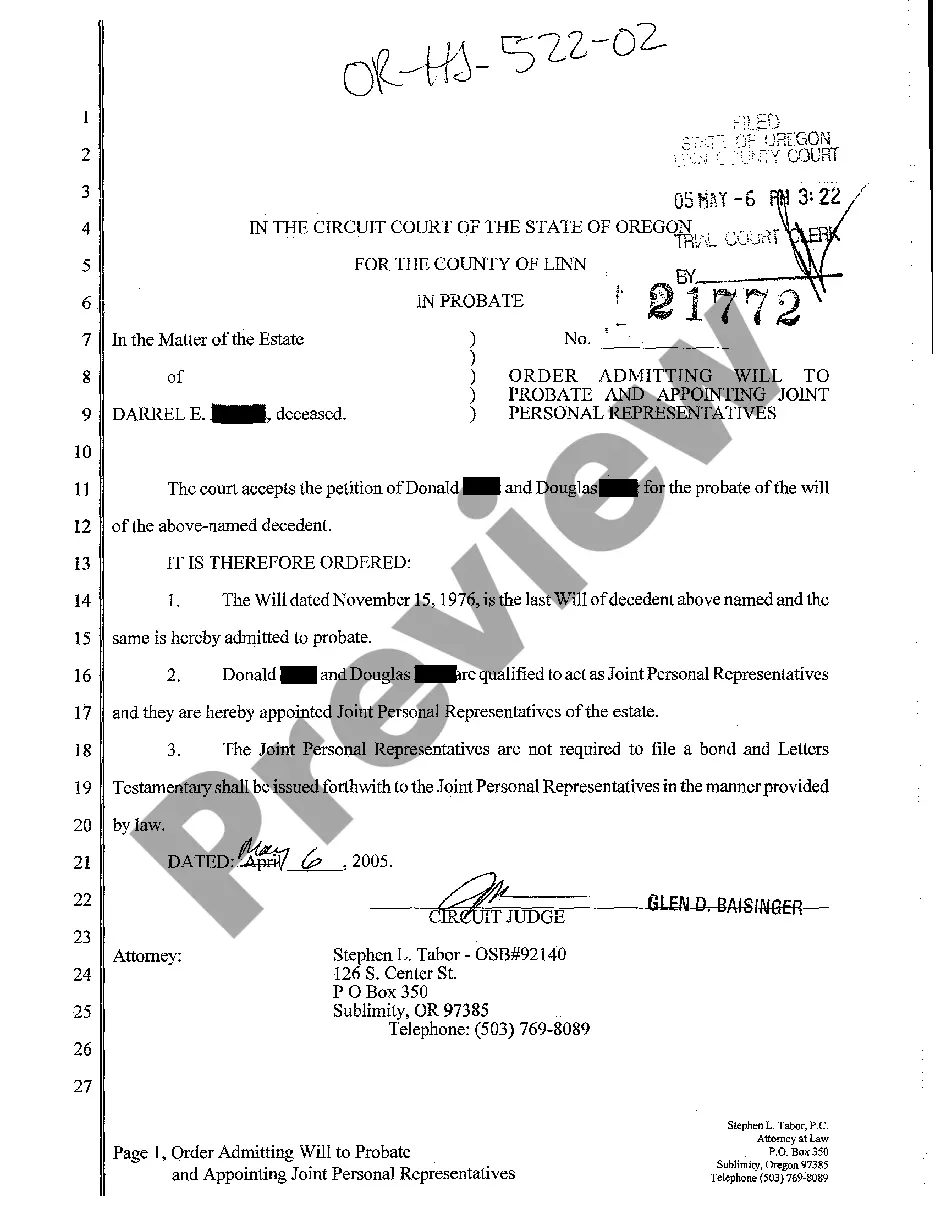

Oregon Order Admitting Will to Probate and Appointing Joint Personal Representatives

Description

How to fill out Oregon Order Admitting Will To Probate And Appointing Joint Personal Representatives?

The work with papers isn't the most uncomplicated job, especially for those who almost never deal with legal papers. That's why we advise making use of correct Oregon Order Admitting Will to Probate and Appointing Joint Personal Representatives templates made by skilled attorneys. It allows you to stay away from difficulties when in court or dealing with formal organizations. Find the documents you want on our site for top-quality forms and accurate descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will automatically appear on the template web page. Right after getting the sample, it’ll be stored in the My Forms menu.

Customers without a subscription can quickly get an account. Follow this short step-by-step guide to get the Oregon Order Admitting Will to Probate and Appointing Joint Personal Representatives:

- Make certain that the form you found is eligible for use in the state it is needed in.

- Verify the file. Use the Preview feature or read its description (if offered).

- Buy Now if this file is what you need or go back to the Search field to get another one.

- Select a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After finishing these easy actions, it is possible to complete the form in an appropriate editor. Recheck completed details and consider asking a legal representative to review your Oregon Order Admitting Will to Probate and Appointing Joint Personal Representatives for correctness. With US Legal Forms, everything gets easier. Try it now!

Form popularity

FAQ

Simply having a last will does not avoid probate; in fact, a will must go through probate. To probate a will, the document is filed with the court, and a personal representative is appointed to gather the decedent's assets and take care of any outstanding debts or taxes.

Probate can be started immediately after death and takes a minimum of four months. If the estate includes property that takes a while to sell, or if there are complicated tax or other matters, probate can last much longer. A small estate proceeding cannot be filed until 30 days after death and is complete upon filing.

Probate is required when an estate's assets are solely in the deceased's name. In most cases, if the deceased owned property that had no other names attached, an estate must go through probate in order to transfer the property into the name(s) of any beneficiaries.

Probate is not always necessary. If the deceased person owned bank accounts or property with another person, the surviving co-owner often will then own that property automatically.

No probate is necessary. Joint tenancy often works well when couples (married or not) acquire real estate, vehicles, bank accounts or other valuable property together. In Oregon, each co-owner must own an equal share.

In Oregon, the law states that the executor's compensation is based on the following: Probate property, including income and gains: (A) Seven percent of any sum not exceeding $1,000. (B) Four percent of all above $1,000 and not exceeding $10,000.

Under Oregon law, a small estate affidavit can be filed if the estate has no more than $75,000 in personal property and no more that $200,000 in real property. These limits may be subject to change. A larger estate may require probate.

Under Oregon law, a small estate affidavit can be filed if the estate has no more than $75,000 in personal property and no more that $200,000 in real property. These limits may be subject to change. A larger estate may require probate.