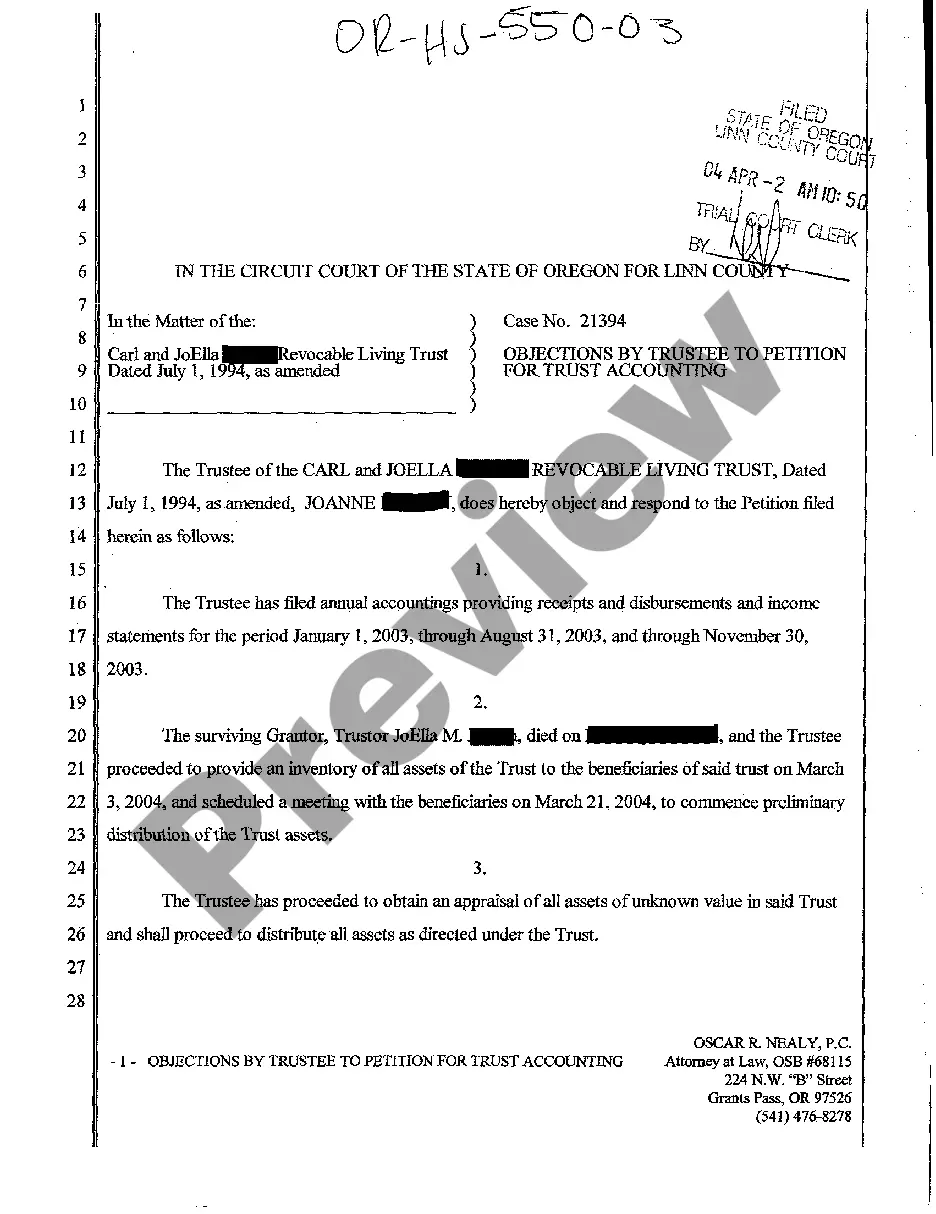

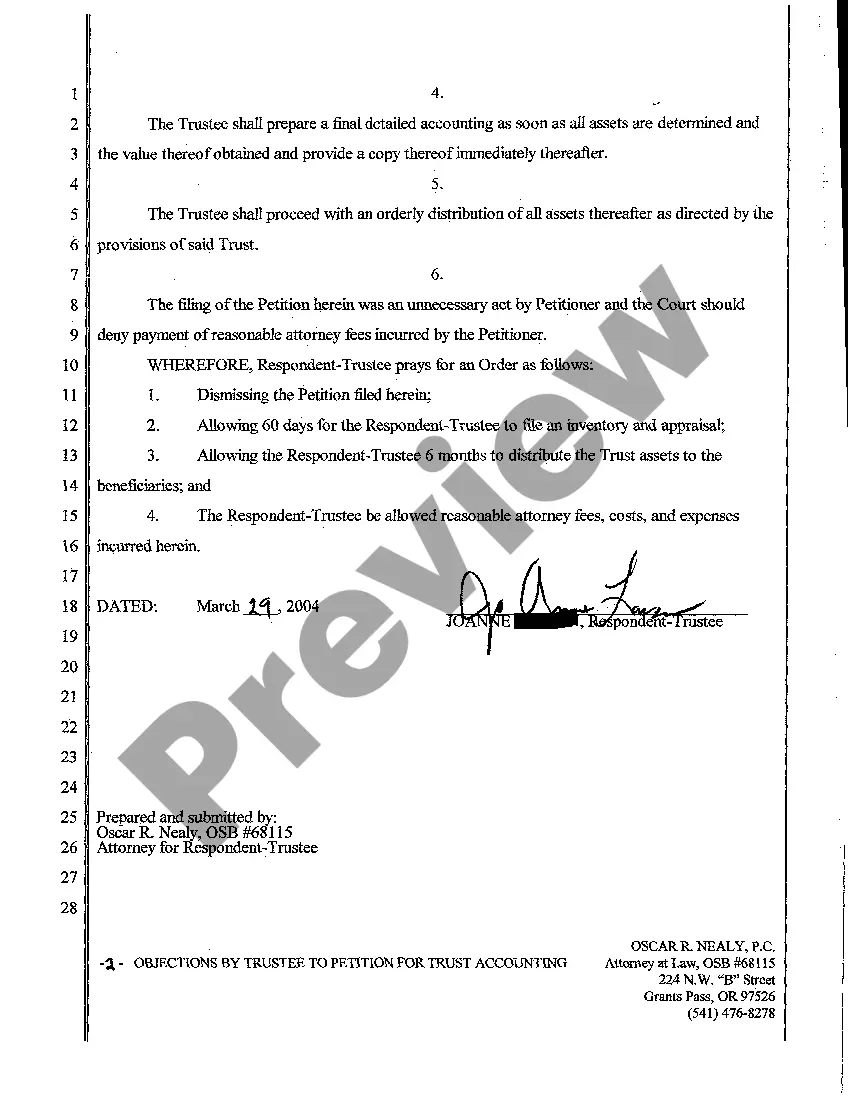

Oregon Objections by Trustee to Petition for Trust Accounting

Description

How to fill out Oregon Objections By Trustee To Petition For Trust Accounting?

Creating papers isn't the most easy task, especially for those who rarely deal with legal paperwork. That's why we advise utilizing correct Oregon Objections by Trustee to Petition for Trust Accounting templates made by professional lawyers. It allows you to prevent problems when in court or handling formal organizations. Find the templates you want on our website for top-quality forms and correct information.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you are in, the Download button will immediately appear on the template web page. Soon after accessing the sample, it’ll be saved in the My Forms menu.

Customers with no an activated subscription can quickly get an account. Look at this simple step-by-step guide to get your Oregon Objections by Trustee to Petition for Trust Accounting:

- Be sure that the form you found is eligible for use in the state it is needed in.

- Confirm the document. Make use of the Preview feature or read its description (if readily available).

- Buy Now if this file is the thing you need or go back to the Search field to find another one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a required format.

Right after doing these simple actions, you can complete the form in your favorite editor. Double-check completed info and consider asking a legal representative to review your Oregon Objections by Trustee to Petition for Trust Accounting for correctness. With US Legal Forms, everything becomes much simpler. Give it a try now!

Form popularity

FAQ

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs.

A person appointed as trustee does not have to accept the appointment. He or she can decline to serve, usually by written instrument. After appointment and acceptance, a trustee may resign, generally only by a written instrument. A trustee may also be removed according to the terms of the trust or by court action.

Whether you are the Trustee, Beneficiary, or Heir of a Living Trust, the question is, can a Trust be contested? The quick answer is, Yes, a trust can be contested! When contesting a trust, i.e., disputing a Trust, voiding a Trust, invalidating a Trust, you will need to consider how the Trust is invalid and a trust

If the trustee fails to account, he or she is in violation of the statute and his or her fiduciary duty. If the beneficiaries are harmed by the lack of accounting, the trustee may be liable. Further, the court may become involved, may levy sanctions and could even remove the trustee.

Right to formal accounting: generally speaking, a trustee is required to provide a trust accounting at least annually, at the termination of the trust, and upon a change of trustees. Accountings are also required at the termination of a trust and upon a change of trustee. (See California Probate Code section 16062(a).)

If you fail to receive a trust distribution, you may want to consider filing a petition to remove the trustee. A trust beneficiary has the right to file a petition with the court seeking to remove the trustee. A beneficiary can also ask the court to suspend the trustee pending removal.

To familiarise itself with the terms of the trust especially beneficiaries and trust property; to act honestly, reasonably and in good faith; to preserve and not waste the value of the trust assets; to accumulate or pay income as directed by the trust instrument;

Each beneficiary is entitled to a trustee's accounting, at least annually, at termination of the trust, and on upon a change of trustee. (California Probate Code 16062). Unfortunately, not all beneficiaries are entitled to automatic accounting, nevertheless, the court may force the trustee to provide an accounting.

Taxes paid, disbursements made to trust beneficiaries, and gains and losses on trust assets. Fees and expenses paid to advisors of the trustee, such as attorneys, CPAs, and financial advisors.