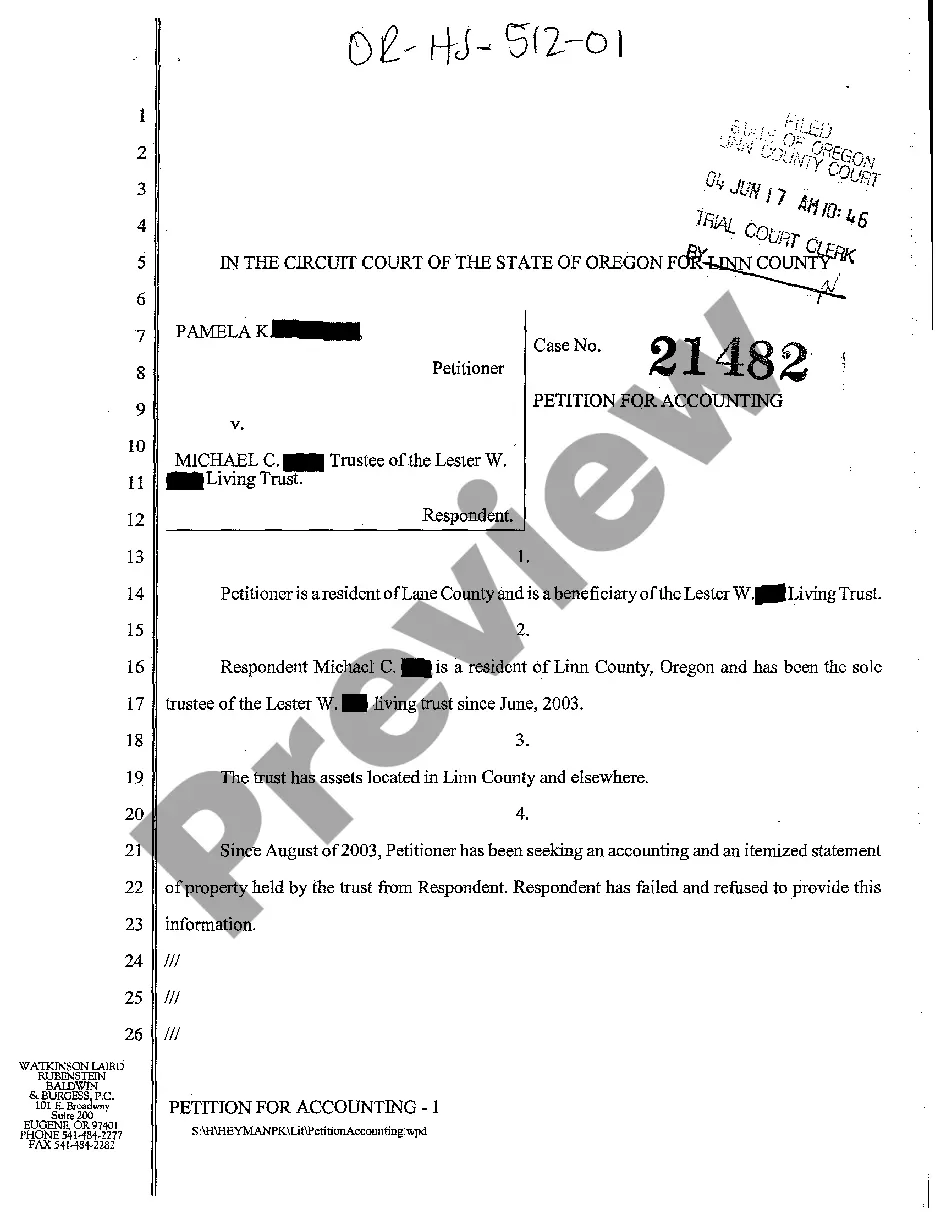

Oregon Petition for Accounting of Living Trust

Description

How to fill out Oregon Petition For Accounting Of Living Trust?

The work with papers isn't the most uncomplicated process, especially for people who almost never deal with legal paperwork. That's why we advise using accurate Oregon Petition for Accounting of Living Trust samples created by skilled lawyers. It gives you the ability to eliminate problems when in court or dealing with official organizations. Find the documents you require on our website for top-quality forms and exact information.

If you’re a user with a US Legal Forms subscription, just log in your account. When you are in, the Download button will immediately appear on the file page. After downloading the sample, it’ll be stored in the My Forms menu.

Customers with no a subscription can quickly get an account. Use this simple step-by-step guide to get your Oregon Petition for Accounting of Living Trust:

- Be sure that the document you found is eligible for use in the state it is needed in.

- Confirm the document. Utilize the Preview feature or read its description (if available).

- Click Buy Now if this form is the thing you need or go back to the Search field to get another one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a required format.

After doing these straightforward steps, you are able to fill out the sample in your favorite editor. Double-check filled in details and consider asking a lawyer to examine your Oregon Petition for Accounting of Living Trust for correctness. With US Legal Forms, everything gets easier. Try it now!

Form popularity

FAQ

To allow the settlor to keep his estate plans private, the trust instrument is generally not recorded, and the trustee uses the certification of trust in the place of disclosing the entire contents of the trust instrument.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Public RecordCalifornia law requires any deed transfer involving real estate property be recorded in the county clerk's or county recorder's office in the county where the property is located. The trust grantor must record the original trust document, real estate deed and appraisal report.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

A trust checking account is a bank account held by a trust that trustees may use to pay incidental expenses and disperse assets to a trust's beneficiaries, after a settlor's death.And as bank deposit accounts, trust checking accounts are insured by the Federal Deposit Insurance Corporation (FDIC).

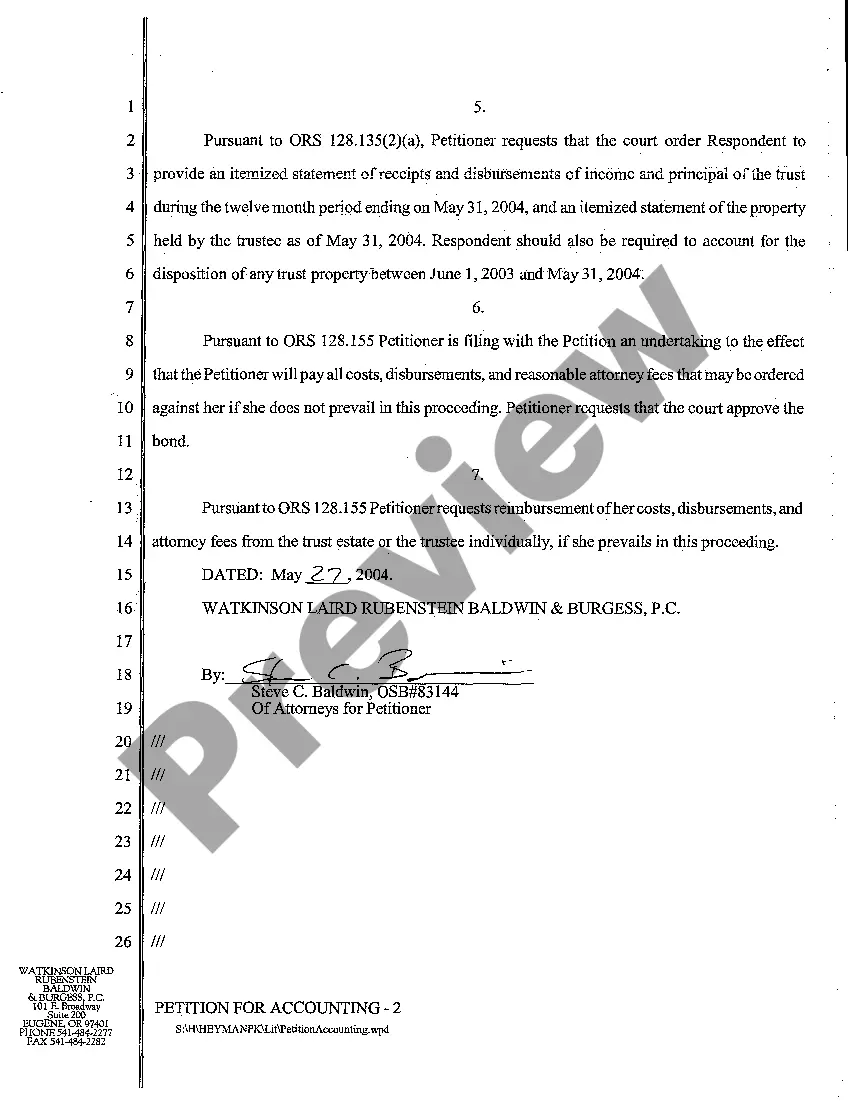

Generally, the trustee only has to provide the annual accounting to each beneficiary to whom income or principal is required or authorized in the trustee's discretion to be currently distributed. The trust document has to be read and interpreted to determine who is entitled to accountings.

If the trustee fails to account, he or she is in violation of the statute and his or her fiduciary duty. If the beneficiaries are harmed by the lack of accounting, the trustee may be liable. Further, the court may become involved, may levy sanctions and could even remove the trustee.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.