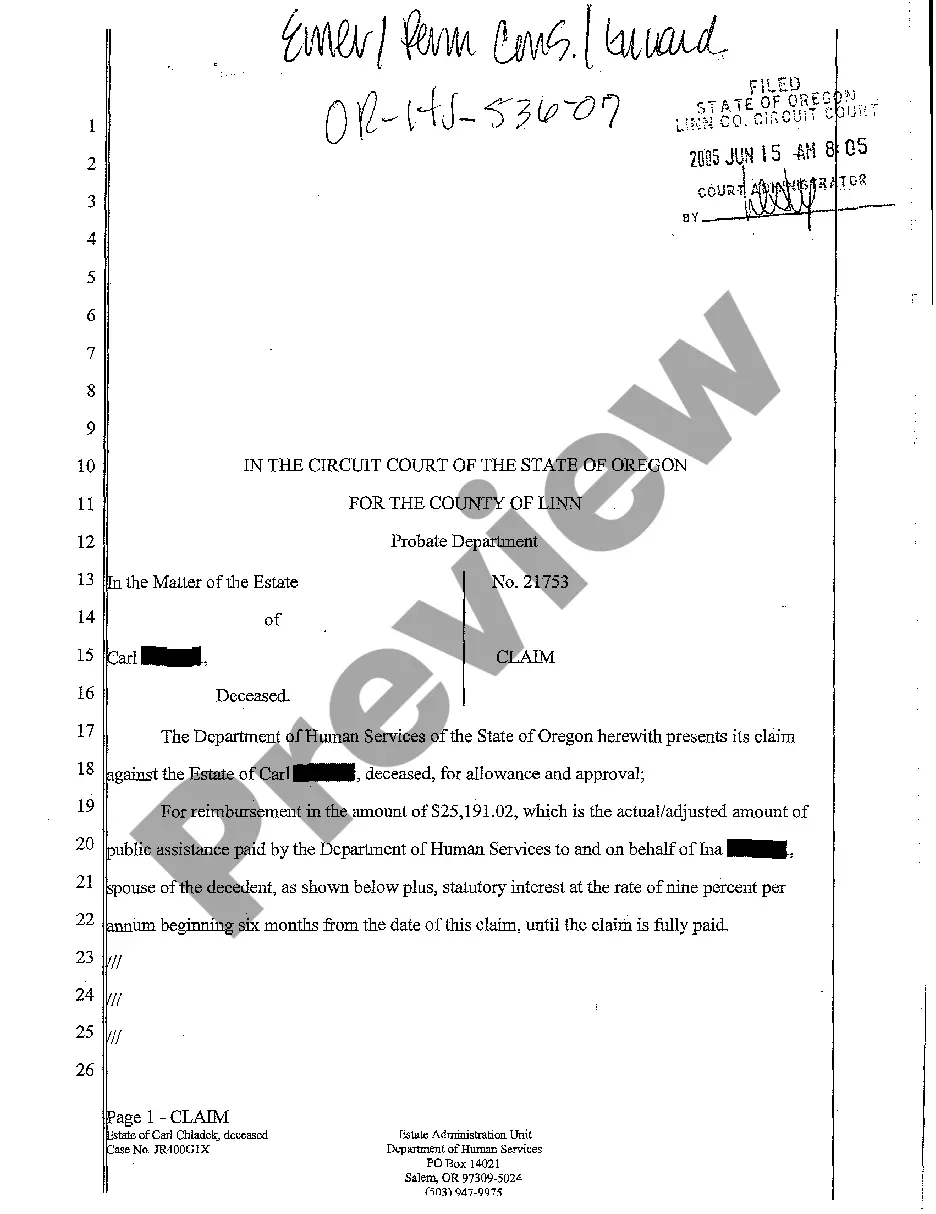

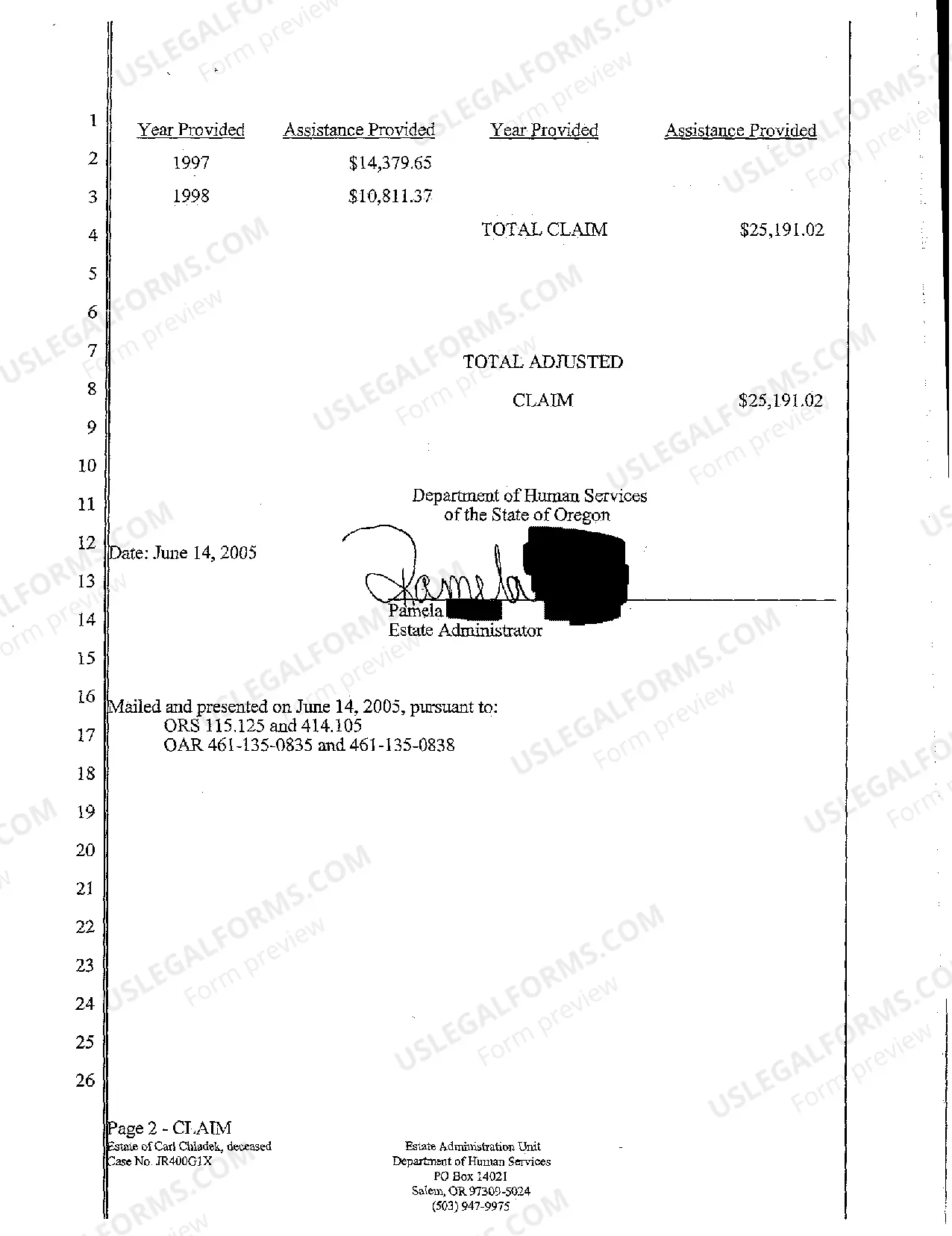

Oregon Claim Against Deceased Estate for Reimbursement of Services Rendered

Description

How to fill out Oregon Claim Against Deceased Estate For Reimbursement Of Services Rendered?

The work with papers isn't the most simple process, especially for those who rarely work with legal papers. That's why we advise making use of correct Oregon Claim Against Deceased Estate for Reimbursement of Services Rendered templates created by professional lawyers. It gives you the ability to eliminate troubles when in court or dealing with official organizations. Find the samples you want on our website for high-quality forms and correct information.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you are in, the Download button will automatically appear on the template page. After getting the sample, it will be stored in the My Forms menu.

Users with no a subscription can easily create an account. Make use of this brief step-by-step guide to get the Oregon Claim Against Deceased Estate for Reimbursement of Services Rendered:

- Make certain that the sample you found is eligible for use in the state it is required in.

- Confirm the document. Utilize the Preview option or read its description (if readily available).

- Click Buy Now if this form is the thing you need or return to the Search field to find a different one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after completing these simple steps, it is possible to fill out the form in a preferred editor. Check the completed details and consider asking a lawyer to review your Oregon Claim Against Deceased Estate for Reimbursement of Services Rendered for correctness. With US Legal Forms, everything becomes much simpler. Give it a try now!

Form popularity

FAQ

Find the Correct Probate Court. The probate court handles issues involving a deceased person's estate, along with potential disputes regarding outstanding debts, issues with heirs, etc. Confirm the Debt. Complete the Claim Form. File the Claim Form.

Godoy. After someone dies, anyone who thinks they are owed money or property by the deceased can file a claim against the estate. Estate claims range from many different types of debts, such as mortgages, credit card debt, loans, unpaid wages, or breach of contract.

Is there a time limit for a claim against a deceased estate? Yes, there is. You have only 6 months from the date of the grant of probate to make a claim. In some very limited circumstances, an extension of this time frame may be granted.

Any spouse or civil partner. Any former spouse or civil partner, provided they have not remarried or registered a new civil partnership, and provided no court order was made at the time of their split that specifically precludes them from bringing such a claim.

N. upon the death of a person and beginning of probate (filing of will, etc), a person believing he/she is owed money should file a written claim (statement) promptly with the executor or administrator of the estate, who will then approve it, in whole or in part, or deny the claim.

Can I make a claim against an Estate? If you are unhappy with your inheritance under the terms of a Will or the rules of intestacy, you may have a right to make a claim against the estate for reasonable financial provision.

In NSW an eligible person has 12 months from the date of death to lodge a family provision claim in Court. It's possible to seek an extension of time, but the Court will only extend time if there is sufficient reason for the delay in bringing the claim.

A claim for reasonable financial provision must be made within six months after probate or letters of administration have been issued, although the court can extend this period in certain circumstances (eg if the applicant has not made an earlier claim because of negotiations with the executors or administrators).

If the deceased had a Will before their death, then the people that they named as the executors of their estate will be the people legally entitled to bring a claim. They will have an obligation to distribute the estate (including any compensation received) in accordance with the terms of the Will.