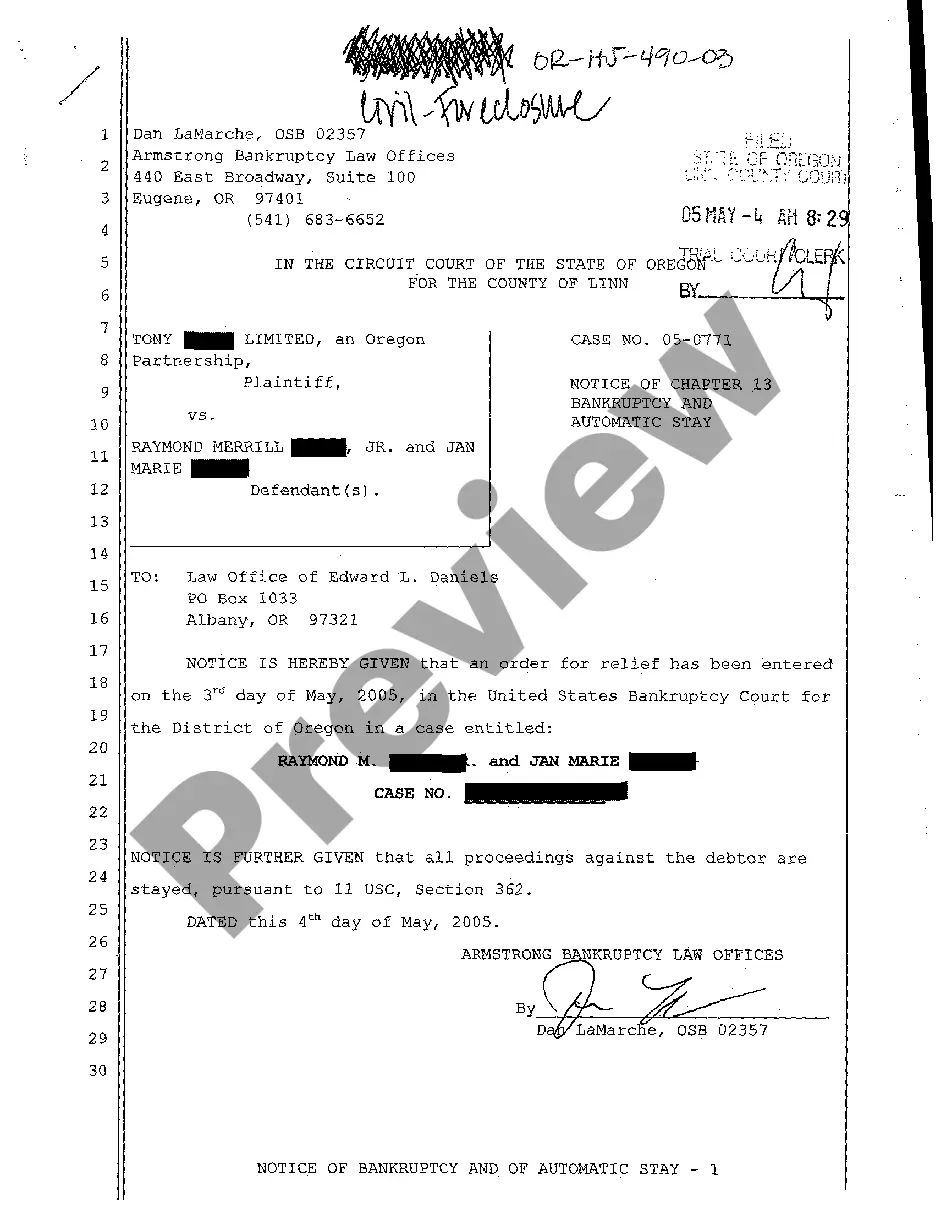

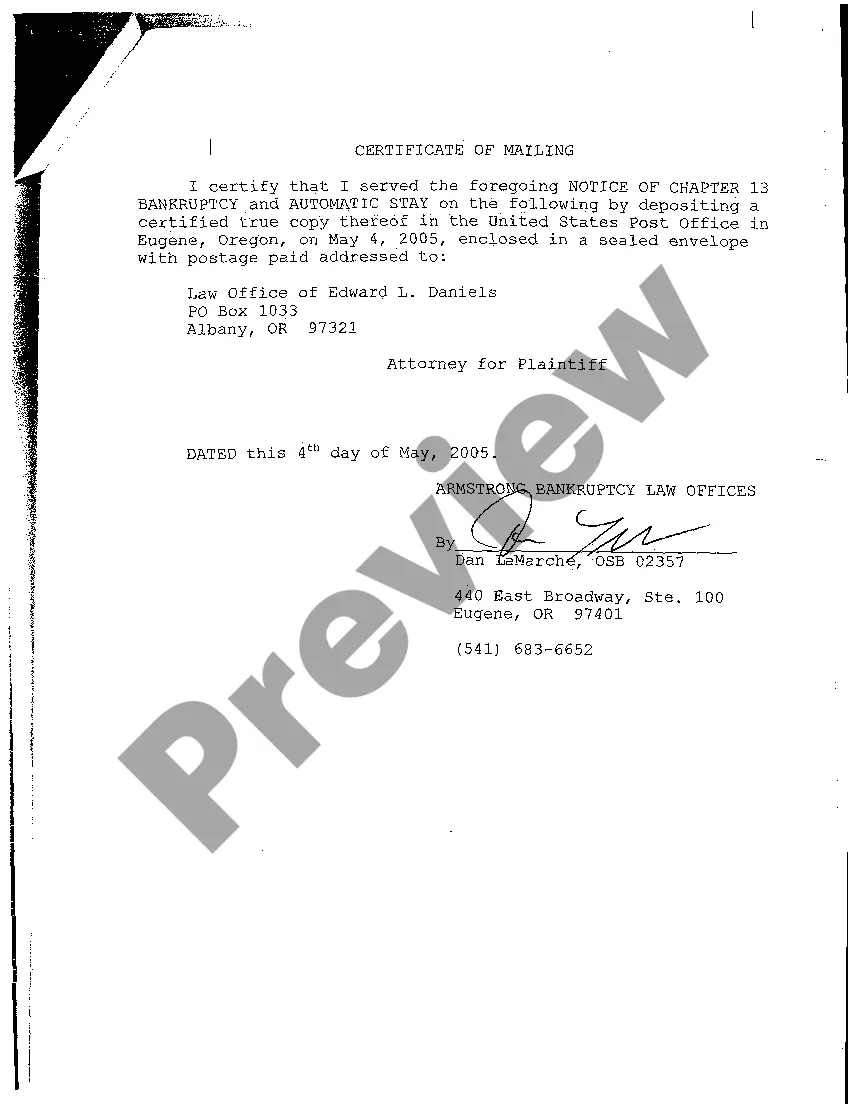

Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay

Description

How to fill out Oregon Notice Of Chapter 13 Bankruptcy And Automatic Stay?

Among countless free and paid samples that you can find on the web, you can't be certain about their accuracy and reliability. For example, who made them or if they’re qualified enough to take care of the thing you need those to. Always keep relaxed and use US Legal Forms! Get Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay templates created by professional lawyers and prevent the expensive and time-consuming procedure of looking for an lawyer or attorney and after that having to pay them to write a papers for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button near the form you are seeking. You'll also be able to access your previously saved templates in the My Forms menu.

If you are making use of our service the very first time, follow the instructions listed below to get your Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay with ease:

- Make certain that the file you see is valid where you live.

- Review the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering process or look for another sample using the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

Once you have signed up and bought your subscription, you may use your Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay as many times as you need or for as long as it stays active in your state. Edit it in your favored offline or online editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

Generally, the creditor on a post-petition debt cannot collect the debt until either the automatic stay is terminated or the creditor receives permission to collect from the bankruptcy court.

Creditors can file a Motion for Relief from the Co-debtor Stay and ask the Court to terminate the Stay under any one of three appropriate circumstances.

Generally, the court can sanction a violation of the automatic stay under its power of contempt (because the creditor violated the court's order). The court can impose fines, assess attorney's fees, and order the collector to pay damages. Punitive damages are not available. File a lawsuit.

Two Bankruptcies Within One Year: Stay Limited to 30 Days. Three Bankruptcies Within One Year: No Automatic Stay. Asking the Court to Impose the Stay or Extend It Beyond 30 days. Joint Bankruptcy Filings. If the Stay Is Not In Effect: What Can Creditors Take?

2d 206, 207 (2d Cir. 1986) (Since the purpose of the stay is to protect creditors as well as the debtor, the debtor may not waive the automatic stay); Matter of Pease, 195 B.R. 431, 434 (Bankr.

Filing for Chapter 7 or 13 bankruptcy automatically triggers the stay. No additional action is required for the automatic stay to go into effect. (Learn more in Bankruptcy's Automatic Stay.)

Defaulting (failing to make payments) on your Chapter 13 plan has many unfortunate consequences. It can lead to your creditors obtaining permission from the court to foreclose on your house or repossess your car. Or the court might dismiss your case or never approve it in the first place.

Once they get a court order lifting the automatic stay, the creditor is allowed to move forward with the foreclosure or repossession of the property that secures the debt.You no longer have the property and you're still paying on it.

If you fall behind on your Chapter 13 plan payments, your bankruptcy trustee or a creditor will usually ask the court to dismiss your bankruptcy case. However, other options might help you save your bankruptcy and obtain a discharge.