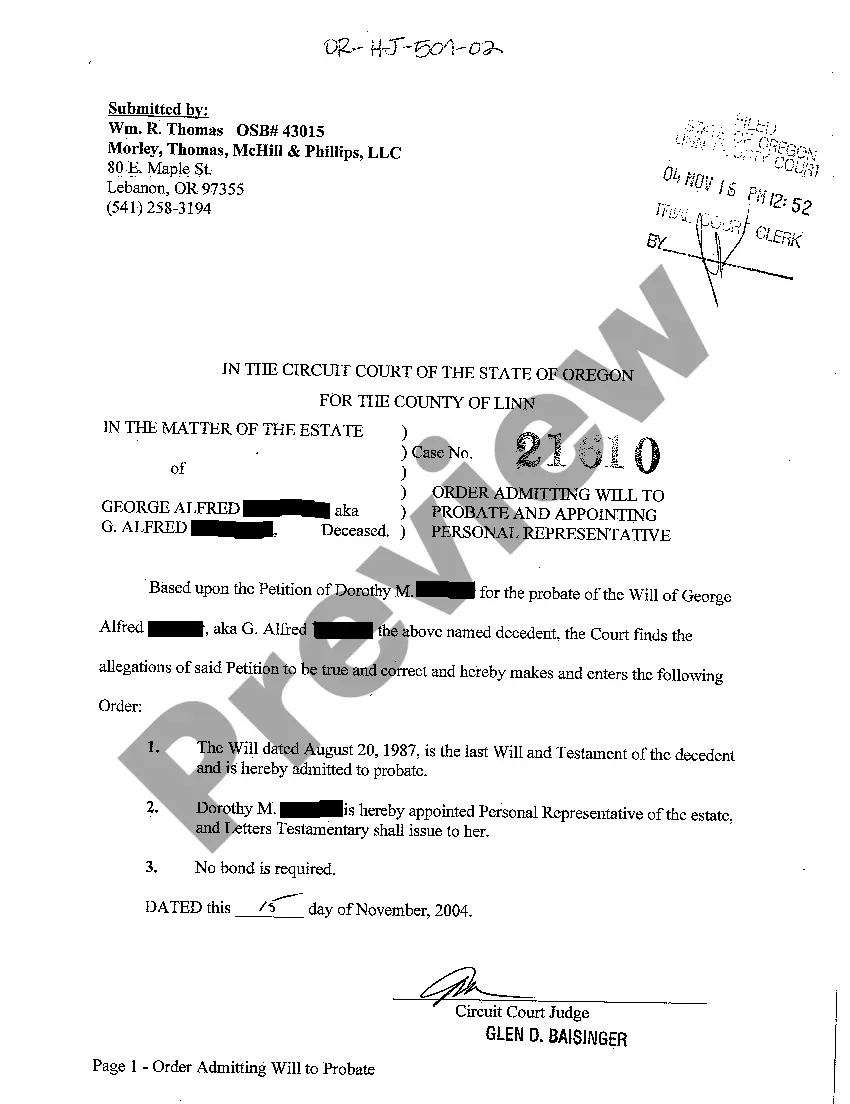

Oregon Order Admitting Will to Probate and Appointing Personal Representative

Description

How to fill out Oregon Order Admitting Will To Probate And Appointing Personal Representative?

Creating documents isn't the most straightforward task, especially for those who rarely deal with legal paperwork. That's why we recommend using correct Oregon Order Admitting Will to Probate and Appointing Personal Representative templates created by skilled attorneys. It gives you the ability to eliminate troubles when in court or handling formal organizations. Find the files you want on our website for high-quality forms and correct explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you are in, the Download button will immediately appear on the file webpage. Right after getting the sample, it will be stored in the My Forms menu.

Customers with no an active subscription can easily create an account. Follow this brief step-by-step guide to get your Oregon Order Admitting Will to Probate and Appointing Personal Representative:

- Make certain that file you found is eligible for use in the state it is required in.

- Confirm the document. Utilize the Preview option or read its description (if offered).

- Buy Now if this sample is what you need or go back to the Search field to find a different one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a required format.

After completing these straightforward steps, you are able to complete the form in a preferred editor. Double-check completed information and consider requesting a legal representative to examine your Oregon Order Admitting Will to Probate and Appointing Personal Representative for correctness. With US Legal Forms, everything gets easier. Try it out now!

Form popularity

FAQ

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

Locate Documents. Record the preferences of the testator. Check status of property and accounts. Confirm beneficiaries are correct. Make a list of personal possessions. Create a schedule of assets. Make a list of credit cards and debts. Electronic access to information.

Can I appoint a beneficiary as my executor? Yes, your executor may also be a beneficiary to your estate. In fact, if you are leaving everything to your spouse or adult children who are capable of managing their finances, it is a natural choice to appoint your spouse or one or more of your children as your executor(s).

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.

Determine who has priority to serve. State law establishes the qualifications for an administrator and sets the order of priority that the court must follow in making an appointment. Prepare to file a petition to administer. Collect the necessary information. File the petition with the court.

An executor is someone named in your will, or appointed by the court, who is given the legal responsibility to take care of any remaining financial obligations. Typical duties include: Distributing assets according to the will. Maintaining property until the estate is settled (e.g., upkeep of a house)

A personal representative usually is named in a will. However, courts sometimes appoint a personal representative. Usually, whether or not the deceased left a will, the probate court will issue a finding of fact that a will has or has not been filed and a personal representative or administrator has been appointed.

You can administer an estate even if the deceased died without a will or failed to specify an executor. If your relationship to the deceased doesn't make you the probate court's default choice for administrator, you'll need to get permission from the relatives ahead of you in the priority order.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.