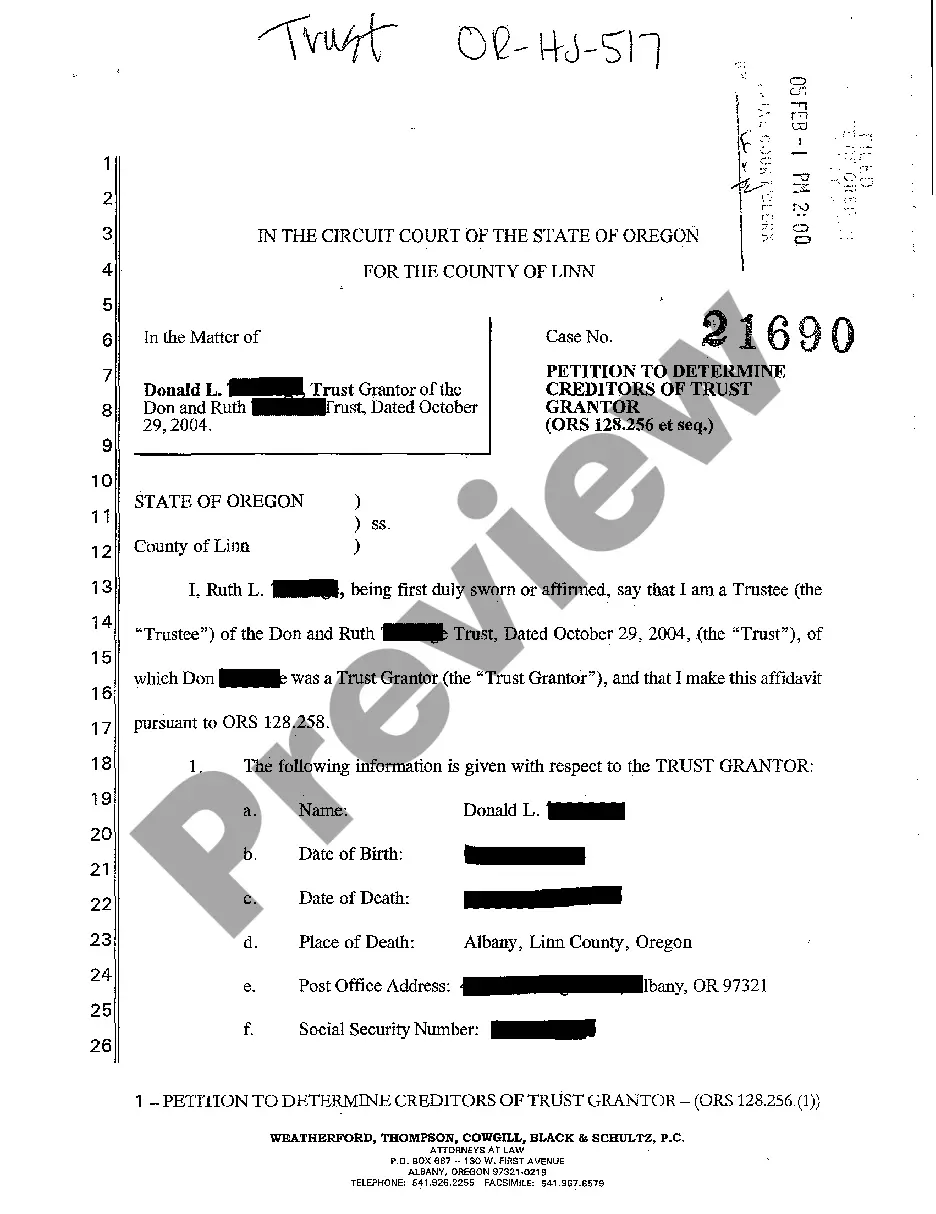

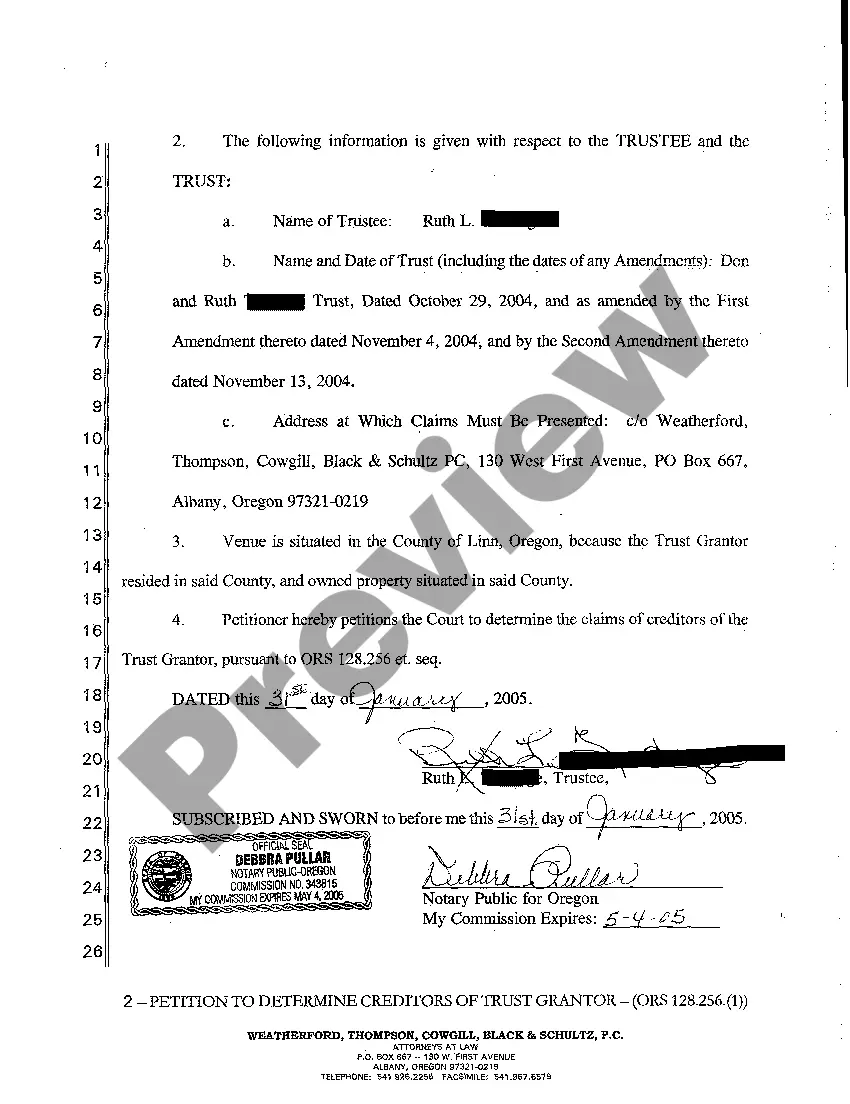

Oregon Petition to Determine Creditors of Trust Grantor

Description

How to fill out Oregon Petition To Determine Creditors Of Trust Grantor?

The work with papers isn't the most simple task, especially for people who almost never work with legal paperwork. That's why we advise utilizing accurate Oregon Petition to Determine Creditors of Trust Grantor samples created by skilled attorneys. It gives you the ability to stay away from difficulties when in court or handling formal institutions. Find the samples you need on our site for top-quality forms and accurate explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. As soon as you are in, the Download button will automatically appear on the file webpage. After getting the sample, it will be saved in the My Forms menu.

Users with no a subscription can quickly create an account. Use this simple step-by-step guide to get your Oregon Petition to Determine Creditors of Trust Grantor:

- Make certain that the form you found is eligible for use in the state it’s necessary in.

- Verify the file. Use the Preview feature or read its description (if readily available).

- Click Buy Now if this template is the thing you need or utilize the Search field to get another one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After completing these straightforward steps, it is possible to fill out the sample in a preferred editor. Double-check completed details and consider asking a lawyer to examine your Oregon Petition to Determine Creditors of Trust Grantor for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

Form popularity

FAQ

The funds in the trust itself likely cannot be garnished, but the funds you ultimately receive from the trust may be exposed to savvy creditors. While creditors typically garnish income directly from an employer on your paycheck, they can also seek funds from other sources, such as money sitting in bank accounts.

A trust is a legal document that is used for estate planning.This is where a trust petition comes in. Trust petitions allows a closer legal examination of an individual's trust after death, establishing results and actions in accordance to the intent of the trust.

Trusts aren't public record, so they're not usually recorded anywhere. Instead, the trust attorney determines who is entitled to receive a copy of the document, even if state law doesn't require it.

One type of trust that will protect your assets from your creditors is called an irrevocable trust. Once you establish an irrevocable trust, you no longer legally own the assets you used to fund it and can no longer control how those assets are distributed.

With an irrevocable trust, the assets that fund the trust become the property of the trust, and the terms of the trust direct that the trustor no longer controls the assets.Because the assets within the trust are no longer the property of the trustor, a creditor cannot come after them to satisfy debts of the trustor.

The Trustees and beneficiaries are not personally liable for debts owed by the Trust. The Trustee is acting in a fiduciary capacity.The Trust will typically state that once the debts are paid, the Trustee can distribute the remaining funds to the Beneficiaries.

Its primary purpose is to avoid probate court, since revocable living trusts do not reduce estate taxes. With a revocable trust, your assets will not be protected from creditors looking to sue.Additionally, the assets placed in an irrevocable trust cannot be pursued by creditors seeking payment of debt.

Family trust can be searched using a stack of individual searches, including property search and people search. It can be challenging to find the trustee and it can take some detective work. The key is to use the last name of the family and the property address as your starting point for your search.

Generally, trusts in California can help shield assets only from future creditors of third party beneficiaries for whose benefit the trusts are created. California limits a person's ability to create a trust for his own benefit and shield those assets from creditors.