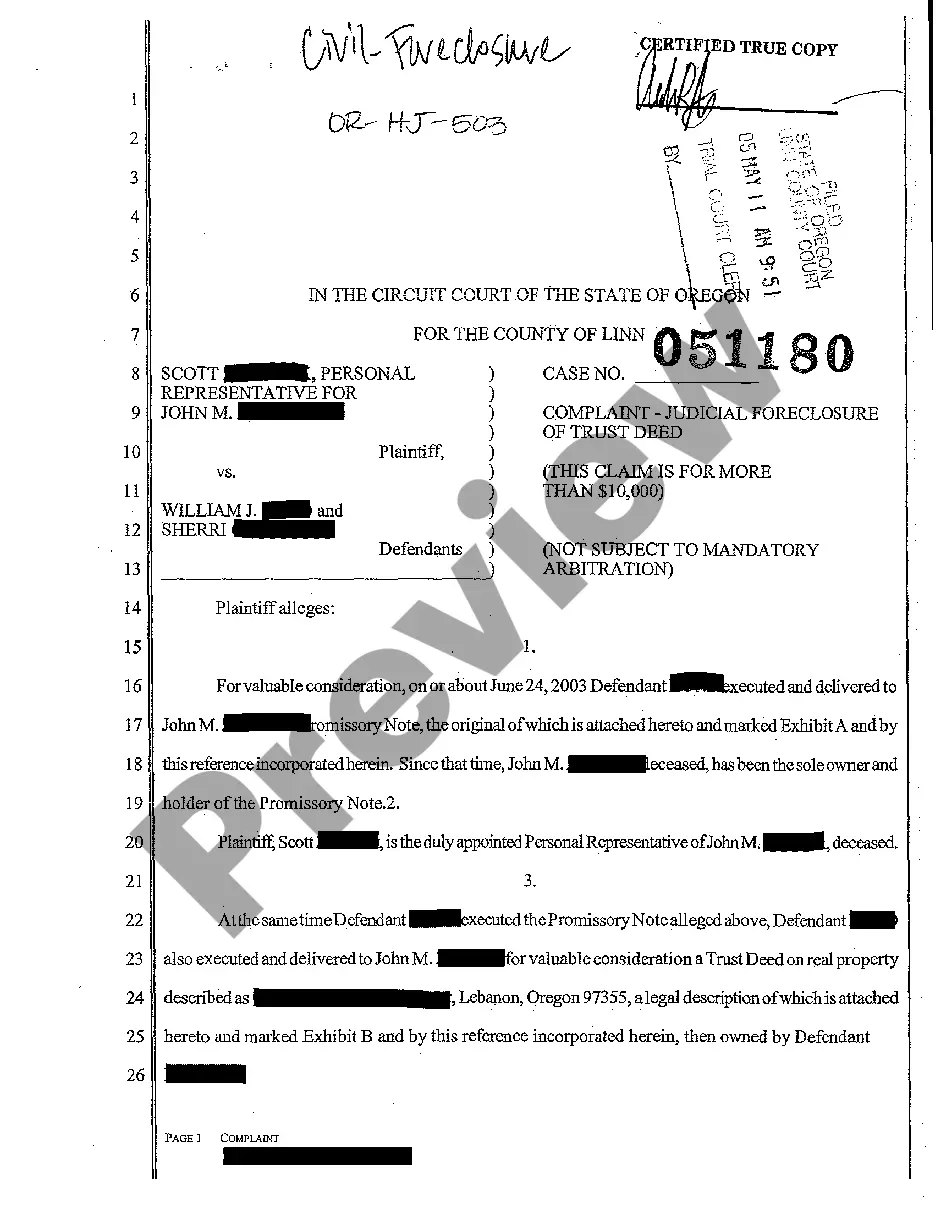

Oregon Complaint - Judicial Foreclosure of Trust Deed

Description

How to fill out Oregon Complaint - Judicial Foreclosure Of Trust Deed?

Creating papers isn't the most easy process, especially for people who rarely deal with legal paperwork. That's why we recommend making use of correct Oregon Complaint - Judicial Foreclosure of Trust Deed samples created by skilled attorneys. It allows you to eliminate troubles when in court or working with official institutions. Find the documents you require on our website for top-quality forms and correct explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. When you’re in, the Download button will immediately appear on the file web page. Soon after accessing the sample, it will be saved in the My Forms menu.

Customers with no an active subscription can easily create an account. Follow this short step-by-step help guide to get the Oregon Complaint - Judicial Foreclosure of Trust Deed:

- Make certain that file you found is eligible for use in the state it’s required in.

- Verify the document. Make use of the Preview option or read its description (if offered).

- Click Buy Now if this sample is the thing you need or return to the Search field to find another one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

Right after completing these easy steps, you can fill out the sample in your favorite editor. Double-check filled in details and consider asking a lawyer to examine your Oregon Complaint - Judicial Foreclosure of Trust Deed for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

Form popularity

FAQ

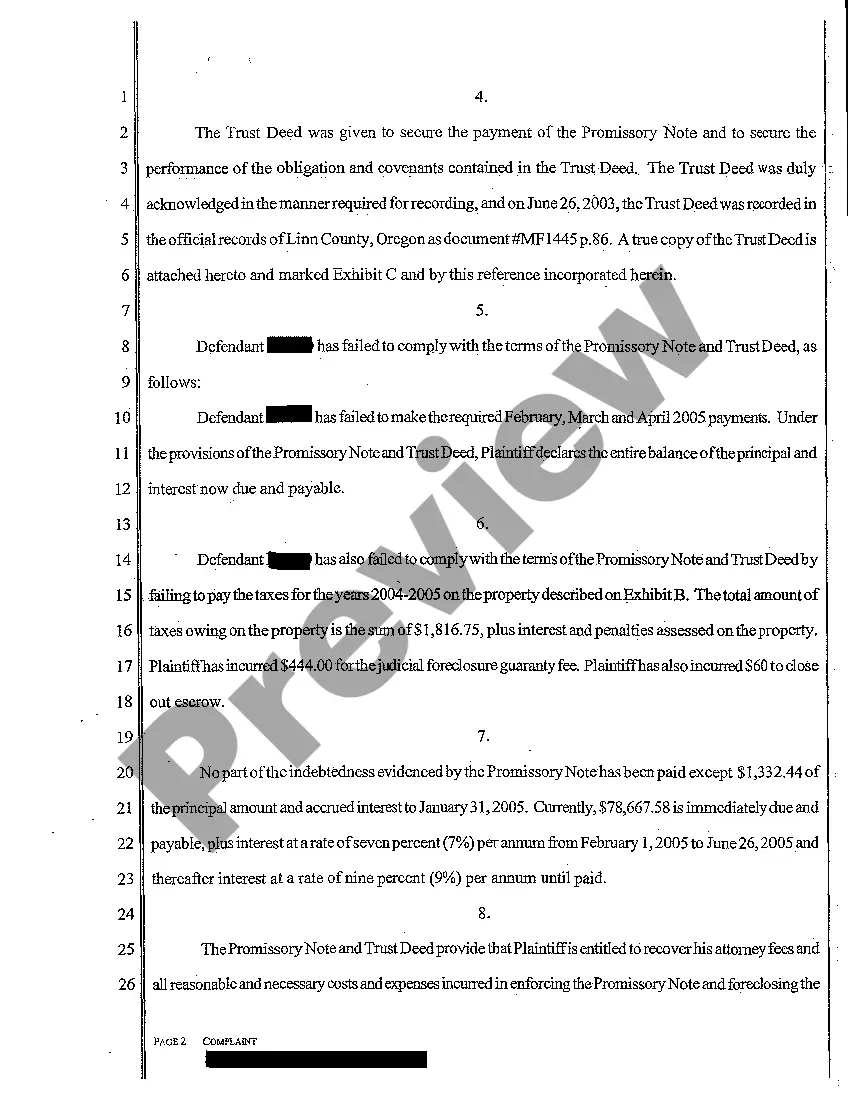

Banks and other lenders typically use a trust deed. A trust deed can be foreclosed by a lawsuit in the circuit court of the county where the property is located. This type of foreclosure is referred to as a judicial foreclosure and is now common for residential loans in Oregon.

Again, most residential foreclosures in Oregon are nonjudicial. Here's how the process works. Before filing a notice of default, the lender provides you (the borrower) with notice about participating in a resolution conference (mediation).

Step 1 Notice of Default. Record a Notice of Default with the county recorder. Step 2 Notice of Sale. If the borrower does not pay the balance stated in the Notice of Default within the deadline, the lender can go ahead with recording a Notice of Sale. Step 3 Auction. Step 4 Obtain Possession of Property.

Oregon borrowers can expect that the foreclosure process will take approximately six months to complete if everything goes smoothly during the foreclosure. Court delays, borrower objects or a borrower's filing for bankruptcy can delay the process.

Currently, 22 states in the U.S. only allow banks to attempt judicial foreclosures, including Arkansas, Connecticut, Delaware, Florida, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Nebraska, New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, Virginia, and

Judicial foreclosure is when foreclosure proceedings on a property take place through the court system. This type of foreclosure process often occurs when a mortgage note lacks a power of sale clause, which would legally authorize the mortgage lender to sell the property if a default occurred.

If the borrower defaults on the loan, the trustee has the power to foreclose on the property on behalf of the beneficiary. In most U.S. states, a deed of trust (but not a mortgage) can contain a special "power of sale" clause that permits the trustee to exercise these powers.

In Oregon, lenders may foreclose on deeds of trusts or mortgages in default using either a judicial or non-judicial foreclosure process. The judicial process of foreclosure, which involves filing a lawsuit to obtain a court order to foreclose, is used when no power of sale is present in the mortgage or deed of trust.

To contest a judicial foreclosure, you have to file a written answer to the complaint (the lawsuit). You'll need to present your defenses and explain the reasons why the lender shouldn't be able to foreclose. You might need to defend yourself against a motion for summary judgment and at trial.