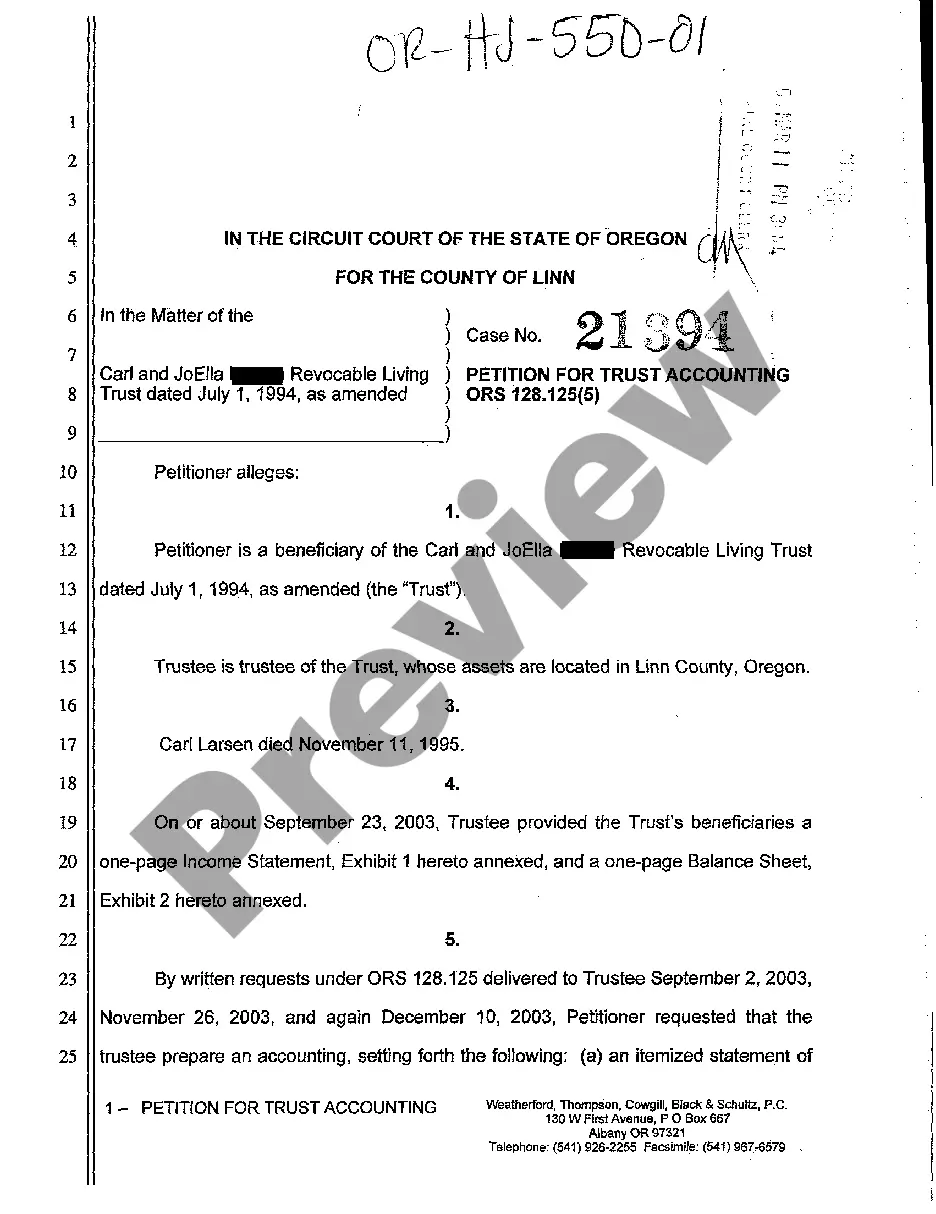

Oregon Petition for Trust Accounting

Description

How to fill out Oregon Petition For Trust Accounting?

The work with papers isn't the most easy process, especially for those who almost never work with legal paperwork. That's why we advise utilizing correct Oregon Petition for Trust Accounting samples created by skilled attorneys. It gives you the ability to prevent problems when in court or working with formal institutions. Find the documents you require on our website for top-quality forms and correct explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you are in, the Download button will immediately appear on the file web page. Soon after accessing the sample, it’ll be stored in the My Forms menu.

Users without an active subscription can quickly create an account. Make use of this short step-by-step guide to get your Oregon Petition for Trust Accounting:

- Make sure that the sample you found is eligible for use in the state it is required in.

- Confirm the document. Utilize the Preview feature or read its description (if offered).

- Buy Now if this template is the thing you need or utilize the Search field to find another one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after finishing these straightforward actions, you are able to complete the sample in a preferred editor. Double-check filled in information and consider asking a legal representative to examine your Oregon Petition for Trust Accounting for correctness. With US Legal Forms, everything gets much easier. Give it a try now!

Form popularity

FAQ

Taxes paid, disbursements made to trust beneficiaries, and gains and losses on trust assets. Fees and expenses paid to advisors of the trustee, such as attorneys, CPAs, and financial advisors.

The best way to find a trust is to ask the person who created it or the person who manages it. If the trust owns real estate, then a deed to the trust has probably been recorded in the county where the real estate is.

Right to formal accounting: generally speaking, a trustee is required to provide a trust accounting at least annually, at the termination of the trust, and upon a change of trustees. Accountings are also required at the termination of a trust and upon a change of trustee. (See California Probate Code section 16062(a).)

To familiarise itself with the terms of the trust especially beneficiaries and trust property; to act honestly, reasonably and in good faith; to preserve and not waste the value of the trust assets; to accumulate or pay income as directed by the trust instrument;

Each beneficiary is entitled to a trustee's accounting, at least annually, at termination of the trust, and on upon a change of trustee. (California Probate Code 16062). Unfortunately, not all beneficiaries are entitled to automatic accounting, nevertheless, the court may force the trustee to provide an accounting.

Trust accounting is a detailed record that includes information about all income and expenses of a trust. Information that should be included in a trust accounting includes details regarding: Taxes paid, disbursements made to trust beneficiaries, and gains and losses on trust assets.

To allow the settlor to keep his estate plans private, the trust instrument is generally not recorded, and the trustee uses the certification of trust in the place of disclosing the entire contents of the trust instrument.

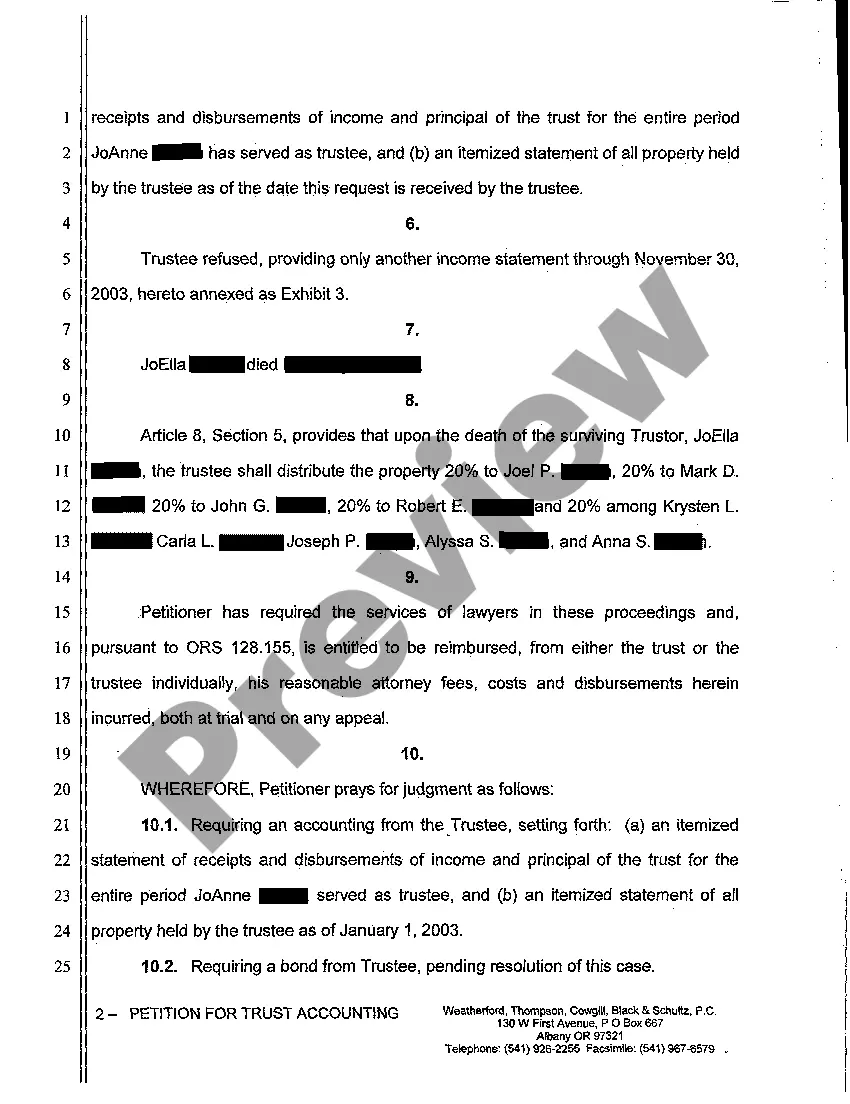

If the accounting is not provided in the proper form as required by the law, then after sixty days the beneficiary can file a probate court petition to seek a court order requiring the trustee to prepare the proper accounting and can request reimbursement for the fees and costs they incur in bringing the petition.