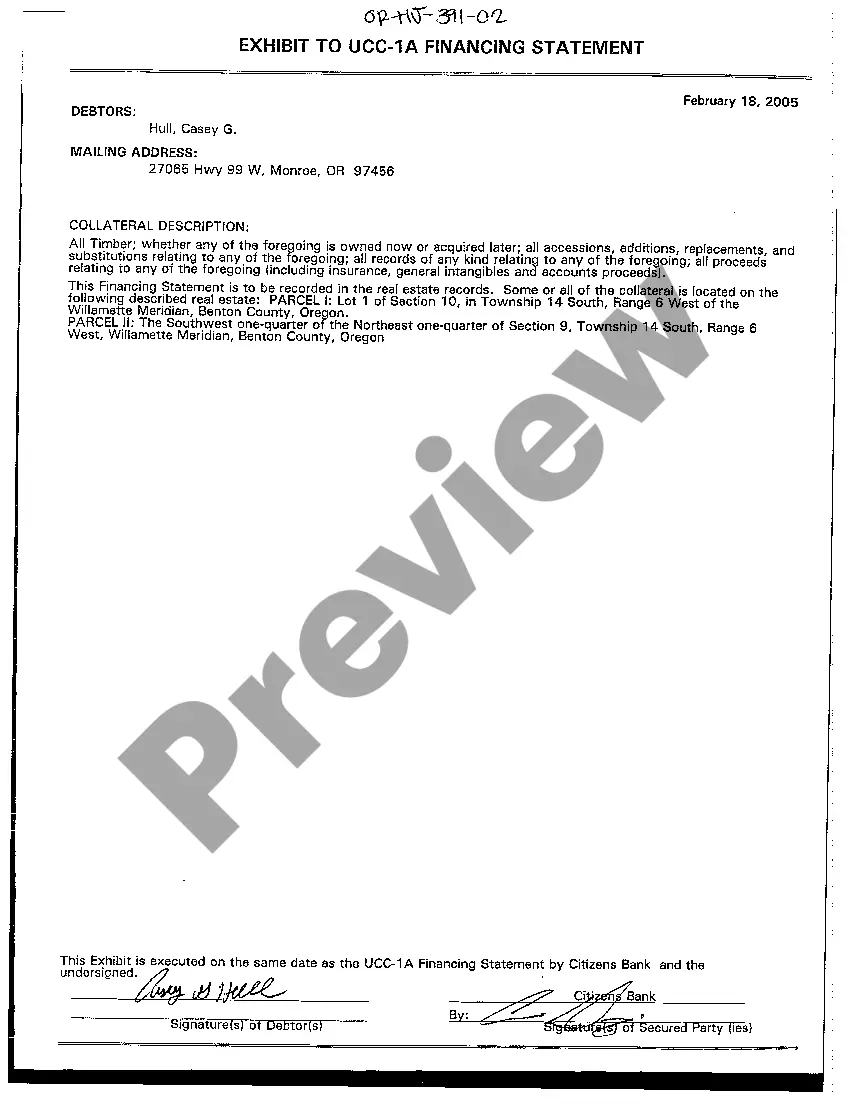

Oregon Exhibit to UCC-1A Financing Statement

Description

How to fill out Oregon Exhibit To UCC-1A Financing Statement?

Creating documents isn't the most simple task, especially for those who almost never work with legal papers. That's why we advise using accurate Oregon Exhibit to UCC-1A Financing Statement templates created by professional lawyers. It allows you to prevent troubles when in court or dealing with official organizations. Find the files you want on our site for high-quality forms and correct information.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you are in, the Download button will immediately appear on the template webpage. Right after downloading the sample, it will be saved in the My Forms menu.

Users without an activated subscription can easily get an account. Make use of this simple step-by-step guide to get your Oregon Exhibit to UCC-1A Financing Statement:

- Ensure that the document you found is eligible for use in the state it is needed in.

- Confirm the document. Make use of the Preview feature or read its description (if readily available).

- Buy Now if this form is the thing you need or return to the Search field to find another one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after doing these simple actions, you are able to complete the form in an appropriate editor. Check the completed details and consider requesting an attorney to review your Oregon Exhibit to UCC-1A Financing Statement for correctness. With US Legal Forms, everything gets easier. Give it a try now!

Form popularity

FAQ

It should be noted that UCC financing statements filed now generally do not contain a grant of the security interest and generally are not signed or otherwise authenticated by the Debtor and therefore would not satisfy the requirement of a security agreement.

It should be noted that UCC financing statements filed now generally do not contain a grant of the security interest and generally are not signed or otherwise authenticated by the Debtor and therefore would not satisfy the requirement of a security agreement.

Section 9-503 of the UCC provides various, more specific rules regarding the sufficiency of a debtor's name on a financing statement.However, unlike with a security agreement, on a financing statement it is acceptable to use a supergeneric description of collateral.

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

To assign (1) some or all of Assignor's right to amend the identified financing statement, or (2) the Assignor's right to amend the identified financing statement with respect to some (but not all) of the collateral covered by the identified financing statement: Check box in item 3 and enter name of Assignee in item 7a

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.