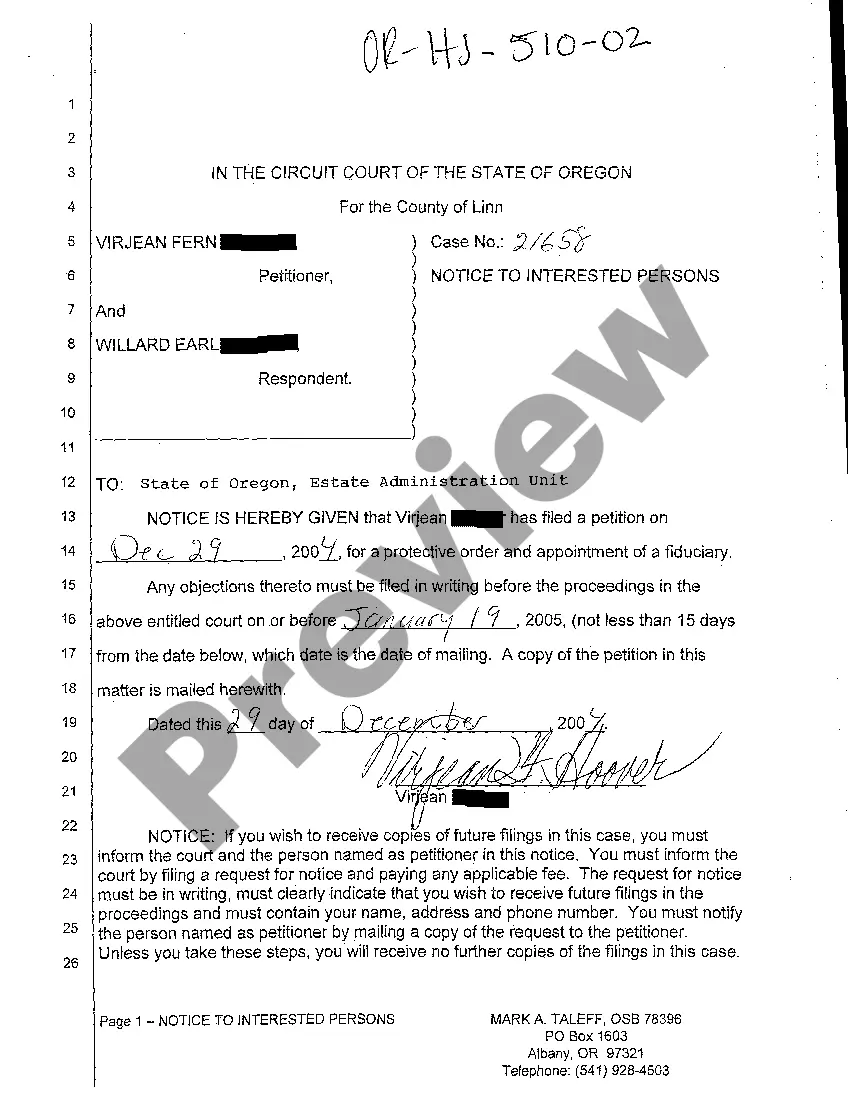

Oregon Notice to Interested Persons of the Filing for the Appointment of Fiduciary

Description

How to fill out Oregon Notice To Interested Persons Of The Filing For The Appointment Of Fiduciary?

Creating papers isn't the most simple task, especially for those who rarely work with legal papers. That's why we recommend utilizing correct Oregon Notice to Interested Persons of the Filing for the Appointment of Fiduciary templates created by professional attorneys. It gives you the ability to eliminate troubles when in court or working with formal institutions. Find the templates you need on our website for high-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you are in, the Download button will automatically appear on the file web page. After downloading the sample, it’ll be stored in the My Forms menu.

Users without an active subscription can quickly get an account. Look at this simple step-by-step help guide to get your Oregon Notice to Interested Persons of the Filing for the Appointment of Fiduciary:

- Make certain that the document you found is eligible for use in the state it is necessary in.

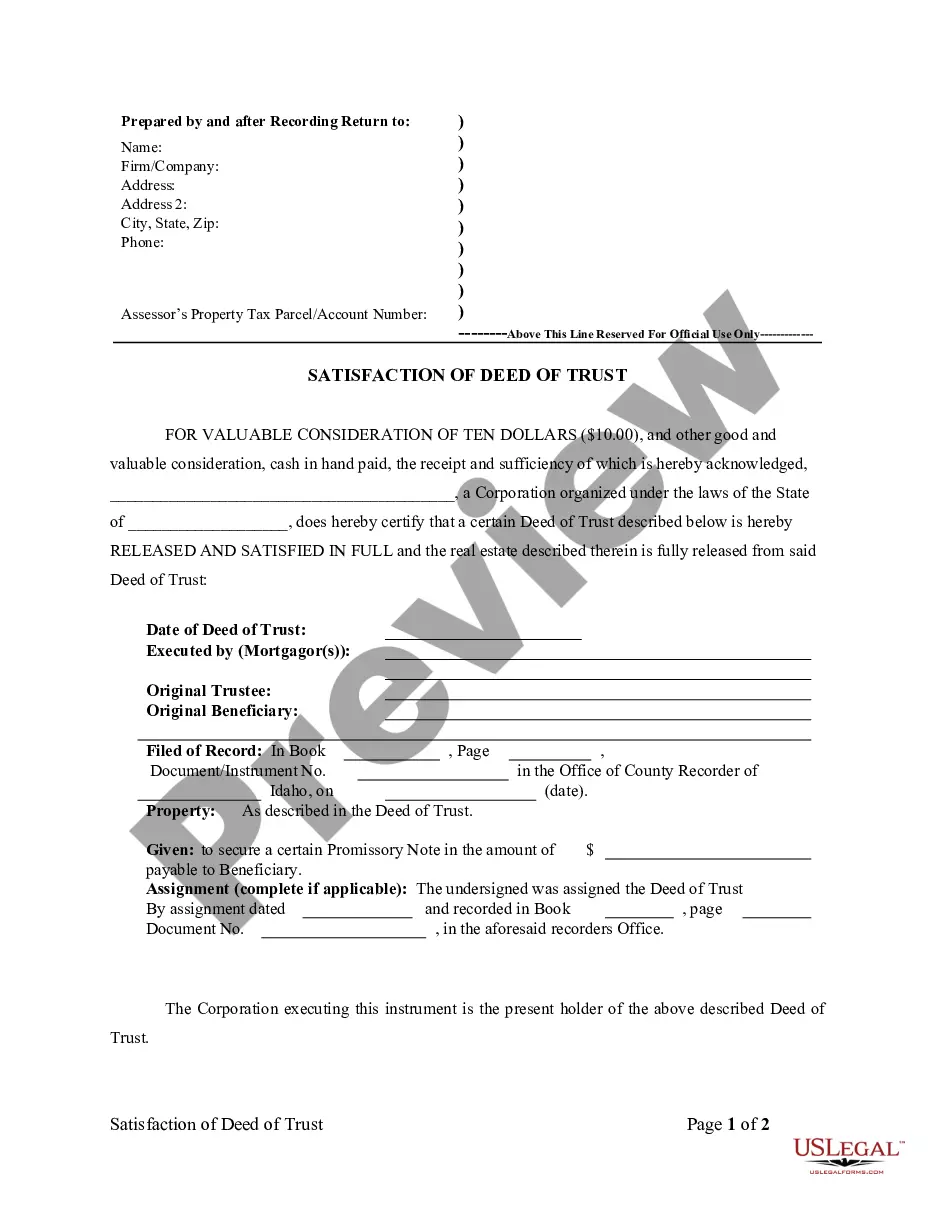

- Verify the document. Make use of the Preview option or read its description (if available).

- Click Buy Now if this file is what you need or return to the Search field to get another one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

Right after completing these easy actions, you are able to complete the sample in a preferred editor. Check the completed information and consider asking a legal representative to examine your Oregon Notice to Interested Persons of the Filing for the Appointment of Fiduciary for correctness. With US Legal Forms, everything gets much simpler. Try it now!

Form popularity

FAQ

But generally if the total value of the Estate is less than £15,000 then usually Probate will not be required. But if the deceased owned assets worth more than the threshold, you'll need to go through the Probate process.

Every financial institution will have a different threshold as to the amount they will transfer without a Grant of Probate. To provide you some guidance, a balance of somewhere in the vicinity of $20,000.00 $50,000.00 will not require a Grant of Probate.

In Oregon, the law states that the executor's compensation is based on the following: Probate property, including income and gains: (A) Seven percent of any sum not exceeding $1,000. (B) Four percent of all above $1,000 and not exceeding $10,000.

How do I get a guardianship for a child? You will need a lawyer to ask a judge to appoint a guardian. Parents and the people taking care of the child must be told when someone is trying to get a guardian appointed. A judge will order a guardianship without the parents' consent only in limited circumstances.

In California, estates valued over $150,000, and that don't qualify for any exemptions, must go to probate.If a person dies and owns real estate, regardless of value, either in his/her name alone or as a "tenant in common" with another, a probate proceeding is typically required to transfer the property.

Probate is not always necessary. If the deceased person owned bank accounts or property with another person, the surviving co-owner often will then own that property automatically.Settle a dispute between people who claim they are entitled to assets of the deceased person.

Under Oregon law, a small estate affidavit can be filed if the estate has no more than $75,000 in personal property and no more that $200,000 in real property. These limits may be subject to change. A larger estate may require probate.

The out-of-pocket costs to begin a guardianship in Oregon are the filing fee, which is $124 (in 2019); the fee for the court visitor, which varies by county but is generally between $300 and $600; and the expenses for having the respondent personally served, getting certified copies from the court, etc., which are